It was a CPI report for the ages: with most already expecting a hotter than expected print (thanks to JPM), that's precisely what they got and then some.

First, a quick recap:

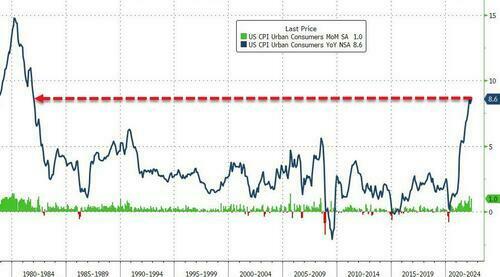

- Headline CPI prices surged by 1.0% (0.97% unrounded) mom in May, beating consensus expectations of a 0.7% increase.

- Energy prices spiked 3.9% mom as gasoline prices reached record levels and food prices increases 1.2%.

- Yoy headline CPI inflation made a new 40-year high of 8.6%.

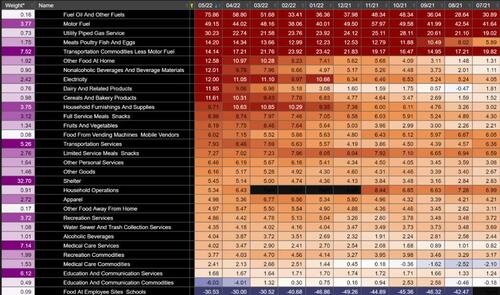

A chart showing the annual increases in all segments shows that just two thing in the entire CPI basket are cheaper compared to a year ago: food at employee sites/schools and education and communication commodities. Meanwhile, fuel is up more than 75% Y/Y.

Core CPI also beat expectations, rising 0.6% (0.63% unrounded) mom versus consensus at 0.5%. The yoy rate dropped from 6.2% to 6.0%, because of base effects.

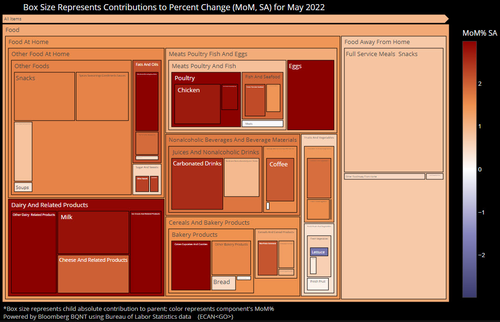

Headline inflation was largely driven by energy and food. Amid the soaring food costs, Chicken, Eggs, Milk, and Cupcakes all screamed higher. In fact, food contributed 0.16% of the 1% MoM CPI. The size of the box below represents each component’s contribution to food and the color of the box shows the MoM% change in price: eggs were up 5% in May!

The strength in core inflation was across the board: core commodities rose 0.7% on the back of 1.0% and 1.8% increases in new and used car prices, respectively. Along with the sharp drop in auto sales last month, this suggests that the auto industry was hit by a fresh bout of supply shortages last month. Meanwhile apparel prices increased 0.7% and other goods were up 0.8%.

Core services were also very strong in May, increasing by 0.6%: the main drivers were 0.6% increases in OER and rental prices, and a 0.4% rise in medical care services. The reopening-related components showed continued large increases. Lodging was up 0.9% and recreation services increased 0.5%. Airfares spiked 12.6%, contributing nearly 11bp to the core.

In the last three months alone, airfares have risen 48%, although some if not much of this strength is likely to reverse in the coming months. (to confirm the broadbased nature of inflation, BofA's economists recommend that investors keep an eye out for the Cleveland Fed’s release of trimmed-mean and median inflation at 11am today.)

What is even more striking about today's report is that, as BofA's Aditua Bhave writes, Stepping back, is the fact that there were almost no pockets of weakness in this report, and indeed Brean writes that "61% of the detailed CPI components are seeing price gains over the last year of 6% or more, down only slightly from April’s 63%." The data are consistent with the increasingly popular view that inflation is no longer just a function of goods supply-chain disruptions. Inflation is also being driven by strong consumer demand because of a red hot labor market and strong wage inflation.

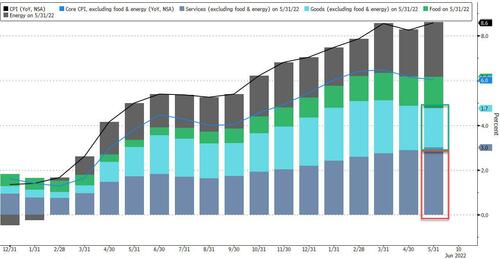

Accordingly, inflation has become embedded in the more cyclical service sectors (e.g., housing) as well. In fact, as shown below, while goods inflation dropped to "only" 1.7% in Y/Y terms, the lowest since last September, services inflation is the highest in over three decades, contributing to 3.0% of the 8.6% Y/Y headline print.

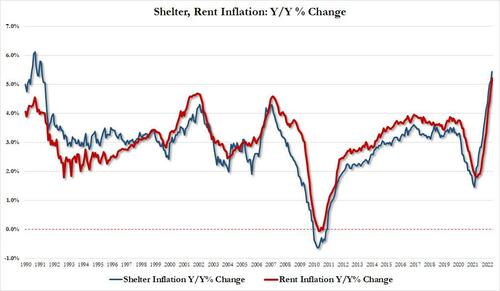

The next chart shows the problem for policy makers posed by diverging headline and core indexes: While the contribution from used cars and trucks is starting to dissipate, shelter continues to push higher - just as we said it would about one year ago - even though it's only a matter of time before soaring rents and mortgages bring prices sharply lower. And speaking of shelter inflation, it surged 5.45% Y/Y in May, up from 5.14% in April and the highest since 1991. As for Rent Inflation, it jumped 5.22%Y/Y in May, up from 4.82% in April and the highest on record.

All other items in the core index taken together have at least stopped increasing on a year-over-year basis. But food and energy inflation continue pushing to new highs.

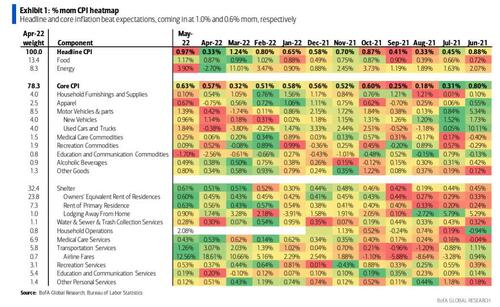

Below is a heatmap of CPI on a MoM basis...

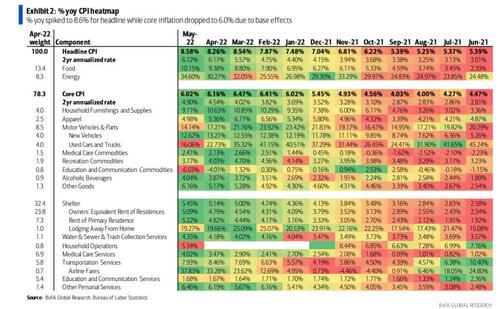

... and YoY:

What happens next?

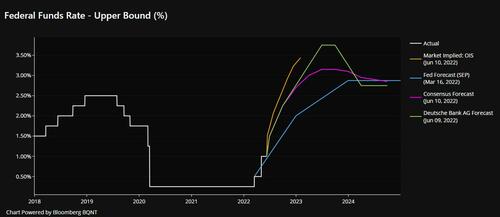

Well, the Fed has telegraphed 50bp rate hikes in June and July. Its next decision point is in September. BofA writes that although its base case remains a 25bp hike, today’s print increases the risk of another 50bp increase. Meanwhile, the market is pricing a more aggressive Fed response on the back of today’s print. FOMC OIS now reflects 155 bps rate hikes through the September FOMC, assigning some probability to a 75bps hike in July.

Goldman's Jan Hatzius writes that he now expects the Fed to "hike the funds rate by 50 bps in September (vs. +25bp previously), in addition to +50bp moves in June and in July."

The 2y30y curve flattened 15 bps, with the 5s30s briefly inverting, as the move higher in the front end was driven by inflation breakevens and rally at the back end concentrated in real rates. This curve move is consistent with a Fed needing to hike aggressively to cool inflation at the expense of longer term growth and is consistent with our baseline stagflation scenario.

Below we share several reactions from Wall Street strategists and economists, all of whom were more or less stunned by just how high "non-transitory" inflation is:

- Goldman, Chief Economist Jan Hatzius: "In our view, the broad-based strength in core inflation tips the balance for the Fed to continue its 50bp-per-meeting pace of tightening through September. We continue to expect a terminal rate of 3.0-3.25%, which will now be reached in 1Q2023 under our forecast."

- Brean Economics: "There were no signs here" of deceleration. "Over the last three months, the core CPI has risen 6.3% at an annual rate, faster than its year-over-year increase of 6.0%. .. This report ought to be disturbing for Fed officials as they prepare for next week’s meeting. We estimate that 61% of the detailed CPI components are seeing price gains over the last year of 6% or more, down only slightly from April’s 63%."

- Schwab Chief Fixed-income strategist Kathy Jones: the hot CPI reading will “keep the Fed on track for more tightening" adding that one should “expect some curve flattening as the market discounts steeper pace of rate hikes.”

- Bloomberg Intelligence, Chief US rates strategist Ira Jersey: “The strong bear flattening given the across-the-board CPI beat is unsurprising. We would expect some profit-taking at some point, but at least tactically a bear flattening may continue into the FOMC meeting next week. We still don’t think the Fed will seriously consider 75-bp hikes, but the market may price for the possibility, and given the strength of core CPI, we think there may be additional 50-bp hikes priced in beyond September. It’s possible the Fed tries to get into restrictive territory this year and will consider pausing after hiking toward 4% to let the ‘long and variable lags’ of monetary policy take effect.”

- AXS Investments, CEO Greg Bassuk: the investor narrative going forward will be less about whether inflation has reached a peak and more about how long it’s going to be here with us. One of the lessons we’ve all learned over the past year is that any single data point has been shown to be vastly inconclusive. We’re going to be looking at Tuesday’s PPI numbers next week. Wednesday, we’ll get retail sales data and some more commentary from the FOMC. What we’re doing every week is really aggregating all of these elements that drive toward what we see in connection with this elevated price environment.”

- Mohamed El-Erian: "Reaction to inflation report of the US bond market implies (a) a more aggressive Fed and (b) bigger economic slowdown. Re distribution of macro outcomes, greater probability of the stagflation baseline, higher recession risk, and a thinner right rail of high growth/low inflation"

- Miller Tabak, Matt Maley: "This stronger-than-expected inflation data pushes out the time frame for peak inflation and it gives the Fed the green light to continue with their aggressive tightening policy. I’d also note that the drop in the 10-year yield on this data and the flattening of the yield curve is a signal that markets are seeing stagflation as an even bigger problem."

- TD Securities, Priya Misra: "markets are moving closer to pricing in a 50 basis-point hike in September, which would be terrible for risk assets “since the Fed may not have the policy space to slow down the pace of hikes after neutral."

- MKM Partners, chief economist Michael Darda: “it might be a bit of a fool’s errand here to just assume that if crude oil prices back off, all of a sudden the magic wand is waived and the inflation problem simply goes away.”

- Alpine Woods Capital Investors, portfolio manager Sarah Hunt: “A September pause is off the table. The ‘hope’ was a peak last month, but since oil, food prices and rents keep going higher it’s hard to say why that was the hope.”

- National Retail Federation called on Biden to lift tariffs to ease price pressures: “While the Federal Reserve continues with its long-term strategy to stem inflation, we need the administration and Congress to move forward on steps to lower prices that can be taken immediately. Repealing tariffs is one of those steps and one of the most effective and meaningful.”

It was a CPI report for the ages: with most already expecting a hotter than expected print (thanks to JPM), that’s precisely what they got and then some.

First, a quick recap:

- Headline CPI prices surged by 1.0% (0.97% unrounded) mom in May, beating consensus expectations of a 0.7% increase.

- Energy prices spiked 3.9% mom as gasoline prices reached record levels and food prices increases 1.2%.

- Yoy headline CPI inflation made a new 40-year high of 8.6%.

A chart showing the annual increases in all segments shows that just two thing in the entire CPI basket are cheaper compared to a year ago: food at employee sites/schools and education and communication commodities. Meanwhile, fuel is up more than 75% Y/Y.

Core CPI also beat expectations, rising 0.6% (0.63% unrounded) mom versus consensus at 0.5%. The yoy rate dropped from 6.2% to 6.0%, because of base effects.

Headline inflation was largely driven by energy and food. Amid the soaring food costs, Chicken, Eggs, Milk, and Cupcakes all screamed higher. In fact, food contributed 0.16% of the 1% MoM CPI. The size of the box below represents each component’s contribution to food and the color of the box shows the MoM% change in price: eggs were up 5% in May!

The strength in core inflation was across the board: core commodities rose 0.7% on the back of 1.0% and 1.8% increases in new and used car prices, respectively. Along with the sharp drop in auto sales last month, this suggests that the auto industry was hit by a fresh bout of supply shortages last month. Meanwhile apparel prices increased 0.7% and other goods were up 0.8%.

Core services were also very strong in May, increasing by 0.6%: the main drivers were 0.6% increases in OER and rental prices, and a 0.4% rise in medical care services. The reopening-related components showed continued large increases. Lodging was up 0.9% and recreation services increased 0.5%. Airfares spiked 12.6%, contributing nearly 11bp to the core.

In the last three months alone, airfares have risen 48%, although some if not much of this strength is likely to reverse in the coming months. (to confirm the broadbased nature of inflation, BofA’s economists recommend that investors keep an eye out for the Cleveland Fed’s release of trimmed-mean and median inflation at 11am today.)

What is even more striking about today’s report is that, as BofA’s Aditua Bhave writes, Stepping back, is the fact that there were almost no pockets of weakness in this report, and indeed Brean writes that “61% of the detailed CPI components are seeing price gains over the last year of 6% or more, down only slightly from April’s 63%.” The data are consistent with the increasingly popular view that inflation is no longer just a function of goods supply-chain disruptions. Inflation is also being driven by strong consumer demand because of a red hot labor market and strong wage inflation.

Accordingly, inflation has become embedded in the more cyclical service sectors (e.g., housing) as well. In fact, as shown below, while goods inflation dropped to “only” 1.7% in Y/Y terms, the lowest since last September, services inflation is the highest in over three decades, contributing to 3.0% of the 8.6% Y/Y headline print.

The next chart shows the problem for policy makers posed by diverging headline and core indexes: While the contribution from used cars and trucks is starting to dissipate, shelter continues to push higher – just as we said it would about one year ago – even though it’s only a matter of time before soaring rents and mortgages bring prices sharply lower. And speaking of shelter inflation, it surged 5.45% Y/Y in May, up from 5.14% in April and the highest since 1991. As for Rent Inflation, it jumped 5.22%Y/Y in May, up from 4.82% in April and the highest on record.

All other items in the core index taken together have at least stopped increasing on a year-over-year basis. But food and energy inflation continue pushing to new highs.

Below is a heatmap of CPI on a MoM basis…

… and YoY:

What happens next?

Well, the Fed has telegraphed 50bp rate hikes in June and July. Its next decision point is in September. BofA writes that although its base case remains a 25bp hike, today’s print increases the risk of another 50bp increase. Meanwhile, the market is pricing a more aggressive Fed response on the back of today’s print. FOMC OIS now reflects 155 bps rate hikes through the September FOMC, assigning some probability to a 75bps hike in July.

Goldman’s Jan Hatzius writes that he now expects the Fed to “hike the funds rate by 50 bps in September (vs. +25bp previously), in addition to +50bp moves in June and in July.”

The 2y30y curve flattened 15 bps, with the 5s30s briefly inverting, as the move higher in the front end was driven by inflation breakevens and rally at the back end concentrated in real rates. This curve move is consistent with a Fed needing to hike aggressively to cool inflation at the expense of longer term growth and is consistent with our baseline stagflation scenario.

Below we share several reactions from Wall Street strategists and economists, all of whom were more or less stunned by just how high “non-transitory” inflation is:

- Goldman, Chief Economist Jan Hatzius: “In our view, the broad-based strength in core inflation tips the balance for the Fed to continue its 50bp-per-meeting pace of tightening through September. We continue to expect a terminal rate of 3.0-3.25%, which will now be reached in 1Q2023 under our forecast.”

- Brean Economics: “There were no signs here” of deceleration. “Over the last three months, the core CPI has risen 6.3% at an annual rate, faster than its year-over-year increase of 6.0%. .. This report ought to be disturbing for Fed officials as they prepare for next week’s meeting. We estimate that 61% of the detailed CPI components are seeing price gains over the last year of 6% or more, down only slightly from April’s 63%.”

- Schwab Chief Fixed-income strategist Kathy Jones: the hot CPI reading will “keep the Fed on track for more tightening” adding that one should “expect some curve flattening as the market discounts steeper pace of rate hikes.”

- Bloomberg Intelligence, Chief US rates strategist Ira Jersey: “The strong bear flattening given the across-the-board CPI beat is unsurprising. We would expect some profit-taking at some point, but at least tactically a bear flattening may continue into the FOMC meeting next week. We still don’t think the Fed will seriously consider 75-bp hikes, but the market may price for the possibility, and given the strength of core CPI, we think there may be additional 50-bp hikes priced in beyond September. It’s possible the Fed tries to get into restrictive territory this year and will consider pausing after hiking toward 4% to let the ‘long and variable lags’ of monetary policy take effect.”

- AXS Investments, CEO Greg Bassuk: the investor narrative going forward will be less about whether inflation has reached a peak and more about how long it’s going to be here with us. One of the lessons we’ve all learned over the past year is that any single data point has been shown to be vastly inconclusive. We’re going to be looking at Tuesday’s PPI numbers next week. Wednesday, we’ll get retail sales data and some more commentary from the FOMC. What we’re doing every week is really aggregating all of these elements that drive toward what we see in connection with this elevated price environment.”

- Mohamed El-Erian: “Reaction to inflation report of the US bond market implies (a) a more aggressive Fed and (b) bigger economic slowdown. Re distribution of macro outcomes, greater probability of the stagflation baseline, higher recession risk, and a thinner right rail of high growth/low inflation”

- Miller Tabak, Matt Maley: “This stronger-than-expected inflation data pushes out the time frame for peak inflation and it gives the Fed the green light to continue with their aggressive tightening policy. I’d also note that the drop in the 10-year yield on this data and the flattening of the yield curve is a signal that markets are seeing stagflation as an even bigger problem.”

- TD Securities, Priya Misra: “markets are moving closer to pricing in a 50 basis-point hike in September, which would be terrible for risk assets “since the Fed may not have the policy space to slow down the pace of hikes after neutral.”

- MKM Partners, chief economist Michael Darda: “it might be a bit of a fool’s errand here to just assume that if crude oil prices back off, all of a sudden the magic wand is waived and the inflation problem simply goes away.”

- Alpine Woods Capital Investors, portfolio manager Sarah Hunt: “A September pause is off the table. The ‘hope’ was a peak last month, but since oil, food prices and rents keep going higher it’s hard to say why that was the hope.”

- National Retail Federation called on Biden to lift tariffs to ease price pressures: “While the Federal Reserve continues with its long-term strategy to stem inflation, we need the administration and Congress to move forward on steps to lower prices that can be taken immediately. Repealing tariffs is one of those steps and one of the most effective and meaningful.”