By George Lei, Bloomberg markets Live Analyst and Commentator

Chinese tech stocks are poised for their biggest weekly advance in months, boosted by news of a potential wrap-up of the probe into Didi as well as relaxed Covid curbs in Shanghai and Beijing. Still, it might be premature to call a bottom in the tech sector, let alone the broader market.

The Nasdaq Golden Dragon China Index has rallied about 15% since last Friday, poised for the best week in almost three months; the Hang Seng Tech Index is also on course for its biggest weekly gain since the end of April.

Chinese equities are “bumping along the bottom” and will stage a “very strong and sustained recovery” once there’s a clear exit strategy from Covid Zero, said Chi Lo, a senior strategist at BNP Paribas Asset Management. JPMorgan also sees a “turning point” in China stocks with buying opportunities emerging, according to a Monday note by strategist Marko Kolanovic.

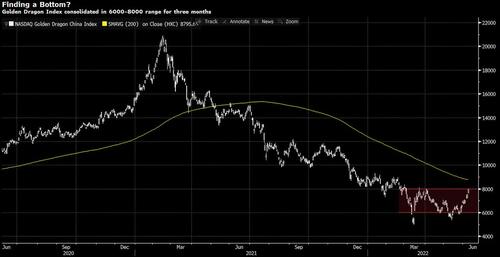

The Golden Dragon Index has mostly consolidated in a 6,000-8,000 range over the past three months. The gauge may be forming a bottom, yet it is still more than 10% away from its 200-day moving average. Hang Seng Tech, among other stock indexes, remains far below the 200-DMA.

“Expecting the regulator to change other rules, which currently harm the companies in my coverage, seems a bit too soon,” according to DZ Bank’s Manuel Muehl, who was the first among more than 70 analysts tracked by Bloomberg to go bearish on China tech.

For broader Chinese stocks, how fast and far the rebound goes depends very much on how long Covid Zero lasts. BNP’s Lo sees little room for policy change this year but possibly more clarity into the second quarter of 2023: “The point here is the timing of that we don’t know,” he added.

Bets on China reopening have always been risky. In early March, Trip.com and casino operator Wynn Resorts climbed 10.8% and 8.6% respectively on a report that China might experiment with a laxer Covid policy as soon as this summer. The gains quickly fizzled and current prices are about 15% and 22% below their respective closings back then. China is showing “little evidence” of reopening aviation and the industry will continue to suffer, IATA Director General Willie Walsh said on Tuesday.

A case in point is Hong Kong. The city has allowed most mildly ill patients to stay at home since February, yet it announced last week that people infected with Covid sub-variants including BA.2.12.1 will be sent to government facilities for mandatory quarantine, even if they are not severely sick. Unless and until Hong Kong fully embraces living with the virus, it will be a stretch to expect China to abandon its pandemic rules any time soon.

“Any new waves of Covid could return cities back to lockdowns” as long as “the leadership remains dedicated to its Zero Covid Strategy,” Nomura analysts led by Chief China Economist Ting Lu wrote in a report on Wednesday. Economic data are likely to improve in June, representing a brief respite rather than a real turning point since the property sector will still be under stress and fiscal stimulus will be used primarily to fill the funding gap of local governments, Lu argued.

By George Lei, Bloomberg markets Live Analyst and Commentator

Chinese tech stocks are poised for their biggest weekly advance in months, boosted by news of a potential wrap-up of the probe into Didi as well as relaxed Covid curbs in Shanghai and Beijing. Still, it might be premature to call a bottom in the tech sector, let alone the broader market.

The Nasdaq Golden Dragon China Index has rallied about 15% since last Friday, poised for the best week in almost three months; the Hang Seng Tech Index is also on course for its biggest weekly gain since the end of April.

Chinese equities are “bumping along the bottom” and will stage a “very strong and sustained recovery” once there’s a clear exit strategy from Covid Zero, said Chi Lo, a senior strategist at BNP Paribas Asset Management. JPMorgan also sees a “turning point” in China stocks with buying opportunities emerging, according to a Monday note by strategist Marko Kolanovic.

The Golden Dragon Index has mostly consolidated in a 6,000-8,000 range over the past three months. The gauge may be forming a bottom, yet it is still more than 10% away from its 200-day moving average. Hang Seng Tech, among other stock indexes, remains far below the 200-DMA.

“Expecting the regulator to change other rules, which currently harm the companies in my coverage, seems a bit too soon,” according to DZ Bank’s Manuel Muehl, who was the first among more than 70 analysts tracked by Bloomberg to go bearish on China tech.

For broader Chinese stocks, how fast and far the rebound goes depends very much on how long Covid Zero lasts. BNP’s Lo sees little room for policy change this year but possibly more clarity into the second quarter of 2023: “The point here is the timing of that we don’t know,” he added.

Bets on China reopening have always been risky. In early March, Trip.com and casino operator Wynn Resorts climbed 10.8% and 8.6% respectively on a report that China might experiment with a laxer Covid policy as soon as this summer. The gains quickly fizzled and current prices are about 15% and 22% below their respective closings back then. China is showing “little evidence” of reopening aviation and the industry will continue to suffer, IATA Director General Willie Walsh said on Tuesday.

A case in point is Hong Kong. The city has allowed most mildly ill patients to stay at home since February, yet it announced last week that people infected with Covid sub-variants including BA.2.12.1 will be sent to government facilities for mandatory quarantine, even if they are not severely sick. Unless and until Hong Kong fully embraces living with the virus, it will be a stretch to expect China to abandon its pandemic rules any time soon.

“Any new waves of Covid could return cities back to lockdowns” as long as “the leadership remains dedicated to its Zero Covid Strategy,” Nomura analysts led by Chief China Economist Ting Lu wrote in a report on Wednesday. Economic data are likely to improve in June, representing a brief respite rather than a real turning point since the property sector will still be under stress and fiscal stimulus will be used primarily to fill the funding gap of local governments, Lu argued.