Authored by Lance Roberts via RealInvestmentAdvice.com,

As the “soft landing” narrative grows, the risk of a “crisis” event in the economy increases. Will the Fed trigger another crisis event? While unknown, the risk seems likely as the Fed’s “higher for longer” narrative is compromised by lagging economic data.

Such is a question worth asking as we look back at the Fed’s history of previous monetary actions. Such was a topic I discussed in “Investors Push Risk Bets.” To wit:

“With the entirety of the financial ecosystem more heavily levered than ever, the “instability of stability” is the most significant risk.

The ‘stability/instability paradox’ assumes all players are rational and implies avoidance of destruction. In other words, all players will act rationally, and no one will push ‘the big red button.’

The Fed is highly dependent on this assumption. After more than 13-years of the most unprecedented monetary policy program in U.S. history, they are attempting to navigate the risks built up in the system.“

Historically, when the Fed hikes interest rates and yield curves invert, someone inevitability pushes the “big red button.”

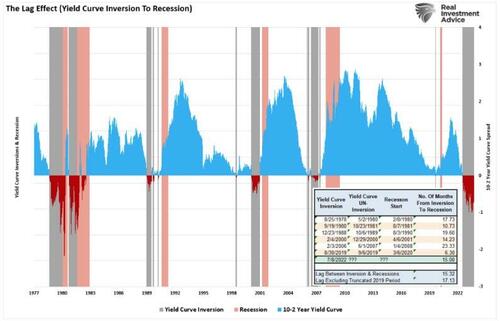

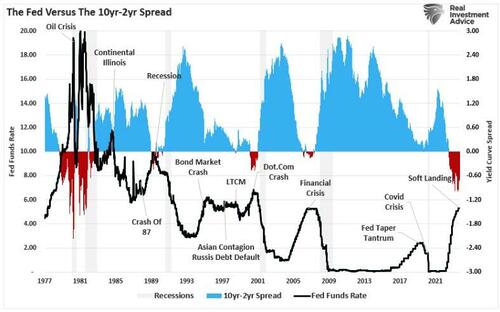

But that is also the fallacy in the 1995 “soft landing” scenario the media is currently pinning its hopes on. Indeed, the economy did not slip into a recession; however, there were crisis events along the way. More importantly, the yield curve did not invert in 1995. However, it inverted in 1998, and a recession followed roughly 24 months later.

The chart above shows that yield curve inversions occur roughly 10-24 months before recognizing a recession or crisis event. This is because it takes time for the “lag effect” of higher borrowing costs to negatively impact the economy.

While the Fed hopes individuals will act rationally as they tighten monetary policy, investors tend not to act that way. But what the markets are likely missing is that we are not just talking about the Fed’s monetary policy decisions in isolation.

A Collision Of Events

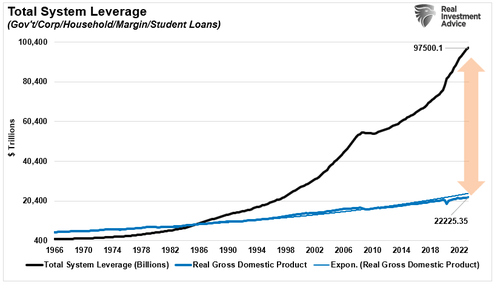

We currently live in the most highly leveraged economic era in U.S. history. As of Q2 of 2023, the total measurable leverage in the economy is $97 Trillion. The entire economy is currently at $22.2 Trillion, so it requires $4.36 in debt for each $1 of economic growth. Critically, that level of debt has nearly doubled since 2008, when it stood at $54 Trillion and the economy was roughly $16 Trillion in value. In other words, in just 13 years, the economic leverage rose from $3.38 per $1 of growth to $4.36. That massive surge in leverage was made possible by near-zero interest rates during that period.

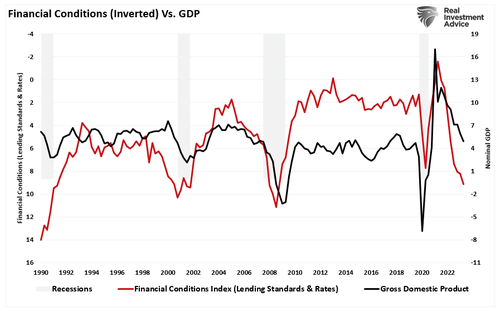

Given the financial system’s leverage, the collision of debt-financed activity with restrictive financial conditions will lead to weaker growth. Historically, such increases in financial conditions have always preceded recessionary onsets and crisis events. Notably, those events occurred at substantially lower levels of overall leverage.

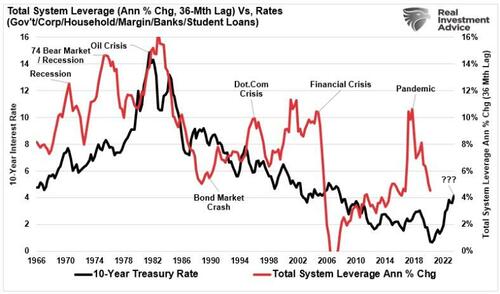

If we look at the annual rate of change in total system leverage versus changes in interest rates, we find about a 36-month lag from when rates increase to a crisis event. Given that rates started to rise in 2021, such suggests the next crisis event will occur later in 2024.

As noted above, confirmation of the timing of the next recession or crisis event in 2024 comes from the yield curve inversions. Historically, when yield curves invert, the media proclaims a recession is coming. However, when it doesn’t immediately manifest, they assume it’s “different this time.” We just aren’t there yet, as the “lag effect” has yet to take hold.

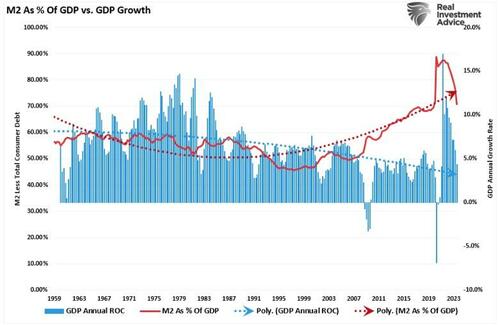

Due to the amount of “stimulus” injected into the economy and the still elevated levels of money supply as a percentage of the economy, the recessionary onset likely will be akin to the 2006 episode.

Simply, just because the collision of higher borrowing costs, reduced money supply, and slowing economic growth hasn’t caused a crisis or recession yet doesn’t mean it won’t.

The Risk Of A Policy Mistake Is Enormous

In “Rising Interest Rates Matter,” we discussed how a crisis event is possible if interest rates rise, the Fed tightens monetary policy, or the economic recovery falters.

“In the short term, the economy and markets (due to current momentum) can DEFY the laws of financial gravity as interest rates rise. However, they act as a ‘brake’ on economic activity as rates NEGATIVELY impact a highly levered economy:”

-

Rates increase debt servicing requirements, reducing future productive investment.

-

Housing slows. People buy payments, not houses.

-

Higher borrowing costs lead to lower profit margins.

-

The massive derivatives and credit markets get negatively impacted.

-

Variable rate interest payments on credit cards and home equity lines of credit increase.

-

Rising defaults on debt service will negatively impact banks.

-

Many corporate share buyback plans and dividend payments were accomplished using cheap debt.

-

Corporate capital expenditures are dependent on low borrowing costs.

-

The deficit/GDP ratio will soar as borrowing costs rise sharply.

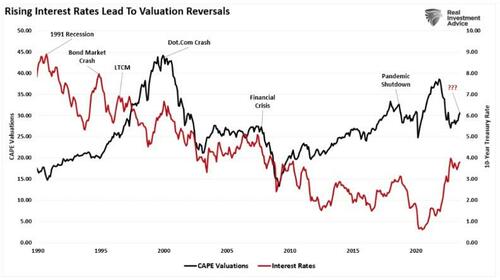

Most importantly, over the last decade, the primary rationalization for overpaying for equity ownership is that low rates justify high valuations. Unfortunately, with inflation elevated, which shrinks profit margins, and high interest rates, valuations are likely a more significant issue than most suspect.

“Investors should keep an eye on the risk of an abrupt shift from a relative valuation market mindset to an absolute valuation one. If that happens, you should stop worrying about the return on your capital and start worrying about the return of your capital.”

At the moment, we don’t know when the next “crisis event” will arrive.

However, it is only a function of time until the Fed’s “higher for longer” causes someone to push the “big red button.”

Authored by Lance Roberts via RealInvestmentAdvice.com,

As the “soft landing” narrative grows, the risk of a “crisis” event in the economy increases. Will the Fed trigger another crisis event? While unknown, the risk seems likely as the Fed’s “higher for longer” narrative is compromised by lagging economic data.

Such is a question worth asking as we look back at the Fed’s history of previous monetary actions. Such was a topic I discussed in “Investors Push Risk Bets.” To wit:

“With the entirety of the financial ecosystem more heavily levered than ever, the “instability of stability” is the most significant risk.

The ‘stability/instability paradox’ assumes all players are rational and implies avoidance of destruction. In other words, all players will act rationally, and no one will push ‘the big red button.’

The Fed is highly dependent on this assumption. After more than 13-years of the most unprecedented monetary policy program in U.S. history, they are attempting to navigate the risks built up in the system.“

Historically, when the Fed hikes interest rates and yield curves invert, someone inevitability pushes the “big red button.”

But that is also the fallacy in the 1995 “soft landing” scenario the media is currently pinning its hopes on. Indeed, the economy did not slip into a recession; however, there were crisis events along the way. More importantly, the yield curve did not invert in 1995. However, it inverted in 1998, and a recession followed roughly 24 months later.

The chart above shows that yield curve inversions occur roughly 10-24 months before recognizing a recession or crisis event. This is because it takes time for the “lag effect” of higher borrowing costs to negatively impact the economy.

While the Fed hopes individuals will act rationally as they tighten monetary policy, investors tend not to act that way. But what the markets are likely missing is that we are not just talking about the Fed’s monetary policy decisions in isolation.

A Collision Of Events

We currently live in the most highly leveraged economic era in U.S. history. As of Q2 of 2023, the total measurable leverage in the economy is $97 Trillion. The entire economy is currently at $22.2 Trillion, so it requires $4.36 in debt for each $1 of economic growth. Critically, that level of debt has nearly doubled since 2008, when it stood at $54 Trillion and the economy was roughly $16 Trillion in value. In other words, in just 13 years, the economic leverage rose from $3.38 per $1 of growth to $4.36. That massive surge in leverage was made possible by near-zero interest rates during that period.

Given the financial system’s leverage, the collision of debt-financed activity with restrictive financial conditions will lead to weaker growth. Historically, such increases in financial conditions have always preceded recessionary onsets and crisis events. Notably, those events occurred at substantially lower levels of overall leverage.

If we look at the annual rate of change in total system leverage versus changes in interest rates, we find about a 36-month lag from when rates increase to a crisis event. Given that rates started to rise in 2021, such suggests the next crisis event will occur later in 2024.

As noted above, confirmation of the timing of the next recession or crisis event in 2024 comes from the yield curve inversions. Historically, when yield curves invert, the media proclaims a recession is coming. However, when it doesn’t immediately manifest, they assume it’s “different this time.” We just aren’t there yet, as the “lag effect” has yet to take hold.

Due to the amount of “stimulus” injected into the economy and the still elevated levels of money supply as a percentage of the economy, the recessionary onset likely will be akin to the 2006 episode.

Simply, just because the collision of higher borrowing costs, reduced money supply, and slowing economic growth hasn’t caused a crisis or recession yet doesn’t mean it won’t.

The Risk Of A Policy Mistake Is Enormous

In “Rising Interest Rates Matter,” we discussed how a crisis event is possible if interest rates rise, the Fed tightens monetary policy, or the economic recovery falters.

“In the short term, the economy and markets (due to current momentum) can DEFY the laws of financial gravity as interest rates rise. However, they act as a ‘brake’ on economic activity as rates NEGATIVELY impact a highly levered economy:”

-

Rates increase debt servicing requirements, reducing future productive investment.

-

Housing slows. People buy payments, not houses.

-

Higher borrowing costs lead to lower profit margins.

-

The massive derivatives and credit markets get negatively impacted.

-

Variable rate interest payments on credit cards and home equity lines of credit increase.

-

Rising defaults on debt service will negatively impact banks.

-

Many corporate share buyback plans and dividend payments were accomplished using cheap debt.

-

Corporate capital expenditures are dependent on low borrowing costs.

-

The deficit/GDP ratio will soar as borrowing costs rise sharply.

Most importantly, over the last decade, the primary rationalization for overpaying for equity ownership is that low rates justify high valuations. Unfortunately, with inflation elevated, which shrinks profit margins, and high interest rates, valuations are likely a more significant issue than most suspect.

“Investors should keep an eye on the risk of an abrupt shift from a relative valuation market mindset to an absolute valuation one. If that happens, you should stop worrying about the return on your capital and start worrying about the return of your capital.”

At the moment, we don’t know when the next “crisis event” will arrive.

However, it is only a function of time until the Fed’s “higher for longer” causes someone to push the “big red button.”

Loading…