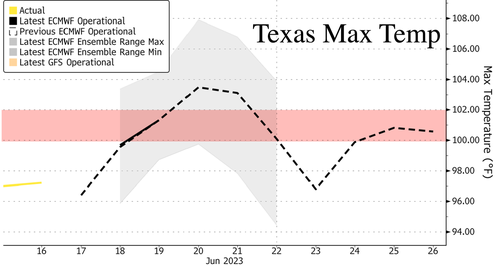

Extreme temperatures in Texas will push the mercury into triple-digit territory for much of the state through mid-next week. The first heat wave of the summer season is expected to send power demand to record levels as homes and businesses crank up their air conditioners.

The Electric Reliability Council of Texas (ERCOT), which operates the state's grid with 26 million customers, or about 90% of the state's power load, forecasted peak demand could reach 82,275 megawatts by Wednesday, the first day of summer. The current record of 80,148 megawatts was set last July.

The heat wave brings up two important questions. First, can ERCOT provide enough power to handle record demand? And second, will volatility emerge in wholesale power markets?

BloombergNEF answers those questions:

Is there enough generation available?

Regarding the first of these questions, the situation is most likely under control – at least for now. While high power demand does put pressure on the grid, a better measure of grid stress is net load (also known as the 'thermal gap'), which is the load remaining after solar and wind generation are subtracted.

The impact of higher-than-expected demand on net load is offset by the fact that solar capacity in Ercot has increased by 4.3GW — or more than a third — since this time last year. So although demand is expected to reach unprecedented levels, net load will not break records: it will just be very high. BNEF anticipates a peak net load of 62GW for June 16, and 65GW for June 20-21. Net load exceeded 65GW for a total of 83 hours between 2018 and 2022 – so the situation is rare, but not unprecedented.

How will the power market respond?

To the question of prices, there is no doubt that the high net load expectations are having an impact. Historically, BNEF has observed that prices in Ercot start to spike when net load is between 55GW and 60GW. For net loads above 64GW, price spikes are not only possible but probable.

The peak net load for Friday is 62GW, which means the market is on the threshold between conventional pricing dynamics and extreme volatility. At 62GW, real-time prices will likely fall between $35/MWh and $104/MWh, a broad but modest interquartile range given how high demand is.

However, the mean of BNEF's expectations in the same analysis is $158/MWh, lying well outside that range. This seeming contradiction stems from the fact that there is a finite chance of prices hitting the $1,000/MWh-$5,000/MWh range, which could happen if some generators unexpectedly come offline. This possibility pulls up the average. Additionally, if net demand is any higher than expected, extreme prices will be very much in the cards. The hub average day-ahead price for 5:00 pm Friday is $195.70/MWh, which likely reflects concerns of potential upside risk, even if a lower real-time price is more probable.

Next week, keep track of the wind forecast.

Whatever happens with prices, BNEF expects Ercot to have enough generation to keep the power on. Next week's 81-82GW peak demand will be far more testing and uncertain. The whims of the wind could sway net load by 16GW: strong winds could bring it down to 54GW, while lackluster winds could push it up to unchartered 70GW territory.

Current forecasts for the days in question put mid-afternoon wind speeds at five to six meters per second, which is relatively high, suggesting that net load at the lower end of the above range is more likely. However, net load at the higher end is still a possibility, and the result would be astronomical power prices and potential outages. Those that participate in the Ercot power market or depend on the Texas grid would be wise to keep an eye on the weather forecast as it evolves. June will prove to be the first test of the summer season. However, even if the coming days prove uneventful, the rest of the summer will likely see continued demand records, a continuation of last year's trend. Moreover, August and September see temperatures – and hence demand – peak later in the day, when solar generation is less of a factor. This could prove to be the true test of whether Ercot is ready to meet new levels of power demand.

ERCOT will face its first major challenge of the summer season next week. According to Bloomberg, they anticipate the grid will hold up. However, stress on the grid may emerge as the season progresses.

Extreme temperatures in Texas will push the mercury into triple-digit territory for much of the state through mid-next week. The first heat wave of the summer season is expected to send power demand to record levels as homes and businesses crank up their air conditioners.

The Electric Reliability Council of Texas (ERCOT), which operates the state’s grid with 26 million customers, or about 90% of the state’s power load, forecasted peak demand could reach 82,275 megawatts by Wednesday, the first day of summer. The current record of 80,148 megawatts was set last July.

The heat wave brings up two important questions. First, can ERCOT provide enough power to handle record demand? And second, will volatility emerge in wholesale power markets?

BloombergNEF answers those questions:

Is there enough generation available?

Regarding the first of these questions, the situation is most likely under control – at least for now. While high power demand does put pressure on the grid, a better measure of grid stress is net load (also known as the ‘thermal gap’), which is the load remaining after solar and wind generation are subtracted.

The impact of higher-than-expected demand on net load is offset by the fact that solar capacity in Ercot has increased by 4.3GW — or more than a third — since this time last year. So although demand is expected to reach unprecedented levels, net load will not break records: it will just be very high. BNEF anticipates a peak net load of 62GW for June 16, and 65GW for June 20-21. Net load exceeded 65GW for a total of 83 hours between 2018 and 2022 – so the situation is rare, but not unprecedented.

How will the power market respond?

To the question of prices, there is no doubt that the high net load expectations are having an impact. Historically, BNEF has observed that prices in Ercot start to spike when net load is between 55GW and 60GW. For net loads above 64GW, price spikes are not only possible but probable.

The peak net load for Friday is 62GW, which means the market is on the threshold between conventional pricing dynamics and extreme volatility. At 62GW, real-time prices will likely fall between $35/MWh and $104/MWh, a broad but modest interquartile range given how high demand is.

However, the mean of BNEF’s expectations in the same analysis is $158/MWh, lying well outside that range. This seeming contradiction stems from the fact that there is a finite chance of prices hitting the $1,000/MWh-$5,000/MWh range, which could happen if some generators unexpectedly come offline. This possibility pulls up the average. Additionally, if net demand is any higher than expected, extreme prices will be very much in the cards. The hub average day-ahead price for 5:00 pm Friday is $195.70/MWh, which likely reflects concerns of potential upside risk, even if a lower real-time price is more probable.

Next week, keep track of the wind forecast.

Whatever happens with prices, BNEF expects Ercot to have enough generation to keep the power on. Next week’s 81-82GW peak demand will be far more testing and uncertain. The whims of the wind could sway net load by 16GW: strong winds could bring it down to 54GW, while lackluster winds could push it up to unchartered 70GW territory.

Current forecasts for the days in question put mid-afternoon wind speeds at five to six meters per second, which is relatively high, suggesting that net load at the lower end of the above range is more likely. However, net load at the higher end is still a possibility, and the result would be astronomical power prices and potential outages. Those that participate in the Ercot power market or depend on the Texas grid would be wise to keep an eye on the weather forecast as it evolves. June will prove to be the first test of the summer season. However, even if the coming days prove uneventful, the rest of the summer will likely see continued demand records, a continuation of last year’s trend. Moreover, August and September see temperatures – and hence demand – peak later in the day, when solar generation is less of a factor. This could prove to be the true test of whether Ercot is ready to meet new levels of power demand.

ERCOT will face its first major challenge of the summer season next week. According to Bloomberg, they anticipate the grid will hold up. However, stress on the grid may emerge as the season progresses.

Loading…