–>

June 5, 2023

A CNN poll revealed that 60 percent of Americans wanted meaningful cuts before a debt limit rise. Another 15 percent wanted the United States to default. Only 25% wanted the debt ceiling raised unconditionally.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3028”) { googletag.display(“div-hre-Americanthinker—New-3028”); } }); }); }

The concern was that the United States would default on its debt. This was a fearmongering falsehood. Treasury Secretary Janet Yellen never produced actual numbers, and she changed the default date several times. The truth of the matter is that the federal revenue cash flow easily would easily have covered all debt payments while temporarily delaying some contact payments.

Nonetheless in an overwhelming bipartisan vote (the House — 314 to 117, and Senate — 63 to 36), Congress voted to give President Biden unlimited spending for the remainder of his term.

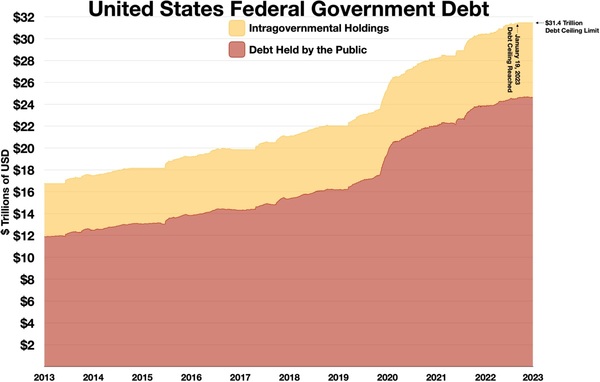

Even the New York Times declared that the new debt limit bill will not save a penny or cut a dime from government spending. Over the next two years Biden will have access to $14 trillion of new spending, $4 trillion that will not be covered by tax and revenue income. The Congressional Budget Office estimates the bill will save $2.1 trillion over six years, but since there are no statutory caps in place, the 2.1 trillion is a fiction. In fact, supplemental requests for natural disasters and the Ukraine war will add to the $14 trillion.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3035”) { googletag.display(“div-hre-Americanthinker—New-3035”); } }); }); }

Everyone, including those in Congress and the White House, knows what additional spending will mean in the near term. Inflation will rise and the Federal Reserve will have to raise interest rates significantly. People will spend less, tax revenue will drop and personal investment managed by the likes of Blackstone and Sequoia Capital will continue to feed the Chinese economy while U.S. small businesses will be denied access to capital.

But there is something even worse: the impact this new bill will have on the dollar. Over the next two years, the debt will increase to $36 trillion or more, weakening the dollar on the world stage. The Chinese Communist Party (CCP) and their coalition of nations call the BRICS (Brazil, Russia, India, China and South Africa) are developing a gold-backed alternative to our weak fiat currency. Central banks are buying gold at record rates and the BRICS are far ahead in this race. (The BRICS are geographically dispersed, have over 40 percent of the global population, the vast majority of natural resources and minerals, and their intention is to replace the dollar as the world’s currency.) Their new currency will be backed by a precious metal while the dollar by the Fed’s reckless printing of money.

But there is something even worse: the impact this new bill will have on the dollar. Over the next two years, the debt will increase to $36 trillion or more, weakening the dollar on the world stage. The Chinese Communist Party (CCP) and their coalition of nations call the BRICS (Brazil, Russia, India, China and South Africa) are developing a gold-backed alternative to our weak fiat currency. Central banks are buying gold at record rates and the BRICS are far ahead in this race. (The BRICS are geographically dispersed, have over 40 percent of the global population, the vast majority of natural resources and minerals, and their intention is to replace the dollar as the world’s currency.) Their new currency will be backed by a precious metal while the dollar by the Fed’s reckless printing of money.

Unlimited spending is exactly what the BRICS want and McCarthy, Biden, and the globalist Congress have agreed to do exactly what the coalition wants. If the BRICS new currency replaces the dollar, hyperinflation will set in. Our debt will increase. The U.S. energy sector will still be restrained, making the United States a net buyer of foreign oil. As interest rates climb to check more inflation, banks holding low-interest U.S. bonds will be in worse condition than they are now.

But inflation will soar like Americans cannot imagine.

This country has never experienced hyperinflation. For example, when I was in Brazil, I watched the cruzeiro — the currency at that time — devalue two, sometimes three times a day. Finally, the cruzeiro plunged to zero and the government had to create a new currency (the real), which ironically was tied to the dollar.

If China has its way, the U.S. dollar will be replaced with a currency tied to the Chinese yuan or other BRICS currency. A coalition of third-world countries will have and control the world’s currency. This transition is occurring, not when China and the other BRICS are doing so well, but when the West is purposely propping up that coalition, sending U.S. investment dollars to China and buying their oil and other natural resources.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3027”) { googletag.display(“div-hre-Americanthinker—New-3027”); } }); }); } if (publir_show_ads) { document.write(“

Why, then, are American globalists from venture capital firms to Wall Street using dollars to bolster Chinese industry that is determined to take down the West? Because they admire China’s totalitarian form of government and want to replicate it in the “New World Order.”

But when China finally has the world’s currency and Western globalists have to rely on it, will those globalists control the world or will they be even more subservient to the Chinese Communist Party than they already are?

Image: Wikideas1

<!–

–>

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>