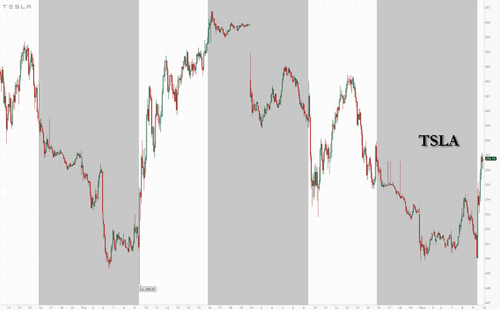

Despite a downgrade from Goldman Sachs over the weekend, shares of Tesla continue to show strength, going green less than an hour after Monday's cash open and settling near unchanged heading into the 11AM EST hour as the broader market rallied.

In a note out over the weekend, Goldman, led by analyst Mark Delaney, noted that the stock price moving higher, in addition to a tougher pricing environment for autos, were two of the reasons for downgrading the name:

We’re downgrading Tesla shares to Neutral from Buy, as we believe the stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning post the substantial move higher YTD (up 108% vs. the S&P 500 up 13%) and in the last month (up 38% vs. the S&P 500 up 5%). While the primary reason for the change in our view is that we think the market is now giving the stock more credit for its longer-term opportunities, we are also cognizant of the difficult pricing environment for new vehicles that we think will continue to weigh on Tesla’s automotive non-GAAP gross margin this year.

Delaney noted that recent strength in the name was likely a factor of better than expected sales in April and May and less price cuts than expected, among other things:

We attribute the recent move higher in Tesla shares (which significantly exceeded our expectation) to a combination of factors including: 1) relatively solid monthly sales in April and May; 2) less price declines/discounting from Tesla in 2Q than investors (and we) had expected (with prices for some new vehicles being slightly increased in the US recently post the larger cuts in January and April, and price reductions being focused on vehicles in inventory); 3) incremental IRA credits for RWD Model 3; 4) several companies now planning to use Tesla’s charging network in North America (which we think will help Tesla to build a small but growing new charging business, drive awareness of Tesla products, and help Tesla/NACS connectors be a larger part of the market all else equal); and 5) incremental market focus on companies that benefit from AI.

And despite the price target cut, he actually raised the company's EPS estimates to "assume a more moderate rate of price declines going forward".

Similar to Morgan Stanley last week, Delaney couldn't avoid the fact that he still thinks Tesla is positioned for the long term but believes the stock may be overextended, stating: "Overall we believe our view that Tesla is well positioned for long-term growth, given its leading position in the EV and clean energy markets (which we attribute in part to its ability to offer full solutions including charging, storage, software/FSD and services with a direct sales model), is now better reflected in the stock."

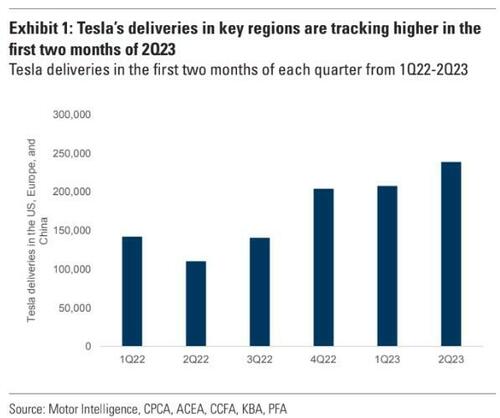

Goldman says it believes that Q2 deliveries are tracking in the right direction, to 445-450k:

We believe that Tesla’s deliveries are off to a solid start for 2Q, with volumes in the first two months of the quarter for the US, Europe and China higher than the first two months of deliveries in prior quarters (Exhibit 1). It’s important to note that Tesla has been in the process of transitioning to a more even delivery schedule throughout the quarter in order to ease logistics and operational constraints. As a result, we expect less of an increase in the last month of the quarter than was the case historically. We believe that volumes are tracking to be roughly in line with consensus at ~445-450K (per FactSet and Visible Alpha) as our base case.

He also hones in on the fact that pricing cuts haven't been as egregious as once predicted. Delaney writes: "We had previously been expecting additional price reductions in 2Q given company commentary on the 1Q23 earnings call and due to a relatively tepid macroeconomic backdrop (with easing vehicle supply/demand). However, Tesla pricing has been stronger than we had expected (with some small price increases on certain models, and discounting focused on vehicles in inventory)."

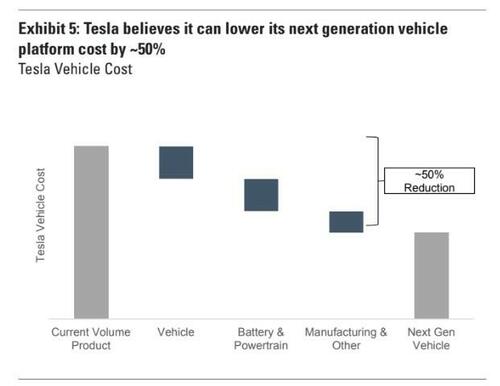

"We view Tesla as an industry leader in terms of powertrain technology and costs, as evidenced by powertrain efficiency compared to vehicle price," the note continues, making the case that the company remains at the front of innovating in both "cost and capabilities".

Goldman also has optimistic hopes for the next drivetrain that the company will eventually manufacture as it looks toward 2025:

On powertrain specifically, Tesla believes its next drive unit will be even more scalable with a roughly 75% reduction in silicon carbide, while also reducing the rare earth materials required to zero. We believe that this program is a priority for Tesla, and we believe the company is targeting a ramp in 2025 based on company commentary

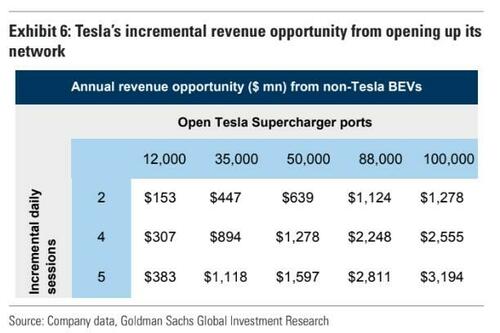

Finally, Goldman takes note of Tesla's major win in charging, having Ford, GM and Rivian recently adopt its charging standard. Delaney predicts $1 to $3 billion of incremental revenue from opening up the network:

Recall that Tesla has already been in the process of opening up select chargers in the US and Europe. In Europe, owners have been able to acquire a membership (for about €12.99 or $14 USD per month) or pay a higher rate per charge. We believe that Tesla has not opened up the most highly utilized chargers to preserve a better experience for Tesla drivers.

As we wrote in our 6/29/22 report, The case for Tesla to open the Supercharging network, we sized the potential for Tesla opening its network more widely in the next few years (i.e. more than just the 12K chargers in North America) at $1-$3 bn of incremental revenue (although Tesla wouldn’t necessarily capture all of this).

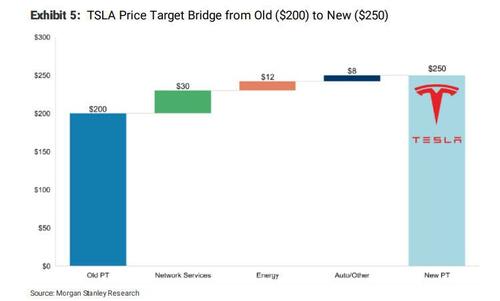

Recall, late last week the other major sell side bank that covers Tesla, Morgan Stanley, also downgraded the name to equal weight despite raising their price target from $200 to $250 per share.

As we noted last week, Morgan Stanley's Adam Jonas' bull case remains at $450 and his bear case remains at $90 for shares, to wit:

We raise our Tesla price target to $250 from $200, Bear Case valuation to $90 from $70,and Bull Case valuation to $450 from $390. Following these changes, we change our rating to Equal-weight from Overweight given a relatively full valuation and a more balanced risk reward and highlight key drivers and investor debates for the stock at this level.

Even Morgan Stanley didn't sound convinced of its downgrade last week, with Jonas admitting that Tesla "remains a 'must own' company in any EV portfolio" and that it "is emerging as an industrial 'standard bearer' for one of the greatest industrial changes we've witnessed in over a century.

Recall, we have been documenting how Tesla's charging standard is now quickly becoming the EV industry's charging standard.

To Jonas the fly in the ointment was that the stock's price has moved significantly higher, stating "Some investors may feel inclined to play the positive momentum from here, but we believe the current price, at over 100x our FY23 US GAAP EPS forecast, discounts significantly more than Tesla as just a dominant EV company."

Right now sentiment is starting to feel like after a couple more of these downgrades, shares could soon blow through $300...

Both full notes available to pro subscribers in the usual place.

Despite a downgrade from Goldman Sachs over the weekend, shares of Tesla continue to show strength, going green less than an hour after Monday’s cash open and settling near unchanged heading into the 11AM EST hour as the broader market rallied.

In a note out over the weekend, Goldman, led by analyst Mark Delaney, noted that the stock price moving higher, in addition to a tougher pricing environment for autos, were two of the reasons for downgrading the name:

We’re downgrading Tesla shares to Neutral from Buy, as we believe the stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning post the substantial move higher YTD (up 108% vs. the S&P 500 up 13%) and in the last month (up 38% vs. the S&P 500 up 5%). While the primary reason for the change in our view is that we think the market is now giving the stock more credit for its longer-term opportunities, we are also cognizant of the difficult pricing environment for new vehicles that we think will continue to weigh on Tesla’s automotive non-GAAP gross margin this year.

Delaney noted that recent strength in the name was likely a factor of better than expected sales in April and May and less price cuts than expected, among other things:

We attribute the recent move higher in Tesla shares (which significantly exceeded our expectation) to a combination of factors including: 1) relatively solid monthly sales in April and May; 2) less price declines/discounting from Tesla in 2Q than investors (and we) had expected (with prices for some new vehicles being slightly increased in the US recently post the larger cuts in January and April, and price reductions being focused on vehicles in inventory); 3) incremental IRA credits for RWD Model 3; 4) several companies now planning to use Tesla’s charging network in North America (which we think will help Tesla to build a small but growing new charging business, drive awareness of Tesla products, and help Tesla/NACS connectors be a larger part of the market all else equal); and 5) incremental market focus on companies that benefit from AI.

And despite the price target cut, he actually raised the company’s EPS estimates to “assume a more moderate rate of price declines going forward”.

Similar to Morgan Stanley last week, Delaney couldn’t avoid the fact that he still thinks Tesla is positioned for the long term but believes the stock may be overextended, stating: “Overall we believe our view that Tesla is well positioned for long-term growth, given its leading position in the EV and clean energy markets (which we attribute in part to its ability to offer full solutions including charging, storage, software/FSD and services with a direct sales model), is now better reflected in the stock.”

Goldman says it believes that Q2 deliveries are tracking in the right direction, to 445-450k:

We believe that Tesla’s deliveries are off to a solid start for 2Q, with volumes in the first two months of the quarter for the US, Europe and China higher than the first two months of deliveries in prior quarters (Exhibit 1). It’s important to note that Tesla has been in the process of transitioning to a more even delivery schedule throughout the quarter in order to ease logistics and operational constraints. As a result, we expect less of an increase in the last month of the quarter than was the case historically. We believe that volumes are tracking to be roughly in line with consensus at ~445-450K (per FactSet and Visible Alpha) as our base case.

He also hones in on the fact that pricing cuts haven’t been as egregious as once predicted. Delaney writes: “We had previously been expecting additional price reductions in 2Q given company commentary on the 1Q23 earnings call and due to a relatively tepid macroeconomic backdrop (with easing vehicle supply/demand). However, Tesla pricing has been stronger than we had expected (with some small price increases on certain models, and discounting focused on vehicles in inventory).”

“We view Tesla as an industry leader in terms of powertrain technology and costs, as evidenced by powertrain efficiency compared to vehicle price,” the note continues, making the case that the company remains at the front of innovating in both “cost and capabilities”.

Goldman also has optimistic hopes for the next drivetrain that the company will eventually manufacture as it looks toward 2025:

On powertrain specifically, Tesla believes its next drive unit will be even more scalable with a roughly 75% reduction in silicon carbide, while also reducing the rare earth materials required to zero. We believe that this program is a priority for Tesla, and we believe the company is targeting a ramp in 2025 based on company commentary

Finally, Goldman takes note of Tesla’s major win in charging, having Ford, GM and Rivian recently adopt its charging standard. Delaney predicts $1 to $3 billion of incremental revenue from opening up the network:

Recall that Tesla has already been in the process of opening up select chargers in the US and Europe. In Europe, owners have been able to acquire a membership (for about €12.99 or $14 USD per month) or pay a higher rate per charge. We believe that Tesla has not opened up the most highly utilized chargers to preserve a better experience for Tesla drivers.

As we wrote in our 6/29/22 report, The case for Tesla to open the Supercharging network, we sized the potential for Tesla opening its network more widely in the next few years (i.e. more than just the 12K chargers in North America) at $1-$3 bn of incremental revenue (although Tesla wouldn’t necessarily capture all of this).

Recall, late last week the other major sell side bank that covers Tesla, Morgan Stanley, also downgraded the name to equal weight despite raising their price target from $200 to $250 per share.

As we noted last week, Morgan Stanley’s Adam Jonas’ bull case remains at $450 and his bear case remains at $90 for shares, to wit:

We raise our Tesla price target to $250 from $200, Bear Case valuation to $90 from $70,and Bull Case valuation to $450 from $390. Following these changes, we change our rating to Equal-weight from Overweight given a relatively full valuation and a more balanced risk reward and highlight key drivers and investor debates for the stock at this level.

Even Morgan Stanley didn’t sound convinced of its downgrade last week, with Jonas admitting that Tesla “remains a ‘must own’ company in any EV portfolio” and that it “is emerging as an industrial ‘standard bearer’ for one of the greatest industrial changes we’ve witnessed in over a century.

Recall, we have been documenting how Tesla’s charging standard is now quickly becoming the EV industry’s charging standard.

To Jonas the fly in the ointment was that the stock’s price has moved significantly higher, stating “Some investors may feel inclined to play the positive momentum from here, but we believe the current price, at over 100x our FY23 US GAAP EPS forecast, discounts significantly more than Tesla as just a dominant EV company.”

Right now sentiment is starting to feel like after a couple more of these downgrades, shares could soon blow through $300…

Both full notes available to pro subscribers in the usual place.

Loading…