Authored by Mike Shedlock via MishTalk.com,

The more you think you really need a loan, the less likely you are to get one, especially auto loans...

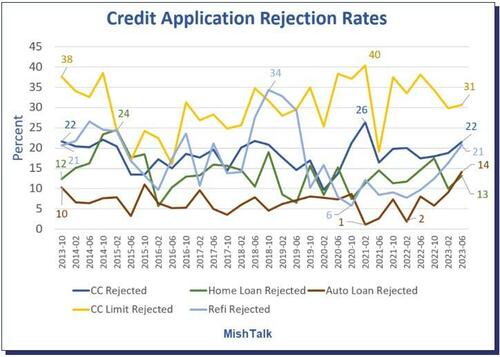

Data from New York Fed Survey of Consumers, chart by Mish

New York Fed Credit Access Survey report comes out every for months. The June report shows significant tightening of credit standards by lenders and less demand for loans by consumers.

June SCE Credit Access Survey Key Findings

-

The application rate for any kind of credit over the past twelve months declined to 40.3 percent from 40.9 percent in February, its lowest reading since October 2020. Application rates declined to 11.9 percent for auto loans and 12.5 percent for credit card limit requests, but increased to 24.8 percent for credit cards, 6.5 percent for mortgages, and 5.3 percent for mortgage refinances.

-

The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.

-

The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.

-

The proportion of respondents reporting that they are likely to apply for one or more types of credit over the next twelve months rose to 26.4 percent from 26.1 percent in February.

-

The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 46.1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.

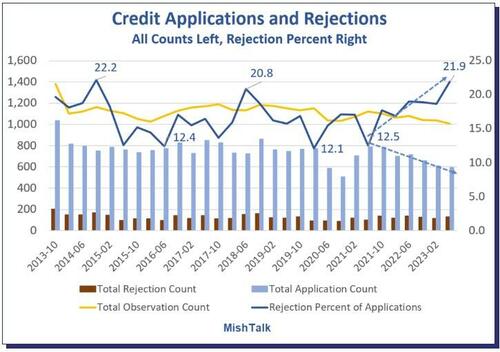

Credit Applications and Rejections

Count data from New York Fed Survey of Consumers, rejection percent calculation and chart by Mish

Some of the decline in applications is due to declining observations. But the percentages tell the story.

Among survey respondents, the auto loan rejection rates was 2 percent in February of 2022. It’s jumped to over 14 percent as of June 2023. And that is with an application rate decline of 12 percent.

In short, fewer people want auto loans, but of those who do, rejection rates are soaring.

Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

ZeroHedge noted Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

“What we are seeing is people who are doing significant score migration — a 680 or a 690 going to a 620,” Synchrony Financial CFO Brian Wenzel said in an interview.

That’s a dive from good to fair.

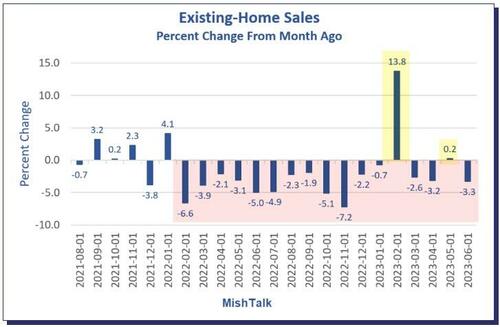

Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

Note that Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

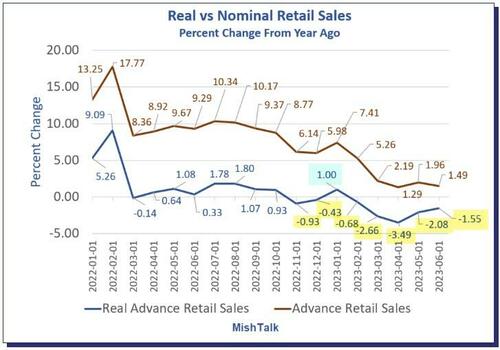

Inflation-Adjusted Retail Sales Are Weak

Real vs nominal retail sales percent change from year ago, data from Commerce Department, chart by Mish.

On July 18, I noted Inflation-Adjusted Retail Sales Weak Four of the Last Five Months

It’s not just consumers.

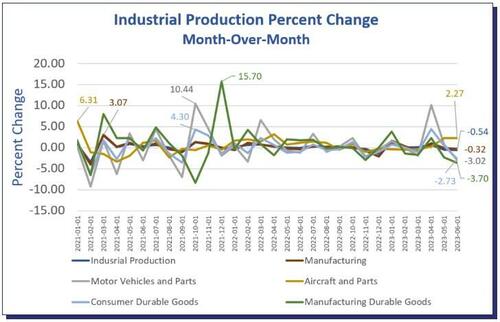

The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

Industrial production data from the Fed, chart by Mish

Also note The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

The Bloomberg Econoday consensus estimate was unchanged in May from June. Instead, Industrial production fell 0.5 percent and the Fed revised May from -0.2 percent to -0.5 percent.

Meanwhile, the consensus opinion has changed from recession to soft landing. Does anyone hear a bell?

* * *

Authored by Mike Shedlock via MishTalk.com,

The more you think you really need a loan, the less likely you are to get one, especially auto loans…

Data from New York Fed Survey of Consumers, chart by Mish

New York Fed Credit Access Survey report comes out every for months. The June report shows significant tightening of credit standards by lenders and less demand for loans by consumers.

June SCE Credit Access Survey Key Findings

-

The application rate for any kind of credit over the past twelve months declined to 40.3 percent from 40.9 percent in February, its lowest reading since October 2020. Application rates declined to 11.9 percent for auto loans and 12.5 percent for credit card limit requests, but increased to 24.8 percent for credit cards, 6.5 percent for mortgages, and 5.3 percent for mortgage refinances.

-

The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.

-

The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.

-

The proportion of respondents reporting that they are likely to apply for one or more types of credit over the next twelve months rose to 26.4 percent from 26.1 percent in February.

-

The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 46.1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.

Credit Applications and Rejections

Count data from New York Fed Survey of Consumers, rejection percent calculation and chart by Mish

Some of the decline in applications is due to declining observations. But the percentages tell the story.

Among survey respondents, the auto loan rejection rates was 2 percent in February of 2022. It’s jumped to over 14 percent as of June 2023. And that is with an application rate decline of 12 percent.

In short, fewer people want auto loans, but of those who do, rejection rates are soaring.

Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

ZeroHedge noted Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

“What we are seeing is people who are doing significant score migration — a 680 or a 690 going to a 620,” Synchrony Financial CFO Brian Wenzel said in an interview.

That’s a dive from good to fair.

Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

Note that Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

Inflation-Adjusted Retail Sales Are Weak

Real vs nominal retail sales percent change from year ago, data from Commerce Department, chart by Mish.

On July 18, I noted Inflation-Adjusted Retail Sales Weak Four of the Last Five Months

It’s not just consumers.

The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

Industrial production data from the Fed, chart by Mish

Also note The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

The Bloomberg Econoday consensus estimate was unchanged in May from June. Instead, Industrial production fell 0.5 percent and the Fed revised May from -0.2 percent to -0.5 percent.

Meanwhile, the consensus opinion has changed from recession to soft landing. Does anyone hear a bell?

* * *

Loading…