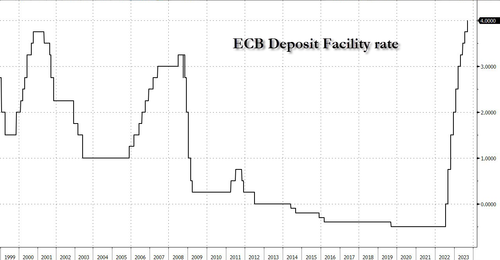

As we previewed earlier, while the ECB decision was a tough call and while pure mathematical consensus expected no hike today, moments ago the ECB surprised the consensus (if not our readers) with what is most likely the final rate hike, when it raised all three deposits rates by 25bps (and the key Deposit rate for the 10th consecutive time to a record 4.00%) because while "inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points."

Explaining its decision, the ECB said that the "rate increase today reflects the Governing Council's assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission."

The ECB also said that "the Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary" and "will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction." In particular, "interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission."

Here is a redline comparison of the latest two statements:

Some more commentary on rates:

- Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.

- The Governing Council's past interest rate increases continue to be transmitted forcefully.

- The Governing Council's future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.

- The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

- Governing Council's interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

On Inflation:

- Underlying price pressures remain high, even though most indicators have started to ease

Forecasts:

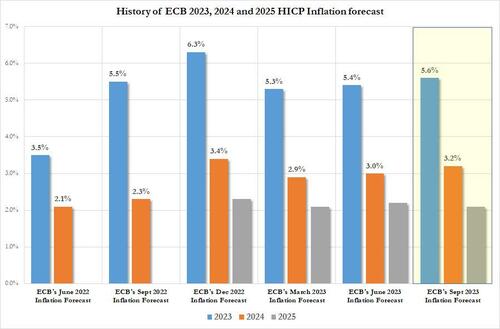

- Core inflation seen at 5.1% in 2023 (prev. 5 1%), 2.9% in 2024 (prev. 3.0%) and 2.2% in 2025 (prev. 2.3%).

- Headline inflation to average 5.6% in 2023 (prev. 5.4%), 3.2% in 2024 (prev. 3.0%) and 2.1% in 2025 (prev. 2.2%).

- Expect the economy to grow 0.7% in 2023 (prev. 0.9%). 1.0% in 2024 (prev. 1.5%) and 1.5% in 2025 (prev. 1.6%).

PEPP Purchases:

- As concerns the PEPP the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024

As the FT notes, the council’s decision was the most consequential for more than a year, with more dovish members pointing to signs of weaker growth, slowing bank lending, a cooling labour market and falling inflation to argue for a pause. But hawks worried inflation was still too high.

ECB hiking rates into a stagflationary recession. pic.twitter.com/TGHxTrsS3M

— zerohedge (@zerohedge) September 14, 2023

Thursday’s decision takes the ECB deposit rate above the previous record high in 2001, when rate-setters raised borrowing costs to boost the value of the newly launched euro. The decision also shows policymakers remain more worried about the risk of consumer price growth staying above target than the danger of a sharp economic downturn.

Economists have trimmed eurozone growth forecasts in recent weeks after industrial production and retail sales fell in July and business surveys pointed to a further downturn in August. Rate-setters think slowing economic activity is likely to cool price pressures.

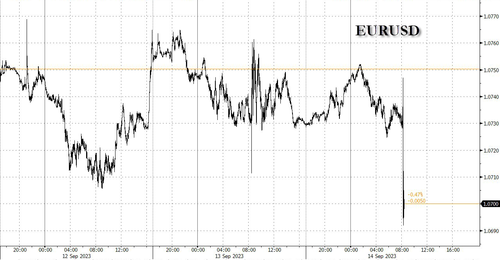

And with Europe already edging into a stagflationary recession, the kneejerk reaction in the EURUSD was to tumble, on expectations that the European recession will only go from bad to worse and force the ECB to cut rates that much faster.

As we previewed earlier, while the ECB decision was a tough call and while pure mathematical consensus expected no hike today, moments ago the ECB surprised the consensus (if not our readers) with what is most likely the final rate hike, when it raised all three deposits rates by 25bps (and the key Deposit rate for the 10th consecutive time to a record 4.00%) because while “inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points.”

Explaining its decision, the ECB said that the “rate increase today reflects the Governing Council’s assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.“

The ECB also said that “the Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary” and “will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.” In particular, “interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.”

Here is a redline comparison of the latest two statements:

Some more commentary on rates:

- Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.

- The Governing Council’s past interest rate increases continue to be transmitted forcefully.

- The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.

- The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

- Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

On Inflation:

- Underlying price pressures remain high, even though most indicators have started to ease

Forecasts:

- Core inflation seen at 5.1% in 2023 (prev. 5 1%), 2.9% in 2024 (prev. 3.0%) and 2.2% in 2025 (prev. 2.3%).

- Headline inflation to average 5.6% in 2023 (prev. 5.4%), 3.2% in 2024 (prev. 3.0%) and 2.1% in 2025 (prev. 2.2%).

- Expect GDP to grow 0.7% in 2023 (prev. 0.9%). 1.0% in 2024 (prev. 1.5%) and 1.5% in 2025 (prev. 1.6%).

PEPP Purchases:

- As concerns the PEPP the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024

As the FT notes, the council’s decision was the most consequential for more than a year, with more dovish members pointing to signs of weaker growth, slowing bank lending, a cooling labour market and falling inflation to argue for a pause. But hawks worried inflation was still too high.

ECB hiking rates into a stagflationary recession. pic.twitter.com/TGHxTrsS3M

— zerohedge (@zerohedge) September 14, 2023

Thursday’s decision takes the ECB deposit rate above the previous record high in 2001, when rate-setters raised borrowing costs to boost the value of the newly launched euro. The decision also shows policymakers remain more worried about the risk of consumer price growth staying above target than the danger of a sharp economic downturn.

Economists have trimmed eurozone growth forecasts in recent weeks after industrial production and retail sales fell in July and business surveys pointed to a further downturn in August. Rate-setters think slowing economic activity is likely to cool price pressures.

And with Europe already edging into a stagflationary recession, the kneejerk reaction in the EURUSD was to tumble, on expectations that the European recession will only go from bad to worse and force the ECB to cut rates that much faster.

Loading…