Pfizer - best known for rushing through a covid gene-therapy mRNA injection which had little impact on actually preventing infection, i.e. acting like a "vaccine", but left the injectee with potentially deadly undisclosed side-effects - is halting early development of a weight-loss drug on safety concerns, sparking investor fears about another experimental treatment for diabetes and obesity.

The drugmaker will halt all work on lotiglipron following data from phase 1 clinical trials and lab measurements which showed elevated levels of enzymes called transaminases from an ongoing mid-stage study, according to a statement Monday. The enzymes play a key role in liver function. None of the patients reported liver side effects or symptoms, Pfizer said, but Pfizer is known for saying a lot of things that aren't true... allegedly.

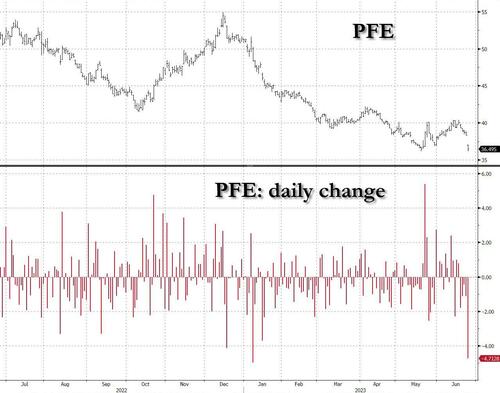

Pfizer's retreat from a space that is considered by most to be "the AI of healthcare", i.e., helping fatsos lose weight with a weekly injection, sent its shares tumbling as much as 5% at the New York market open, their biggest intraday drop since January.

Struggling to recover from plunging Covid vaccine demand, Pfizer is now racing to catch up with Novo Nordisk S and Eli Lilly in an obesity-treatment market estimated to grow to more than $100 billion in size in the coming years. Pfizer - which is finding out how much more difficult its life is when the government isn't actively peddling its gene therapy- is pinning its hopes on danuglipron, another treatment still in development, to compete with the likes of Novo’s Wegovy and Lilly’s Mounjaro, both emerging as blockbuster market leaders.

The company was developing two treatments with the intent of choosing one to move forward with, said William Sessa, senior vice president and chief scientific officer for internal medicine research, in the company’s statement. Lotiglipron is a once-daily oral treatment, and Pfizer’s decision follows positive data from a competing experimental treatment from Lilly, orforglipron, according to Bloomberg Intelligence analysts John Murphy and Mila Bankovskaia.

Danuglipron is a twice-daily oral drug in mid-stage studies, and Pfizer said it hasn’t seen the same elevated enzymes in more than 1,400 patients enrolled in tests. That dosing regimen could hurt the product’s competitiveness versus Lilly’s and Novo’s rival oral drugs, the Bloomberg analysts said.

“A twice-daily pill could prove challenging, assuming all else is equal, leaving Pfizer’s $10 billion peak-sales estimate for danuglipron looking optimistic,” they said in a note.

Pfizer expects to finalize plans for danuglipron’s late-stage development by the end of 2023 and is working on a once-daily, modified release version.

Pfizer – best known for rushing through a covid gene-therapy mRNA injection which had little impact on actually preventing infection, i.e. acting like a “vaccine”, but left the injectee with potentially deadly undisclosed side-effects – is halting early development of a weight-loss drug on safety concerns, sparking investor fears about another experimental treatment for diabetes and obesity.

The drugmaker will halt all work on lotiglipron following data from phase 1 clinical trials and lab measurements which showed elevated levels of enzymes called transaminases from an ongoing mid-stage study, according to a statement Monday. The enzymes play a key role in liver function. None of the patients reported liver side effects or symptoms, Pfizer said, but Pfizer is known for saying a lot of things that aren’t true… allegedly.

Pfizer’s retreat from a space that is considered by most to be “the AI of healthcare”, i.e., helping fatsos lose weight with a weekly injection, sent its shares tumbling as much as 5% at the New York market open, their biggest intraday drop since January.

Struggling to recover from plunging Covid vaccine demand, Pfizer is now racing to catch up with Novo Nordisk S and Eli Lilly in an obesity-treatment market estimated to grow to more than $100 billion in size in the coming years. Pfizer – which is finding out how much more difficult its life is when the government isn’t actively peddling its gene therapy- is pinning its hopes on danuglipron, another treatment still in development, to compete with the likes of Novo’s Wegovy and Lilly’s Mounjaro, both emerging as blockbuster market leaders.

The company was developing two treatments with the intent of choosing one to move forward with, said William Sessa, senior vice president and chief scientific officer for internal medicine research, in the company’s statement. Lotiglipron is a once-daily oral treatment, and Pfizer’s decision follows positive data from a competing experimental treatment from Lilly, orforglipron, according to Bloomberg Intelligence analysts John Murphy and Mila Bankovskaia.

Danuglipron is a twice-daily oral drug in mid-stage studies, and Pfizer said it hasn’t seen the same elevated enzymes in more than 1,400 patients enrolled in tests. That dosing regimen could hurt the product’s competitiveness versus Lilly’s and Novo’s rival oral drugs, the Bloomberg analysts said.

“A twice-daily pill could prove challenging, assuming all else is equal, leaving Pfizer’s $10 billion peak-sales estimate for danuglipron looking optimistic,” they said in a note.

Pfizer expects to finalize plans for danuglipron’s late-stage development by the end of 2023 and is working on a once-daily, modified release version.

Loading…