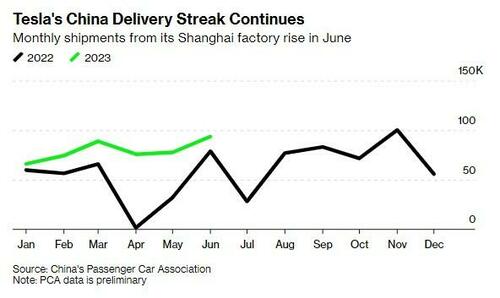

It wasn't just in the United States where Tesla impressed with deliveries heading into the end of Q2 - the company also saw its output in China increase by a whopping 20%, according to Bloomberg.

Last month Tesla shipped 93,680 vehicles from its Shanghai plant, according to data from China’s Passenger Car Association. That number is up from 78,906 last year and 77,695 last month.

The company's robust sales are still being helped along by price cuts it put into place at the beginning of the year, with Bloomberg noting that "after a price war leading into the Shanghai auto show in April, deliveries started to pick up again and the overall market for new-energy vehicles remained strong."

Recall, Tesla stock rocketed higher on the shortened trading day on Monday, rising nearly 7% at its high of the day.

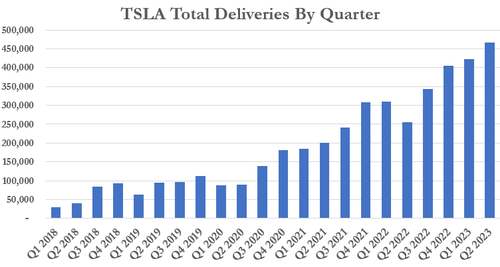

At the end of Q2 Tesla posted 466,140 deliveries for the quarter, ahead of Bloomberg's consensus estimate of 448,351. The auto manufacturer produced 479,700 vehicles in the quarter, exceeding estimates of 456,617.

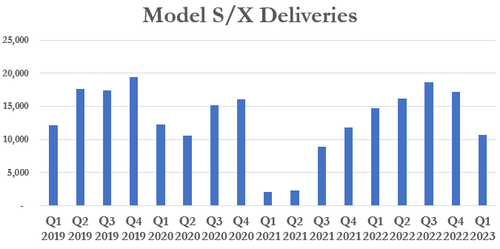

Tesla delivered 19,225 Model S/X vehicles in the quarter, beating expectations of 14,606.

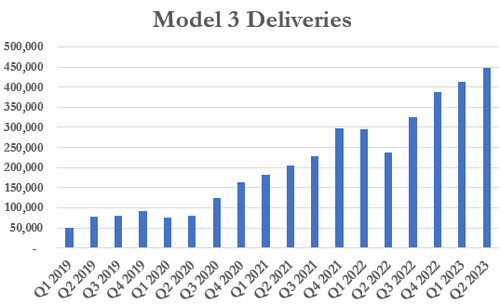

The EV manufacturer also delivered 446,915 Model 3/Y vehicles in the quarter, exceeding estimates of 437,386.

We'll be sure to keep an eye on this trend in future quarters, especially as Tesla continues to expand globally. For now, however, the market's focus will likely remain on the headline numbers beating expectations.

Recall, over the last month, we have been covering how legacy automakers like Ford and GM, paired with new EV companies like Rivian, have adopted Tesla's charging standard, allowing their vehicles to utilize Tesla's nationwide network of Superchargers. As such, we have been documenting how Tesla's charging standard is now quickly becoming the EV industry's charging standard.

Hilariously, days ago, both Goldman Sachs and Morgan Stanley downgraded Tesla. Despite the downgrade two weekends ago, shares held steady after their recent 3 month rally, up nearly 75% off their 52 week lows. Goldman, led by analyst Mark Delaney, noted that the stock price moving higher, in addition to a tougher pricing environment for autos, were two of the reasons for downgrading the name.

Like clockwork. TSLA up 6% https://t.co/Js9mLzCnCb

— zerohedge (@zerohedge) July 3, 2023

It wasn’t just in the United States where Tesla impressed with deliveries heading into the end of Q2 – the company also saw its output in China increase by a whopping 20%, according to Bloomberg.

Last month Tesla shipped 93,680 vehicles from its Shanghai plant, according to data from China’s Passenger Car Association. That number is up from 78,906 last year and 77,695 last month.

The company’s robust sales are still being helped along by price cuts it put into place at the beginning of the year, with Bloomberg noting that “after a price war leading into the Shanghai auto show in April, deliveries started to pick up again and the overall market for new-energy vehicles remained strong.”

Recall, Tesla stock rocketed higher on the shortened trading day on Monday, rising nearly 7% at its high of the day.

At the end of Q2 Tesla posted 466,140 deliveries for the quarter, ahead of Bloomberg’s consensus estimate of 448,351. The auto manufacturer produced 479,700 vehicles in the quarter, exceeding estimates of 456,617.

Tesla delivered 19,225 Model S/X vehicles in the quarter, beating expectations of 14,606.

The EV manufacturer also delivered 446,915 Model 3/Y vehicles in the quarter, exceeding estimates of 437,386.

We’ll be sure to keep an eye on this trend in future quarters, especially as Tesla continues to expand globally. For now, however, the market’s focus will likely remain on the headline numbers beating expectations.

Recall, over the last month, we have been covering how legacy automakers like Ford and GM, paired with new EV companies like Rivian, have adopted Tesla’s charging standard, allowing their vehicles to utilize Tesla’s nationwide network of Superchargers. As such, we have been documenting how Tesla’s charging standard is now quickly becoming the EV industry’s charging standard.

Hilariously, days ago, both Goldman Sachs and Morgan Stanley downgraded Tesla. Despite the downgrade two weekends ago, shares held steady after their recent 3 month rally, up nearly 75% off their 52 week lows. Goldman, led by analyst Mark Delaney, noted that the stock price moving higher, in addition to a tougher pricing environment for autos, were two of the reasons for downgrading the name.

Like clockwork. TSLA up 6% https://t.co/Js9mLzCnCb

— zerohedge (@zerohedge) July 3, 2023

Loading…