By Russell Clark, author of the Capital Flows and Asset Markets substack

When I managed money, I never worried too much about politics or politicians. I didn’t even bother with central bankers much either (can you imagine!). They would always promise inflation - but were never able to deliver it. There was one big exception to this, which was China.

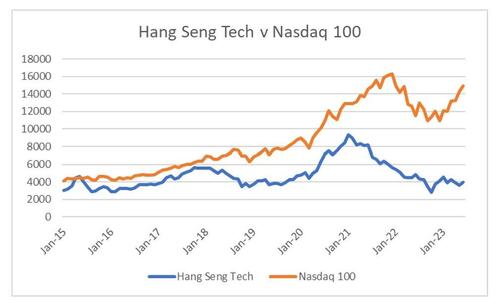

Whatever the Chinese government said it was going to do, it generally did. But even then, I thought ultimately Chinese policymakers would eventually succumb to free market forces, particularly in terms of the exchange rate - but here I was wrong. A closed capital account, and control of the banking system has made Chinese Yuan exchange rate a policy choice as well. For equity investors, the clearest example of Chinese policy affecting assets is China deciding that “big tech” had too much power and needed to have its wings clipped. The difference in performance gets starker every day.

What I originally thought was that Chinese changes in policy would act as an example for the rest of the world. That China would lead a worldwide swing against pro-capital policies to pro-labour policies. We have seen that to a degree - and certainly I think inflation and interest rates are going to go higher. My favourite trade, Long GLD and Short TLT still appeals to me.

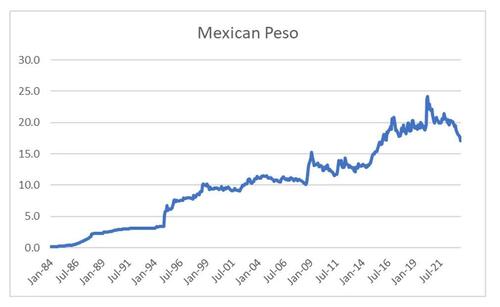

But what I am seeing in currency markets suggest government policy is having a greater effect on assets markets everywhere. Ever since Nixon left the gold standard, generally the world has been moving to free floating exchange rates, determined by market forces. And this force was by and large irresistible - where nations like Mexico, Argentina, Thailand, Korea, Malaysia all eventually forced to free floating exchange rates - and ultimately devalued. Japan had the opposite problem where it spent years trying to devalue, but could not. That has changed in recent years. One traditional very safe trade in currency world was to short the Mexican Peso vs the US dollar. It had a fairly consistent trend of moving sideways for a number of years, and then devaluing to a new lower level, and never recapturing its old value. True to form, Mexico devalued during Covid, but has been appreciating ever since. From a low of 25 Peso to the US dollar during Covid, it now at 17 Peso to the dollar. The Peso has strengthened against the US dollar in an era of US dollar strength. It has also achieved this in a period of relative commodity weakness, which historically has been bad for the Peso.

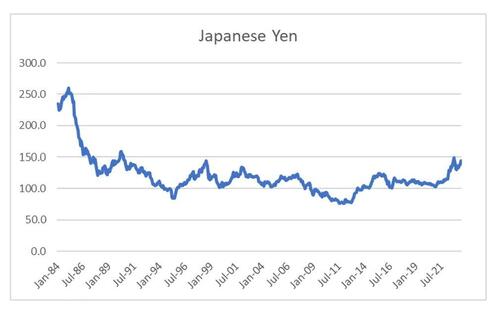

The corollary to the unexpected strength of the Peso, and been the sustained weakness in the Yen. This was for many years, the antithesis of the Peso. Bouts of yen strength, that then proved difficult to reverse, but moving ever stronger versus the US dollar. Last two years, the Yen has weakened significantly.

On a pure macro view, with Japan and commodity importer, and Mexico a commodity exporter, I would have expected the Yen to strengthen against the Peso, given the weakness in oil prices. I would have been wrong.

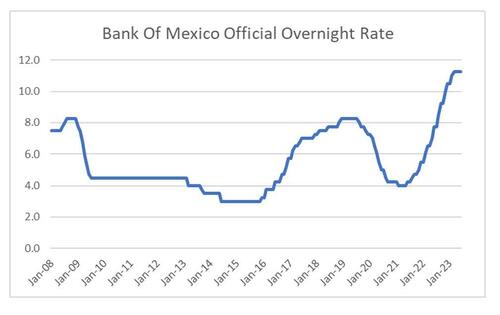

A better way to analyse the Mexican peso and the Yen would have been politically. The President of Mexico, Andres Manuel Lopez Obrador (AMLO) is definitely a president on the left - favouring labour over capital. In my view, pro-labour governments push for rising wages, and rising interest rates to preserve the buying power of the exchange rate. Bank of Mexico interest rate policy is about as far away as you can get from the QE addicted Western World.

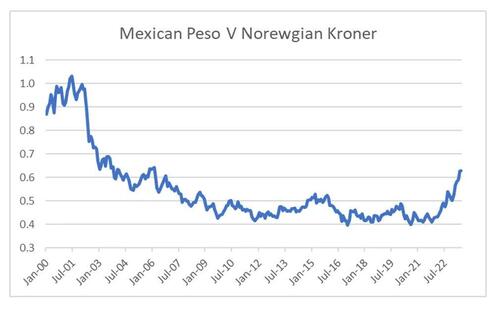

But interest rate policy is not the only factor here. Tariffs on Chinese goods means that a “strong peso” policy can be followed without the risk of factories being relocated to Asia. That is China-US conflict is allowing “left wing” policy makers to adopt pro-labour policies. You are also see many manufacturers are investing into Mexico as an insurance policy on a US-China conflict. Japan does not have this benefit, making the Yen/Peso divergence easier to understand. When we add in the Russia’s invasion of Ukraine, and the negative effect that has on Europe, we can also understand the huge strength of the Peso versus the Norwegian Kroner. Every macro indicator would suggest to own Norwegian Kroner over Mexican Peso (NIIP, Foreign Reserves, CPI etc) - but that would be the wrong trade this year.

Just like China, investors need to pick political winners, not just in equities, but in currency markets too.

By Russell Clark, author of the Capital Flows and Asset Markets substack

When I managed money, I never worried too much about politics or politicians. I didn’t even bother with central bankers much either (can you imagine!). They would always promise inflation – but were never able to deliver it. There was one big exception to this, which was China.

Whatever the Chinese government said it was going to do, it generally did. But even then, I thought ultimately Chinese policymakers would eventually succumb to free market forces, particularly in terms of the exchange rate – but here I was wrong. A closed capital account, and control of the banking system has made Chinese Yuan exchange rate a policy choice as well. For equity investors, the clearest example of Chinese policy affecting assets is China deciding that “big tech” had too much power and needed to have its wings clipped. The difference in performance gets starker every day.

What I originally thought was that Chinese changes in policy would act as an example for the rest of the world. That China would lead a worldwide swing against pro-capital policies to pro-labour policies. We have seen that to a degree – and certainly I think inflation and interest rates are going to go higher. My favourite trade, Long GLD and Short TLT still appeals to me.

But what I am seeing in currency markets suggest government policy is having a greater effect on assets markets everywhere. Ever since Nixon left the gold standard, generally the world has been moving to free floating exchange rates, determined by market forces. And this force was by and large irresistible – where nations like Mexico, Argentina, Thailand, Korea, Malaysia all eventually forced to free floating exchange rates – and ultimately devalued. Japan had the opposite problem where it spent years trying to devalue, but could not. That has changed in recent years. One traditional very safe trade in currency world was to short the Mexican Peso vs the US dollar. It had a fairly consistent trend of moving sideways for a number of years, and then devaluing to a new lower level, and never recapturing its old value. True to form, Mexico devalued during Covid, but has been appreciating ever since. From a low of 25 Peso to the US dollar during Covid, it now at 17 Peso to the dollar. The Peso has strengthened against the US dollar in an era of US dollar strength. It has also achieved this in a period of relative commodity weakness, which historically has been bad for the Peso.

The corollary to the unexpected strength of the Peso, and been the sustained weakness in the Yen. This was for many years, the antithesis of the Peso. Bouts of yen strength, that then proved difficult to reverse, but moving ever stronger versus the US dollar. Last two years, the Yen has weakened significantly.

On a pure macro view, with Japan and commodity importer, and Mexico a commodity exporter, I would have expected the Yen to strengthen against the Peso, given the weakness in oil prices. I would have been wrong.

A better way to analyse the Mexican peso and the Yen would have been politically. The President of Mexico, Andres Manuel Lopez Obrador (AMLO) is definitely a president on the left – favouring labour over capital. In my view, pro-labour governments push for rising wages, and rising interest rates to preserve the buying power of the exchange rate. Bank of Mexico interest rate policy is about as far away as you can get from the QE addicted Western World.

But interest rate policy is not the only factor here. Tariffs on Chinese goods means that a “strong peso” policy can be followed without the risk of factories being relocated to Asia. That is China-US conflict is allowing “left wing” policy makers to adopt pro-labour policies. You are also see many manufacturers are investing into Mexico as an insurance policy on a US-China conflict. Japan does not have this benefit, making the Yen/Peso divergence easier to understand. When we add in the Russia’s invasion of Ukraine, and the negative effect that has on Europe, we can also understand the huge strength of the Peso versus the Norwegian Kroner. Every macro indicator would suggest to own Norwegian Kroner over Mexican Peso (NIIP, Foreign Reserves, CPI etc) – but that would be the wrong trade this year.

Just like China, investors need to pick political winners, not just in equities, but in currency markets too.

Loading…