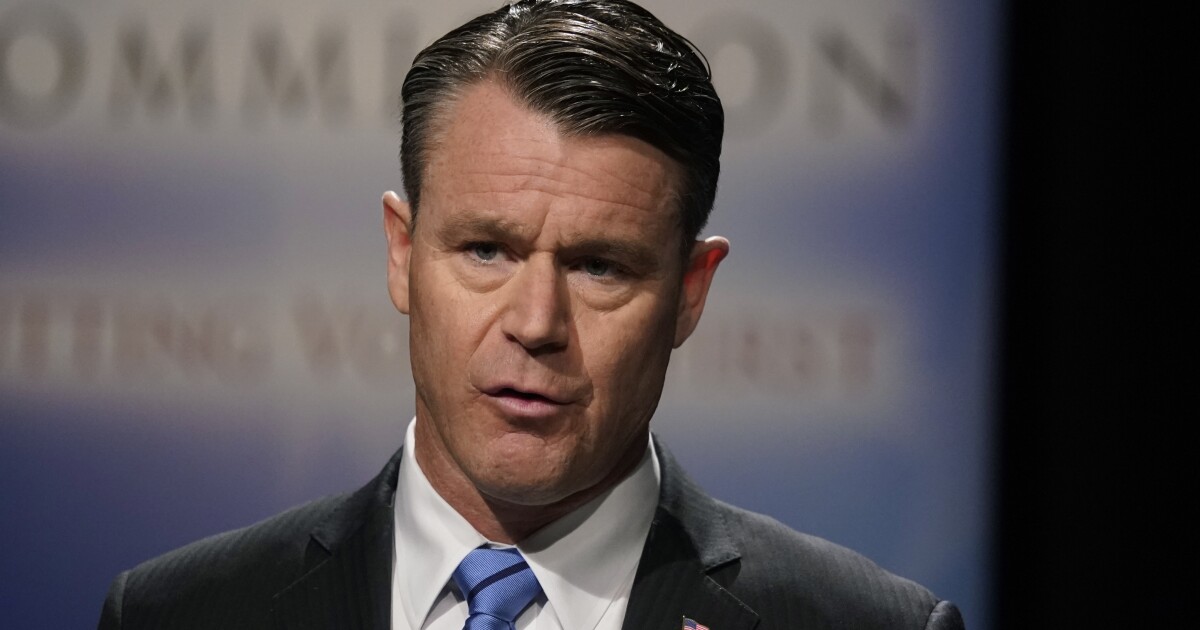

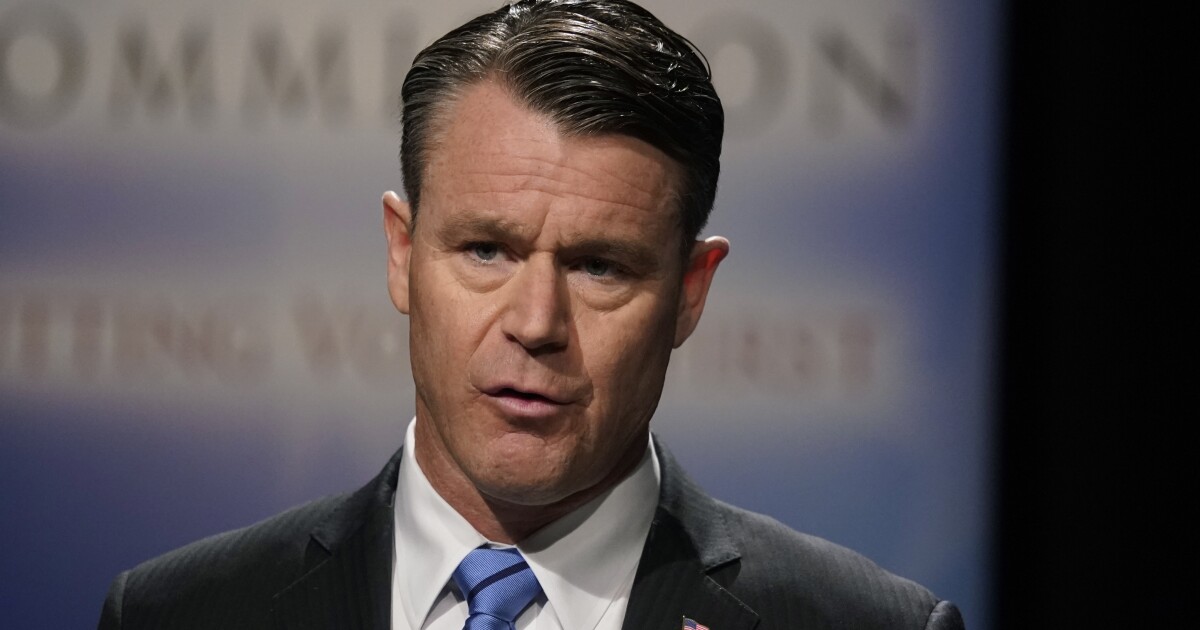

Sen. Todd Young (R-IN) wrote a letter to Gary Gensler, the chairman of the Securities and Exchange Commission, to express concerns about the potential exposure American investors face from publicly traded companies based in China.

Young urged the SEC to take additional steps to protect traders and fiduciaries from what he says are “chronic, often intentional, lack of transparency; poor corporate governance or fraudulent behaviors” by companies based in China that can be traded in the United States. Young also said there is a great risk for “arbitrary or spurious” enforcement actions by Chinese regulators.

BIDEN’S CLIMATE TRANSITION WILL HARM OUR MILITARY READINESS AND NATIONAL SECURITY

The concerns are also related to the Chinese government’s manipulation of the global financial markets and its ability to skirt oversight by American financial regulators.

“In addition, Chinese corporations are not incentivized to properly disclose their business practices because the enforcement options available to U.S. regulators pale in comparison to the punitive threat from state regulators in the [People’s Republic of China],” Young said.

He provides examples of five companies that meet these descriptions, including iQiyi, Luckin Coffee, TAL Education Group, HNA Group, and Evergrande Group.

“Generally, I am concerned that U.S. investors, especially passive investors in indexes and exchange-traded funds (ETFs), are still unaware of the risks posed to their investments by the mere presence of Chinese companies in their funds,” Young said. “In addition to the risks outlined above, the potential of Chinese military and political aggression, including against Taiwan, adds an additional layer of risk to not only active and passive investors in Chinese companies listed on U.S. exchanges, but to publicly-traded U.S. firms with operations, supply chains, and business arrangements in both mainland China and Hong Kong.”

Young’s concerns are heightened now that the Chinese government is asking these companies to move away from independent and regulated auditors to Chinese-based auditors, which he says are “more susceptible to state influence and coercion.”

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

He asked Gensler a series of eight questions in a bid to improve the transparency around these publicly traded companies.

“In light of these concerns, I believe that additional informational and regulatory actions by the SEC need to be on the table to protect American markets, shareholders, and our economic and national security,” Young said