Wait Till Next Year

The most heralded recession in American history will probably not arrive until next year.

The U.S. economy is turning out to be far more resilient in the face of the Fed’s aggressive rate hikes than most analysts had projected. What’s more, several of the big risks that were threatening to drag down the economy have been resolved. The Fed’s willingness to slow down hikes to an every-other-meeting pace will likely extend growth through the end of the year and possibly further.

The four biggest risks to the U.S. economy coming into this year were:

- labor market tightness holding back businesses seeking to expand;

- a banking crisis spurred by deposit withdrawals and bond losses;

- a messy debt ceiling debacle;

- surging fuel prices.

Each of these now looks much less threatening.

Gasoline Has Gotten Much Cheaper

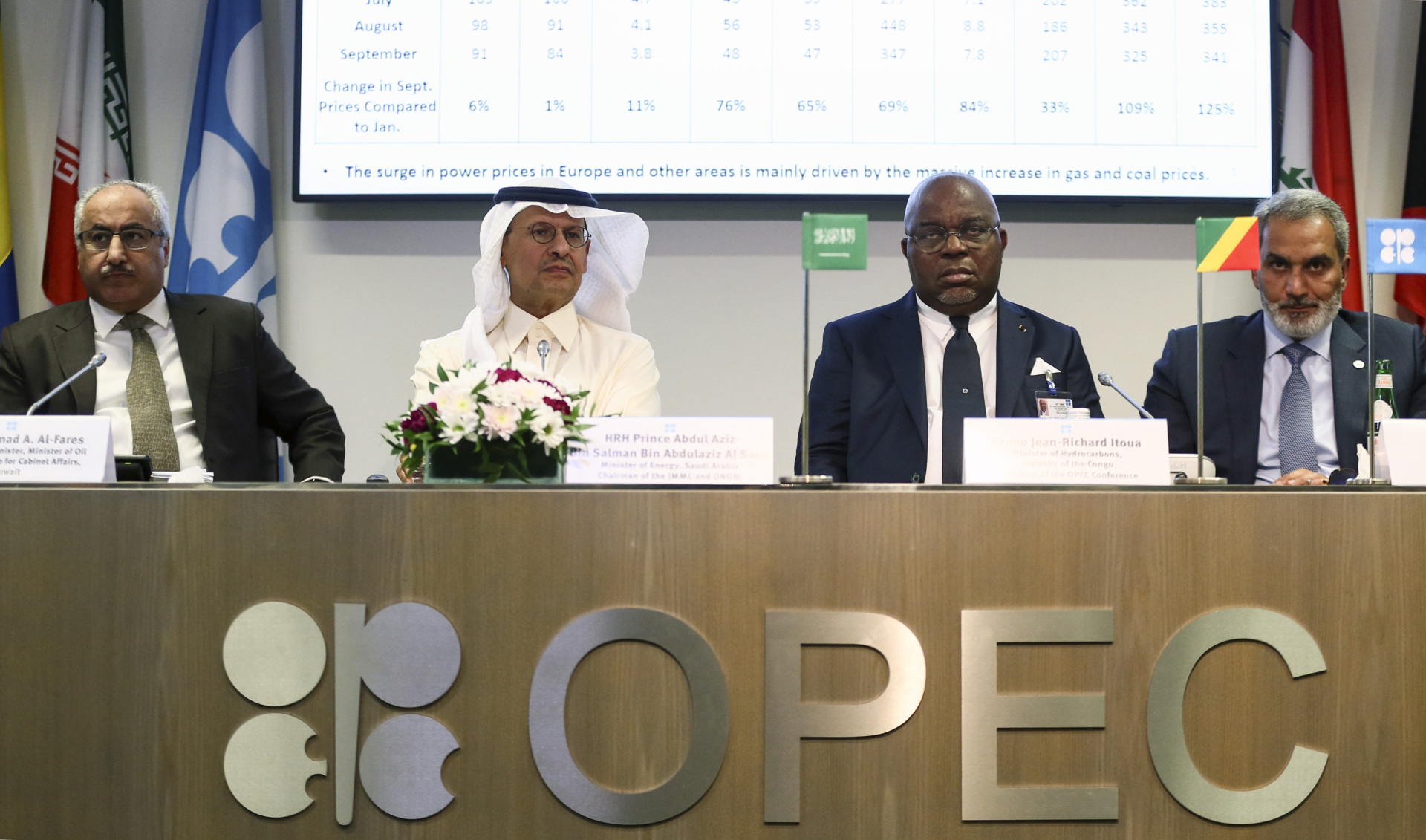

Beginning at the end, fuel prices are not soaring despite Saudi and OPEC+ cuts. Much of this appears to be due to the disappointing China reopening holding back demand. The supply of oil and natural gas coming from Russia into global markets is also much higher than anticipated despite ongoing sanctions. What’s more, the recent Saudi-only cuts suggest that the other members of OPEC+ are not willing to further cut production to prop up prices. The refusal of the Biden administration to refill the strategic petroleum reserves may be a blunder in terms of national security, but it is also keeping prices lower than anticipated.

Secretary-General of OPEC Haitham al-Ghais (right) and Saudi Arabia’s Minister of Energy Prince Abdulaziz bin Salman Al-Saud (second left) hold a press conference after the OPEC and non-OPEC ministerial meeting in Vienna, Austria, on October 5, 2022. (Askin Kiyagan/Anadolu Agency via Getty Images)

As a result, gas prices are much lower than they would have been. The American Automobile Association says that the national average price for a gallon of gasoline is around $3.58, far below the $5.08 Americans were paying at this time last year. The Department of Labor’s consumer price index shows gasoline prices have fallen in four out of the last seven months, including a dramatic 5.6 percent decline in May, the beginning of the summer driving season. Compared with a year ago, the consumer price index for gasoline is down 20.1 percent, and the broader energy index is down 11.7 percent from a year ago.

This has helped drag down headline inflation to just 4.0 percent year-over-year. That, in turn, has helped reassure Fed officials that they can back off from hiking interest rates at every meeting. The slower pace of rate hikes will likely extend the expansion.

The Debt Ceiling Was Resolved Smoothly

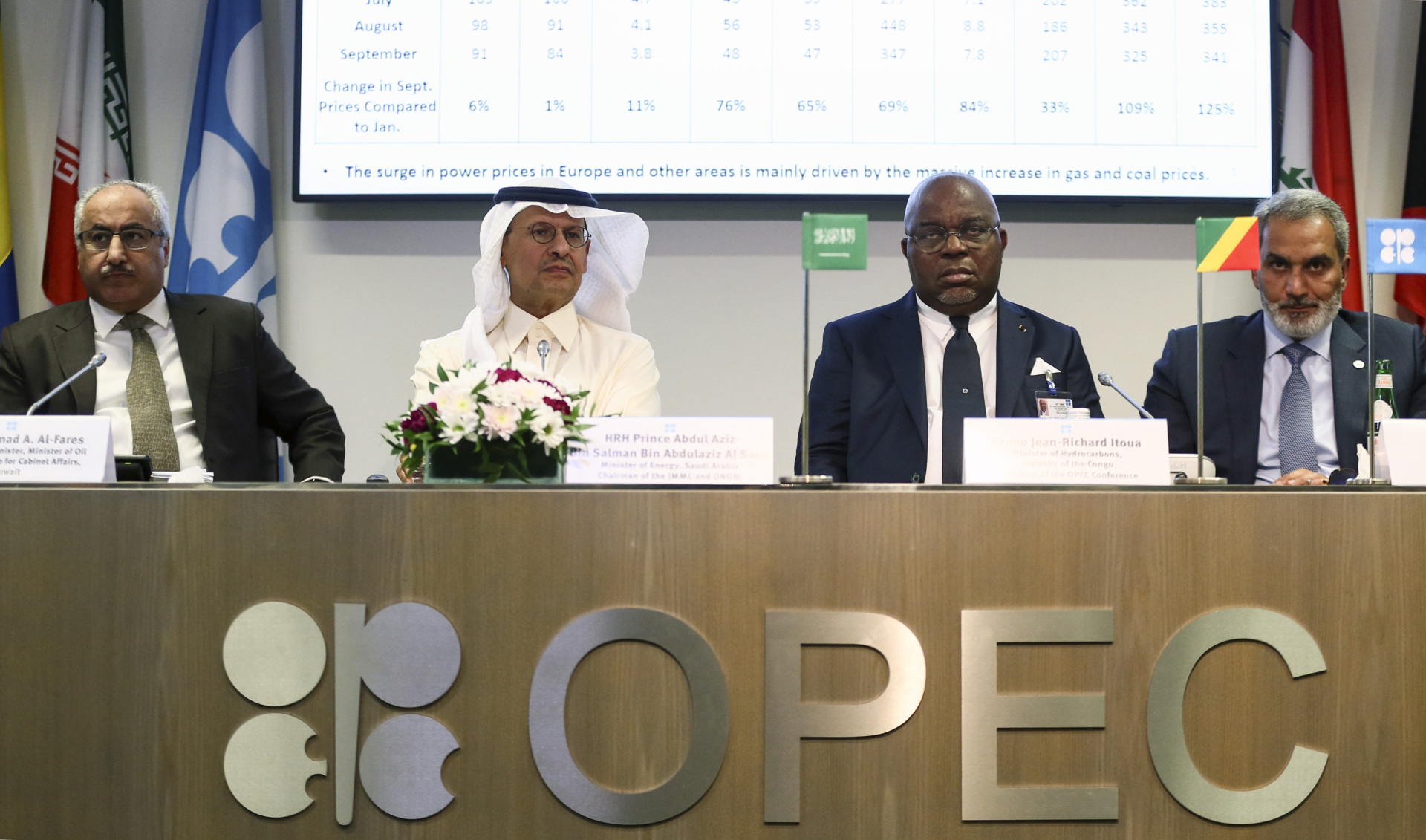

Going into this year, it looked like all the dominoes were in place for a messy debacle over the debt ceiling. Both Republicans and Democrats appeared willing to engage in extreme brinksmanship, with President Joe Biden vowing that he would never negotiate over raising the debt limit and House Speaker Kevin McCarthy (R-CA) promising his caucus that they would not be asked to pass a “clean” debt ceiling hike.

As the year wore on, tensions heightened. Treasury Secretary Janet Yellen dismissed the idea of adopting the various proposals to unilaterally override the debt limit, whether by invoking the Fourteenth Amendment, minting a platinum coin, or issuing perpetual bonds. At the same time, Yellen surprised analysts by announcing that the Treasury’s ability to continue to pay all its bills would run out in June rather than later this summer or early fall.

The debt limit posed three different economic risks. The first, and least probable, was an actual default on U.S. government bonds. This would have been chaotic but was never likely because the government could prioritize bond payments, and incoming revenue would always be sufficient to make interest and principal payments on the debt. The second was that the stock market could plunge sharply, mirroring the events of 2011. The third was simply that a prolonged standoff would drag down consumer confidence, pressuring households to cut back on spending and defensively save in anticipation of a downturn.

Speaker of the House Kevin McCarthy (R-CA) talks with reporters about the debt ceiling negotiations in the U.S. Capitol’s Statuary Hall on May 24, 2023. (Tom Williams/CQ Roll Call)

The success of Speaker McCarthy in forcing the White House to negotiate and in bringing along his sometimes fractious GOP caucus averted these risks. As Friday’s consumer sentiment numbers showed, the public’s confidence in the economy improved following the resolution.

Banking Normalizes and Labor Market Expands

One of the less commented upon aspects of last month’s extremely strong jobs numbers is the fact that employers were able to find enough workers to expand payrolls by more than 300,000. With an unemployment rate below four percent, this was never clear. But in recent months it seems that the tight labor market is drawing workers from the sidelines and from marginal self-employment, especially women in prime working age.

The banking turmoil that captured so much attention this spring has largely subsided. We’ve had no major bank failures, and deposit flights are no longer emptying the vaults of mid-sized banks. The Fed’s slowdown in rate hikes will help keep the sector steady. Bank runs are always possible but now seem not much more likely than typical.

With these risks pushed aside, there’s little on the horizon that should be expected to push the U.S. economy into a recession this year. We still think a recession is in the cards for next year because inflation is still running very high and the Fed will likely have to raise interest rates more than currently anticipated. That will make for a very interesting election year.

Programming Note: The Breitbart Business Digest will be off next week and the first half of the following week. We’ll return on Thursday, June 27.