By Bre Bradham, Bloomberg markets live reporter and analyst

When US banks kick off the third-quarter earnings season Friday, it will mark the first in a long line of hurdles the group needs to clear in order to assuage investor fears.

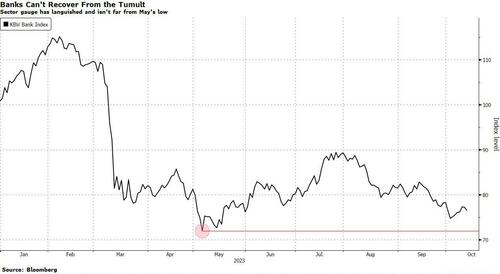

Bank stocks are hovering near the lowest level of the year, a mark hit in May following First Republic Bank’s collapse. The KBW Bank Index has tumbled 24% this year, a sharp underperformance to the S&P 500 Index’s 13% gain. Five of the largest US banks, excluding JPMorgan Chase & Co., have combined to lose about $100 billion in market capitalization this year.

“Investors in the bank space just have about a half-dozen issues that are out there that need to get resolved to their better satisfaction,” Piper Sandler analyst R. Scott Siefers said.

Among the challenges are new regulatory proposals that would impose higher capital requirements on banks, unrealized losses in their securities’ portfolios and rising bad loan write-offs. The demise of three banks in the S&P 500 earlier this year is also still fresh in investors’ minds.

The sector fell 1% on Thursday, underperforming the broader market as yields climbed.

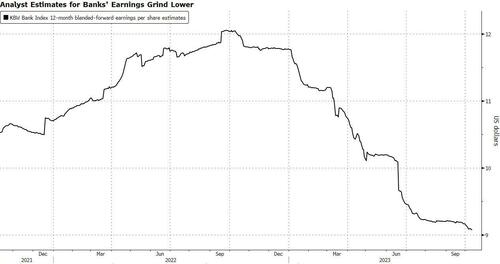

“Investors are sort of looking at things and saying, the spring was an actual crisis with three large bank failures. The summer was downward estimates revisions due to interest rates and funding pressures, and now you’re telling me we’re on the cusp of a potential credit cycle,” Siefers said. “The industry is in sort of a show-me phase right now.”

The weakness in recent weeks has been driven in part by concerns over unrealized losses due to rising bond yields. With the Federal Reserve’s path of interest-rate hikes remaining uncertain and instances of bank charge-offs due to borrower distress emerging, investors will likely remain bolted to the sidelines.

“Third-quarter is not likely to flip a switch from good to bad, but it is likely to affirm an upward progression of loan losses from what’s been unusually favorable levels,” Wells Fargo analyst Mike Mayo said about credit.

For Keefe, Bruyette & Woods analyst Christopher McGratty, it’s going to take time to get more constructive on bank stocks. The market can’t account for credit weakness until it can get a sense of just how deep it will run.

“There’s a high degree of unpredictability,” said McGratty. His firm has a market-weight stance on the sector.

Meanwhile, banks’ net interest income results will be in focus amid the higher deposit costs, as firms continue to compete for business amid the tumult sparked by the collapses of regional lenders like Silicon Valley Bank in March. JPMorgan, one of the first firms scheduled to report third-quarter results on Friday, is expected to be an NII outlier among its biggest peers because of its acquisition of First Republic.

Shares of the nation’s biggest bank gained more than 8% this year, adding $30 billion in market capitalization. That’s made JPMorgan roughly twice as big as the second-largest US bank by market value, Bank of America Corp.

Analysts expect guidance to reflect relative stability, following downward revisions from many banks over the summer.

Of course, the uncertainties could be resolved in a favorable way to banks. The Fed could engineer a soft landing, rate cuts could alleviate deposit costs and final versions of regulatory proposals may be tempered.

Given that the sector’s trading at such cheap valuations, some analysts have argued for investors to take a stock-picking approach. Others warn the group has become woefully undervalued and poised for a bounce. Earnings season will bring “micro” factors to “center stage” and banks could outperform, according to Citi analysts.

“Large-cap banks appear materially oversold,” UBS analyst Erika Najarian wrote in a note recently. “Once again, stocks are reflecting what we think are unwarranted existential concerns, rather than the fundamental issues.”

By Bre Bradham, Bloomberg markets live reporter and analyst

When US banks kick off the third-quarter earnings season Friday, it will mark the first in a long line of hurdles the group needs to clear in order to assuage investor fears.

Bank stocks are hovering near the lowest level of the year, a mark hit in May following First Republic Bank’s collapse. The KBW Bank Index has tumbled 24% this year, a sharp underperformance to the S&P 500 Index’s 13% gain. Five of the largest US banks, excluding JPMorgan Chase & Co., have combined to lose about $100 billion in market capitalization this year.

“Investors in the bank space just have about a half-dozen issues that are out there that need to get resolved to their better satisfaction,” Piper Sandler analyst R. Scott Siefers said.

Among the challenges are new regulatory proposals that would impose higher capital requirements on banks, unrealized losses in their securities’ portfolios and rising bad loan write-offs. The demise of three banks in the S&P 500 earlier this year is also still fresh in investors’ minds.

The sector fell 1% on Thursday, underperforming the broader market as yields climbed.

“Investors are sort of looking at things and saying, the spring was an actual crisis with three large bank failures. The summer was downward estimates revisions due to interest rates and funding pressures, and now you’re telling me we’re on the cusp of a potential credit cycle,” Siefers said. “The industry is in sort of a show-me phase right now.”

The weakness in recent weeks has been driven in part by concerns over unrealized losses due to rising bond yields. With the Federal Reserve’s path of interest-rate hikes remaining uncertain and instances of bank charge-offs due to borrower distress emerging, investors will likely remain bolted to the sidelines.

“Third-quarter is not likely to flip a switch from good to bad, but it is likely to affirm an upward progression of loan losses from what’s been unusually favorable levels,” Wells Fargo analyst Mike Mayo said about credit.

For Keefe, Bruyette & Woods analyst Christopher McGratty, it’s going to take time to get more constructive on bank stocks. The market can’t account for credit weakness until it can get a sense of just how deep it will run.

“There’s a high degree of unpredictability,” said McGratty. His firm has a market-weight stance on the sector.

Meanwhile, banks’ net interest income results will be in focus amid the higher deposit costs, as firms continue to compete for business amid the tumult sparked by the collapses of regional lenders like Silicon Valley Bank in March. JPMorgan, one of the first firms scheduled to report third-quarter results on Friday, is expected to be an NII outlier among its biggest peers because of its acquisition of First Republic.

Shares of the nation’s biggest bank gained more than 8% this year, adding $30 billion in market capitalization. That’s made JPMorgan roughly twice as big as the second-largest US bank by market value, Bank of America Corp.

Analysts expect guidance to reflect relative stability, following downward revisions from many banks over the summer.

Of course, the uncertainties could be resolved in a favorable way to banks. The Fed could engineer a soft landing, rate cuts could alleviate deposit costs and final versions of regulatory proposals may be tempered.

Given that the sector’s trading at such cheap valuations, some analysts have argued for investors to take a stock-picking approach. Others warn the group has become woefully undervalued and poised for a bounce. Earnings season will bring “micro” factors to “center stage” and banks could outperform, according to Citi analysts.

“Large-cap banks appear materially oversold,” UBS analyst Erika Najarian wrote in a note recently. “Once again, stocks are reflecting what we think are unwarranted existential concerns, rather than the fundamental issues.”

Loading…