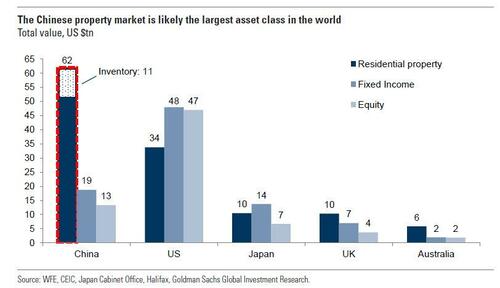

In its attempt to reboot China's real estate property market bubble, which burst spectacularly in late 2021 when most housing developers blew up in the aftermath of Evergrande's historic bankruptcy amid Beijing's ill-fated deleveraging push, and which according to Goldman calculations is the world's largest real estate bubble...

... China's real estate agencies have been quietly resorting to some of the oldest tricks in the US housing bubble book, such as marketing homebuying with "zero down payment" or "negative down payment" so that consumers not only don't need to pay for down payment but also can obtain funds for future renovation, according to media reports.

Of course, with Beijing still stuck in some bizarro Schrodinger economic purgatory where the government both wants housing to reclaim its pre-bubble all time highs yet is loath to inject the massive amounts of credit required, the It didn't take long for some local overzealous bureaucrat to spill the beans, and as the Global Times reports, the Shenzhen Real Estate Intermediary Association in South China's Guangdong Province released a notice on Friday, cautioning local agencies to avoid participating in or assisting the illegal practices of "zero down payment" and "negative down payment," which have sparked discussion among homebuyers.

One real estate agency based in Shenzhen reportedly was telling clients that if a property is evaluated at 5.7 million yuan ($806,828) the owner would sell it at 5.2 million yuan, the homebuyer could then buy the property in full using a bank loan of 5.7 million yuan while using the remaining 500,000 yuan for renovation, cnr.cn reported.

As for the so-called "negative down payment," the report said that it is executed through developers using down payment installments and returning down payment to buyers or setting a relatively high contract price for consumers to apply for a larger bank loan.

If the funds returned to the buyer from the developer, or the bank loan secured against the property exceed the original down payment, the a "negative down payment" is "achieved," per the report from cnr.cn.

The Shenzhen Real Estate Intermediary Association on Friday issued the reminder to caution the market, stressing that the so-called practices of "zero down payment" and "negative down payment" violate China's financial and credit policies. It warned local agencies and practitioners to strictly abide by the principle that "houses are for living in, not speculation," calling for review and adjustment of agency management and prohibiting any form of participation in similar practices.

If local agencies and practitioners are found to have been involved in offering assistance in implementing these illegal practices, the association will immediately report these parties to the competent administrative departments for investigation and punishment in accordance with the law.

The so-called "negative down payment" is essentially the creation of a fictitious purchase agreement, which in turn inflates the purchase price of a home in order to fraudulently obtain a larger loan for the down payment, Yan Yuejin, research director at Shanghai-based E-house China R&D Institute, told the Global Times.

Yan stressed the importance for financial regulators to monitor the situation, aiming to prevent the emergence of financial instability or financial risk, calling for a greater effort to regulate fraudulent contracts, falsified loan materials, and lax bank audits.

Yan also noted that the concept of a "negative down payment" is illegal and comes with high risk. The leverage will be easily raised if a home purchase is not backed by a real down payment, burdening subsequent payment pressure for homebuyers and resulting in a higher risk of mortgage default.

Chinese authorities issued a notice in 2017, strictly banning domestic developers and real estate intermediaries to engage in illegal practices such as providing down payment financing or down payment installments.

Earlier in May, Huizhou in Guangdong issued a notice to further strengthen regulation and on property sales tackling the aforementioned illegal practices, according to media reports.

In its attempt to reboot China’s real estate property market bubble, which burst spectacularly in late 2021 when most housing developers blew up in the aftermath of Evergrande’s historic bankruptcy amid Beijing’s ill-fated deleveraging push, and which according to Goldman calculations is the world’s largest real estate bubble…

… China’s real estate agencies have been quietly resorting to some of the oldest tricks in the US housing bubble book, such as marketing homebuying with “zero down payment” or “negative down payment” so that consumers not only don’t need to pay for down payment but also can obtain funds for future renovation, according to media reports.

Of course, with Beijing still stuck in some bizarro Schrodinger economic purgatory where the government both wants housing to reclaim its pre-bubble all time highs yet is loath to inject the massive amounts of credit required, the It didn’t take long for some local overzealous bureaucrat to spill the beans, and as the Global Times reports, the Shenzhen Real Estate Intermediary Association in South China’s Guangdong Province released a notice on Friday, cautioning local agencies to avoid participating in or assisting the illegal practices of “zero down payment” and “negative down payment,” which have sparked discussion among homebuyers.

One real estate agency based in Shenzhen reportedly was telling clients that if a property is evaluated at 5.7 million yuan ($806,828) the owner would sell it at 5.2 million yuan, the homebuyer could then buy the property in full using a bank loan of 5.7 million yuan while using the remaining 500,000 yuan for renovation, cnr.cn reported.

As for the so-called “negative down payment,” the report said that it is executed through developers using down payment installments and returning down payment to buyers or setting a relatively high contract price for consumers to apply for a larger bank loan.

If the funds returned to the buyer from the developer, or the bank loan secured against the property exceed the original down payment, the a “negative down payment” is “achieved,” per the report from cnr.cn.

The Shenzhen Real Estate Intermediary Association on Friday issued the reminder to caution the market, stressing that the so-called practices of “zero down payment” and “negative down payment” violate China’s financial and credit policies. It warned local agencies and practitioners to strictly abide by the principle that “houses are for living in, not speculation,” calling for review and adjustment of agency management and prohibiting any form of participation in similar practices.

If local agencies and practitioners are found to have been involved in offering assistance in implementing these illegal practices, the association will immediately report these parties to the competent administrative departments for investigation and punishment in accordance with the law.

The so-called “negative down payment” is essentially the creation of a fictitious purchase agreement, which in turn inflates the purchase price of a home in order to fraudulently obtain a larger loan for the down payment, Yan Yuejin, research director at Shanghai-based E-house China R&D Institute, told the Global Times.

Yan stressed the importance for financial regulators to monitor the situation, aiming to prevent the emergence of financial instability or financial risk, calling for a greater effort to regulate fraudulent contracts, falsified loan materials, and lax bank audits.

Yan also noted that the concept of a “negative down payment” is illegal and comes with high risk. The leverage will be easily raised if a home purchase is not backed by a real down payment, burdening subsequent payment pressure for homebuyers and resulting in a higher risk of mortgage default.

Chinese authorities issued a notice in 2017, strictly banning domestic developers and real estate intermediaries to engage in illegal practices such as providing down payment financing or down payment installments.

Earlier in May, Huizhou in Guangdong issued a notice to further strengthen regulation and on property sales tackling the aforementioned illegal practices, according to media reports.

Loading…