This year? Probably not so much...

We once thought JP Morgan was happy to agree to take on the carcass of First Republic Bank because it could get billions in deposits and assets for pennies on the dollar. Now, after learning that one unnamed executive at FRC was actually earning more than Jamie Dimon, we are left to wonder to ourselves if Dimon is even happier to absorb the distressed bank so when he rests his head on the pillow at night, he knows his salary isn't being bested.

We are, of course, joking (kind of), but the headlines about First Republic executive pay are very real. Bloomberg wrote on Thursday that a number of bank executives were comfortably earning more than $10 million a piece each year. "Dozens" were earning the salary during the banks heydey, the report says.

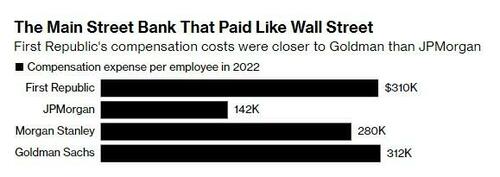

It also notes the one "unnamed banker" that made more than $35 million last year, noting that Dimon has run JP Morgan for more than 16 years and still isn't netting a salary that large. An average employee at First Republic made $310,000 per year, thanks to the company's incentive systems, Bloomberg noted.

The bank's recent surge in business was helped along during the pandemic by issuing "jumbo, interest-only mortgages to borrowers with high incomes and credit scores", which helped the bank double in size in four years, the report says. It was that doubling in size that made it the second largest bank failure in U.S. history.

Bankers that made home loans earned a small percentage of the loan each year, helping bankers strengthen relationships with clients and opening the door for lucrative business, Bloomberg noted. The report also pointed out that family members of executives earned lucrative salaries:

Chief Credit Officer David Lichtman’s spouse, an executive managing director in preferred banking, was paid $8.6 million in 2021, out-earning him, according to a proxy statement last year. The son of First Republic founder and former CEO Jim Herbert made $3.5 million that year as a senior vice president.

As we noted days ago, however, that gravy train at First Republic appears to be over. JP Morgan quickly fired 1,000 First Republic Bank employees, telling them that they aren’t being given jobs — even temporarily — following its takeover of the failed lender.

According to Bloomberg, the biggest US bank on Thursday offered full-time or transitional roles to 85% of the nearly 7,000 employees still working at First Republic when it collapsed, while the rest were told they wouldn’t get offers. Those getting temporary offers would be offered jobs for three, six, nine or 12 months, depending on the position.

“Since our acquisition of First Republic on May 1, we’ve been transparent with their employees and kept our promise to update them on their employment status within 30 days,” a spokesperson for New York-based JPMorgan said in a statement. “We recognize that they have been under stress and uncertainty since March and hope that today will bring clarity and closure.”

First Republic employees who weren’t offered jobs at JPMorgan “will receive pay and benefits covering 60 days and will be offered a package that includes an additional lump-sum payment and continuing benefits coverage,” the spokesperson said; it wasn't clear if the FDIC would be footing those costs as well.

This year? Probably not so much…

We once thought JP Morgan was happy to agree to take on the carcass of First Republic Bank because it could get billions in deposits and assets for pennies on the dollar. Now, after learning that one unnamed executive at FRC was actually earning more than Jamie Dimon, we are left to wonder to ourselves if Dimon is even happier to absorb the distressed bank so when he rests his head on the pillow at night, he knows his salary isn’t being bested.

We are, of course, joking (kind of), but the headlines about First Republic executive pay are very real. Bloomberg wrote on Thursday that a number of bank executives were comfortably earning more than $10 million a piece each year. “Dozens” were earning the salary during the banks heydey, the report says.

It also notes the one “unnamed banker” that made more than $35 million last year, noting that Dimon has run JP Morgan for more than 16 years and still isn’t netting a salary that large. An average employee at First Republic made $310,000 per year, thanks to the company’s incentive systems, Bloomberg noted.

The bank’s recent surge in business was helped along during the pandemic by issuing “jumbo, interest-only mortgages to borrowers with high incomes and credit scores”, which helped the bank double in size in four years, the report says. It was that doubling in size that made it the second largest bank failure in U.S. history.

Bankers that made home loans earned a small percentage of the loan each year, helping bankers strengthen relationships with clients and opening the door for lucrative business, Bloomberg noted. The report also pointed out that family members of executives earned lucrative salaries:

Chief Credit Officer David Lichtman’s spouse, an executive managing director in preferred banking, was paid $8.6 million in 2021, out-earning him, according to a proxy statement last year. The son of First Republic founder and former CEO Jim Herbert made $3.5 million that year as a senior vice president.

As we noted days ago, however, that gravy train at First Republic appears to be over. JP Morgan quickly fired 1,000 First Republic Bank employees, telling them that they aren’t being given jobs — even temporarily — following its takeover of the failed lender.

According to Bloomberg, the biggest US bank on Thursday offered full-time or transitional roles to 85% of the nearly 7,000 employees still working at First Republic when it collapsed, while the rest were told they wouldn’t get offers. Those getting temporary offers would be offered jobs for three, six, nine or 12 months, depending on the position.

“Since our acquisition of First Republic on May 1, we’ve been transparent with their employees and kept our promise to update them on their employment status within 30 days,” a spokesperson for New York-based JPMorgan said in a statement. “We recognize that they have been under stress and uncertainty since March and hope that today will bring clarity and closure.”

First Republic employees who weren’t offered jobs at JPMorgan “will receive pay and benefits covering 60 days and will be offered a package that includes an additional lump-sum payment and continuing benefits coverage,” the spokesperson said; it wasn’t clear if the FDIC would be footing those costs as well.

Loading…