Authored by Michael Maharrey via SchiffGold.com,

Last week, the national debt pushed above $32 trillion. This is a ticking time bomb that will eventually explode.

Keep in mind, there is no limit on the debt for the next two years, so there is no telling how high it will climb. The sky is the limit.

That doesn’t bode well given the federal government’s spending problem. The Biden administration is blowing through about $500 billion every single month. This pace isn’t about to slow down despite what you might have heard about spending cuts in the “Fiscal Responsibility Act.” Even with the spending caps in the debt ceiling deal, overall spending will increase over the next two years. That means we can expect more massive monthly budget deficits.

And that’s assuming Congress and the president stick to the spending plan, which isn’t likely. We all know that the next “emergency” will necessitate additional “emergency” spending. In fact, Secretary of State Antony Blinken just announced he plans to set out a new “robust” assistance package for Ukraine.

There is always something the government needs to spend money on and now it has a credit card with no limit.

On the other side of the ledger, government receipts are falling. In May, the Treasury reported inflows of $307.5 billion. That was a 26.5% drop from May 2022.

Last year, robust tax receipts helped to paper over the spending problem as the federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. We’re already seeing receipts fall, and government tax revenue will decline even faster if the economy spins into a recession.

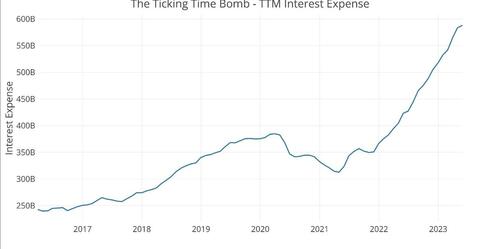

The sheer size of the debt isn’t the only problem. The interest payments on that debt are growing exponentially. The trailing 12-month (TTM) interest on the debt clocked in at just under $600 billion in May. This was up from $350 billion at the start of 2022, less than 18 months ago. The government has added an extra $250 billion in expenses per year on just debt service.

This is just the beginning of an upward trend. Based on the current interest payment, The Treasury is paying less than 2% interest. But a lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

Here are some numbers to consider.

If the national debt climbs to $40 trillion (and given the current deficits it won’t take long) and interest rates remain at 5% (which Jerome Powell says will be necessary to tackle inflation) interest payments on the debt alone would skyrocket around $2 trillion per year. That means that even if the US government balanced the budget so receipts covered all spending minus interest payments, we’d still be facing a $2 trillion annual deficit.

Of course, there won’t be a balanced budget. So, let’s assume the federal government can maintain the current deficit level of around $1 trillion annually (minus interest expense). Even with this overly-optimistic scenario, the Treasury would be running a $3 trillion annual budget deficit. (That’s the current $1 trillion deficit plus $2 trillion in interest expenses.)

And the most likely scenario is spending will continue to climb, along with the budget deficits. There’s no telling how high the annual deficits could run. But just consider that since President Biden took office, the national debt has grown by $4.25 trillion — in just two-and-a-half years.

This is a fiscal powder keg. All it needs is a match.

The looming global economic downturn might just be the match that lights the fuse.

The national debt has been growing for so long that most people just shrug when we talk about it. Nobody seems particularly concerned outside of a handful of contrarians. Sure, most everybody recognizes that it might be a problem “down the road.” But they believe the road is long, so we can get away with continuing to kick the can. But mark my words, eventually, they will run out of road.

Authored by Michael Maharrey via SchiffGold.com,

Last week, the national debt pushed above $32 trillion. This is a ticking time bomb that will eventually explode.

Keep in mind, there is no limit on the debt for the next two years, so there is no telling how high it will climb. The sky is the limit.

That doesn’t bode well given the federal government’s spending problem. The Biden administration is blowing through about $500 billion every single month. This pace isn’t about to slow down despite what you might have heard about spending cuts in the “Fiscal Responsibility Act.” Even with the spending caps in the debt ceiling deal, overall spending will increase over the next two years. That means we can expect more massive monthly budget deficits.

And that’s assuming Congress and the president stick to the spending plan, which isn’t likely. We all know that the next “emergency” will necessitate additional “emergency” spending. In fact, Secretary of State Antony Blinken just announced he plans to set out a new “robust” assistance package for Ukraine.

There is always something the government needs to spend money on and now it has a credit card with no limit.

On the other side of the ledger, government receipts are falling. In May, the Treasury reported inflows of $307.5 billion. That was a 26.5% drop from May 2022.

Last year, robust tax receipts helped to paper over the spending problem as the federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. We’re already seeing receipts fall, and government tax revenue will decline even faster if the economy spins into a recession.

The sheer size of the debt isn’t the only problem. The interest payments on that debt are growing exponentially. The trailing 12-month (TTM) interest on the debt clocked in at just under $600 billion in May. This was up from $350 billion at the start of 2022, less than 18 months ago. The government has added an extra $250 billion in expenses per year on just debt service.

This is just the beginning of an upward trend. Based on the current interest payment, The Treasury is paying less than 2% interest. But a lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

Here are some numbers to consider.

If the national debt climbs to $40 trillion (and given the current deficits it won’t take long) and interest rates remain at 5% (which Jerome Powell says will be necessary to tackle inflation) interest payments on the debt alone would skyrocket around $2 trillion per year. That means that even if the US government balanced the budget so receipts covered all spending minus interest payments, we’d still be facing a $2 trillion annual deficit.

Of course, there won’t be a balanced budget. So, let’s assume the federal government can maintain the current deficit level of around $1 trillion annually (minus interest expense). Even with this overly-optimistic scenario, the Treasury would be running a $3 trillion annual budget deficit. (That’s the current $1 trillion deficit plus $2 trillion in interest expenses.)

And the most likely scenario is spending will continue to climb, along with the budget deficits. There’s no telling how high the annual deficits could run. But just consider that since President Biden took office, the national debt has grown by $4.25 trillion — in just two-and-a-half years.

This is a fiscal powder keg. All it needs is a match.

The looming global economic downturn might just be the match that lights the fuse.

The national debt has been growing for so long that most people just shrug when we talk about it. Nobody seems particularly concerned outside of a handful of contrarians. Sure, most everybody recognizes that it might be a problem “down the road.” But they believe the road is long, so we can get away with continuing to kick the can. But mark my words, eventually, they will run out of road.

Loading…