By Shikhar Balwani, Bloomberg ECM reporter and strategist

The world’s dealmakers are roughly $1 trillion down in one of the worst years for takeovers and stock market listings in a decade.

That’s the year-on-year drop in the value of mergers and acquisitions and initial public offerings in the first half, a period in which inflationary pressures, financing constraints and geopolitical tensions nixed activity across regions and sectors.

And with the traditional summer lull on the doorstep, and fears of a recession lingering, the next six months could bring more pain on Wall Street, where banks have already been slashing bonuses and jobs in response to the slump.

“Deals are being delayed,” said Dominic Lester, head of investment banking for Europe, the Middle East and Africa at Jefferies Financial Group Inc. “Boards are having difficulty valuing assets, and are therefore taking longer to commit to transactions.”

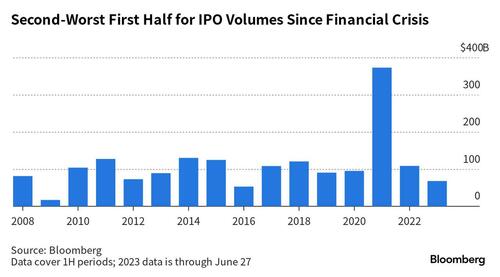

Companies raised just $68 billion via IPOs in the opening six months of 2023, Bloomberg-compiled data show. That’s down more than a third year-on-year, with only 2016 having seen a lower first-half total since the global financial crisis.

The forces dragging down listings are much the same as those for M&A: concerns about a global economic slowdown and a mismatch in pricing expectations between companies and investors.

“The elephant in the room really is that we are expecting a recession. The timing of that recession is challenging and it will be largely consumer-led,” said Stephanie Niven, a London-based portfolio manager at investment firm Ninety One. “That’s why investors are cautious. The market itself hasn’t exactly priced a recession.”

For ECM bankers, brights spot have been found in the east, with China accounting for roughly half the money raised via IPOs this year. The country has cut curbs on local companies seeking listings overseas and made rule changes to encourage more at home.

Seed giant Syngenta Group this month won exchange approval for its 65 billion yuan ($9 billion) IPO, moving the world’s biggest potential listing this year a step closer to completion.

“The next six months of 2023 will definitely have some IPOs, the market is not closed and good companies can always get out,” said Mike Bellin, partner and IPO services leader at PricewaterhouseCoopers LLP. “A lot of the companies we’re talking to are thinking it’s more of a 2024 timeframe.”

By Shikhar Balwani, Bloomberg ECM reporter and strategist

The world’s dealmakers are roughly $1 trillion down in one of the worst years for takeovers and stock market listings in a decade.

That’s the year-on-year drop in the value of mergers and acquisitions and initial public offerings in the first half, a period in which inflationary pressures, financing constraints and geopolitical tensions nixed activity across regions and sectors.

And with the traditional summer lull on the doorstep, and fears of a recession lingering, the next six months could bring more pain on Wall Street, where banks have already been slashing bonuses and jobs in response to the slump.

“Deals are being delayed,” said Dominic Lester, head of investment banking for Europe, the Middle East and Africa at Jefferies Financial Group Inc. “Boards are having difficulty valuing assets, and are therefore taking longer to commit to transactions.”

Companies raised just $68 billion via IPOs in the opening six months of 2023, Bloomberg-compiled data show. That’s down more than a third year-on-year, with only 2016 having seen a lower first-half total since the global financial crisis.

The forces dragging down listings are much the same as those for M&A: concerns about a global economic slowdown and a mismatch in pricing expectations between companies and investors.

“The elephant in the room really is that we are expecting a recession. The timing of that recession is challenging and it will be largely consumer-led,” said Stephanie Niven, a London-based portfolio manager at investment firm Ninety One. “That’s why investors are cautious. The market itself hasn’t exactly priced a recession.”

For ECM bankers, brights spot have been found in the east, with China accounting for roughly half the money raised via IPOs this year. The country has cut curbs on local companies seeking listings overseas and made rule changes to encourage more at home.

Seed giant Syngenta Group this month won exchange approval for its 65 billion yuan ($9 billion) IPO, moving the world’s biggest potential listing this year a step closer to completion.

“The next six months of 2023 will definitely have some IPOs, the market is not closed and good companies can always get out,” said Mike Bellin, partner and IPO services leader at PricewaterhouseCoopers LLP. “A lot of the companies we’re talking to are thinking it’s more of a 2024 timeframe.”

Loading…