By Simon White, Bloomberg Markets Live reporter and analyst

Slumping bonds are a reminder that implicit or explicit yield curve control in the US is increasingly likely at some point, although there is scant evidence the Treasury is already engaging in such a policy by stealth.

Markets love a good “stealth” story. Whether it’s stealth QE, stealth QT or stealth FX intervention, there’s a (sometimes well-founded) yearning to challenge the mainstream narrative. One such theory of late has been that the Treasury has been engaging in stealth yield curve control (YCC).

There is little evidence to support that this is happening, as I’ll show. But with yields climbing and within 15 bps of 15-year highs, it pushes to the top of the agenda whether it will happen eventually. Given the worsening fiscal and market backdrop and elevated inflation, it’s looking more likely than not.

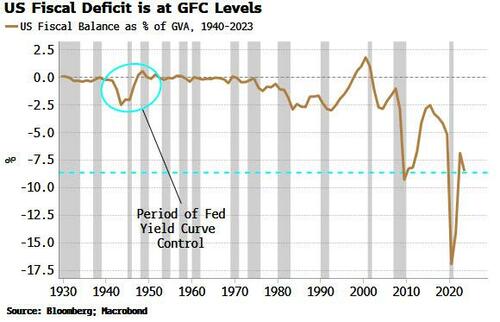

It’s been a tumultuous week for yields, with the Bank of Japan’s policy tweak, and the Treasury increasing its funding needs. But Fitch was the weatherman with its US downgrade, telling us about the downpour we can see for ourselves just by taking a glance at the fiscal data. In short, the US faces a perfect storm of a vertiginous fiscal deficit, a near-historically swollen debt load, ballooning interest-rate costs and collapsing tax revenues.

First, the deficit. It’s close to historical wides, bigger than it’s ever been outside of a recession, and almost as wide as it was in the depths of the GFC. It’s the largest in the world in GDP terms, and it is currently heading in the wrong direction. This heaps more pressure on the government debt-to-GDP level, already uncomfortably high at 112%.

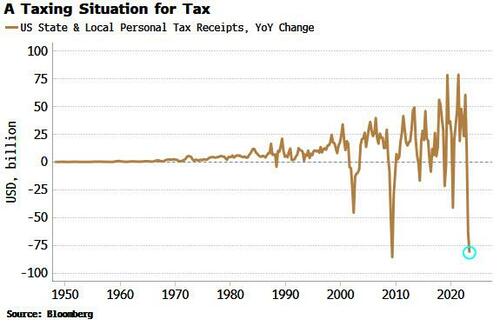

Second, tax revenues. These have seen almost their largest annual fall ever, in an economy that’s supposed to be growing at 2.4%.

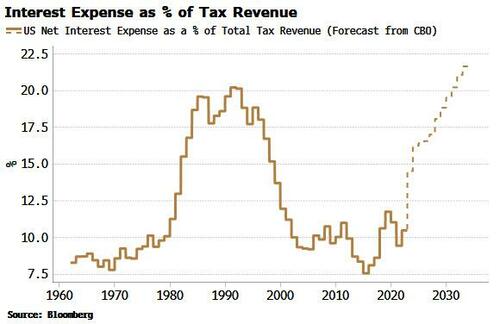

And then there’s rising interest-rate costs. The total interest expense as a percentage of tax revenue is expected to rise sharply in the next year or two, and make new highs by the end of the decade. However, these CBO forecasts should be taken with a grain of salt as they are based on a 10-year yield of only 3.8% (the ten-year average has been higher than that in every decade bar the 2010s and 2020s).

There is a view the Treasury is already implementing YCC, based on the fact it has been skewing its issuance towards bills and away from coupons. But issuing more bills is simply the easiest and fastest way for the Treasury to replenish its account at the Fed (the TGA). It was run down to almost zero in the lead-up to the debt-ceiling limit, and has now risen to over $500 billion.

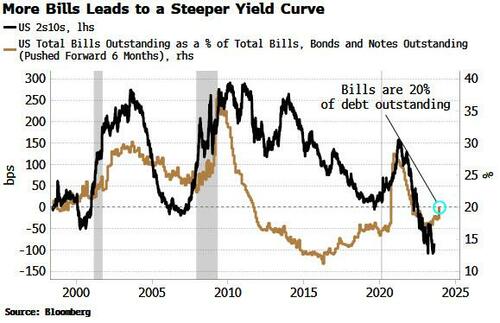

This level of bill issuance is not unusual. The Treasury has an implicit target of about 20% for the amount of bills outstanding as a percentage of total debt. As we can see from the chart below, bills have often been more than 20% of debt outstanding over the last 30 years. Moreover, the Treasury announced this week it was raising its coupon-issuance amounts.

According to the stealth YCC thesis, less longer-dated Treasury issuance implicitly caps longer-term yields, but this has not historically been the case. As the chart above shows, the yield curve typically steepens – not flattens – when there is greater bill issuance – the opposite of what is desired by YCC.

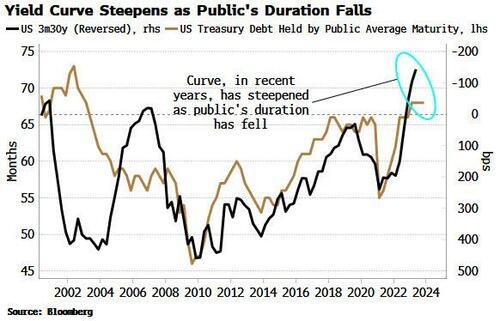

We see the same relationship if we look the duration of US government debt outstanding. When the average duration falls – as it would if issuance is skewed toward bills – the yield curve tends to steepen. The current average duration held by the public is consistent with a steeper, not a flatter, yield curve.

This sounds counter-intuitive. If issuance drives yields, then more issuance at the front-end of the curve versus the longer end - equating to a fall in duration - implies the yield curve should flatten.

But the fact the relationship is the other way implies it’s likely that demand is the more dominant driver of yields in the medium term. There is ready-made demand for bills, from MMFs, etc, so when supply increases, demand rises to meet it, suppressing the yield-curve impact.

It’s thus hard to argue the Treasury is engaging in yield curve control. But that does not detract from the rising possibility it will need to be implemented in some shape or form eventually.

Banks and the Fed are reducing their Treasury holdings, while foreigners now collectively own about $5 trillion less USTs – about 10% – than they did in 2021. At the same time the “Treasury put” means large fiscal deficits are likely to become a feature, not a bug. That means inflation is likely to become embedded.

Fiscal profligacy and elevated price growth are a combustible mix and a road to prohibitively high yields via rising term premium. Yield capping thus starts to look like the endgame.

How it’s done is another matter, whether it’s the Fed co-opted to cap yields as it was in WWII, Treasury buybacks, or financial repression, whereby domestic institutions are forced to hold more government debt. Whatever way, at some point yield curve control in the US is becoming increasingly likely – by stealth or otherwise.

By Simon White, Bloomberg Markets Live reporter and analyst

Slumping bonds are a reminder that implicit or explicit yield curve control in the US is increasingly likely at some point, although there is scant evidence the Treasury is already engaging in such a policy by stealth.

Markets love a good “stealth” story. Whether it’s stealth QE, stealth QT or stealth FX intervention, there’s a (sometimes well-founded) yearning to challenge the mainstream narrative. One such theory of late has been that the Treasury has been engaging in stealth yield curve control (YCC).

There is little evidence to support that this is happening, as I’ll show. But with yields climbing and within 15 bps of 15-year highs, it pushes to the top of the agenda whether it will happen eventually. Given the worsening fiscal and market backdrop and elevated inflation, it’s looking more likely than not.

It’s been a tumultuous week for yields, with the Bank of Japan’s policy tweak, and the Treasury increasing its funding needs. But Fitch was the weatherman with its US downgrade, telling us about the downpour we can see for ourselves just by taking a glance at the fiscal data. In short, the US faces a perfect storm of a vertiginous fiscal deficit, a near-historically swollen debt load, ballooning interest-rate costs and collapsing tax revenues.

First, the deficit. It’s close to historical wides, bigger than it’s ever been outside of a recession, and almost as wide as it was in the depths of the GFC. It’s the largest in the world in GDP terms, and it is currently heading in the wrong direction. This heaps more pressure on the government debt-to-GDP level, already uncomfortably high at 112%.

Second, tax revenues. These have seen almost their largest annual fall ever, in an economy that’s supposed to be growing at 2.4%.

And then there’s rising interest-rate costs. The total interest expense as a percentage of tax revenue is expected to rise sharply in the next year or two, and make new highs by the end of the decade. However, these CBO forecasts should be taken with a grain of salt as they are based on a 10-year yield of only 3.8% (the ten-year average has been higher than that in every decade bar the 2010s and 2020s).

There is a view the Treasury is already implementing YCC, based on the fact it has been skewing its issuance towards bills and away from coupons. But issuing more bills is simply the easiest and fastest way for the Treasury to replenish its account at the Fed (the TGA). It was run down to almost zero in the lead-up to the debt-ceiling limit, and has now risen to over $500 billion.

This level of bill issuance is not unusual. The Treasury has an implicit target of about 20% for the amount of bills outstanding as a percentage of total debt. As we can see from the chart below, bills have often been more than 20% of debt outstanding over the last 30 years. Moreover, the Treasury announced this week it was raising its coupon-issuance amounts.

According to the stealth YCC thesis, less longer-dated Treasury issuance implicitly caps longer-term yields, but this has not historically been the case. As the chart above shows, the yield curve typically steepens – not flattens – when there is greater bill issuance – the opposite of what is desired by YCC.

We see the same relationship if we look the duration of US government debt outstanding. When the average duration falls – as it would if issuance is skewed toward bills – the yield curve tends to steepen. The current average duration held by the public is consistent with a steeper, not a flatter, yield curve.

This sounds counter-intuitive. If issuance drives yields, then more issuance at the front-end of the curve versus the longer end – equating to a fall in duration – implies the yield curve should flatten.

But the fact the relationship is the other way implies it’s likely that demand is the more dominant driver of yields in the medium term. There is ready-made demand for bills, from MMFs, etc, so when supply increases, demand rises to meet it, suppressing the yield-curve impact.

It’s thus hard to argue the Treasury is engaging in yield curve control. But that does not detract from the rising possibility it will need to be implemented in some shape or form eventually.

Banks and the Fed are reducing their Treasury holdings, while foreigners now collectively own about $5 trillion less USTs – about 10% – than they did in 2021. At the same time the “Treasury put” means large fiscal deficits are likely to become a feature, not a bug. That means inflation is likely to become embedded.

Fiscal profligacy and elevated price growth are a combustible mix and a road to prohibitively high yields via rising term premium. Yield capping thus starts to look like the endgame.

How it’s done is another matter, whether it’s the Fed co-opted to cap yields as it was in WWII, Treasury buybacks, or financial repression, whereby domestic institutions are forced to hold more government debt. Whatever way, at some point yield curve control in the US is becoming increasingly likely – by stealth or otherwise.

Loading…