So far we’ve had a fairly light calendar over the summer, but as DB's Jim Reid notes, this week that should change with the Fed’s Jackson Hole Economic Symposium. The overall title this year is “Structural Shifts in the Global Economy”, and Chair Powell’s speech on Friday at 10am is simply given the heading “Economic Outlook”. Unlike last year's fire and brimstone last-minute-revised speech, most economists don’t expect Powell to send strong signals about the near-term policy path. However, it is true that recent years have seen Powell deliver some important longer-term policy messages. In particular, last year saw him deliver a fairly short and direct message on the importance of price stability, which left little doubt as to the Fed’s resolve to return inflation to target.

As Reid observes, this year’s conference comes at an interesting moment. On the one hand, nominal and real yields have risen substantially. But some other measures of overall financial conditions are still not particularly tight, and Bloomberg’s index of US financial conditions right now is more accommodative than its historical average. Moreover, the supposedly resilient economic data out of the US over recent weeks has helped to bolster the soft-landing case. However, the risk is that with the data coming in so strong, real yields keep pressing higher, which raises the chance that something ends up breaking, as has usually occurred during previous Fed hiking cycles through history.

Apart from Jackson Hole, another important focus this week will be China’s economy. On Sunday, the People’s Bank of China encouraged banks to boost lending to support growth. And this morning, banks have cut the one-year loan prime rate by 10bps to 3.45%. However, Chinese equities have still fallen this morning, since that was smaller than the 15bps cut expected. Furthermore, the 5-year loan prime rate was left unchanged, contrary to the 15bps cut that was expected there too.

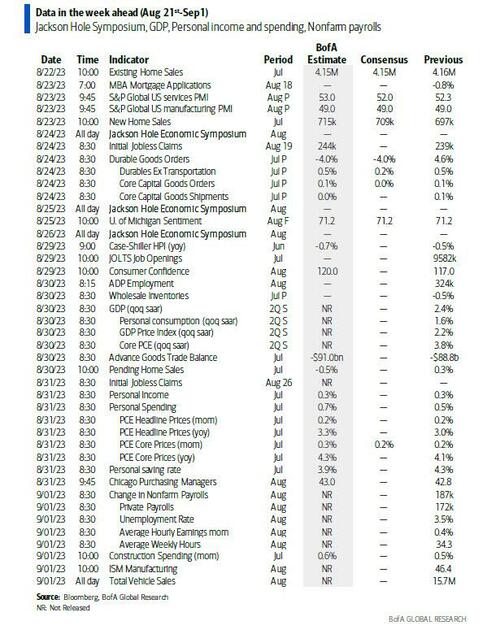

Looking forward to the week ahead, there are several other events to look out for. On the data side, the flash PMIs for August are coming out on Wednesday, which will offer an initial indication as to how the major economies have been faring this month. Separately, another important release that day in the US will be the Q1 Quarterly Census of Employment and Wages (QCEW). That provides a benchmark for employment data, so it means we’ll also get some revisions to nonfarm payrolls over previous months. Our US economists have some more details on the release here.

When it comes to earnings, the bulk of this season is over now, so there’s not much left to come out. That said, one remaining highlight will be Nvidia on Wednesday. Readers might recall that their outlook back in late-May was far above expectations thanks to demand for AI processers, and it helped kick off a significant equity rally that continued into June and July. So that’s definitely one to watch out for.

On the rates side, this week’s US Treasury auctions include 20yr Treasuries (Tuesday) and 30yr inflation-protected Treasuries (Wednesday), which will be interesting with yields having risen to multi-year highs. Otherwise from central banks, there are plenty of speakers apart from Fed Chair Powell, including ECB President Lagarde on Friday.

Lastly in the political sphere, there’ll be some more action on the 2024 US Presidential race over the week ahead. In particular, the first Republican primary debate is taking place on Wednesday. But yesterday, former President Trump confirmed that he wouldn’t be doing the debates. President Trump remains the polling frontrunner for the Republican nomination by a substantial margin, and FiveThirtyEight’s average gives him 54.3%, which is well ahead of the next-placed candidate, Florida Governor Ron DeSantis on 14.8%. No other candidate is in double-digits.

Courtesy of DB, here is a day-by-day calendar of events

Monday August 21

- Data: Germany July PPI

- Earnings: BHP, Zoom

Tuesday August 22

- Data: US July existing home sales, August Richmond Fed manufacturing index, Philadelphia Fed non-manufacturing activity, UK July public finances, Italy June current account balance, France July retail sales, ECB June current account

- Central banks: Fed's Goolsbee and Bowman speak

- Earnings: Baidu, Lowe's

Wednesday August 23

- Data: US, UK, Japan, Germany, France and Eurozone August PMIs, US July new home sales, Eurozone August consumer confidence, Canada June retail sales Earnings: NVIDIA, Analog Devices, Snowflake, Peloton

Thursday August 24

- Data: US July durable goods orders, Chicago Fed national activity, August Kansas City Fed manufacturing activity, initial jobless claims, France August manufacturing and business confidence

- Central banks: Fed's Jackson Hole symposium through August 26, Fed's Harker speaks

- Earnings: Meituan, Marvell, Intuit, GAP, Affirm

Friday August 25

- Data: US August Kansas City Fed services activity, UK August GfK consumer confidence, Japan August Tokyo CPI, July PPI services, Germany Q2 private consumption, government spending, capital investment, August Ifo survey

- Central banks: Fed's Powell and Harker speak

* * *

Finally, looking at just the US, Goldman writes that the key economic data release this week is the durable goods report on Thursday. There are a few scheduled speaking engagements from Fed officials this week, including a speech by Fed Chair Jerome Powell on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 21

- There are no major economic data releases scheduled.

Tuesday, August 22

- 10:00 AM Existing home sales, July (GS -0.5%, consensus -0.2%, last -3.3%)

- 10:00 AM Richmond Fed manufacturing index, August (last -9)

- 02:30 PM Fed Governor Bowman and Chicago Fed President Goolsbee (FOMC voter) speak: Chicago Fed President Austan Goolsbee and Fed Governor Michelle Bowman will participate in a fireside chat at a Fed Listens event on youth unemployment in Chicago. Moderated Q&A is expected. On July 31st, President Goolsbee said that he had not “made up my mind for what should happen” at the FOMC’s September meeting and emphasized that “nothing is off the table.” President Goolsbee noted that “it was fabulous to see that inflation is coming down in this way,” following the release of the June PCE inflation report. On August 5th, Governor Bowman noted that she expected “additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2 percent target,” and stressed that the FOMC “should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

Wednesday, August 23

- 09:45 AM S&P Global US manufacturing PMI, August preliminary (consensus 49.0, last 49.0)

- 09:45 AM S&P Global US services PMI, August preliminary (consensus 52.4, last 52.3)

- 10:00 AM New home sales, July (GS flat, consensus +1.4%, last -2.5%)

Thursday, August 24

- 08:30 AM Initial jobless claims, week ended August 19 (GS 235k, consensus 240k, last 239k); Continuing jobless claims, week ended August 12 (consensus 1,700k, last 1,716k)

- 08:30 AM Durable goods orders, July preliminary (GS -4.0%, consensus -4.0%, last +4.6%); Durable goods orders ex-transportation, July preliminary (GS +0.4%, consensus +0.2%, last +0.5%); Core capital goods orders, July preliminary (GS +0.4%, consensus +0.1%, last +0.1%); Core capital goods shipments, July preliminary (GS +0.4%, consensus +0.1%, last +0.1%): We estimate that durable goods orders fell 4.0% in the preliminary July report, reflecting a pullback in commercial aircraft orders from the spike in June. We forecast a 0.4% rise in both core capital goods orders and shipments, reflecting a pickup in US freight and global industrial activity but a continued modest drag from tighter credit.

- 11:00 AM Kansas City Fed manufacturing index, August (last -11)

- 12:00 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will be interviewed by CNBC at the Kansas City Fed's Jackson Hole Economic Symposium. On August 8th, President Harker noted that “absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work.” President Harker also noted that he expects the funds rate to be at its peak level “for a while,” and observed that he does not “foresee any likely circumstance for an immediate easing of the policy rate.”

Friday, August 25

- 09:00 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will be interviewed by Bloomberg TV and Yahoo Finance Live at the Kansas City Fed's Jackson Hole Economic Symposium.

- 10:00 AM University of Michigan consumer sentiment, August final (GS 71.4, consensus 71.2, last 71.2): We expect the University of Michigan consumer sentiment index to increase by 0.2pt to 71.4.

- 10:05 AM Fed Chair Powell speaks: Federal Reserve Chair Jerome Powell will deliver a speech at the Kansas City Federal Reserve Bank’s annual Economic Symposium in Jackson Hole. The topic of the conference this year is “Structural Shifts in the Global Economy.” Text and media Q&A are expected.

Sourece: DB, Goldman, BofA

So far we’ve had a fairly light calendar over the summer, but as DB’s Jim Reid notes, this week that should change with the Fed’s Jackson Hole Economic Symposium. The overall title this year is “Structural Shifts in the Global Economy”, and Chair Powell’s speech on Friday at 10am is simply given the heading “Economic Outlook”. Unlike last year’s fire and brimstone last-minute-revised speech, most economists don’t expect Powell to send strong signals about the near-term policy path. However, it is true that recent years have seen Powell deliver some important longer-term policy messages. In particular, last year saw him deliver a fairly short and direct message on the importance of price stability, which left little doubt as to the Fed’s resolve to return inflation to target.

As Reid observes, this year’s conference comes at an interesting moment. On the one hand, nominal and real yields have risen substantially. But some other measures of overall financial conditions are still not particularly tight, and Bloomberg’s index of US financial conditions right now is more accommodative than its historical average. Moreover, the supposedly resilient economic data out of the US over recent weeks has helped to bolster the soft-landing case. However, the risk is that with the data coming in so strong, real yields keep pressing higher, which raises the chance that something ends up breaking, as has usually occurred during previous Fed hiking cycles through history.

Apart from Jackson Hole, another important focus this week will be China’s economy. On Sunday, the People’s Bank of China encouraged banks to boost lending to support growth. And this morning, banks have cut the one-year loan prime rate by 10bps to 3.45%. However, Chinese equities have still fallen this morning, since that was smaller than the 15bps cut expected. Furthermore, the 5-year loan prime rate was left unchanged, contrary to the 15bps cut that was expected there too.

Looking forward to the week ahead, there are several other events to look out for. On the data side, the flash PMIs for August are coming out on Wednesday, which will offer an initial indication as to how the major economies have been faring this month. Separately, another important release that day in the US will be the Q1 Quarterly Census of Employment and Wages (QCEW). That provides a benchmark for employment data, so it means we’ll also get some revisions to nonfarm payrolls over previous months. Our US economists have some more details on the release here.

When it comes to earnings, the bulk of this season is over now, so there’s not much left to come out. That said, one remaining highlight will be Nvidia on Wednesday. Readers might recall that their outlook back in late-May was far above expectations thanks to demand for AI processers, and it helped kick off a significant equity rally that continued into June and July. So that’s definitely one to watch out for.

On the rates side, this week’s US Treasury auctions include 20yr Treasuries (Tuesday) and 30yr inflation-protected Treasuries (Wednesday), which will be interesting with yields having risen to multi-year highs. Otherwise from central banks, there are plenty of speakers apart from Fed Chair Powell, including ECB President Lagarde on Friday.

Lastly in the political sphere, there’ll be some more action on the 2024 US Presidential race over the week ahead. In particular, the first Republican primary debate is taking place on Wednesday. But yesterday, former President Trump confirmed that he wouldn’t be doing the debates. President Trump remains the polling frontrunner for the Republican nomination by a substantial margin, and FiveThirtyEight’s average gives him 54.3%, which is well ahead of the next-placed candidate, Florida Governor Ron DeSantis on 14.8%. No other candidate is in double-digits.

Courtesy of DB, here is a day-by-day calendar of events

Monday August 21

- Data: Germany July PPI

- Earnings: BHP, Zoom

Tuesday August 22

- Data: US July existing home sales, August Richmond Fed manufacturing index, Philadelphia Fed non-manufacturing activity, UK July public finances, Italy June current account balance, France July retail sales, ECB June current account

- Central banks: Fed’s Goolsbee and Bowman speak

- Earnings: Baidu, Lowe’s

Wednesday August 23

- Data: US, UK, Japan, Germany, France and Eurozone August PMIs, US July new home sales, Eurozone August consumer confidence, Canada June retail sales Earnings: NVIDIA, Analog Devices, Snowflake, Peloton

Thursday August 24

- Data: US July durable goods orders, Chicago Fed national activity, August Kansas City Fed manufacturing activity, initial jobless claims, France August manufacturing and business confidence

- Central banks: Fed’s Jackson Hole symposium through August 26, Fed’s Harker speaks

- Earnings: Meituan, Marvell, Intuit, GAP, Affirm

Friday August 25

- Data: US August Kansas City Fed services activity, UK August GfK consumer confidence, Japan August Tokyo CPI, July PPI services, Germany Q2 private consumption, government spending, capital investment, August Ifo survey

- Central banks: Fed’s Powell and Harker speak

* * *

Finally, looking at just the US, Goldman writes that the key economic data release this week is the durable goods report on Thursday. There are a few scheduled speaking engagements from Fed officials this week, including a speech by Fed Chair Jerome Powell on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 21

- There are no major economic data releases scheduled.

Tuesday, August 22

- 10:00 AM Existing home sales, July (GS -0.5%, consensus -0.2%, last -3.3%)

- 10:00 AM Richmond Fed manufacturing index, August (last -9)

- 02:30 PM Fed Governor Bowman and Chicago Fed President Goolsbee (FOMC voter) speak: Chicago Fed President Austan Goolsbee and Fed Governor Michelle Bowman will participate in a fireside chat at a Fed Listens event on youth unemployment in Chicago. Moderated Q&A is expected. On July 31st, President Goolsbee said that he had not “made up my mind for what should happen” at the FOMC’s September meeting and emphasized that “nothing is off the table.” President Goolsbee noted that “it was fabulous to see that inflation is coming down in this way,” following the release of the June PCE inflation report. On August 5th, Governor Bowman noted that she expected “additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2 percent target,” and stressed that the FOMC “should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

Wednesday, August 23

- 09:45 AM S&P Global US manufacturing PMI, August preliminary (consensus 49.0, last 49.0)

- 09:45 AM S&P Global US services PMI, August preliminary (consensus 52.4, last 52.3)

- 10:00 AM New home sales, July (GS flat, consensus +1.4%, last -2.5%)

Thursday, August 24

- 08:30 AM Initial jobless claims, week ended August 19 (GS 235k, consensus 240k, last 239k); Continuing jobless claims, week ended August 12 (consensus 1,700k, last 1,716k)

- 08:30 AM Durable goods orders, July preliminary (GS -4.0%, consensus -4.0%, last +4.6%); Durable goods orders ex-transportation, July preliminary (GS +0.4%, consensus +0.2%, last +0.5%); Core capital goods orders, July preliminary (GS +0.4%, consensus +0.1%, last +0.1%); Core capital goods shipments, July preliminary (GS +0.4%, consensus +0.1%, last +0.1%): We estimate that durable goods orders fell 4.0% in the preliminary July report, reflecting a pullback in commercial aircraft orders from the spike in June. We forecast a 0.4% rise in both core capital goods orders and shipments, reflecting a pickup in US freight and global industrial activity but a continued modest drag from tighter credit.

- 11:00 AM Kansas City Fed manufacturing index, August (last -11)

- 12:00 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will be interviewed by CNBC at the Kansas City Fed’s Jackson Hole Economic Symposium. On August 8th, President Harker noted that “absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work.” President Harker also noted that he expects the funds rate to be at its peak level “for a while,” and observed that he does not “foresee any likely circumstance for an immediate easing of the policy rate.”

Friday, August 25

- 09:00 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will be interviewed by Bloomberg TV and Yahoo Finance Live at the Kansas City Fed’s Jackson Hole Economic Symposium.

- 10:00 AM University of Michigan consumer sentiment, August final (GS 71.4, consensus 71.2, last 71.2): We expect the University of Michigan consumer sentiment index to increase by 0.2pt to 71.4.

- 10:05 AM Fed Chair Powell speaks: Federal Reserve Chair Jerome Powell will deliver a speech at the Kansas City Federal Reserve Bank’s annual Economic Symposium in Jackson Hole. The topic of the conference this year is “Structural Shifts in the Global Economy.” Text and media Q&A are expected.

Sourece: DB, Goldman, BofA

Loading…