Quad Witching and the JPM Collar roll are right around the corner, one Friday after the next.

The Gamma Index™ is very high (about 3) with a theoretical max of 4.

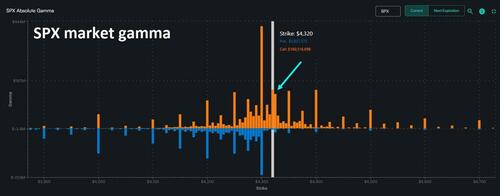

Our chart here shows how much gamma is scheduled to expire on June’s Quad Witching next Friday (June 16).

On the aggregate, SPX options are dominantly focused on June, which is on track to being the large buildup and release of market gamma until Quad Witching later on in December. Part of what makes this Quad Witching is that SPY gamma is guaranteed to focus mostly on that same June monthly expiration.

The market has been following the expected patterns of monthly gamma contraction/expansion. If that continues, then market gamma would remain strong until next Monday.

However, given how cheap long puts are right now, it is important to be aware that this morning is CPI (at 8:30am EST). This invites a potentially unprecedented exogenous shock.

As an additional point for the sake of situational awareness, this is one of the four months a year where the VIX expiration comes the Wednesday after Quad Witching (rather than the Wednesday before).

Following that will be the major JPM Collar [JHEQX] roll on June 30, with that short call strike on 4320.

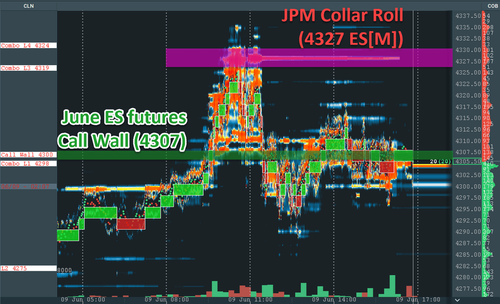

From Friday, the chart below shows how the market pinned right on top of our Call Wall after briefly testing both it and the JHEQX short call.

That [SPX 4320 / ESM 4327] level which the market reacted to as overhead resistance, the JHEQX short call, actually widened the surface of its pin to 4325 via copycats shadowing these levels.

This is shown on our global view of the topology of SPX gamma across all option chains:

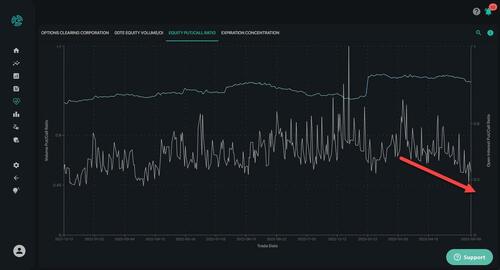

Additionally, the put/call ratio aggregate across all equities has been in noticeable decline over the past few months. This is pictured here in white versus the OI-based put/call ratio in teal.

One piece of information that this tells us is that calls have been becoming increasingly more attractive as a tactical tool.

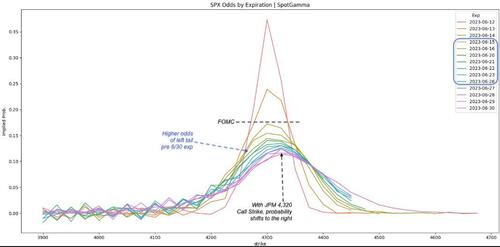

However, the best view of what the market is pricing is through the implied probability plot, shown below:

As you can see the traders largely anticipates this ~4,300 pin before FOMC. There is then a big gap down, or flattening of the probability post-FOMC, as traders look for a wider range of SPX prices. In general it seems there are very low odds being priced of an SPX break of ~4,250 - 4,400 before July 1.

What's really interesting, though, is that the market prices a higher probability of lower SPX prices from FOMC out into the final week of June, as highlighted by expirations in the purple box.

Then, the distribution shifts higher into month end, which is when the JPM collar rolls.

What's ultimately being here reflected in this calculation is a shift, or distortion of options prices due to the large open interest at the 6/30 JPM call collar position (4,320). It leaves a footprint.

Simply put, it appears the market is pricing in a path... first lower, and then up into the JPM collar strike of 4,320 into June 30th expiration.

Quad Witching and the JPM Collar roll are right around the corner, one Friday after the next.

The Gamma Index™ is very high (about 3) with a theoretical max of 4.

Our chart here shows how much gamma is scheduled to expire on June’s Quad Witching next Friday (June 16).

On the aggregate, SPX options are dominantly focused on June, which is on track to being the large buildup and release of market gamma until Quad Witching later on in December. Part of what makes this Quad Witching is that SPY gamma is guaranteed to focus mostly on that same June monthly expiration.

The market has been following the expected patterns of monthly gamma contraction/expansion. If that continues, then market gamma would remain strong until next Monday.

However, given how cheap long puts are right now, it is important to be aware that this morning is CPI (at 8:30am EST). This invites a potentially unprecedented exogenous shock.

As an additional point for the sake of situational awareness, this is one of the four months a year where the VIX expiration comes the Wednesday after Quad Witching (rather than the Wednesday before).

Following that will be the major JPM Collar [JHEQX] roll on June 30, with that short call strike on 4320.

From Friday, the chart below shows how the market pinned right on top of our Call Wall after briefly testing both it and the JHEQX short call.

That [SPX 4320 / ESM 4327] level which the market reacted to as overhead resistance, the JHEQX short call, actually widened the surface of its pin to 4325 via copycats shadowing these levels.

This is shown on our global view of the topology of SPX gamma across all option chains:

Additionally, the put/call ratio aggregate across all equities has been in noticeable decline over the past few months. This is pictured here in white versus the OI-based put/call ratio in teal.

One piece of information that this tells us is that calls have been becoming increasingly more attractive as a tactical tool.

However, the best view of what the market is pricing is through the implied probability plot, shown below:

As you can see the traders largely anticipates this ~4,300 pin before FOMC. There is then a big gap down, or flattening of the probability post-FOMC, as traders look for a wider range of SPX prices. In general it seems there are very low odds being priced of an SPX break of ~4,250 – 4,400 before July 1.

What’s really interesting, though, is that the market prices a higher probability of lower SPX prices from FOMC out into the final week of June, as highlighted by expirations in the purple box.

Then, the distribution shifts higher into month end, which is when the JPM collar rolls.

What’s ultimately being here reflected in this calculation is a shift, or distortion of options prices due to the large open interest at the 6/30 JPM call collar position (4,320). It leaves a footprint.

Simply put, it appears the market is pricing in a path… first lower, and then up into the JPM collar strike of 4,320 into June 30th expiration.

Loading…