Since the last FOMC statement on May 3rd, where Powell hiked rates 25bps but offered some dovish-speak during the presser, stocks have soared (well to be more accurate, mega-cap tech stocks have exploded higher) while bitcoin has been dumped. The dollar is modestly higher with gold and bonds slightly lower...

Source: Bloomberg

Nasdaq has been euphoric (dotcom-esque) while The Dow is barely green since the last FOMC...

Source: Bloomberg

The market's expectations for Fed rate changes have swung wildly, plunging dovishly on the FOMC and then soaring hawkishly back with December expectations swinging from 100bps of cuts to 2.5bps of hikes...

Source: Bloomberg

Notably, stocks have recently completely ignored the tightening of financial conditions...

Source: Bloomberg

That can't be something The Fed wants to see?

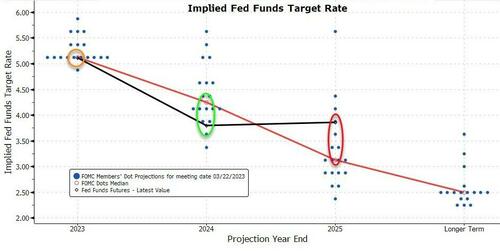

Finally, we also get a new SEP today, which is likely to be key as a signaling tool for the pause/skip/no-cuts narrative. Going into the meeting, the market has converged hawkishly to The Fed's 2023 year-end expectations, remains more dovish in 2024 (expecting more rate-cuts), but then considerably more hawkish in 2025 (rate-cuts re-igniting inflation?)

Source: Bloomberg

Going in to the FOMC statement, the odds of a July hike were 57%, we'll see how Powell does.

So what did The Fed do?

They 'paused' as expected:

-

*FED HOLDS BENCHMARK RATE IN 5%-5.25% TARGET RANGE

But are data-dependent (as always):

-

*FED SAYS `EXTENT OF ADDITIONAL' FIRMING TO HINGE ON ECONOMY

-

*FED SAYS HOLDING RATES ALLOWS FOMC TO ASSESS ADDITIONAL DATA

The new line added is:

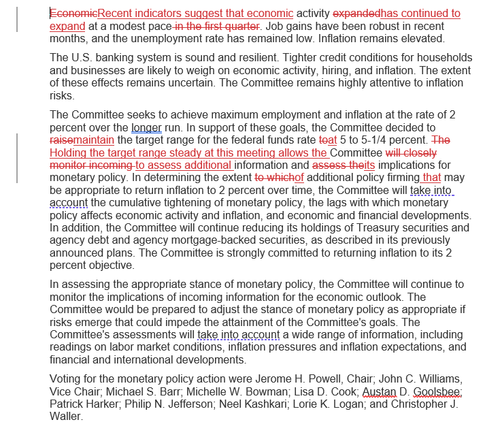

“Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.”

Here’s where the statement makes clear the Fed will still hike rates if they need to:

“The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

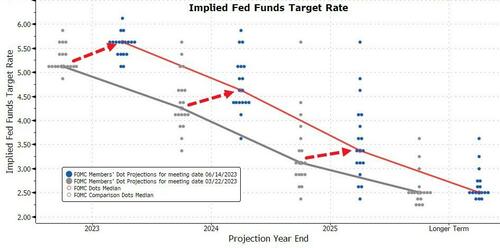

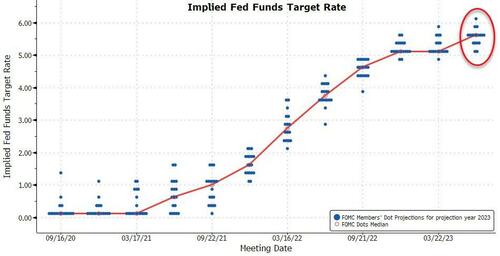

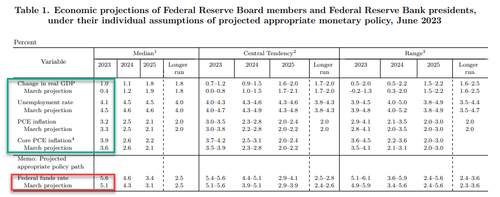

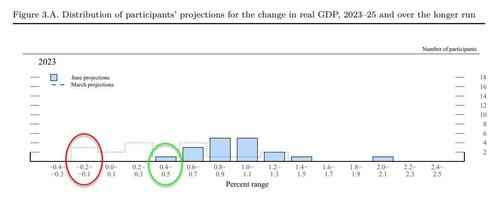

New projections show policymakers favor 50bps of additional increases this year, which would push borrowing costs to about 5.6% - higher than most economists and investors have been expecting...

So a very hawkish pause with the terminal rate rising once again...

Of the 18 FOMC participants, nine are penciling in two more hikes, and three have written down even more hikes than that.

That is a very strong consensus for at least two more hikes.

Finally, we note the delusional forecasts for economic growth and core inflation rose for 2023, while unemployment projections fell.

There are now no Fed members expecting a recession in 2023...

Read the full redline below:

Since the last FOMC statement on May 3rd, where Powell hiked rates 25bps but offered some dovish-speak during the presser, stocks have soared (well to be more accurate, mega-cap tech stocks have exploded higher) while bitcoin has been dumped. The dollar is modestly higher with gold and bonds slightly lower…

Source: Bloomberg

Nasdaq has been euphoric (dotcom-esque) while The Dow is barely green since the last FOMC…

Source: Bloomberg

The market’s expectations for Fed rate changes have swung wildly, plunging dovishly on the FOMC and then soaring hawkishly back with December expectations swinging from 100bps of cuts to 2.5bps of hikes…

Source: Bloomberg

Notably, stocks have recently completely ignored the tightening of financial conditions…

Source: Bloomberg

That can’t be something The Fed wants to see?

Finally, we also get a new SEP today, which is likely to be key as a signaling tool for the pause/skip/no-cuts narrative. Going into the meeting, the market has converged hawkishly to The Fed’s 2023 year-end expectations, remains more dovish in 2024 (expecting more rate-cuts), but then considerably more hawkish in 2025 (rate-cuts re-igniting inflation?)

Source: Bloomberg

Going in to the FOMC statement, the odds of a July hike were 57%, we’ll see how Powell does.

So what did The Fed do?

They ‘paused’ as expected:

But are data-dependent (as always):

The new line added is:

“Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.”

Here’s where the statement makes clear the Fed will still hike rates if they need to:

“The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

New projections show policymakers favor 50bps of additional increases this year, which would push borrowing costs to about 5.6% – higher than most economists and investors have been expecting…

So a very hawkish pause with the terminal rate rising once again…

Of the 18 FOMC participants, nine are penciling in two more hikes, and three have written down even more hikes than that.

That is a very strong consensus for at least two more hikes.

Finally, we note the delusional forecasts for economic growth and core inflation rose for 2023, while unemployment projections fell.

There are now no Fed members expecting a recession in 2023…

Read the full redline below:

Loading…