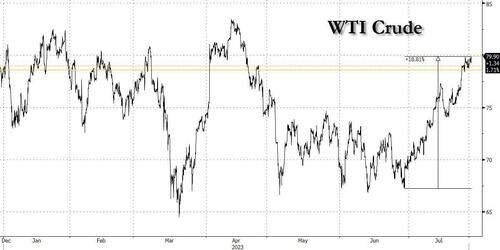

Having been crushed for much of 2023, and left for dead by momentum chasers, oil has staged a long-overdue rebound from the YTD lows in the mid-60s in late June, rising almost 20% to a three month high of $80 earlier today, and back over the 200DMA, something it hadn't done since August of 2022.

And while there are numerous reasons for oil's sharp bounce (which will flow through into headline CPI next month, slamming the brakes on any hope that the Fed will reverse its tightening posture soon) including expectations of Chinese stimulus, near record low futures positioning...

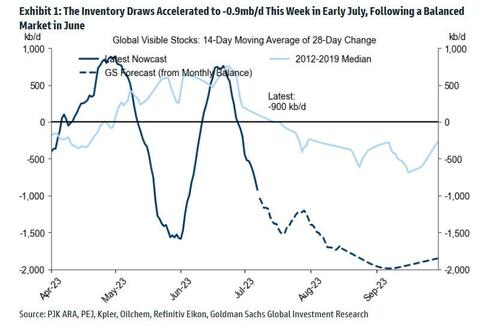

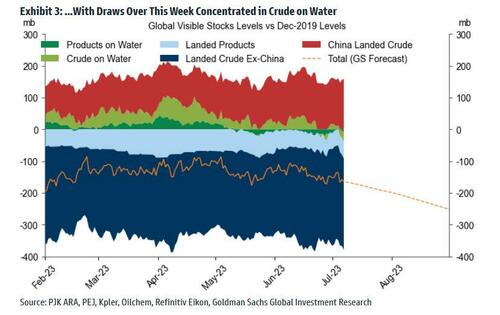

... the most recent bullish thesis is that as a result of the recent sharp cut in OPEC+ production which is only now starting to emerge (especially when it comes to Russian output), oil markets are set for large supply deficits over the next two months as a seasonal increase in demand combines with producer output restraint.

One proponent of this theory is long-running commodities bull Goldman Sachs whose chief commodity strategist Daan Struyven told CNBC's “Squawk Box Asia” that the bank expects record demand in oil markets to send deficits soaring and drive crude prices higher in the near term.

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high" Struyven said and added that the bank forecasts Brent crude to rise from just above $80 per barrel on Monday to $86 per barrel by year-end. It's already at $84 and rising fast.

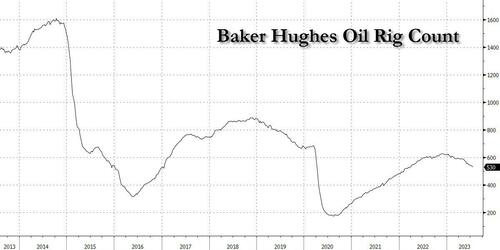

While Struyven acknowledged that U.S. crude output has risen significantly over the past year to 12.7 million barrels per day, he said that pace of growth will slow throughout the rest of 2023.

“We expect U.S. crude supply growth to slow down pretty significantly to a sequential pace of just 200 barrels per day from here,” he said, pointing to the recent steep drop in rig counts which is down 15% from its 2022 peak; last week, Baker Hughes reported US oil rigs fell by 7 to 530 the lowest since March 2022.

Struyven also suggested that the lack of an agreement following the G20 energy ministers’ meeting indicates “very substantial” uncertainty about long-run oil demand.

Elsewhere, the G-20 energy ministers met in India over the weekend, but left without reaching a consensus on the phasing down of fossil fuels, complicating the transition toward clean energy.

“Key point here for investors is, with the uncertainty about oil demand being so elevated, investors may require a premium to compensate for the for the elevated risk from such elevated demand uncertainty,” Struyven said.

Meanwhile, the International Energy Agency in June predicted that global oil demand is on track to rise by 2.4 million barrels per day in 2023, outpacing the previous year’s 2.3 million barrel per day increase, and on pace to hit another record high. Over the weekend, secretary general of the International Energy Forum Joseph McMonigle had forecast that both India and China will make up 2 million barrels a day of demand pick-up in the second half of 2023, a number which will only rise if and when China is forced to inject another major stimulus to boost its flagging economy.

Echoing Goldman's view are Standard Chartered analysts Emily Ashford and Paul Horsnell, who recently said that "supply deficits over the next two months are likely to be so visible and large as to allow the market to move above” $85/bbl in the third quarter" (considering Brent is at $84 as we type, this prediction will certainly come true).

According to Ashford's calculation, shortfalls of 1m b/d in June and July will balloon to 2.8m b/d in August and 2.4m b/d in September. "The point when significantly tighter fundamentals should show clearly is now imminent."

They also noted that while producer cuts have mostly driven market tightening so far, demand will play key role over the next two months.

Then today UBS analyst Giovanni Staunovo also joined the bandwagon, writing that the deficit in global oil markets is set to be ~2m b/d in July and August compared with 0.7m b/d in June, adding that if Saudis extend voluntary cuts, September’s deficit could be more than 1.5m b/d. Same as the abovementioned analysts, UBS expects demand growth to be driven by Asia, mainly China and India, while Brazil and Middle East also remain solid.

Finally, technicals are also supportive, with a break above the 200-day moving average, momentum traders switching from short to long trades, and covering of elevated short futures and options positions.

The bottom line is that while average Brent price forecasts remain unchanged at $88/bbl for 3Q and $93/bbl for 4Q, as energy analysts have been burned way too many times this year predicting a jump, it is almost certain that the next big move in the price of oil will be (much) higher, and already the sharp increase - and near bull market - in prices is a belated market acknowledgment of the significant tightening, and imminent deficit, in crude balances.

More in Goldman's note available to pro subs in the usual place.

Having been crushed for much of 2023, and left for dead by momentum chasers, oil has staged a long-overdue rebound from the YTD lows in the mid-60s in late June, rising almost 20% to a three month high of $80 earlier today, and back over the 200DMA, something it hadn’t done since August of 2022.

And while there are numerous reasons for oil’s sharp bounce (which will flow through into headline CPI next month, slamming the brakes on any hope that the Fed will reverse its tightening posture soon) including expectations of Chinese stimulus, near record low futures positioning…

… the most recent bullish thesis is that as a result of the recent sharp cut in OPEC+ production which is only now starting to emerge (especially when it comes to Russian output), oil markets are set for large supply deficits over the next two months as a seasonal increase in demand combines with producer output restraint.

One proponent of this theory is long-running commodities bull Goldman Sachs whose chief commodity strategist Daan Struyven told CNBC’s “Squawk Box Asia” that the bank expects record demand in oil markets to send deficits soaring and drive crude prices higher in the near term.

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high” Struyven said and added that the bank forecasts Brent crude to rise from just above $80 per barrel on Monday to $86 per barrel by year-end. It’s already at $84 and rising fast.

While Struyven acknowledged that U.S. crude output has risen significantly over the past year to 12.7 million barrels per day, he said that pace of growth will slow throughout the rest of 2023.

“We expect U.S. crude supply growth to slow down pretty significantly to a sequential pace of just 200 barrels per day from here,” he said, pointing to the recent steep drop in rig counts which is down 15% from its 2022 peak; last week, Baker Hughes reported US oil rigs fell by 7 to 530 the lowest since March 2022.

Struyven also suggested that the lack of an agreement following the G20 energy ministers’ meeting indicates “very substantial” uncertainty about long-run oil demand.

Elsewhere, the G-20 energy ministers met in India over the weekend, but left without reaching a consensus on the phasing down of fossil fuels, complicating the transition toward clean energy.

“Key point here for investors is, with the uncertainty about oil demand being so elevated, investors may require a premium to compensate for the for the elevated risk from such elevated demand uncertainty,” Struyven said.

Meanwhile, the International Energy Agency in June predicted that global oil demand is on track to rise by 2.4 million barrels per day in 2023, outpacing the previous year’s 2.3 million barrel per day increase, and on pace to hit another record high. Over the weekend, secretary general of the International Energy Forum Joseph McMonigle had forecast that both India and China will make up 2 million barrels a day of demand pick-up in the second half of 2023, a number which will only rise if and when China is forced to inject another major stimulus to boost its flagging economy.

Echoing Goldman’s view are Standard Chartered analysts Emily Ashford and Paul Horsnell, who recently said that “supply deficits over the next two months are likely to be so visible and large as to allow the market to move above” $85/bbl in the third quarter” (considering Brent is at $84 as we type, this prediction will certainly come true).

According to Ashford’s calculation, shortfalls of 1m b/d in June and July will balloon to 2.8m b/d in August and 2.4m b/d in September. “The point when significantly tighter fundamentals should show clearly is now imminent.”

They also noted that while producer cuts have mostly driven market tightening so far, demand will play key role over the next two months.

Then today UBS analyst Giovanni Staunovo also joined the bandwagon, writing that the deficit in global oil markets is set to be ~2m b/d in July and August compared with 0.7m b/d in June, adding that if Saudis extend voluntary cuts, September’s deficit could be more than 1.5m b/d. Same as the abovementioned analysts, UBS expects demand growth to be driven by Asia, mainly China and India, while Brazil and Middle East also remain solid.

Finally, technicals are also supportive, with a break above the 200-day moving average, momentum traders switching from short to long trades, and covering of elevated short futures and options positions.

The bottom line is that while average Brent price forecasts remain unchanged at $88/bbl for 3Q and $93/bbl for 4Q, as energy analysts have been burned way too many times this year predicting a jump, it is almost certain that the next big move in the price of oil will be (much) higher, and already the sharp increase – and near bull market – in prices is a belated market acknowledgment of the significant tightening, and imminent deficit, in crude balances.

More in Goldman’s note available to pro subs in the usual place.

Loading…