In 2024, the IRS will launch a pilot program to offer its own, government-run, income tax return-preparation website, according to a report the universally-despised agency provided to Congress on Tuesday. The report follows a $15 million study of the concept.

If there were ever a proposal absolutely guaranteed to be a multifaceted disaster, this is it. Boobus Americanus, however, is apparently champing at the bit: IRS surveys find 72% of Americans are "very" or "somewhat interested in" a free government tool for calculating taxes. What are they missing?

For starters, the IRS and all of us animals on the government's taxpayer ranch approach this endeavor with an enormous conflict of interest. We don't want to pay a penny more than we absolutely have to, while the government is hell-bent on extracting an entirely fictional "fair share" -- and more -- from each of us.

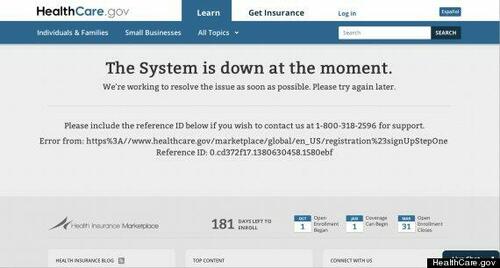

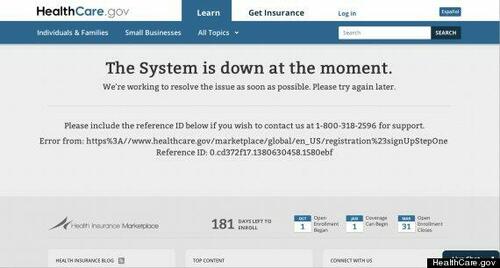

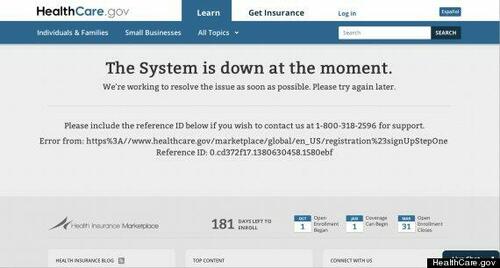

Next, there's the comically-cautionary tale of the rollout of the Obamacare enrollment website in 2013. Even with three years to prepare, it was a cluster**** for the ages. The site crashed immediately upon launch, and then inflicted countless glitches on users after it was up and running.

Even when they function properly, government websites are notorious showcases of confusing communication. Imagine when users inevitably have questions and are compelled to turn to an IRS call center for clarity. Users would have to pray that -- after enduring hold time -- they're actually matched with a competent phone rep. A 2002 Treasury audit found reps only came up with the right answer 78% of the time -- and that's just for the average question.

At first glance, some might assume using an IRS site would make you less of an audit target. Then again, it's conceivable the IRS might log your actions as you navigate the site -- such as trying different inputs to test the impact on your tax return. Such information could be used as an audit flag.

In most states, offering an appealing alternative to TurboTax and H&R Block platforms would require the IRS to also offer state and local tax prep. No way that's happening anytime soon.

The IRS says it hasn't yet defined the complexity of returns it anticipates handling during the pilot. A prototype of the IRS offering that was run by some taxpayers wasn't even built to pre-populate with data the government already has via W-2's and 1099s. As one unimpressed survey participant said, "IRS already knows your tax information. So why wouldn’t I be able to login, put in, say, my [SSN], and then half this information is already filled, and then I just need to put in corrections?”

Many survey participants felt they should receive expedited return-processing for using a government platform. In its report, however, the IRS said, "The IRS does not, and would not, give preferential treatment to taxpayers who use any particular tax filing method."

The IRS estimates its direct-filing platform would cost between $64.3 and $248.9 million annually. The running tally for the Obamacare site surpassed $840 million less than a year after it launched.

Many other countries send taxpayers "pre-filled returns" that are populated with data the government already collected. Some are so accurate in their ongoing income-tax withholding that little or no adjustment is necessary. That accuracy springs from their dramatically simpler approaches to income taxation.

Putting the government-taxpayer conflict of interest aside, until the US income tax is radically simplified -- such as with a flat tax with few or no deductions or credits, no differentiation between short- and long-term capital gains, no differentiation between tax rates on investments and earned income, and no disguised welfare handouts like the EITC -- an IRS-run tax-filing platform is for the birds.

Or maybe we should say "for the birdbrains" -- like the survey participants who said these things about the prospect of an IRS tax-prep platform:

- “It’s probably going to be good; it’s going to tell you everything you need to know because it’s the IRS. The information should be up to date. I would probably expect it to be more accurate doing it directly with IRS than though some other company."

- "They probably more want you to do it correctly than some other company.”

- “Yes [I would trust it]. Because it’s a government website."

In 2024, the IRS will launch a pilot program to offer its own, government-run, income tax return-preparation website, according to a report the universally-despised agency provided to Congress on Tuesday. The report follows a $15 million study of the concept.

If there were ever a proposal absolutely guaranteed to be a multifaceted disaster, this is it. Boobus Americanus, however, is apparently champing at the bit: IRS surveys find 72% of Americans are “very” or “somewhat interested in” a free government tool for calculating taxes. What are they missing?

For starters, the IRS and all of us animals on the government’s taxpayer ranch approach this endeavor with an enormous conflict of interest. We don’t want to pay a penny more than we absolutely have to, while the government is hell-bent on extracting an entirely fictional “fair share” — and more — from each of us.

Next, there’s the comically-cautionary tale of the rollout of the Obamacare enrollment website in 2013. Even with three years to prepare, it was a cluster**** for the ages. The site crashed immediately upon launch, and then inflicted countless glitches on users after it was up and running.

Even when they function properly, government websites are notorious showcases of confusing communication. Imagine when users inevitably have questions and are compelled to turn to an IRS call center for clarity. Users would have to pray that — after enduring hold time — they’re actually matched with a competent phone rep. A 2002 Treasury audit found reps only came up with the right answer 78% of the time — and that’s just for the average question.

At first glance, some might assume using an IRS site would make you less of an audit target. Then again, it’s conceivable the IRS might log your actions as you navigate the site — such as trying different inputs to test the impact on your tax return. Such information could be used as an audit flag.

In most states, offering an appealing alternative to TurboTax and H&R Block platforms would require the IRS to also offer state and local tax prep. No way that’s happening anytime soon.

The IRS says it hasn’t yet defined the complexity of returns it anticipates handling during the pilot. A prototype of the IRS offering that was run by some taxpayers wasn’t even built to pre-populate with data the government already has via W-2’s and 1099s. As one unimpressed survey participant said, “IRS already knows your tax information. So why wouldn’t I be able to login, put in, say, my [SSN], and then half this information is already filled, and then I just need to put in corrections?”

Many survey participants felt they should receive expedited return-processing for using a government platform. In its report, however, the IRS said, “The IRS does not, and would not, give preferential treatment to taxpayers who use any particular tax filing method.”

The IRS estimates its direct-filing platform would cost between $64.3 and $248.9 million annually. The running tally for the Obamacare site surpassed $840 million less than a year after it launched.

Many other countries send taxpayers “pre-filled returns” that are populated with data the government already collected. Some are so accurate in their ongoing income-tax withholding that little or no adjustment is necessary. That accuracy springs from their dramatically simpler approaches to income taxation.

Putting the government-taxpayer conflict of interest aside, until the US income tax is radically simplified — such as with a flat tax with few or no deductions or credits, no differentiation between short- and long-term capital gains, no differentiation between tax rates on investments and earned income, and no disguised welfare handouts like the EITC — an IRS-run tax-filing platform is for the birds.

Or maybe we should say “for the birdbrains” — like the survey participants who said these things about the prospect of an IRS tax-prep platform:

- “It’s probably going to be good; it’s going to tell you everything you need to know because it’s the IRS. The information should be up to date. I would probably expect it to be more accurate doing it directly with IRS than though some other company.”

- “They probably more want you to do it correctly than some other company.”

- “Yes [I would trust it]. Because it’s a government website.”

Loading…