Authored by Peter Reagan via Birch Gold Group,

Two years ago, we referenced various reports about Americans’ savings (consumer and retirement), reporting that they had dropped to the lowest point in years.

Unfortunately, things haven’t improved much since then.

We just discussed the state of consumer debt, and it isn’t very good at all, reaching a record $17 trillion.

Since the economy is primarily driven by consumer spending (currently 68% of GDP), if American households are tapped out and buried in debt, the stage is set for an economic disaster.

So today we’re going to explore the current state of the typical American household’s finances, and extrapolate the future consequences for the entire economy.

Overall American financial wellbeing “declined markedly”

A recent report published by the Federal Reserve examined the Economic Wellbeing of Households in 2022. Unfortunately, households aren’t doing very well at all, according to the information in the 85-page report.

I won’t bore you with the entire thing. Instead, we’ll take a look at the main culprits straight from the report’s summary:

Results… indicate a decline in peoples’ financial well-being over the previous year.

…self-reported financial well-being fell sharply and was among the lowest observed since 2016. Similarly, the share of adults who said that they spent less than their income in the month before the survey fell in 2022 from the prior year, while the share who said that their credit card debt increased rose. Among adults who were not retired, the survey also showed a decline in the share who felt that their retirement savings plan was on track, suggesting that individuals had concerns about their future financial security.

As you might expect, inflation’s impact on adults in the U.S. has been pretty severe since it moved from “transitory” to a seemingly permanent fixture over the last two years.

The Hill offered this pithy summary of the summary:

Americans’ financial well-being “declined markedly” between 2021 and 2022…

Fifty-four percent of adults said their budgets had been affected “a lot” by increased prices in the U.S.

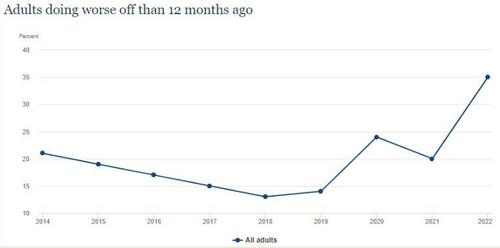

In fact, 75% more Americans are worse off today than they were the year Biden took office:

via Federal Reserve’s Economic Well-Being of U.S. Households in 2022 report

All politicians, especially those in the Biden administration, are notoriously bad at anticipating the ripple effects of their “solutions” to problems like pandemics and inflation.

Their response to emergencies has left us worse off.

And, speaking of emergencies…

Most Americans can’t afford an emergency

When an emergency happens, the consequences could be dire, especially if you aren’t financially equipped to handle it.

But you already know this! I truly appreciate that my readers are mostly well-informed, financially-savvy individuals who are well aware of the importance of expecting the unexpected. Who wouldn’t need to call up a bachelor uncle and beg for a loan to cover, oh, a trip to the ER, or having their brake pads replaced.

Most Americans are different.

For most people, ever since the stimmie checks dried up, they’ve lost the resilience to handle even a minor financial emergency.

Specifically:

-

1 out of every 3 adults can’t cover a $400 emergency expense

-

Barely half of Americans have three months of emergency savings

(Yes, both categories have grown significantly in the last year last year.)

Wolf Richter delved deeper, and broke down just how severe a financial emergency that people could handle. The results were eye-opening:

What is the largest emergency expense individuals could handle right now using only “savings,” as opposed to borrowing or selling assets? These are the results:

– 46% could handle $2,000 or more

– 11% could handle $1,000 to $1,999

– 11% could handle $500 to $999

– 14% could handle $100 to $499

– 18% could handle less than $100

In other words, more than half of Americans couldn’t pay for a visit to the emergency room (average cost $2,200) without resorting to loans or possibly having a yard sale…

And let’s remember, as we recently discussed, consumer debt is already at an all-time high.

Consumer spending, the redlined engine driving economic growth over the last two years, is simply out of gas. Running on fumes.

That’s obviously bad for the families who find themselves in increasingly-difficult financial situations.

The point I want you to understand is it’s also bad for everyone else, too.

And, as we’ve seen, the White House and Federal Reserve’s attempts to make things better all too often backfire.

Fortunately, there are a few things we can do to increase our resilience during tough economic times…

Diversifying your “money of last resort”

Ideally, your emergency fund is:

-

Ample: big enough to cover three months’ worth of your expenses

-

Liquid: easily converted to ready cash

-

Stable: with a historical track record of holding its value

-

Inflation-resistant: doesn’t decline in purchasing power month after month

The first is up to you.

The second is pretty obvious – and also why we generally don’t consider things like a rental property or part ownership of a small business as “emergency funds.” These assets do have value, but realizing that value (selling them) is complex and time-consuming.

The third, well, obviously you don’t need the hassle of checking the balance of your emergency fund every month. Unfortunately, volatility – the opposite of stability – is a feature of most financial assets.

The fourth (really a subset of the third) raises the bar even higher. Why would anyone want to keep their emergency fund in a savings account yielding 0.25% when inflation is officially at 4.9%?

Fortunately, there’s an asset that meets these criteria: physical precious metals.

Diversifying your savings (yes, even your emergency fund) with physical precious metals can give you a highly liquid, stable and inflation-resistant asset you can rely on whether the economy is in the throes of a deep recession or not.

I think Ray Dalio said it best in his Principles for Dealing with the Changing World Order:

There is an old saying that “gold is the only financial asset that isn’t someone else’s liability.” When you receive gold coins from a buyer, you can melt them down and exchange the metal and still receive almost the same value as if you had spent them, unlike a debt asset like paper money, which is a promise to deliver value (which isn’t much of a promise, given how easy it is to print). When countries are at war and there is no trust in their intentions or abilities to pay, they can still pay in gold. So gold (and, to a lesser extent, silver) can be used as both a safe medium of exchange and a safe storehold of wealth.

Learn more about the benefits of investing in precious metals here. When you’re ready to diversify your savings, Birch Gold can help – get started here.

Authored by Peter Reagan via Birch Gold Group,

Two years ago, we referenced various reports about Americans’ savings (consumer and retirement), reporting that they had dropped to the lowest point in years.

Unfortunately, things haven’t improved much since then.

We just discussed the state of consumer debt, and it isn’t very good at all, reaching a record $17 trillion.

Since the economy is primarily driven by consumer spending (currently 68% of GDP), if American households are tapped out and buried in debt, the stage is set for an economic disaster.

So today we’re going to explore the current state of the typical American household’s finances, and extrapolate the future consequences for the entire economy.

Overall American financial wellbeing “declined markedly”

A recent report published by the Federal Reserve examined the Economic Wellbeing of Households in 2022. Unfortunately, households aren’t doing very well at all, according to the information in the 85-page report.

I won’t bore you with the entire thing. Instead, we’ll take a look at the main culprits straight from the report’s summary:

Results… indicate a decline in peoples’ financial well-being over the previous year.

…self-reported financial well-being fell sharply and was among the lowest observed since 2016. Similarly, the share of adults who said that they spent less than their income in the month before the survey fell in 2022 from the prior year, while the share who said that their credit card debt increased rose. Among adults who were not retired, the survey also showed a decline in the share who felt that their retirement savings plan was on track, suggesting that individuals had concerns about their future financial security.

As you might expect, inflation’s impact on adults in the U.S. has been pretty severe since it moved from “transitory” to a seemingly permanent fixture over the last two years.

The Hill offered this pithy summary of the summary:

Americans’ financial well-being “declined markedly” between 2021 and 2022…

Fifty-four percent of adults said their budgets had been affected “a lot” by increased prices in the U.S.

In fact, 75% more Americans are worse off today than they were the year Biden took office:

via Federal Reserve’s Economic Well-Being of U.S. Households in 2022 report

All politicians, especially those in the Biden administration, are notoriously bad at anticipating the ripple effects of their “solutions” to problems like pandemics and inflation.

Their response to emergencies has left us worse off.

And, speaking of emergencies…

Most Americans can’t afford an emergency

When an emergency happens, the consequences could be dire, especially if you aren’t financially equipped to handle it.

But you already know this! I truly appreciate that my readers are mostly well-informed, financially-savvy individuals who are well aware of the importance of expecting the unexpected. Who wouldn’t need to call up a bachelor uncle and beg for a loan to cover, oh, a trip to the ER, or having their brake pads replaced.

Most Americans are different.

For most people, ever since the stimmie checks dried up, they’ve lost the resilience to handle even a minor financial emergency.

Specifically:

(Yes, both categories have grown significantly in the last year last year.)

Wolf Richter delved deeper, and broke down just how severe a financial emergency that people could handle. The results were eye-opening:

What is the largest emergency expense individuals could handle right now using only “savings,” as opposed to borrowing or selling assets? These are the results:

– 46% could handle $2,000 or more

– 11% could handle $1,000 to $1,999

– 11% could handle $500 to $999

– 14% could handle $100 to $499

– 18% could handle less than $100

In other words, more than half of Americans couldn’t pay for a visit to the emergency room (average cost $2,200) without resorting to loans or possibly having a yard sale…

And let’s remember, as we recently discussed, consumer debt is already at an all-time high.

Consumer spending, the redlined engine driving economic growth over the last two years, is simply out of gas. Running on fumes.

That’s obviously bad for the families who find themselves in increasingly-difficult financial situations.

The point I want you to understand is it’s also bad for everyone else, too.

And, as we’ve seen, the White House and Federal Reserve’s attempts to make things better all too often backfire.

Fortunately, there are a few things we can do to increase our resilience during tough economic times…

Diversifying your “money of last resort”

Ideally, your emergency fund is:

-

Ample: big enough to cover three months’ worth of your expenses

-

Liquid: easily converted to ready cash

-

Stable: with a historical track record of holding its value

-

Inflation-resistant: doesn’t decline in purchasing power month after month

The first is up to you.

The second is pretty obvious – and also why we generally don’t consider things like a rental property or part ownership of a small business as “emergency funds.” These assets do have value, but realizing that value (selling them) is complex and time-consuming.

The third, well, obviously you don’t need the hassle of checking the balance of your emergency fund every month. Unfortunately, volatility – the opposite of stability – is a feature of most financial assets.

The fourth (really a subset of the third) raises the bar even higher. Why would anyone want to keep their emergency fund in a savings account yielding 0.25% when inflation is officially at 4.9%?

Fortunately, there’s an asset that meets these criteria: physical precious metals.

Diversifying your savings (yes, even your emergency fund) with physical precious metals can give you a highly liquid, stable and inflation-resistant asset you can rely on whether the economy is in the throes of a deep recession or not.

I think Ray Dalio said it best in his Principles for Dealing with the Changing World Order:

There is an old saying that “gold is the only financial asset that isn’t someone else’s liability.” When you receive gold coins from a buyer, you can melt them down and exchange the metal and still receive almost the same value as if you had spent them, unlike a debt asset like paper money, which is a promise to deliver value (which isn’t much of a promise, given how easy it is to print). When countries are at war and there is no trust in their intentions or abilities to pay, they can still pay in gold. So gold (and, to a lesser extent, silver) can be used as both a safe medium of exchange and a safe storehold of wealth.

Learn more about the benefits of investing in precious metals here. When you’re ready to diversify your savings, Birch Gold can help – get started here.

Loading…