JPMorgan Chase’s chief economist contends that a near-term recession is not likely for the United States, even as the firm’s CEO Jamie Dimon cautions investors of an economic “hurricane” on the horizon.

Bruce Kasman said that while he doesn’t predict a recession this year, he does foresee the U.S. economy slowing while the world economy fares a bit better.

“There’s no real reason to be worried about a recession,” Kasman told Bloomberg. “There is some slowing in the picture.”

“What we have here is a pretty powerful tension between drags that are not going away and a very resilient private sector, with the health of both households and corporates being quite remarkable right now,” he said. “We don’t see a near-term recession. We see a global economy which actually does OK in the second half of the year, with the U.S. slowing and the rest of the world doing somewhat better.”

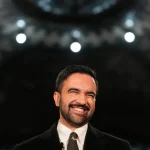

JAMIE DIMON WARNS OF ECONOMIC ‘HURRICANE’

The remarks come after Dimon rattled the markets by warning of an economic maelstrom coming down the pipeline.

Dimon, one of the most authoritative voices in the finance world, said the Federal Reserve’s plan to continue jacking up interest rates, combined with uncertainty surrounding the war in Ukraine, is causing his firm to batten down the hatches.

“You know, I said there’s storm clouds, but I’m going to change it. … It’s a hurricane,” Dimon said at a conference last week. The economic whirlwind could be “a minor one or Superstorm Sandy,” he added.

Dimon said that JPMorgan Chase, the country’s largest full-service investment bank, is going to be quite conservative with its balance sheet and that while some investors might think it’s “sunny” right now and the Fed can handle tightening monetary policy while avoiding a recession, the hurricane is “down the road, coming our way.”

Many economists define a recession as two consecutive quarters of negative gross domestic product growth. While the first quarter of this year saw a decline in GDP, more forecasters expect this quarter to see positive GDP growth, albeit slower growth than was forecast just months ago.

The Congressional Budget Office recently released an economic outlook report that indicated U.S. real GDP would increase by 3.1% this year.

Last month, JPMorgan Chase revised its growth forecast for the second half of 2022 from 3% to 2.4%. The firm also slashed its growth forecast to 1.5% for the first half of next year and a meager 1% in the second half of 2023.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The Fed is now working to contain soaring inflation by driving up interest rates at a historically aggressive pace.

While the central bank hopes to tame the rising prices, which are increasing at the fastest rate since the early 1980s, raising rates naturally slows the economy, causing some economists to fear a looming recession.