Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

Last week I published my thoughts on what was happening in France from a great power rivalry perspective. The infighting between factions and who represents whom is now just as chaotic and temporary as the situation on the ground in places where there is obvious conflict, like Ukraine.

The protests in France are the culmination of many of these factors coming together, some of which I went into.

I left you hanging with the following thought:

… Nothing less than the fate of a 300 year project for world government hangs in the balance. Everyone of these horrific factions wants to rule the world but none of them have the means by themselves to pull it off. So, watching them maneuver each other into the line of fire would be hilarious if the stakes weren’t so freaking high for the rest of us.

That’s a big statement to make but this has been the overriding theme of this blog and all of my work for nearly ten years. It’s been as much of a journey of discovery for me as any of my readers.

And the questions hanging in the air as the NATO Summit goes on in Vilnius center around just who is pushing who forward into war? Macron in France has assumed near dictatorial powers and yet the potential threat of collapse of his government rises daily.

Since that article we’ve had our second major European government in as many months collapse.

First it was Pedro Sanchez’s cobbled together coalition government in Spain, where he called for snap elections (scheduled for next month) after the center-right swept into power regionally.

Over the weekend it was key World Economic Forum leader Mark Rutte’s government in the Netherlands that fell over a failure to come together on new migrant policy. As the WEF pushed the Dutch farmers into open revolt against Rutte through land seizure and onerous regulations on nitrogen usage, the farmers organized themselves into a political party who gained so much support so quickly that it brought down Rutte.

Rutte announced he will not be standing for re-election in the subsequent elections. The revolt in the Netherlands is nearly complete at the national level. The last poll taken in the Netherlands had BBB, the farmers party, winning. Note, however, this poll is now nearly a month old.

Netherlands, Peil poll:

— Europe Elects (@EuropeElects) July 2, 2023

Seat projection

BBB-*: 28 (-1)

VVD-RE: 20

GL-G/EFA: 14

PVV→ID: 14 (+1)

PvdA-S&D: 11

PvdD-LEFT: 10

D66-RE: 10

SP→LEFT: 8 (+1)

JA21-ECR: 7 (+1)

…

+/- vs. 16-17 June 2023

Fieldwork: 30 June - 1 July 2023

Sample size: N/A

➤ https://t.co/dz1X5eQdmV pic.twitter.com/WiDhYBTINB

But even with this change, there is no consensus in the Netherlands. The electorate is split along more than a dozen parties. A ruling coalition has to come up with 76 seats to form a government. Unless current polling shifts significantly between now and the election, getting a fully Anti-WEF coalition running the country is of low probability.

The most likely outcome will be no government in the Netherlands for months as WEF-aligned parties hold their breath and refuse to ally with anyone they deem ‘unworthy.’ And if a coalition does come together it will be hobbled by traitors and backbiting, cf. Italy for the past decade.

And I haven’t even gone into the opposition that government, if it formed, would run into from the apparatchiks in Brussels, who will come down hard on them enforcing any new EU directives that come out of the pie-hole of the EU Commission.

Just ask Viktor Orban in Hungary, for example.

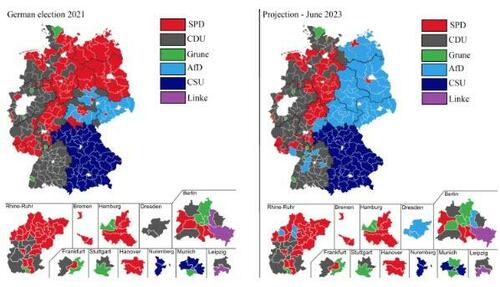

The Netherlands is part of the story of revolt against the planned putsch towards global government by Davos and those adjacent to them. Look at the polling surge for Alternative for Germany (AfD) in places where the center-right has never dominated. AfD is no longer just a former East Germany phenomenon. It’s now an anti-SPD, anti-Green, pro-humanity movement across Germany.

Ultimately, however, there’s still a lot of inertia at every level of society to overcome before real change can be effected, especially in Europe where there isn’t real Federalism within the EU like there is in the US.

It’s a double pit the people have to crawl out of, unless there is something brewing to destroy the EU at the same time this populist movement is gaining momentum.

Mr. Market Tear Down This Wall

Because that inertia is so strong, it’s why I keep my eye on the shifts occurring in the capital markets and the factionalization happening at the central bank level.

On the eve of the major NATO Summit in Vilnius shifting to see if the capital markets are, as Martin Armstrong would put it, sniffing out the future with subtle capital flows seems prudent.

This is why I broke this up into two parts, because as I was writing part I the price action in the sovereign debt and commodity markets were doing just that.

For two years since I first toyed with the idea that FOMC Chair Jerome Powell began ‘stealth tightening’ of US monetary policy, I’ve watched for signs that capital was preferentially flowing into the US at the expense of Europe.

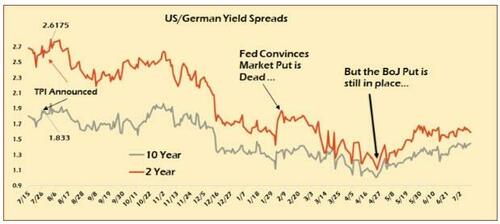

The main indicator for me has been the US/German 10-year yield spread. These are the two benchmarkt bond markets for the US and Europe. One is the global ‘safe haven’ sovereign bond the other the European ‘safe haven’ bond.

I’ve since added the 2 year spread as well. As I discussed with Danielle Dimartino Booth in our last chat (Ep.#148 of the GGnG Podcast) there have been three big events over the past year that marked significant policy or sentiment shifts.

Event #1 – ECB President Christine Lagarde announces the TPI – Transmission Protection Instrument or Toilet Paper Initiative where she told the world she will manage credit spreads as the ECB is forced to raise rates to 1) combat inflation and 2) follow the Fed because Powell wasn’t pivoting.

It led to the Bank of Japan widening the band on their yield curve control (YCC) policy to 0.50% at the December meeting which sent the spread tumbling into….

Event #2 – February 1st FOMC Meeting — Powell only raises by 25 basis points but finally convinces the markets he was serious about his “Higher for Longer” policy. It’s reflected in the prices of all markets.

It was also the beginning of the end of liquidity of the Eurodollar Futures Contract on the Chicago Mercantile Exchange (CME). By April the Three-Month SOFR Futures contract would replace the Eurodollar contract completely. I wrote about this in my last two-part series “The War for the Dollar is Already Over” (Part I and Part II).

That set in motion a big sell-off in US treasuries which I think Lagarde managed by holding German rates down blowing out the spread. A month later we had a few bank failures in the US. Credit Suisse blew up, etc. This led to …

Event #3 — Japan Doesn’t End YCC Yet — When new Bank of Japan President Kazuo Ueda told markets he wasn’t giving up YCC it helped bail out Lagarde and the ECB one more time as spreads widened again into the Debt Ceiling “Crisis” of June and is still in effect today.

But, that’s not the whole story because the fear of the BoJ giving up YCC and the turmoil in the US banks was so strong we saw massive short covering in the Japanese 10-year bond. So much so Ueda didn’t have to change policy because the yield was so far below the 0.5% limit.

So for a few months the unwinding of short JGB carry trades built up over years of YCC and Zero-bound rates globally helped Lagarde hold the whole range of Eurobond prices below what look to me as trip-wire levels.

But note, the 10-year JGB is rocketing back towards the 0.5% limit where Ueda will have to intervene. In fact, I’d say he’s already doing something because the yen has moved from 145 back to nearly 140 in just a couple of days.

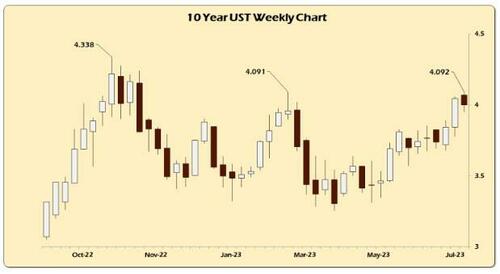

Chart Porn incoming:

Germany’s CPI came in at 6.4% this month. In line with expectations, but meaning Lagarde can no longer hold this line. And the Bundesbank needs a massive bailout according to a recent audit of its finances.

Rutte’s government fell, the risk of a major political upheaval is rising. Who else other than Lagarde would buy Dutch debt at 3%

Spain’s government is about to change. Energy prices are starting to rise as we get into the winter. Who’s buying this debt below 3.75%?

It may be my confirmation bias talking but all I see is someone sitting on certain levels and intervening hard to ensure those levels are not breached for any length of time. The moment these yields get ‘out of the box,’ Lagarde comes in to tamp them back inside.

The Big Dogs Are Howling

The US CPI is forecast to come in at 3.1% and the market is saying Powell will raise in two weeks. I’m not sure he does because that would be interpreted as him hiking too far with recession just over the horizon.

And that would pressure the long-end of the yield curve again. Powell would be better served letting the market do his work in normalizing the yield curve for him by not raising here and waiting until the September meeting.

The market reaction to no rate hike would be immense and blow apart the carefully-constructed yield edifice Lagarde and her partner-in-crime Janet Yellen have erected.

How does Lagarde manage these spreads if Powell lets his foot off the neck of domestic credit for a few more weeks and Japan is staring at ending YCC with current inflation at ~3%?

Look at oil prices folks, they are rising again. Brent’s knocking on $80 per barrel with WTI following right along. US gasoline prices are coiling into this fall, setting up for a rally. Still think inflation is over? Not a chance.

Last week’s bond action put Lagarde in another ugly situation because the US 10 year broke above 4% and closed there, pushing all of these yields up through her redlines and so far there’s been no rally in US bonds to help her stuff them back down.

This week is therefore pivotal because the US 10 year is flirting dangerously close with a major breakout above 4.09%. We’ve already had the violation of the March high this week and there’s no indication that rates have topped here or will back down. The 2/10 spread has also significantly reversed from a low of -110 bps to -86 bps.

The one thing everyone short dollars is afraid of right now is any amount of yield curve normalization in US Treasuries. But that is exactly what is happening.

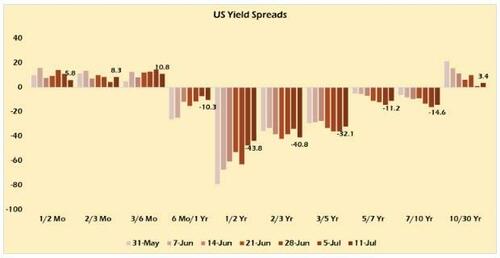

For the past few months I’ve been tracking the internal spreads within the US yield curve for my Patrons. And since the Debt Ceiling was resolved (not well, I might add) the markets have rightly begun taking on more duration risk.

There’s no argument that there is a lot of work yet to be done, but the trends on a weekly basis are clear. Capital is demanding a higher yield going further out the yield curve than it was in Q2. And eventually this bodes well for domestic banks to begin repairing their balance sheets.

But it won’t be the ones in Europe, who are standing on the verge of a rate shock that’s been just over the horizon for a while now. The current policy path is set. Powell’s not flinching in the face of rapid de-dollarization and domestic fiscal insanity.

It’s his job to fix the parts of the US balance sheet that he controls. He’s doing that. The traitors on Capitol Hill are trying to spend us into debtor’s prison.

Vilnius or Bust

Now think about what’s happening at Vilnius, at the NATO Summit. Biden wants a new commitment to spend even more on weapons for Ukraine but doesn’t want to bring Ukraine into the fold. The UK is screaming for both things.

Macron is now happy to supply missiles to Ukraine because it feeds his military-industrial complex and his longer-term goals of a European security pact without the US.

Turkey stopped blocking Sweden’s entry into the alliance because he got the F-16s he needs to fulfill his ambitions regionally. Someone finally offered Erdogan the right bribe to get him to sign off on this.

What’s happening in the financial markets is a harbinger that the bureaucratic inertia of the West is too powerful to overcome. They are preparing for the worst but still holding onto hope for the best. Once these yield walls fail, however, we’ll know there is no turning back.

Why? Because if the European sovereign bond market goes into rapid meltdown then escalation is the only politically expedient path for these narcissistic assholes to maintain power as their economies collapse.

Macron and France may have successfully beaten down the migrant riots/color revolution but they don’t have control over the situation. If anything the divisions between French nativism and the migrant population are only deeper today than two weeks ago.

The political upheaval on the ground is a few weeks/months ahead of the real turmoil under the surface of the capital markets. Lagarde is rapidly being put in a box by geopolitical imperatives and the opposition in the US to fighting a war with Russia over Ukraine.

The conflicted message coming from the Biden Administration reflects this. “Biden” wants more weapons in Ukraine to keep bleeding Russia out, but his military is clearly trying to restrain him from taking us past the point of no return.

Hence his reasoning to block the UK’s Ben Wallace’s ascension to NATO Gen. Secretary and retaining Jens Stoltenberg for another year. It’s why Stoltenberg continues to hold the line about Ukraine’s entry into NATO being predicated on them “winning the war as a sovereign nation.”

The war-mongers in London, DC and Brussels realize that this half-baked form of war is running out of runway. It’s costing them politically, economically and spiritually. They are losing the momentum and need something to ‘wake the sheeple up!’

What should scare everyone is that their thinking is simple: If “Biden” won’t fully commit to Ukraine then we’ll make that decision for him.

Because, despite everything, it’s finally sinking into their thick skulls that Russia’s economy is not collapsing. And while its industrial production, wage and inflation data all point to real productivity growth neither is it fully committed to full industrial war status yet.

Putin, unlike Biden, isn’t trying to escalate any further than he needs to. By not upgrading the conflict to allow full mobilization Putin keeps the door open for a negotiated settlement. The problem, as the Russians have pointed out time and again, is that they don’t know who to talk to.

No one is in charge of this operation. There are just competing factions without final say as to what the policy should be.

Putin’s approval rating rose in the wake of his handling Prigozhin’s Rebellion. He successfully navigated the domestic division between the realists he represents and the hard-liners who Prigozhin represented.

For the West losing in Ukraine after this much blood and treasure have been spilled, fomenting a full-blown sovereign debt crisis which will consume not only a few more national governments but quite likely the EU itself, will be the end of that 300 year project I talked about at the beginning.

It’s both terribly complicated but incredibly simple.

And it could all coming crashing down in the next few weeks.

* * *

Join my Patreon if you grave walk through empires

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

Last week I published my thoughts on what was happening in France from a great power rivalry perspective. The infighting between factions and who represents whom is now just as chaotic and temporary as the situation on the ground in places where there is obvious conflict, like Ukraine.

The protests in France are the culmination of many of these factors coming together, some of which I went into.

I left you hanging with the following thought:

… Nothing less than the fate of a 300 year project for world government hangs in the balance. Everyone of these horrific factions wants to rule the world but none of them have the means by themselves to pull it off. So, watching them maneuver each other into the line of fire would be hilarious if the stakes weren’t so freaking high for the rest of us.

That’s a big statement to make but this has been the overriding theme of this blog and all of my work for nearly ten years. It’s been as much of a journey of discovery for me as any of my readers.

And the questions hanging in the air as the NATO Summit goes on in Vilnius center around just who is pushing who forward into war? Macron in France has assumed near dictatorial powers and yet the potential threat of collapse of his government rises daily.

Since that article we’ve had our second major European government in as many months collapse.

First it was Pedro Sanchez’s cobbled together coalition government in Spain, where he called for snap elections (scheduled for next month) after the center-right swept into power regionally.

Over the weekend it was key World Economic Forum leader Mark Rutte’s government in the Netherlands that fell over a failure to come together on new migrant policy. As the WEF pushed the Dutch farmers into open revolt against Rutte through land seizure and onerous regulations on nitrogen usage, the farmers organized themselves into a political party who gained so much support so quickly that it brought down Rutte.

Rutte announced he will not be standing for re-election in the subsequent elections. The revolt in the Netherlands is nearly complete at the national level. The last poll taken in the Netherlands had BBB, the farmers party, winning. Note, however, this poll is now nearly a month old.

Netherlands, Peil poll:

Seat projection

BBB-*: 28 (-1)

VVD-RE: 20

GL-G/EFA: 14

PVV→ID: 14 (+1)

PvdA-S&D: 11

PvdD-LEFT: 10

D66-RE: 10

SP→LEFT: 8 (+1)

JA21-ECR: 7 (+1)

…+/- vs. 16-17 June 2023

Fieldwork: 30 June – 1 July 2023

Sample size: N/A

➤ https://t.co/dz1X5eQdmV pic.twitter.com/WiDhYBTINB— Europe Elects (@EuropeElects) July 2, 2023

But even with this change, there is no consensus in the Netherlands. The electorate is split along more than a dozen parties. A ruling coalition has to come up with 76 seats to form a government. Unless current polling shifts significantly between now and the election, getting a fully Anti-WEF coalition running the country is of low probability.

The most likely outcome will be no government in the Netherlands for months as WEF-aligned parties hold their breath and refuse to ally with anyone they deem ‘unworthy.’ And if a coalition does come together it will be hobbled by traitors and backbiting, cf. Italy for the past decade.

And I haven’t even gone into the opposition that government, if it formed, would run into from the apparatchiks in Brussels, who will come down hard on them enforcing any new EU directives that come out of the pie-hole of the EU Commission.

Just ask Viktor Orban in Hungary, for example.

The Netherlands is part of the story of revolt against the planned putsch towards global government by Davos and those adjacent to them. Look at the polling surge for Alternative for Germany (AfD) in places where the center-right has never dominated. AfD is no longer just a former East Germany phenomenon. It’s now an anti-SPD, anti-Green, pro-humanity movement across Germany.

Ultimately, however, there’s still a lot of inertia at every level of society to overcome before real change can be effected, especially in Europe where there isn’t real Federalism within the EU like there is in the US.

It’s a double pit the people have to crawl out of, unless there is something brewing to destroy the EU at the same time this populist movement is gaining momentum.

Mr. Market Tear Down This Wall

Because that inertia is so strong, it’s why I keep my eye on the shifts occurring in the capital markets and the factionalization happening at the central bank level.

On the eve of the major NATO Summit in Vilnius shifting to see if the capital markets are, as Martin Armstrong would put it, sniffing out the future with subtle capital flows seems prudent.

This is why I broke this up into two parts, because as I was writing part I the price action in the sovereign debt and commodity markets were doing just that.

For two years since I first toyed with the idea that FOMC Chair Jerome Powell began ‘stealth tightening’ of US monetary policy, I’ve watched for signs that capital was preferentially flowing into the US at the expense of Europe.

The main indicator for me has been the US/German 10-year yield spread. These are the two benchmarkt bond markets for the US and Europe. One is the global ‘safe haven’ sovereign bond the other the European ‘safe haven’ bond.

I’ve since added the 2 year spread as well. As I discussed with Danielle Dimartino Booth in our last chat (Ep.#148 of the GGnG Podcast) there have been three big events over the past year that marked significant policy or sentiment shifts.

Event #1 – ECB President Christine Lagarde announces the TPI – Transmission Protection Instrument or Toilet Paper Initiative where she told the world she will manage credit spreads as the ECB is forced to raise rates to 1) combat inflation and 2) follow the Fed because Powell wasn’t pivoting.

It led to the Bank of Japan widening the band on their yield curve control (YCC) policy to 0.50% at the December meeting which sent the spread tumbling into….

Event #2 – February 1st FOMC Meeting — Powell only raises by 25 basis points but finally convinces the markets he was serious about his “Higher for Longer” policy. It’s reflected in the prices of all markets.

It was also the beginning of the end of liquidity of the Eurodollar Futures Contract on the Chicago Mercantile Exchange (CME). By April the Three-Month SOFR Futures contract would replace the Eurodollar contract completely. I wrote about this in my last two-part series “The War for the Dollar is Already Over” (Part I and Part II).

That set in motion a big sell-off in US treasuries which I think Lagarde managed by holding German rates down blowing out the spread. A month later we had a few bank failures in the US. Credit Suisse blew up, etc. This led to …

Event #3 — Japan Doesn’t End YCC Yet — When new Bank of Japan President Kazuo Ueda told markets he wasn’t giving up YCC it helped bail out Lagarde and the ECB one more time as spreads widened again into the Debt Ceiling “Crisis” of June and is still in effect today.

But, that’s not the whole story because the fear of the BoJ giving up YCC and the turmoil in the US banks was so strong we saw massive short covering in the Japanese 10-year bond. So much so Ueda didn’t have to change policy because the yield was so far below the 0.5% limit.

So for a few months the unwinding of short JGB carry trades built up over years of YCC and Zero-bound rates globally helped Lagarde hold the whole range of Eurobond prices below what look to me as trip-wire levels.

But note, the 10-year JGB is rocketing back towards the 0.5% limit where Ueda will have to intervene. In fact, I’d say he’s already doing something because the yen has moved from 145 back to nearly 140 in just a couple of days.

Chart Porn incoming:

Germany’s CPI came in at 6.4% this month. In line with expectations, but meaning Lagarde can no longer hold this line. And the Bundesbank needs a massive bailout according to a recent audit of its finances.

Rutte’s government fell, the risk of a major political upheaval is rising. Who else other than Lagarde would buy Dutch debt at 3%

Spain’s government is about to change. Energy prices are starting to rise as we get into the winter. Who’s buying this debt below 3.75%?

It may be my confirmation bias talking but all I see is someone sitting on certain levels and intervening hard to ensure those levels are not breached for any length of time. The moment these yields get ‘out of the box,’ Lagarde comes in to tamp them back inside.

The Big Dogs Are Howling

The US CPI is forecast to come in at 3.1% and the market is saying Powell will raise in two weeks. I’m not sure he does because that would be interpreted as him hiking too far with recession just over the horizon.

And that would pressure the long-end of the yield curve again. Powell would be better served letting the market do his work in normalizing the yield curve for him by not raising here and waiting until the September meeting.

The market reaction to no rate hike would be immense and blow apart the carefully-constructed yield edifice Lagarde and her partner-in-crime Janet Yellen have erected.

How does Lagarde manage these spreads if Powell lets his foot off the neck of domestic credit for a few more weeks and Japan is staring at ending YCC with current inflation at ~3%?

Look at oil prices folks, they are rising again. Brent’s knocking on $80 per barrel with WTI following right along. US gasoline prices are coiling into this fall, setting up for a rally. Still think inflation is over? Not a chance.

Last week’s bond action put Lagarde in another ugly situation because the US 10 year broke above 4% and closed there, pushing all of these yields up through her redlines and so far there’s been no rally in US bonds to help her stuff them back down.

This week is therefore pivotal because the US 10 year is flirting dangerously close with a major breakout above 4.09%. We’ve already had the violation of the March high this week and there’s no indication that rates have topped here or will back down. The 2/10 spread has also significantly reversed from a low of -110 bps to -86 bps.

The one thing everyone short dollars is afraid of right now is any amount of yield curve normalization in US Treasuries. But that is exactly what is happening.

For the past few months I’ve been tracking the internal spreads within the US yield curve for my Patrons. And since the Debt Ceiling was resolved (not well, I might add) the markets have rightly begun taking on more duration risk.

There’s no argument that there is a lot of work yet to be done, but the trends on a weekly basis are clear. Capital is demanding a higher yield going further out the yield curve than it was in Q2. And eventually this bodes well for domestic banks to begin repairing their balance sheets.

But it won’t be the ones in Europe, who are standing on the verge of a rate shock that’s been just over the horizon for a while now. The current policy path is set. Powell’s not flinching in the face of rapid de-dollarization and domestic fiscal insanity.

It’s his job to fix the parts of the US balance sheet that he controls. He’s doing that. The traitors on Capitol Hill are trying to spend us into debtor’s prison.

Vilnius or Bust

Now think about what’s happening at Vilnius, at the NATO Summit. Biden wants a new commitment to spend even more on weapons for Ukraine but doesn’t want to bring Ukraine into the fold. The UK is screaming for both things.

Macron is now happy to supply missiles to Ukraine because it feeds his military-industrial complex and his longer-term goals of a European security pact without the US.

Turkey stopped blocking Sweden’s entry into the alliance because he got the F-16s he needs to fulfill his ambitions regionally. Someone finally offered Erdogan the right bribe to get him to sign off on this.

What’s happening in the financial markets is a harbinger that the bureaucratic inertia of the West is too powerful to overcome. They are preparing for the worst but still holding onto hope for the best. Once these yield walls fail, however, we’ll know there is no turning back.

Why? Because if the European sovereign bond market goes into rapid meltdown then escalation is the only politically expedient path for these narcissistic assholes to maintain power as their economies collapse.

Macron and France may have successfully beaten down the migrant riots/color revolution but they don’t have control over the situation. If anything the divisions between French nativism and the migrant population are only deeper today than two weeks ago.

The political upheaval on the ground is a few weeks/months ahead of the real turmoil under the surface of the capital markets. Lagarde is rapidly being put in a box by geopolitical imperatives and the opposition in the US to fighting a war with Russia over Ukraine.

The conflicted message coming from the Biden Administration reflects this. “Biden” wants more weapons in Ukraine to keep bleeding Russia out, but his military is clearly trying to restrain him from taking us past the point of no return.

Hence his reasoning to block the UK’s Ben Wallace’s ascension to NATO Gen. Secretary and retaining Jens Stoltenberg for another year. It’s why Stoltenberg continues to hold the line about Ukraine’s entry into NATO being predicated on them “winning the war as a sovereign nation.”

The war-mongers in London, DC and Brussels realize that this half-baked form of war is running out of runway. It’s costing them politically, economically and spiritually. They are losing the momentum and need something to ‘wake the sheeple up!’

What should scare everyone is that their thinking is simple: If “Biden” won’t fully commit to Ukraine then we’ll make that decision for him.

Because, despite everything, it’s finally sinking into their thick skulls that Russia’s economy is not collapsing. And while its industrial production, wage and inflation data all point to real productivity growth neither is it fully committed to full industrial war status yet.

Putin, unlike Biden, isn’t trying to escalate any further than he needs to. By not upgrading the conflict to allow full mobilization Putin keeps the door open for a negotiated settlement. The problem, as the Russians have pointed out time and again, is that they don’t know who to talk to.

No one is in charge of this operation. There are just competing factions without final say as to what the policy should be.

Putin’s approval rating rose in the wake of his handling Prigozhin’s Rebellion. He successfully navigated the domestic division between the realists he represents and the hard-liners who Prigozhin represented.

For the West losing in Ukraine after this much blood and treasure have been spilled, fomenting a full-blown sovereign debt crisis which will consume not only a few more national governments but quite likely the EU itself, will be the end of that 300 year project I talked about at the beginning.

It’s both terribly complicated but incredibly simple.

And it could all coming crashing down in the next few weeks.

* * *

Join my Patreon if you grave walk through empires

Loading…