Authored by Simon White, Bloomberg macro strategist,

Stocks’ rally in response to bad economic news might be short lived as there is plenty of room to catch down to burgeoning recession risks, while option-market dynamics create upside resistance and more instability.

Tuesday’s weaker-than-expected JOLTS and consumer confidence data sent bond yields lower across the curve by 8-10 bps. Stocks, in time-honored fashion, took them as a reason for celebration and promptly rallied.

Two volatile data-points are not reason alone to believe a recession is a shoo-in or imminent.

However, they do fit a narrative of an economy that has several recessionary signs and is slowing. More importantly, they highlight that the gap between the likelihood the market ascribes to a recession and the probability implied by the data has become quite large, meaning a downturn would be that more impactful on asset prices.

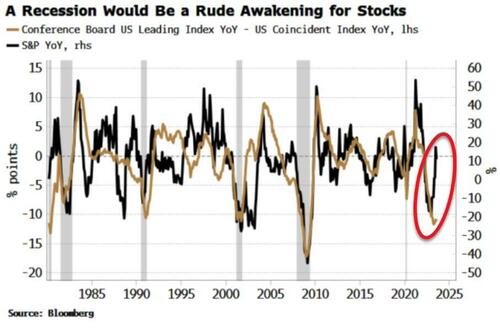

Stocks have been defying the very negative message from leading economic data for some time now.

The chart below shows the large divergence between the S&P and the ratio of the Conference Board’s Leading and Coincident Indexes. This also demonstrates that stocks have not insignificant potential downside if a recession suddenly looks more likely. (And when they happen, they tend to happen quickly.)

Stocks are also likely to run up against resistance from volatility trading.

The S&P rallied Tuesday but hit resistance at 4,500.

This is not uncoincidentally where there is a “call wall,” i.e. the strike where there is there is the most amount of calls outstanding. Option dealers have to sell at the strike to dynamically hedge.

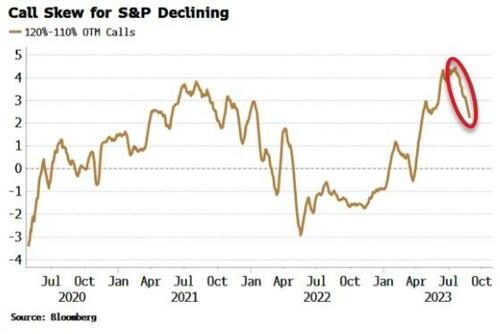

We could break through the wall, but the more fevered option trading we have seen in recent months – fueling the market’s rally – is dying down. Call skew became elevated, but is now clearly rolling over.

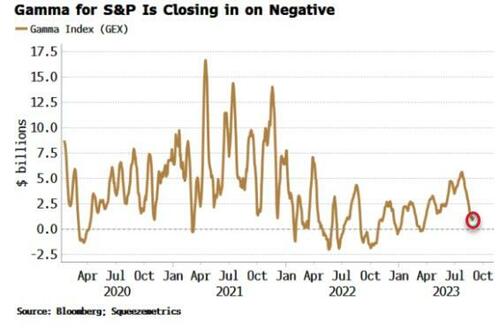

As a result gamma has been falling fast. On some banks’ estimates it is already negative, while Squeezemetrics’ Gamma Index has fallen quite rapidly and is now close to negative territory.

Negative gamma results in a more unstable market, with downside bias as option dealers’ short put-inventory becomes closer to the money.

With low volatility, more instability, and pricing that is not expectant of a near-term recession, risks are mounting for equities.

Authored by Simon White, Bloomberg macro strategist,

Stocks’ rally in response to bad economic news might be short lived as there is plenty of room to catch down to burgeoning recession risks, while option-market dynamics create upside resistance and more instability.

Tuesday’s weaker-than-expected JOLTS and consumer confidence data sent bond yields lower across the curve by 8-10 bps. Stocks, in time-honored fashion, took them as a reason for celebration and promptly rallied.

Two volatile data-points are not reason alone to believe a recession is a shoo-in or imminent.

However, they do fit a narrative of an economy that has several recessionary signs and is slowing. More importantly, they highlight that the gap between the likelihood the market ascribes to a recession and the probability implied by the data has become quite large, meaning a downturn would be that more impactful on asset prices.

Stocks have been defying the very negative message from leading economic data for some time now.

The chart below shows the large divergence between the S&P and the ratio of the Conference Board’s Leading and Coincident Indexes. This also demonstrates that stocks have not insignificant potential downside if a recession suddenly looks more likely. (And when they happen, they tend to happen quickly.)

Stocks are also likely to run up against resistance from volatility trading.

The S&P rallied Tuesday but hit resistance at 4,500.

This is not uncoincidentally where there is a “call wall,” i.e. the strike where there is there is the most amount of calls outstanding. Option dealers have to sell at the strike to dynamically hedge.

We could break through the wall, but the more fevered option trading we have seen in recent months – fueling the market’s rally – is dying down. Call skew became elevated, but is now clearly rolling over.

As a result gamma has been falling fast. On some banks’ estimates it is already negative, while Squeezemetrics’ Gamma Index has fallen quite rapidly and is now close to negative territory.

Negative gamma results in a more unstable market, with downside bias as option dealers’ short put-inventory becomes closer to the money.

With low volatility, more instability, and pricing that is not expectant of a near-term recession, risks are mounting for equities.

Loading…