By Marcel Kasumovich, Head of Research for One River Asset Management

Anecdote:

“Art is the shortest path from man to man.” It is a phrase etched into the museum glass, and these words are spilling into the Arabian Gulf. I am lying on a black beanbag in the courtyard of the Louvre, Abu Dhabi edition.

Cultural Centers are an invitation for dialogue. And the UAE is building a magical one, a symbolic understanding that their future isn’t in fossils.

The irony is everywhere. Innovation defines cold wars. And innovation centers on energy. But the race to “net-zero” emission brings into focus the most efficient energy production in the long, long term. Nuclear. It is the only practical, scalable solution.

Demands of new technologies give new meaning to the race. The fear and greed around technologies like artificial intelligence are a great leap. Even the Hollywood bubble fears disruption with likeness of stars trivially replicated, almost costless.

Only, it isn’t costless. AI consumes inordinate amounts of energy. And that needs a vast amount of investment. Low inflation was deemed the ideal path to efficient investment - the best way to support innovation.

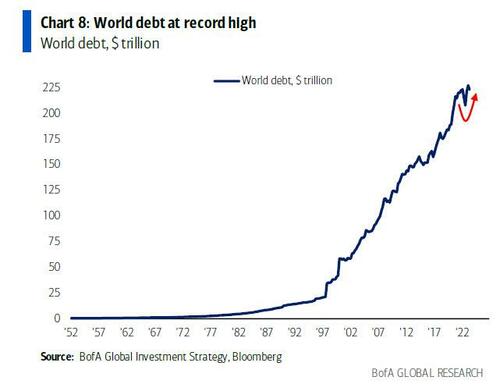

It failed. Overvalued assets are in the hands of the few and overwhelming debt in the arms of the many.

Innovation needs financial resources - a clean balance sheet. And despite wildly different economic philosophies, the US and China are commonly burdened by liabilities built from smoothing past shocks.

Both are also racing to build our sun on earth - nuclear fusion, perpetual energy.

China leads on patents, the US on commercialization. Who controls infinite energy takes an impenetrable advantage.

Resolving debt challenges is where philosophy will shine brightest - liberalism and the invisible hand guiding to safety, not censorship. Fate has a great sense of irony.

By Marcel Kasumovich, Head of Research for One River Asset Management

Anecdote:

“Art is the shortest path from man to man.” It is a phrase etched into the museum glass, and these words are spilling into the Arabian Gulf. I am lying on a black beanbag in the courtyard of the Louvre, Abu Dhabi edition.

Cultural Centers are an invitation for dialogue. And the UAE is building a magical one, a symbolic understanding that their future isn’t in fossils.

The irony is everywhere. Innovation defines cold wars. And innovation centers on energy. But the race to “net-zero” emission brings into focus the most efficient energy production in the long, long term. Nuclear. It is the only practical, scalable solution.

Demands of new technologies give new meaning to the race. The fear and greed around technologies like artificial intelligence are a great leap. Even the Hollywood bubble fears disruption with likeness of stars trivially replicated, almost costless.

Only, it isn’t costless. AI consumes inordinate amounts of energy. And that needs a vast amount of investment. Low inflation was deemed the ideal path to efficient investment – the best way to support innovation.

It failed. Overvalued assets are in the hands of the few and overwhelming debt in the arms of the many.

Innovation needs financial resources – a clean balance sheet. And despite wildly different economic philosophies, the US and China are commonly burdened by liabilities built from smoothing past shocks.

Both are also racing to build our sun on earth – nuclear fusion, perpetual energy.

China leads on patents, the US on commercialization. Who controls infinite energy takes an impenetrable advantage.

Resolving debt challenges is where philosophy will shine brightest – liberalism and the invisible hand guiding to safety, not censorship. Fate has a great sense of irony.

Loading…