US stock futures crept higher on Wednesday and traded near the best levels of the session, as investors remained focused on debt ceiling talks while negotiators seek a framework agreement for Joe Biden and Kevin McCarthy to review upon the president’s return from a truncated trip to Asia. Contracts on the S&P 500 were up 0.3% as 7:45am ET a.m. while Nasdaq 100 futures added 0.2%. Europe's Estoxx50 little changed on the day; while Japan's Nikkei 225 closed above the 30,000 for the first time since September 2021 a day after the Topix closed at its highest level in more than three decades. Treasuries are slightly richer across the curve with spreads broadly within 1bp-2bps of Tuesday’s close while the dollar is flat. Oil rebounded from an earlier drop concerns over demand in China and expectations of rising stockpiles in the US. Iron ore continues its week in the green, while gold and bitcoin declines.

In premarket trading, Western Alliance Bancorp jumped as much as 9.8% after the regional lender reported growth in deposits this quarter, soothing concerns after it was caught up in the turmoil engulfing the US regional banking sector. Tesla rose as much as 1.7% in premarket trading on Wednesday, as CEO Elon Musk said the electric-car maker will “try a little advertising and see how it goes.” This is a major shift for the company that’s largely avoided traditional marketing to sell its vehicles. Manchester United gained after Bloomberg reported that Sheikh Jassim Bin Hamad J.J. Al-Thani submitted an improved offer for the football club. Here are some other notable premarket movers:

- Doximity drops as much as 11% in premarket trading on Wednesday, after the health-care software company gave a weaker-than-expected 1Q forecast due to delayed product launches. Analysts note that the outlook puts a lot of pressure on the company to ramp in the second half of the year.

- Gates Industrial Corp. declined 1.4% postmarket after leading holder Blackstone offered 22.5 million shares via Citigroup, Evercore ISI, Goldman Sachs.

- Maxeon Solar Technologies dropped 6% postmarket after the solar-panel maker offered 5.1 million shares and leading holder TotalEnergies offered an additional 1.7 million via BofA Securities, Morgan Stanley.

- Intapp Inc. fell 5.2% postmarket after the software company offered 2 million shares and selling stockholders offered 4.25 million via BofA Securities, Barclays.

- Container Store tumbled 17% in post-market trading Tuesday after its full- year net sales forecast fell short of the average of analysts’ estimates.

- Vivid Seats dropped 12% postmarket as selling stockholder Hoya Topco LLC offers 16m Class A shares via Citigroup, Morgan Stanley.

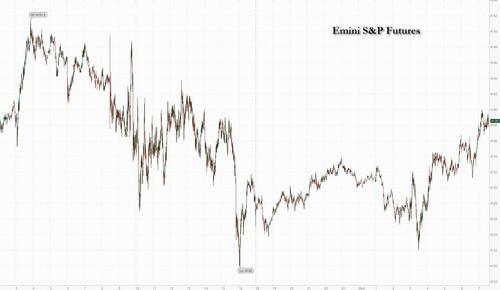

A rally that lifted global stocks by almost 9% this year through the end of April reversed this month as the debt-ceiling standoff compounded fears about an economic slowdown and outweighed a better-than-feared corporate earnings season. “That is leading to the reason why equity markets have stalled over the last couple of weeks because you are not really paid now to make big bets ahead of this event,” Grace Peters, JPMorgan Private Bank’s head of investment strategy, said in an interview with Bloomberg TV.

Still, the calm in equity indexes “hides a lot of movement under the surface,” said Marija Veitmane, senior multi-asset strategist for State Street Global Markets.“Our favorite trade is preference for growth stocks over value as we believe that recession is inevitable so earnings are likely to falter, while growth should get some support from falling rates.”

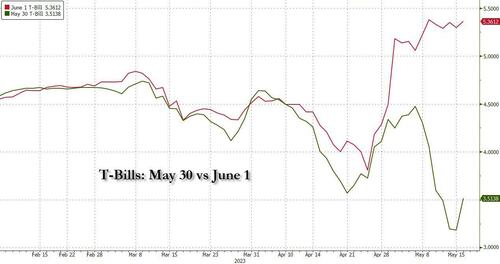

Negotiators are seeking a framework agreement to review upon President Joe Biden’s return from a truncated trip to Asia. Any breakthrough in the talks would give markets cause to rally, dissipating one of the biggest tail risks weighing on sentiment. “Longer term, that would be a dip that we would buy if that were to come to pass,” Peters said. “The market does ultimately I think assume this will get resolved.” In the meantime, Treasury bills maturing after June 1 are under pressure, as costs to insure Treasuries in the credit-default swap market surge.

Meanwhile, strategists at Goldman Sachs Group said artificial intelligence offers the biggest potential long-term support for US profit margins, although they warned there’s high uncertainty around AI’s impact. AI can boost net margins by nearly 400 basis points over a decade, strategists led by Ben Snider wrote in a note.

European stocks are slightly lower as risk sentiment struggles to gain any real traction with US debt ceiling negotiations making only glacial progress. The Stoxx 600 is down 0.1% with real estate, financial services and retail the worst performing sectors while miners and travel stocks rise. Here are the most notable European movers:

- Argenx shares rise as much as 5.8% after Bloomberg reported several major drugmakers keen to expand in immunology have been studying the biotech and have it at the top of their wish lists

- Aegon shares climb as much as 5.6% after the Dutch insurance company’s 1Q capital generation before holdco costs beat consensus expectations, suggesting modest consensus upgrades, Citi says

- SAP shares rise as much as 1.9% after the software giant projected sales growth to accelerate beyond 2025, a bullish ambition as the firm’s transition to cloud bears fruit, according to analysts

- Watches of Switzerland shares fall as much as 12%, to the lowest since September 30, after the top seller of Rolex timepieces in the UK said it expects a decline in first-quarter sales

- Commerzbank declines as much as 7.9%, worst performer on the Stoxx 600 Banks Index, as analysts say an increase in guidance for FY net interest income is not enough, as it only matches consensus

- Experian shares decline as much as 5.7%, reaching the lowest since March, after the consumer credit reporting company’s organic revenue forecast for the year failed to match expectations

- British Land declines as much as 5.1% after the landlord’s FY results showed net asset values for the group fell more than expected. Jefferies noted the decline was worse than for rival Land Securities

- Ubisoft shares sink as much as 11% after the French video-game company’s quarterly bookings and outlook for the current quarter came in well below expectations

- Euronext shares decline as much as 5.5% as analysts point to limited room for consensus change after the French stock-market operator offered no adjustment to 2023 cost guidance

- JD Sports drops as much as 5.2% after the sports retailer reported a FY gross profit margin that missed estimates. RBC flagged the gross profit margin being below their expectations

- Zurich falls as much as 3.6% after the insurer’s presented “relatively solid” quarterly figures, with Jefferies flagging some weakness in its Farmers division and Vontobel notes a miss on Solvency

Elsewhere, the greenback remains on the front foot with the Bloomberg Dollar Spot Index rising 0.3% to its highest in over five weeks. Bunds and gilts are on the front foot with German and UK 10-year yields falling by 4bps and 3bps respectively.

Earlier in the session, Asian stocks retreated as weaker-than-expected data from China continued to weigh on sentiment concerning the country’s economic growth outlook. The MSCI Asia Pacific Index fell as much as 0.5%, with AIA Group, Meituan and Ping An Insurance Group the biggest drags. Shares in Hong Kong were the region’s worst performers after disappointing factory output and jobless data yesterday. Key gauges in Japan, Taiwan and South Korea rose. The Hang Seng Index declined 2.1%, the most in a week, dragged lower by property and technology stocks. Tencent, which ended down 0.6%, saw large fund net outflow before its earnings report came after the market closed.

Japanese stocks gained for a fourth day after a better-than-expected GDP report, with the Nikkei 225 closing above the 30,000 for the first time since September 2021 a day after the Topix closed at its highest level in more than three decades. The Topix Index rose 0.3% to 2,133.61, while the Nikkei advanced 0.8% to 30,093.59. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index gain, increasing 2.2%. Out of 2,159 stocks in the index, 900 rose and 1,161 fell, while 98 were unchanged. “It’s fascinating time to be looking at the Japanese equity market at the moment,” said Bruce Kirk, Chief Japan Equity Strategist at Goldman Sachs, on Bloomberg TV. “What we are seeing is a perfect alignment between the interests of the government, the regulator, the exchange, and also the investors, both foreign and domestic.”

Meanwhile commodity-heavy Australian stocks continued their decline, as the S&P/ASX 200 index fell 0.5% to close at 7,199.20, weighed by mining shares and banks. Australian salaries rose at around half the pace of inflation in the first three months of 2023, suggesting the economy will avoid a wage-price spiral and bolstering the case for the central bank to stand pat in June. Read: Australia Pay Gains Suggest Economy to Avoid Wage Breakout In New Zealand, the S&P/NZX 50 index was little changed at 11,951.66

Stocks in India also dropped for a second session as investors continued to book profits after a recent rally in the key gauges. The S&P BSE Sensex fell 0.6% to 61,560.64 in Mumbai, while the NSE Nifty 50 Index posted a similar decline to close at 18,181.75. Stocks in the benchmark gauges are trading at 19.2 times their estimated earnings for the next 12 months, close to the 5-year average of 19.8x. Infosys contributed the most to the index’s decline, decreasing 1.3%. Out of 30 shares in the Sensex index, 7 rose and 23 fell

In FX, the Bloomberg Dollar Spot Index rose 0.3% to 1234.32 as the greenback rallied to a two-week high of 137.17 yen. In quiet trade, the dollar gained against all G10 currencies bar the New Zealand dollar, which rose as much as 0.4% to 0.6253. The yuan slid past the key level of 7 per dollar for the first time this year in a further sign the recovery of the world’s second- largest economy from its Covid restrictions is grinding to a halt; the offshore yuan slipped as much as 0.3% to 7.0201 per dollar, while the onshore currency dropped as much as 0.4% to 7.0026.

In rates, treasuries are slightly richer across the curve with spreads broadly within 1bp-2bps of Tuesday’s close. 10-year yields are around 3.515%, richer by ~2bp on the day, with bunds and gilts outperforming by 3bp and 1.5bp in the sector. The two-year Treasury yield rose 2 basis points to 4.10%, after climbing as high as 4.12% on Tuesday; Treasuries remained pressured after Fed officials appeared divided on whether to raise rates or pause its tightening cycle. Traders are betting on the possibility that the Fed will keep rates on hold at 5.25% at its June meeting; they are pricing around 19 basis points in cuts in September, and a total of around 60 basis points of cuts by year-end.

Bigger gains remain in core European rates after a strong 10-year German bond auction, which produced highest demand since August 2020. US session features 20-year bond sale at 1pm New York time. For $15b 20- year bond auction, WI yield ~3.945% is 2.5bp cheaper than April’s stop-out, which tailed the WI by 0.2bp. IG issuance slate empty so far; Pfizer priced a $31b deal Tuesday, the 4th largest on record, while energy producer Ovintiv issued a $2.3b offering; Pfizer offered investors upwards of 20bps in new-issue concessions

In commodities, crude futures decline with WTI down 0.2% to trade near $70.70. Spot gold falls 0.2% to around $1,985. Bitcoin drops 0.4%.

UK MPs have warned that trading in Bitcoin and other speculative crypto assets should be regulated to prevent consumers from being lulled into a false sense of security about the risks posed, according to The Times.

Looking to the day ahead now, data releases include US housing starts and building permits for April, along with the final CPI print for April from the Euro Area. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, along with the ECB’s de Cos, Elderson, Centeno and Rehn. Finally, earnings releases include Target and Cisco.

Market Snapshot

- S&P 500 futures up 0.3% to 4,133.50

- MXAP down 0.4% to 161.25

- MXAPJ down 0.6% to 510.86

- Nikkei up 0.8% to 30,093.59

- Topix up 0.3% to 2,133.61

- Hang Seng Index down 2.1% to 19,560.57

- Shanghai Composite down 0.2% to 3,284.23

- Sensex down 0.8% to 61,445.80

- Australia S&P/ASX 200 down 0.5% to 7,199.24

- Kospi up 0.6% to 2,494.66

- STOXX Europe 600 down 0.1% to 464.11

- German 10Y yield little changed at 2.33%

- Euro down 0.2% to $1.0843

- Brent Futures down 0.3% to $74.67/bbl

- Gold spot down 0.1% to $1,986.63

- U.S. Dollar Index up 0.28% to 102.85

Top Overnight News from Bloomberg

- Japan’s Q1 GDP comes in solidly above the Street consensus at +1.6% (the Street was modeling +0.8%) thanks to strong consumer spending. WSJ

- China’s new home prices for April comes in +0.32% M/M, down from the +0.44% number posted in March. WSJ

- UBS projects a massive accounting gain from its takeover of Credit Suisse, with the combined firms' "negative goodwill" seen boosting reported profit by $34.8 billion. On the downside, UBS estimates litigation, regulatory matters and related liabilities may take $4 billion out of capital over 12 months. BBG

- House Democrats plan to begin collecting signatures Wednesday for a discharge petition to raise the debt ceiling, a long-shot parliamentary maneuver designed to circumvent House Republican leadership and force a vote. WSJ

- US oil/gas drilling is starting to dip amid subdued prices, creating headwinds for the equipment industry (and potentially leading to higher energy prices down the board). FT

- The FTC’s lawsuit to block AMGN-HZNP is the first time in more than 10 years that the gov’t has tried to stop a drug merger (the FTC warned on Tues that “rampant consolidation” in the industry was pushing up prices). FT

- Western Alliance provided some encouraging statistics around deposit dynamics. Overall deposits stabilized during the final days of March and have resumed a growth trajectory since. QTD deposit growth is north of $2B as of May 12. In addition, insured deposits are now nearly 80% of the total, while the company is making progress repositioning its balance sheet. RTRS

- TGT: Stock is down in the pre-market on the 2Q guide but our desk thinks they did what they needed to do with 1Q good enough and 2Q possible conservative (we’ll see more on that from the call). 2Q EPS of $2.05 vs Consensus $1.77 and EBITDA 12% better. Total sales were in-line, with comps of 0% (traffic was +0.9% vs Consensus +1% (bogey was for around a 0% to +0.5%, so this was about in-line and while nothing special, is no worse than feared). Gross margins missed by 40 bps but SG&A beat by a sizeable 150 bps. Guided 2Q EPS below at $1.30-$1.70 (Consensus $1.91) and comps of down low-singles (Consensus +0.2%). Encouragingly, inventory down 17% y/t vs -3% last quarter, reaffirming the FY guide, which could be considered a bit conservative after today’s beat (but early to say). H/T Scott Feiler

- Tesla's CEO Elon Musk said the electric-car maker will dabble in advertisements, a major shift for the company that’s largely avoided traditional marketing. “We’ll try a little advertising and see how it goes,” Musk said Tuesday at Tesla’s annual shareholder meeting, in response to an investor’s question. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with the region cautious after the weak handover from the US where risk appetite was clouded amid debt ceiling concerns, while the meeting between US President Biden and congressional leaders achieved no major breakthroughs although was said to be productive and has set the stage to carry on further conversations. ASX 200 was subdued amid losses across nearly all sectors and following mixed wage price index data. Nikkei 225 outperformed and climbed above the 30,000 level for the first time since September 2021 with sentiment also underpinned by stronger-than-expected Japanese GDP data. Hang Seng and Shanghai Comp. were lower with price action contained amid a lack of fresh macro catalysts to detract from the recent streak of disappointing data releases from China.

Top Asian News

- Chinese embassy spokesman said the visit to Taiwan by former UK PM Truss this week is a dangerous political show which will do nothing but harm to the UK, according to The Guardian.

European bourses are in close proximity to the unchanged mark, Euro Stoxx 50 +0.1%, with fresh drivers somewhat limited and following a mixed APAC session though one that feature marked Nikkei 225 outperformance, above 30k. Within Europe, the DAX 40 +0.3% outperforms after heavyweight Siemens' (+2.0%) Q2 update alongside strength in SAP (+1.6%) following a guidance update and buyback announcement; in contrast, Financial Services are pressured by LSE and Euronext while Commerzbank is the Banking sector laggard. Stateside, futures are modestly firmer in generally horizontal trade with the ES +0.1% around 4130 ahead of debt ceiling updates with the overnight developments slightly constructive but the impasse ultimately remains. Tencent (700 HK): Q1 2023 (CNY): Revenue 149.99bln (exp. 146.29nlm). Net 32.5bln (exp. 33.2bln), Operating 40.43bln (exp. 40.7bln); Weixin and Wechat MAUs 1.32bln (exp. 1.32bln).

Top European News

- The Royal United Services Institute think tank warned that UK PM Sunak will have to find USD 42bln in tax hikes and spending cuts to pay for his pledge to boost defence spending to 2.5% of GDP, according to The Mirror.

- The Resolution Foundation has warned that the BoE's decision to hike interest rates could limit Chancellor Hunt's room to lower taxes in the Autumn, according to The Times.

- UK Labour opposition leader Keir Starmer calls for the UK's current Brexit deal to be renegotiated, but declares the UK must not re-join the EU or single market, according to Sky News.

- ECB's de Cos says the ECB is getting near the end of its tightening cycle; transmission remains strong.

- ECB's Rehn says need to see core CPI slow substantially.

- BoE Governor Bailey says "If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.". MPC pays particular attention to indicators of inflation persistence, including labour market tightness and wage growth, and services price inflation. There are signs that the labour market is loosening a little.

FX

- DXY tops 103.000 amidst broad gains mainly forged at the expense of the Yuan.

- USD/CNY probes 7.0000 and USD/CNH approaches Fib at 7.0364 after a spate of disappointing Chinese data.

- Yen under 137.00 vs Dollar and relying on 200 DMA for a reprieve, Sterling sub-1.2450 and relatively unaffected by BoE's Bailey.

- Euro teeters above Fib in the low 1.0800 zone.

- PBoC set USD/CNY mid-point at 6.9748 vs exp. 6.9750 (prev. 6.9506).

Fixed Income

- Firm bounce in core EU bonds and strong demand for supply along the way.

- Bunds and Gilts are both towards the top of ranges extending to 135.82 and 100.83 from 135.28 and 100.41 respectively.

- USTs relatively restrained with T-note tethered to 115-00 ahead of US housing data and USD 15bln 20-year sale.

Commodities

- Crude benchmarks are essentially unchanged after drifting in the first half of the session as the USD picked up and sentiment slipped; a narrative that has eased/lifted from respective session peaks since.

- Currently, WTI and Brent are incrementally firmer within circa. USD 1/bbl parameters with specific newsflow light and focus on geopols. amid reports that Iran's Economy Minister discussed oil and gas projects with Saudi Arabia, according to Bloomberg.

- Spot gold is drifting with the USD firmer and sentiment improving throughout the morning, yellow metal below USD 2k/oz and approaching the USD 1981/oz 50-DMA.

- Base metals are more mixed, with the region attempting to recoup some of the recent China-induced pressures but with action capped on USD strength.

- US Energy Inventory Data (bbls): Crude +3.7mln (exp. -0.9mln), Gasoline -2.5mln (exp. -1.1mln), Distillate -0.9mln (exp. +0.1mln), Cushing +2.9mln.

- UBS lowers Year-End Brent forecast by USD 10/bbl to USD 95/bbl amid greater-than-expected supply.

Debt Ceiling latest

- US President Biden said they had a good, productive meeting on the debt ceiling and there is still more work to do, while he made it clear to House Speaker McCarthy that they will talk regularly over the next several days. Biden is confident they will continue to make progress on avoiding default and said that defaulting on debt is not an option, while he also noted it is disappointing Republicans refuse to consider raising revenue, according to Reuters.

- White House said President Biden directed staff to meet daily on outstanding issues and said he would like to check in with leaders later this week by phone and meet with them upon return from overseas. Biden also emphasised that while more work remains on a range of difficult issues, he is optimistic that there is a path to a budget agreement, according to Reuters.

- President Biden will no longer visit Australia or Papua New Guinea and will return to the US on Sunday to focus on the debt ceiling talks, according to NBC.

- US House Speaker McCarthy said they have set the stage to carry on conversations in debt talks and that President Biden agreed to appoint a couple of people from the administration to negotiate directly with his team. McCarthy also said there is a lot of work to do in a short amount of time and that they are still very far apart but added it is possible to get a deal by the end of the week and it is not that difficult to reach an agreement. However, McCarthy later said he is not more optimistic about getting a deal by the end of the week.

- US Senate Majority Leader Schumer said the debt meeting was good and productive, while he added that they all agreed a default is a horrible option, according to Reuters.

- US Senate Republican Leader McConnell earlier told Senate Republicans there had not been much progress on debt ceilings talks with POTUS and other leaders.

- House Democrats are to reportedly begin collecting signatures for effort to raise debt ceiling, according to WSJ.

- Punchbowl on the US debt limit, says "Initial discussions began Tuesday night, with full-scale negotiations set to kick off this morning, we’re told", "Sources close to the talks expect any debt-limit boost to run well into 2025."

Geopolitics

- Russia's Kremlin says it will not enter a hypothetical discussion on what Russia will do if the grain deal lapses.

DB's Jim Reid concludes the overnight wrap

Yesterday Henry and I published a chartbook entitled "A Time Capsule for the Future". It imagines how those in the distant future might look at what the macro signals were telling us now in May 2023. Would it be obvious in hindsight as to what happened next? For us, this has been the most predictable US cycle of our careers from the moment the US money supply exploded. From then it wasn’t difficult to predict we’d get very high inflation, and from then that central banks would have to hike rates aggressively. The next stage continues to look clear to us: given aggressive rate hikes and curve inversions, we think there’ll be a US recession rather than a soft landing. Indeed, just about every leading indicator is now pointing to one. Does it look as obvious to you? Will future historians digging up this time capsule say the same thing? Or what are we not seeing that might prove us wrong? We'd be interested in hearing your views, especially those of you from the future! The presentation is here and tomorrow we'll be hosting a webinar on it at 2:30pm London time. Please Register Here if you want to view.

Markets had a slightly tough session yesterday, as robust data and hawkish comments from Fed officials helped drive a selloff across bonds (mostly) and equities (a bit). Having said that the market was really waiting for the results of the latest meeting on the debt ceiling between President Biden and congressional leaders starting an hour before the US close. House Speaker McCarthy continues to say the two sides remain far apart. However, he acknowledged that “it is possible to get a deal by the end of the week” despite there being a lot of work to do. He also noted that the talks were “more productive” than previous meetings and that a smaller group of staffers from both sides are working toward a deal, with talks commencing as soon as tonight. President Biden announced that there was “consensus, I think, among the congressional leaders that defaulting on the debt is simply not an option.” Senate leadership from both parties exhibited optimism that a deal could be reached as well. Before the meeting even started there was news that President Biden was going to shorten his upcoming trip to Asia and return to Washington on Sunday after the G-7 meeting in Japan. This highlights the seriousness around Treasury Secretary Yellen’s June 1st deadline.

Ahead of the meeting, Treasuries had already been hurt by a collection of strong data releases, which knocked hopes among investors that rates would be cut later this year. For instance, retail sales (excluding auto and gas) were up by +0.6% in April (vs. +0.2% expected) following two consecutive monthly declines. Then industrial production grew by +0.5% in April (vs. unch expected), whilst the NAHB’s housing market index rose for a 5th month running to 50 (vs. 45 expected).

With those releases in hand and the hawkish Fed-speak discussed below, investors grew more doubtful that the Fed would pivot towards rate cuts this year, and the rate priced in for the December meeting was up +7.4bps on the day to 4.484%. In turn, that helped spur a rise in Treasury yields across the curve, with the 10yr yield up +3.2bps to 3.534% and 2yr yields +7.2bps higher. Meanwhile the 30yr yield was up +1.2bps at 3.854%, marking its highest level since March 8, just before SVB’s collapse led to market turmoil. Having said that yields are 1-2bps lower across the curve in Asia.

Before the slight rally back in Asia, the losses for Treasuries were given added support from various Fed speakers, whose tone was generally on the hawkish side. First, we had Cleveland Fed President Mester, who said that rates weren’t sufficiently restrictive just yet, and that “given how stubborn inflation has been, I can’t say that I’m at a level of the fed funds rate where it’s equally probably that the next move could be an increase or a decrease”. Later on, Richmond Fed President Barkin said that “if more increases are what’s necessary” to reduce inflation then he was “comfortable doing that.”

New York Fed President Williams said the committee was still waiting for the long lags of monetary policy while also noting that inflation is still “too high”. He did say that he sees supply-demand imbalances improving throughout the economy. Chicago Fed President Goolsbee reminded the market that service inflation remains too high and that “its far too premature to be talking about rate cuts.” Lastly, Dallas Fed President Logan tried to walk the line between the hawks and doves saying that gradual policy adjustment can help mitigate stability risks and that justifies the Fed slowing the pace of hikes or outright pausing.

This combination of news meant that equities struggled yesterday, with the S&P 500 (-0.64%) reversing its gains from the previous session and close near its lows on the day. The declines were generally broad-based (88% of the index lower), but tech stocks were the exception and saw the NASDAQ outperform slightly (-0.18%) . That was aided by a strong advance from the megacap stocks, with the FANG+ index rising +0.97% yesterday in a big outperformance. The latest moves further showcase just show top-heavy the equity gains have been this year. Indeed, the S&P 500 is up by +7.04% on a YTD basis, but the equal-weighted S&P 500 is now down -0.80% since the start of the year.

Back in Europe, markets followed a broadly similar pattern to the US, with the STOXX 600 down -0.42%, whilst yields on 10yr bunds (+4.4bps), OATs (+5.1bps) and BTPs (+3.5bps) all moved higher. Sentiment wasn’t helped by the latest ZEW survey from Germany, where the expectations component fell for a 3rd consecutive month in May to -10.7 (vs. -5.0 expected), so further reversing the more positive sentiment we saw around the turn of the year. On the other hand, there was some further good news from natural gas prices, which fell -1.53% to another 22-month low of €31.82/MWh.

Elsewhere, UK gilts were an outperformer yesterday following signs that the labour market might be softening. In particular, the number of payrolled employees unexpectedly fell by -136k in April (vs. +25k expected), which marked the first monthly decline in that measure since February 2021. Furthermore, the unemployment rate over the three months to March rose a tenth to 3.9% (vs. 3.8% expected). See our economist's view on the data here. The release meant investors slightly downgraded the likelihood of a rate hike at the BoE’s next meeting in June, with the chances down to 78%, having been at 85% the previous day.

It was the reverse story in Canada, with 10yr yields up by +17bps after the country’s CPI reading unexpectedly rose in April. That showed inflation rising to +4.4% (vs. +4.1% expected), which ended a run of 5 consecutive monthly declines in headline inflation. In turn, investors dialled up the chances that the Bank of Canada might hike rates at the next meeting following their recent pause, with overnight index swaps now seeing a 35% chance of another 25bp move in June.

Asian equity markets are mixed this morning as US debt negotiations continue. Across the region, the Nikkei (+0.66%) is topping gains, moving beyond the 30,000 level for the first time since September 2021, as Japan’s Q1 GDP beat estimates (more below) while the KOSPI (+0.56%) is also trading up. Elsewhere, Chinese stocks are losing ground this morning with the Hang Seng (-0.48%), the CSI (-0.35%) and the Shanghai Composite (-0.24%) all edging lower. Outside of Asia, US stock futures are printing mild gains with those on the S&P 500 (+0.19%) and NASDAQ 100 (+0.25%) retracing some of yesterday's losses.

Coming back to Japan, data showed that the economy grew +1.6% in the first quarter this year on an annualized basis (v/s +0.8% expected), recording the first increase in three quarters and following a revised -0.1% fall in Q4 last year (initially +0.1%). A strong rebound in service activity after reopening post pandemic was the main driver of growth.

To the day ahead now, and data releases include US housing starts and building permits for April, along with the final CPI print for April from the Euro Area. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, along with the ECB’s de Cos, Elderson, Centeno and Rehn. Finally, earnings releases include Target and Cisco.

US stock futures crept higher on Wednesday and traded near the best levels of the session, as investors remained focused on debt ceiling talks while negotiators seek a framework agreement for Joe Biden and Kevin McCarthy to review upon the president’s return from a truncated trip to Asia. Contracts on the S&P 500 were up 0.3% as 7:45am ET a.m. while Nasdaq 100 futures added 0.2%. Europe’s Estoxx50 little changed on the day; while Japan’s Nikkei 225 closed above the 30,000 for the first time since September 2021 a day after the Topix closed at its highest level in more than three decades. Treasuries are slightly richer across the curve with spreads broadly within 1bp-2bps of Tuesday’s close while the dollar is flat. Oil rebounded from an earlier drop concerns over demand in China and expectations of rising stockpiles in the US. Iron ore continues its week in the green, while gold and bitcoin declines.

In premarket trading, Western Alliance Bancorp jumped as much as 9.8% after the regional lender reported growth in deposits this quarter, soothing concerns after it was caught up in the turmoil engulfing the US regional banking sector. Tesla rose as much as 1.7% in premarket trading on Wednesday, as CEO Elon Musk said the electric-car maker will “try a little advertising and see how it goes.” This is a major shift for the company that’s largely avoided traditional marketing to sell its vehicles. Manchester United gained after Bloomberg reported that Sheikh Jassim Bin Hamad J.J. Al-Thani submitted an improved offer for the football club. Here are some other notable premarket movers:

- Doximity drops as much as 11% in premarket trading on Wednesday, after the health-care software company gave a weaker-than-expected 1Q forecast due to delayed product launches. Analysts note that the outlook puts a lot of pressure on the company to ramp in the second half of the year.

- Gates Industrial Corp. declined 1.4% postmarket after leading holder Blackstone offered 22.5 million shares via Citigroup, Evercore ISI, Goldman Sachs.

- Maxeon Solar Technologies dropped 6% postmarket after the solar-panel maker offered 5.1 million shares and leading holder TotalEnergies offered an additional 1.7 million via BofA Securities, Morgan Stanley.

- Intapp Inc. fell 5.2% postmarket after the software company offered 2 million shares and selling stockholders offered 4.25 million via BofA Securities, Barclays.

- Container Store tumbled 17% in post-market trading Tuesday after its full- year net sales forecast fell short of the average of analysts’ estimates.

- Vivid Seats dropped 12% postmarket as selling stockholder Hoya Topco LLC offers 16m Class A shares via Citigroup, Morgan Stanley.

A rally that lifted global stocks by almost 9% this year through the end of April reversed this month as the debt-ceiling standoff compounded fears about an economic slowdown and outweighed a better-than-feared corporate earnings season. “That is leading to the reason why equity markets have stalled over the last couple of weeks because you are not really paid now to make big bets ahead of this event,” Grace Peters, JPMorgan Private Bank’s head of investment strategy, said in an interview with Bloomberg TV.

Still, the calm in equity indexes “hides a lot of movement under the surface,” said Marija Veitmane, senior multi-asset strategist for State Street Global Markets.“Our favorite trade is preference for growth stocks over value as we believe that recession is inevitable so earnings are likely to falter, while growth should get some support from falling rates.”

Negotiators are seeking a framework agreement to review upon President Joe Biden’s return from a truncated trip to Asia. Any breakthrough in the talks would give markets cause to rally, dissipating one of the biggest tail risks weighing on sentiment. “Longer term, that would be a dip that we would buy if that were to come to pass,” Peters said. “The market does ultimately I think assume this will get resolved.” In the meantime, Treasury bills maturing after June 1 are under pressure, as costs to insure Treasuries in the credit-default swap market surge.

Meanwhile, strategists at Goldman Sachs Group said artificial intelligence offers the biggest potential long-term support for US profit margins, although they warned there’s high uncertainty around AI’s impact. AI can boost net margins by nearly 400 basis points over a decade, strategists led by Ben Snider wrote in a note.

European stocks are slightly lower as risk sentiment struggles to gain any real traction with US debt ceiling negotiations making only glacial progress. The Stoxx 600 is down 0.1% with real estate, financial services and retail the worst performing sectors while miners and travel stocks rise. Here are the most notable European movers:

- Argenx shares rise as much as 5.8% after Bloomberg reported several major drugmakers keen to expand in immunology have been studying the biotech and have it at the top of their wish lists

- Aegon shares climb as much as 5.6% after the Dutch insurance company’s 1Q capital generation before holdco costs beat consensus expectations, suggesting modest consensus upgrades, Citi says

- SAP shares rise as much as 1.9% after the software giant projected sales growth to accelerate beyond 2025, a bullish ambition as the firm’s transition to cloud bears fruit, according to analysts

- Watches of Switzerland shares fall as much as 12%, to the lowest since September 30, after the top seller of Rolex timepieces in the UK said it expects a decline in first-quarter sales

- Commerzbank declines as much as 7.9%, worst performer on the Stoxx 600 Banks Index, as analysts say an increase in guidance for FY net interest income is not enough, as it only matches consensus

- Experian shares decline as much as 5.7%, reaching the lowest since March, after the consumer credit reporting company’s organic revenue forecast for the year failed to match expectations

- British Land declines as much as 5.1% after the landlord’s FY results showed net asset values for the group fell more than expected. Jefferies noted the decline was worse than for rival Land Securities

- Ubisoft shares sink as much as 11% after the French video-game company’s quarterly bookings and outlook for the current quarter came in well below expectations

- Euronext shares decline as much as 5.5% as analysts point to limited room for consensus change after the French stock-market operator offered no adjustment to 2023 cost guidance

- JD Sports drops as much as 5.2% after the sports retailer reported a FY gross profit margin that missed estimates. RBC flagged the gross profit margin being below their expectations

- Zurich falls as much as 3.6% after the insurer’s presented “relatively solid” quarterly figures, with Jefferies flagging some weakness in its Farmers division and Vontobel notes a miss on Solvency

Elsewhere, the greenback remains on the front foot with the Bloomberg Dollar Spot Index rising 0.3% to its highest in over five weeks. Bunds and gilts are on the front foot with German and UK 10-year yields falling by 4bps and 3bps respectively.

Earlier in the session, Asian stocks retreated as weaker-than-expected data from China continued to weigh on sentiment concerning the country’s economic growth outlook. The MSCI Asia Pacific Index fell as much as 0.5%, with AIA Group, Meituan and Ping An Insurance Group the biggest drags. Shares in Hong Kong were the region’s worst performers after disappointing factory output and jobless data yesterday. Key gauges in Japan, Taiwan and South Korea rose. The Hang Seng Index declined 2.1%, the most in a week, dragged lower by property and technology stocks. Tencent, which ended down 0.6%, saw large fund net outflow before its earnings report came after the market closed.

Japanese stocks gained for a fourth day after a better-than-expected GDP report, with the Nikkei 225 closing above the 30,000 for the first time since September 2021 a day after the Topix closed at its highest level in more than three decades. The Topix Index rose 0.3% to 2,133.61, while the Nikkei advanced 0.8% to 30,093.59. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index gain, increasing 2.2%. Out of 2,159 stocks in the index, 900 rose and 1,161 fell, while 98 were unchanged. “It’s fascinating time to be looking at the Japanese equity market at the moment,” said Bruce Kirk, Chief Japan Equity Strategist at Goldman Sachs, on Bloomberg TV. “What we are seeing is a perfect alignment between the interests of the government, the regulator, the exchange, and also the investors, both foreign and domestic.”

Meanwhile commodity-heavy Australian stocks continued their decline, as the S&P/ASX 200 index fell 0.5% to close at 7,199.20, weighed by mining shares and banks. Australian salaries rose at around half the pace of inflation in the first three months of 2023, suggesting the economy will avoid a wage-price spiral and bolstering the case for the central bank to stand pat in June. Read: Australia Pay Gains Suggest Economy to Avoid Wage Breakout In New Zealand, the S&P/NZX 50 index was little changed at 11,951.66

Stocks in India also dropped for a second session as investors continued to book profits after a recent rally in the key gauges. The S&P BSE Sensex fell 0.6% to 61,560.64 in Mumbai, while the NSE Nifty 50 Index posted a similar decline to close at 18,181.75. Stocks in the benchmark gauges are trading at 19.2 times their estimated earnings for the next 12 months, close to the 5-year average of 19.8x. Infosys contributed the most to the index’s decline, decreasing 1.3%. Out of 30 shares in the Sensex index, 7 rose and 23 fell

In FX, the Bloomberg Dollar Spot Index rose 0.3% to 1234.32 as the greenback rallied to a two-week high of 137.17 yen. In quiet trade, the dollar gained against all G10 currencies bar the New Zealand dollar, which rose as much as 0.4% to 0.6253. The yuan slid past the key level of 7 per dollar for the first time this year in a further sign the recovery of the world’s second- largest economy from its Covid restrictions is grinding to a halt; the offshore yuan slipped as much as 0.3% to 7.0201 per dollar, while the onshore currency dropped as much as 0.4% to 7.0026.

In rates, treasuries are slightly richer across the curve with spreads broadly within 1bp-2bps of Tuesday’s close. 10-year yields are around 3.515%, richer by ~2bp on the day, with bunds and gilts outperforming by 3bp and 1.5bp in the sector. The two-year Treasury yield rose 2 basis points to 4.10%, after climbing as high as 4.12% on Tuesday; Treasuries remained pressured after Fed officials appeared divided on whether to raise rates or pause its tightening cycle. Traders are betting on the possibility that the Fed will keep rates on hold at 5.25% at its June meeting; they are pricing around 19 basis points in cuts in September, and a total of around 60 basis points of cuts by year-end.

Bigger gains remain in core European rates after a strong 10-year German bond auction, which produced highest demand since August 2020. US session features 20-year bond sale at 1pm New York time. For $15b 20- year bond auction, WI yield ~3.945% is 2.5bp cheaper than April’s stop-out, which tailed the WI by 0.2bp. IG issuance slate empty so far; Pfizer priced a $31b deal Tuesday, the 4th largest on record, while energy producer Ovintiv issued a $2.3b offering; Pfizer offered investors upwards of 20bps in new-issue concessions

In commodities, crude futures decline with WTI down 0.2% to trade near $70.70. Spot gold falls 0.2% to around $1,985. Bitcoin drops 0.4%.

UK MPs have warned that trading in Bitcoin and other speculative crypto assets should be regulated to prevent consumers from being lulled into a false sense of security about the risks posed, according to The Times.

Looking to the day ahead now, data releases include US housing starts and building permits for April, along with the final CPI print for April from the Euro Area. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, along with the ECB’s de Cos, Elderson, Centeno and Rehn. Finally, earnings releases include Target and Cisco.

Market Snapshot

- S&P 500 futures up 0.3% to 4,133.50

- MXAP down 0.4% to 161.25

- MXAPJ down 0.6% to 510.86

- Nikkei up 0.8% to 30,093.59

- Topix up 0.3% to 2,133.61

- Hang Seng Index down 2.1% to 19,560.57

- Shanghai Composite down 0.2% to 3,284.23

- Sensex down 0.8% to 61,445.80

- Australia S&P/ASX 200 down 0.5% to 7,199.24

- Kospi up 0.6% to 2,494.66

- STOXX Europe 600 down 0.1% to 464.11

- German 10Y yield little changed at 2.33%

- Euro down 0.2% to $1.0843

- Brent Futures down 0.3% to $74.67/bbl

- Gold spot down 0.1% to $1,986.63

- U.S. Dollar Index up 0.28% to 102.85

Top Overnight News from Bloomberg

- Japan’s Q1 GDP comes in solidly above the Street consensus at +1.6% (the Street was modeling +0.8%) thanks to strong consumer spending. WSJ

- China’s new home prices for April comes in +0.32% M/M, down from the +0.44% number posted in March. WSJ

- UBS projects a massive accounting gain from its takeover of Credit Suisse, with the combined firms’ “negative goodwill” seen boosting reported profit by $34.8 billion. On the downside, UBS estimates litigation, regulatory matters and related liabilities may take $4 billion out of capital over 12 months. BBG

- House Democrats plan to begin collecting signatures Wednesday for a discharge petition to raise the debt ceiling, a long-shot parliamentary maneuver designed to circumvent House Republican leadership and force a vote. WSJ

- US oil/gas drilling is starting to dip amid subdued prices, creating headwinds for the equipment industry (and potentially leading to higher energy prices down the board). FT

- The FTC’s lawsuit to block AMGN-HZNP is the first time in more than 10 years that the gov’t has tried to stop a drug merger (the FTC warned on Tues that “rampant consolidation” in the industry was pushing up prices). FT

- Western Alliance provided some encouraging statistics around deposit dynamics. Overall deposits stabilized during the final days of March and have resumed a growth trajectory since. QTD deposit growth is north of $2B as of May 12. In addition, insured deposits are now nearly 80% of the total, while the company is making progress repositioning its balance sheet. RTRS

- TGT: Stock is down in the pre-market on the 2Q guide but our desk thinks they did what they needed to do with 1Q good enough and 2Q possible conservative (we’ll see more on that from the call). 2Q EPS of $2.05 vs Consensus $1.77 and EBITDA 12% better. Total sales were in-line, with comps of 0% (traffic was +0.9% vs Consensus +1% (bogey was for around a 0% to +0.5%, so this was about in-line and while nothing special, is no worse than feared). Gross margins missed by 40 bps but SG&A beat by a sizeable 150 bps. Guided 2Q EPS below at $1.30-$1.70 (Consensus $1.91) and comps of down low-singles (Consensus +0.2%). Encouragingly, inventory down 17% y/t vs -3% last quarter, reaffirming the FY guide, which could be considered a bit conservative after today’s beat (but early to say). H/T Scott Feiler

- Tesla’s CEO Elon Musk said the electric-car maker will dabble in advertisements, a major shift for the company that’s largely avoided traditional marketing. “We’ll try a little advertising and see how it goes,” Musk said Tuesday at Tesla’s annual shareholder meeting, in response to an investor’s question. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with the region cautious after the weak handover from the US where risk appetite was clouded amid debt ceiling concerns, while the meeting between US President Biden and congressional leaders achieved no major breakthroughs although was said to be productive and has set the stage to carry on further conversations. ASX 200 was subdued amid losses across nearly all sectors and following mixed wage price index data. Nikkei 225 outperformed and climbed above the 30,000 level for the first time since September 2021 with sentiment also underpinned by stronger-than-expected Japanese GDP data. Hang Seng and Shanghai Comp. were lower with price action contained amid a lack of fresh macro catalysts to detract from the recent streak of disappointing data releases from China.

Top Asian News

- Chinese embassy spokesman said the visit to Taiwan by former UK PM Truss this week is a dangerous political show which will do nothing but harm to the UK, according to The Guardian.

European bourses are in close proximity to the unchanged mark, Euro Stoxx 50 +0.1%, with fresh drivers somewhat limited and following a mixed APAC session though one that feature marked Nikkei 225 outperformance, above 30k. Within Europe, the DAX 40 +0.3% outperforms after heavyweight Siemens’ (+2.0%) Q2 update alongside strength in SAP (+1.6%) following a guidance update and buyback announcement; in contrast, Financial Services are pressured by LSE and Euronext while Commerzbank is the Banking sector laggard. Stateside, futures are modestly firmer in generally horizontal trade with the ES +0.1% around 4130 ahead of debt ceiling updates with the overnight developments slightly constructive but the impasse ultimately remains. Tencent (700 HK): Q1 2023 (CNY): Revenue 149.99bln (exp. 146.29nlm). Net 32.5bln (exp. 33.2bln), Operating 40.43bln (exp. 40.7bln); Weixin and Wechat MAUs 1.32bln (exp. 1.32bln).

Top European News

- The Royal United Services Institute think tank warned that UK PM Sunak will have to find USD 42bln in tax hikes and spending cuts to pay for his pledge to boost defence spending to 2.5% of GDP, according to The Mirror.

- The Resolution Foundation has warned that the BoE’s decision to hike interest rates could limit Chancellor Hunt’s room to lower taxes in the Autumn, according to The Times.

- UK Labour opposition leader Keir Starmer calls for the UK’s current Brexit deal to be renegotiated, but declares the UK must not re-join the EU or single market, according to Sky News.

- ECB’s de Cos says the ECB is getting near the end of its tightening cycle; transmission remains strong.

- ECB’s Rehn says need to see core CPI slow substantially.

- BoE Governor Bailey says “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”. MPC pays particular attention to indicators of inflation persistence, including labour market tightness and wage growth, and services price inflation. There are signs that the labour market is loosening a little.

FX

- DXY tops 103.000 amidst broad gains mainly forged at the expense of the Yuan.

- USD/CNY probes 7.0000 and USD/CNH approaches Fib at 7.0364 after a spate of disappointing Chinese data.

- Yen under 137.00 vs Dollar and relying on 200 DMA for a reprieve, Sterling sub-1.2450 and relatively unaffected by BoE’s Bailey.

- Euro teeters above Fib in the low 1.0800 zone.

- PBoC set USD/CNY mid-point at 6.9748 vs exp. 6.9750 (prev. 6.9506).

Fixed Income

- Firm bounce in core EU bonds and strong demand for supply along the way.

- Bunds and Gilts are both towards the top of ranges extending to 135.82 and 100.83 from 135.28 and 100.41 respectively.

- USTs relatively restrained with T-note tethered to 115-00 ahead of US housing data and USD 15bln 20-year sale.

Commodities

- Crude benchmarks are essentially unchanged after drifting in the first half of the session as the USD picked up and sentiment slipped; a narrative that has eased/lifted from respective session peaks since.

- Currently, WTI and Brent are incrementally firmer within circa. USD 1/bbl parameters with specific newsflow light and focus on geopols. amid reports that Iran’s Economy Minister discussed oil and gas projects with Saudi Arabia, according to Bloomberg.

- Spot gold is drifting with the USD firmer and sentiment improving throughout the morning, yellow metal below USD 2k/oz and approaching the USD 1981/oz 50-DMA.

- Base metals are more mixed, with the region attempting to recoup some of the recent China-induced pressures but with action capped on USD strength.

- US Energy Inventory Data (bbls): Crude +3.7mln (exp. -0.9mln), Gasoline -2.5mln (exp. -1.1mln), Distillate -0.9mln (exp. +0.1mln), Cushing +2.9mln.

- UBS lowers Year-End Brent forecast by USD 10/bbl to USD 95/bbl amid greater-than-expected supply.

Debt Ceiling latest

- US President Biden said they had a good, productive meeting on the debt ceiling and there is still more work to do, while he made it clear to House Speaker McCarthy that they will talk regularly over the next several days. Biden is confident they will continue to make progress on avoiding default and said that defaulting on debt is not an option, while he also noted it is disappointing Republicans refuse to consider raising revenue, according to Reuters.

- White House said President Biden directed staff to meet daily on outstanding issues and said he would like to check in with leaders later this week by phone and meet with them upon return from overseas. Biden also emphasised that while more work remains on a range of difficult issues, he is optimistic that there is a path to a budget agreement, according to Reuters.

- President Biden will no longer visit Australia or Papua New Guinea and will return to the US on Sunday to focus on the debt ceiling talks, according to NBC.

- US House Speaker McCarthy said they have set the stage to carry on conversations in debt talks and that President Biden agreed to appoint a couple of people from the administration to negotiate directly with his team. McCarthy also said there is a lot of work to do in a short amount of time and that they are still very far apart but added it is possible to get a deal by the end of the week and it is not that difficult to reach an agreement. However, McCarthy later said he is not more optimistic about getting a deal by the end of the week.

- US Senate Majority Leader Schumer said the debt meeting was good and productive, while he added that they all agreed a default is a horrible option, according to Reuters.

- US Senate Republican Leader McConnell earlier told Senate Republicans there had not been much progress on debt ceilings talks with POTUS and other leaders.

- House Democrats are to reportedly begin collecting signatures for effort to raise debt ceiling, according to WSJ.

- Punchbowl on the US debt limit, says “Initial discussions began Tuesday night, with full-scale negotiations set to kick off this morning, we’re told”, “Sources close to the talks expect any debt-limit boost to run well into 2025.”

Geopolitics

- Russia’s Kremlin says it will not enter a hypothetical discussion on what Russia will do if the grain deal lapses.

DB’s Jim Reid concludes the overnight wrap

Yesterday Henry and I published a chartbook entitled “A Time Capsule for the Future”. It imagines how those in the distant future might look at what the macro signals were telling us now in May 2023. Would it be obvious in hindsight as to what happened next? For us, this has been the most predictable US cycle of our careers from the moment the US money supply exploded. From then it wasn’t difficult to predict we’d get very high inflation, and from then that central banks would have to hike rates aggressively. The next stage continues to look clear to us: given aggressive rate hikes and curve inversions, we think there’ll be a US recession rather than a soft landing. Indeed, just about every leading indicator is now pointing to one. Does it look as obvious to you? Will future historians digging up this time capsule say the same thing? Or what are we not seeing that might prove us wrong? We’d be interested in hearing your views, especially those of you from the future! The presentation is here and tomorrow we’ll be hosting a webinar on it at 2:30pm London time. Please Register Here if you want to view.

Markets had a slightly tough session yesterday, as robust data and hawkish comments from Fed officials helped drive a selloff across bonds (mostly) and equities (a bit). Having said that the market was really waiting for the results of the latest meeting on the debt ceiling between President Biden and congressional leaders starting an hour before the US close. House Speaker McCarthy continues to say the two sides remain far apart. However, he acknowledged that “it is possible to get a deal by the end of the week” despite there being a lot of work to do. He also noted that the talks were “more productive” than previous meetings and that a smaller group of staffers from both sides are working toward a deal, with talks commencing as soon as tonight. President Biden announced that there was “consensus, I think, among the congressional leaders that defaulting on the debt is simply not an option.” Senate leadership from both parties exhibited optimism that a deal could be reached as well. Before the meeting even started there was news that President Biden was going to shorten his upcoming trip to Asia and return to Washington on Sunday after the G-7 meeting in Japan. This highlights the seriousness around Treasury Secretary Yellen’s June 1st deadline.

Ahead of the meeting, Treasuries had already been hurt by a collection of strong data releases, which knocked hopes among investors that rates would be cut later this year. For instance, retail sales (excluding auto and gas) were up by +0.6% in April (vs. +0.2% expected) following two consecutive monthly declines. Then industrial production grew by +0.5% in April (vs. unch expected), whilst the NAHB’s housing market index rose for a 5th month running to 50 (vs. 45 expected).

With those releases in hand and the hawkish Fed-speak discussed below, investors grew more doubtful that the Fed would pivot towards rate cuts this year, and the rate priced in for the December meeting was up +7.4bps on the day to 4.484%. In turn, that helped spur a rise in Treasury yields across the curve, with the 10yr yield up +3.2bps to 3.534% and 2yr yields +7.2bps higher. Meanwhile the 30yr yield was up +1.2bps at 3.854%, marking its highest level since March 8, just before SVB’s collapse led to market turmoil. Having said that yields are 1-2bps lower across the curve in Asia.

Before the slight rally back in Asia, the losses for Treasuries were given added support from various Fed speakers, whose tone was generally on the hawkish side. First, we had Cleveland Fed President Mester, who said that rates weren’t sufficiently restrictive just yet, and that “given how stubborn inflation has been, I can’t say that I’m at a level of the fed funds rate where it’s equally probably that the next move could be an increase or a decrease”. Later on, Richmond Fed President Barkin said that “if more increases are what’s necessary” to reduce inflation then he was “comfortable doing that.”

New York Fed President Williams said the committee was still waiting for the long lags of monetary policy while also noting that inflation is still “too high”. He did say that he sees supply-demand imbalances improving throughout the economy. Chicago Fed President Goolsbee reminded the market that service inflation remains too high and that “its far too premature to be talking about rate cuts.” Lastly, Dallas Fed President Logan tried to walk the line between the hawks and doves saying that gradual policy adjustment can help mitigate stability risks and that justifies the Fed slowing the pace of hikes or outright pausing.

This combination of news meant that equities struggled yesterday, with the S&P 500 (-0.64%) reversing its gains from the previous session and close near its lows on the day. The declines were generally broad-based (88% of the index lower), but tech stocks were the exception and saw the NASDAQ outperform slightly (-0.18%) . That was aided by a strong advance from the megacap stocks, with the FANG+ index rising +0.97% yesterday in a big outperformance. The latest moves further showcase just show top-heavy the equity gains have been this year. Indeed, the S&P 500 is up by +7.04% on a YTD basis, but the equal-weighted S&P 500 is now down -0.80% since the start of the year.

Back in Europe, markets followed a broadly similar pattern to the US, with the STOXX 600 down -0.42%, whilst yields on 10yr bunds (+4.4bps), OATs (+5.1bps) and BTPs (+3.5bps) all moved higher. Sentiment wasn’t helped by the latest ZEW survey from Germany, where the expectations component fell for a 3rd consecutive month in May to -10.7 (vs. -5.0 expected), so further reversing the more positive sentiment we saw around the turn of the year. On the other hand, there was some further good news from natural gas prices, which fell -1.53% to another 22-month low of €31.82/MWh.

Elsewhere, UK gilts were an outperformer yesterday following signs that the labour market might be softening. In particular, the number of payrolled employees unexpectedly fell by -136k in April (vs. +25k expected), which marked the first monthly decline in that measure since February 2021. Furthermore, the unemployment rate over the three months to March rose a tenth to 3.9% (vs. 3.8% expected). See our economist’s view on the data here. The release meant investors slightly downgraded the likelihood of a rate hike at the BoE’s next meeting in June, with the chances down to 78%, having been at 85% the previous day.

It was the reverse story in Canada, with 10yr yields up by +17bps after the country’s CPI reading unexpectedly rose in April. That showed inflation rising to +4.4% (vs. +4.1% expected), which ended a run of 5 consecutive monthly declines in headline inflation. In turn, investors dialled up the chances that the Bank of Canada might hike rates at the next meeting following their recent pause, with overnight index swaps now seeing a 35% chance of another 25bp move in June.

Asian equity markets are mixed this morning as US debt negotiations continue. Across the region, the Nikkei (+0.66%) is topping gains, moving beyond the 30,000 level for the first time since September 2021, as Japan’s Q1 GDP beat estimates (more below) while the KOSPI (+0.56%) is also trading up. Elsewhere, Chinese stocks are losing ground this morning with the Hang Seng (-0.48%), the CSI (-0.35%) and the Shanghai Composite (-0.24%) all edging lower. Outside of Asia, US stock futures are printing mild gains with those on the S&P 500 (+0.19%) and NASDAQ 100 (+0.25%) retracing some of yesterday’s losses.

Coming back to Japan, data showed that the economy grew +1.6% in the first quarter this year on an annualized basis (v/s +0.8% expected), recording the first increase in three quarters and following a revised -0.1% fall in Q4 last year (initially +0.1%). A strong rebound in service activity after reopening post pandemic was the main driver of growth.

To the day ahead now, and data releases include US housing starts and building permits for April, along with the final CPI print for April from the Euro Area. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, along with the ECB’s de Cos, Elderson, Centeno and Rehn. Finally, earnings releases include Target and Cisco.

Loading…