By Philip Marey, Senior US Strategist at Rabobank

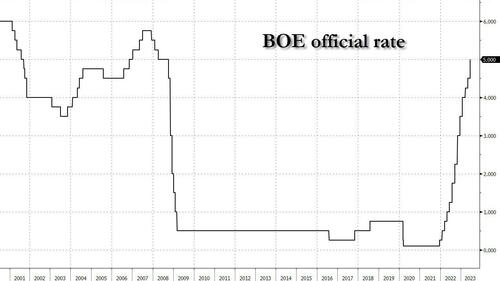

For the first time this hiking cycle, the Bank of England delivered an upward surprise: it voted by a 7-2 majority to raise its policy rate by 50bp to 5.00%. Economists didn’t expect this. It is likely that Wednesday’s shock inflation figure frightened the majority of the MPC, prompting it to take more drastic action right away. The MPC doesn’t dare to rely on models or forward-looking indicators too much, and thinks it safer to set policy based on what they are actually seeing in the rear view mirror. It seeks to regain the initiative on inflation, with a reaction function based on wage growth and services inflation. It is willing to break the economy to restore policy credibility. Yesterday’s 50bp hike will likely do little to reduce short-term inflation, but will definitely add to the mortgage squeeze in front of us. The risk of an accident has increased. We still expect two 25bp rate increases at the two upcoming meetings, with obvious upside risk. Our forecast for the terminal rate is following today’s surprise higher and has been lifted to 5.50% from 5.25%. For more details, we refer to the BoE Post Meeting Commentary by Stefan Koopman.

Three hours before the Bank of England, Norges Bank also surprised the markets with a 50 bps hike, instead of 25 bps expected. This brought the styringsrenten at 3.75%. The Norwegian central bank’s current assessment of the outlook and balance of risks implies that the policy rate will most likely be raised further in August. Inflation is markedly above the target and wage growth is set to be higher than in 2022. Governor Ida Wolden Bache stated that “if we do not raise the policy rate, prices and wages could continue to rise rapidly and inflation become entrenched. It may then become more costly to bring inflation down again.”

Yesterday, as expected, Banxico left its policy rate unchanged at 11.25% and said it “considers that it will be necessary to maintain the reference rate at its current level for an extended period”, repeating its forward guidance from last month. The decision was unanimous. The Governing Board noted that since the last meeting, annual headline and core inflation continued decreasing, but remained high, at 5.18% and 6.91%, respectively. Our Banxico-watcher Christian Lawrence expects rates to stay on hold into 2024, although the risk is skewed towards further tightening.

In the US, Fed Chair Powell returned to Capitol Hill for the second day of his monetary policy report to Congress. Powell explained that the FOMC did not hike in June to slow down the hiking cycle: “We moved very quickly at the beginning, and we’ve gradually slowed down. This is just a continuation of that… to give ourselves more time – to stretch out the time for making those decisions.” He confirmed that the two additional hikes in the dot plot were “a pretty good guess of what will happen if the economy performs as expected.” Besides Powell, several other FOMC participants also made the news yesterday. Fed Governor Michelle Bowman said that she believes that additional policy rate increases will be necessary. She said that we have seen core inflation essentially plateau since the fall of 2022. Richmond Fed President Thomas Barkin, who does not vote this year, said that he is still looking to be convinced that slowing demand returning inflation relatively quickly to target is happening, but if the coming data doesn’t support that, he’s more than comfortable doing more.

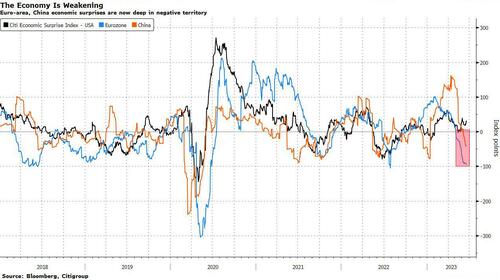

Meanwhile, US economic data are confirming a slowdown in growth. The US initial jobless claims remained elevated at 264K in the week ending on June 17, indicating that labor demand has softened somewhat. However, declining continuing claims suggest that the discrepancy between demand and supply has actually fallen in recent weeks. The Chicago Fed’s national economic activity index turned negative again (-0.15) in May, from 0.14 in April (upward revision from 0.07). Negative readings indicate below-trend growth, which the Fed thinks is necessary – with some softening of the labor market – to squeeze out inflation.

By Philip Marey, Senior US Strategist at Rabobank

For the first time this hiking cycle, the Bank of England delivered an upward surprise: it voted by a 7-2 majority to raise its policy rate by 50bp to 5.00%. Economists didn’t expect this. It is likely that Wednesday’s shock inflation figure frightened the majority of the MPC, prompting it to take more drastic action right away. The MPC doesn’t dare to rely on models or forward-looking indicators too much, and thinks it safer to set policy based on what they are actually seeing in the rear view mirror. It seeks to regain the initiative on inflation, with a reaction function based on wage growth and services inflation. It is willing to break the economy to restore policy credibility. Yesterday’s 50bp hike will likely do little to reduce short-term inflation, but will definitely add to the mortgage squeeze in front of us. The risk of an accident has increased. We still expect two 25bp rate increases at the two upcoming meetings, with obvious upside risk. Our forecast for the terminal rate is following today’s surprise higher and has been lifted to 5.50% from 5.25%. For more details, we refer to the BoE Post Meeting Commentary by Stefan Koopman.

Three hours before the Bank of England, Norges Bank also surprised the markets with a 50 bps hike, instead of 25 bps expected. This brought the styringsrenten at 3.75%. The Norwegian central bank’s current assessment of the outlook and balance of risks implies that the policy rate will most likely be raised further in August. Inflation is markedly above the target and wage growth is set to be higher than in 2022. Governor Ida Wolden Bache stated that “if we do not raise the policy rate, prices and wages could continue to rise rapidly and inflation become entrenched. It may then become more costly to bring inflation down again.”

Yesterday, as expected, Banxico left its policy rate unchanged at 11.25% and said it “considers that it will be necessary to maintain the reference rate at its current level for an extended period”, repeating its forward guidance from last month. The decision was unanimous. The Governing Board noted that since the last meeting, annual headline and core inflation continued decreasing, but remained high, at 5.18% and 6.91%, respectively. Our Banxico-watcher Christian Lawrence expects rates to stay on hold into 2024, although the risk is skewed towards further tightening.

In the US, Fed Chair Powell returned to Capitol Hill for the second day of his monetary policy report to Congress. Powell explained that the FOMC did not hike in June to slow down the hiking cycle: “We moved very quickly at the beginning, and we’ve gradually slowed down. This is just a continuation of that… to give ourselves more time – to stretch out the time for making those decisions.” He confirmed that the two additional hikes in the dot plot were “a pretty good guess of what will happen if the economy performs as expected.” Besides Powell, several other FOMC participants also made the news yesterday. Fed Governor Michelle Bowman said that she believes that additional policy rate increases will be necessary. She said that we have seen core inflation essentially plateau since the fall of 2022. Richmond Fed President Thomas Barkin, who does not vote this year, said that he is still looking to be convinced that slowing demand returning inflation relatively quickly to target is happening, but if the coming data doesn’t support that, he’s more than comfortable doing more.

Meanwhile, US economic data are confirming a slowdown in growth. The US initial jobless claims remained elevated at 264K in the week ending on June 17, indicating that labor demand has softened somewhat. However, declining continuing claims suggest that the discrepancy between demand and supply has actually fallen in recent weeks. The Chicago Fed’s national economic activity index turned negative again (-0.15) in May, from 0.14 in April (upward revision from 0.07). Negative readings indicate below-trend growth, which the Fed thinks is necessary – with some softening of the labor market – to squeeze out inflation.

Loading…