By Michael Msika, Bloomberg Markets Live reporter and strategist

Europe’s equities have lost a third of their annual gains in just about a week, and so far dip buyers are proving hard to find.

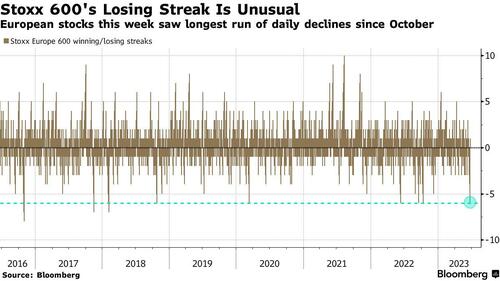

Hit by a slew of hawkish central-bank comments, the Stoxx 600 fell for six straight sessions before halting the losing streak on Tuesday. While far from a correction, the benchmark’s longest stretch of declines since October highlights the near absence of investors who were ready to buy the dip sooner during previous pullbacks.

“Optimistic market participants are currently having a hard time resisting the tendency to take profits,” says Andreas Lipkow, strategist at Comdirect Bank. “The interest in buying is not sufficient and there is still a lack of positive impetus, which is due to the current summer doldrums in international financial markets. This situation will not change for the time being.”

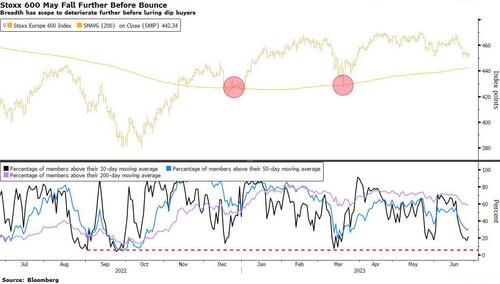

With trading volume already down ahead of the seasonal summer lull, the moves to the downside may be exacerbated. On the technical side, breadth is deteriorating, but hasn’t yet reached levels that signal a bounce ahead.

The next big support level for the Stoxx 600, after it breached 50- and 100-day moving averages this month, is the 200-day level — roughly 2% below where the gauge is currently trading. On a more granular level, the proportion of stocks below their 10-day moving average has the potential to go lower before buyers step in.

Looking at the composition of this year’s rally, 39% of Europe’s gains have come from the biggest 15 companies. The median stock has gained a modest 4%, versus the broader gauge’s 6.6%. Some large caps are now showing weakness, which bodes ill for the Stoxx 600.

“While the broader European index isn’t at a technically relevant level, beneath the surface, the biggest three stocks in the region are,” says Carl Dooley, head of EMEA trading at TD Cowen, pointing out that LVMH, Novo Nordisk and Nestle are all pinned around their 100-day moving averages. The next move in that group will likely drive the rest of the market from here on, he adds.

Momentum based on MACD is weakening across the board, and has turned outright negative for most of the main indexes in Europe — a sharp contrast with the all-green readings of last month.

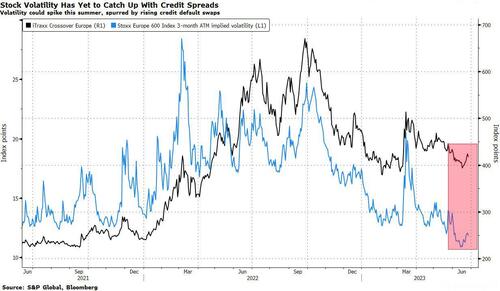

On Monday, we flagged the cracks appearing in the bull case for stocks, with mounting macroeconomic concerns clearly not reflected in the price. While a collapse in volatility has supported equity markets, credit spreads are still elevated, pricing in more economic trouble ahead.

For BofA derivative strategists including Riddhi Prasad, equity volatility is unlikely to sustain the extreme lows seen recently through the fall, “given a still hawkish ECB and fundamental risks to growth after a record tightening cycle,” they wrote last week.

Goldman Sachs strategist Peter Oppenheimer expects most equity markets to remain in a “fat and flat” range over the next 12 months. Poor earnings growth at the index level coupled with high valuations will cap the upside, according to him.

By Michael Msika, Bloomberg Markets Live reporter and strategist

Europe’s equities have lost a third of their annual gains in just about a week, and so far dip buyers are proving hard to find.

Hit by a slew of hawkish central-bank comments, the Stoxx 600 fell for six straight sessions before halting the losing streak on Tuesday. While far from a correction, the benchmark’s longest stretch of declines since October highlights the near absence of investors who were ready to buy the dip sooner during previous pullbacks.

“Optimistic market participants are currently having a hard time resisting the tendency to take profits,” says Andreas Lipkow, strategist at Comdirect Bank. “The interest in buying is not sufficient and there is still a lack of positive impetus, which is due to the current summer doldrums in international financial markets. This situation will not change for the time being.”

With trading volume already down ahead of the seasonal summer lull, the moves to the downside may be exacerbated. On the technical side, breadth is deteriorating, but hasn’t yet reached levels that signal a bounce ahead.

The next big support level for the Stoxx 600, after it breached 50- and 100-day moving averages this month, is the 200-day level — roughly 2% below where the gauge is currently trading. On a more granular level, the proportion of stocks below their 10-day moving average has the potential to go lower before buyers step in.

Looking at the composition of this year’s rally, 39% of Europe’s gains have come from the biggest 15 companies. The median stock has gained a modest 4%, versus the broader gauge’s 6.6%. Some large caps are now showing weakness, which bodes ill for the Stoxx 600.

“While the broader European index isn’t at a technically relevant level, beneath the surface, the biggest three stocks in the region are,” says Carl Dooley, head of EMEA trading at TD Cowen, pointing out that LVMH, Novo Nordisk and Nestle are all pinned around their 100-day moving averages. The next move in that group will likely drive the rest of the market from here on, he adds.

Momentum based on MACD is weakening across the board, and has turned outright negative for most of the main indexes in Europe — a sharp contrast with the all-green readings of last month.

On Monday, we flagged the cracks appearing in the bull case for stocks, with mounting macroeconomic concerns clearly not reflected in the price. While a collapse in volatility has supported equity markets, credit spreads are still elevated, pricing in more economic trouble ahead.

For BofA derivative strategists including Riddhi Prasad, equity volatility is unlikely to sustain the extreme lows seen recently through the fall, “given a still hawkish ECB and fundamental risks to growth after a record tightening cycle,” they wrote last week.

Goldman Sachs strategist Peter Oppenheimer expects most equity markets to remain in a “fat and flat” range over the next 12 months. Poor earnings growth at the index level coupled with high valuations will cap the upside, according to him.

Loading…