As happens every quarter, moments ago JPM - the largest US bank - officially fired the starting gun on Q3 earnings season when it reported earnings which - courtesy of the bank's taxpayer-funded g(r)ift of First Republic earlier this year - were stellar, beating on the top and bottom line, and despite some weakness (in equity sales and trading) and some gloomy comments from CEO Jamie Dimon, were well received by the market: it is the other US banks, and especially the smaller ones, that are a far more concerning prospect, while JPM once again validates its "fortress balance sheet" especially with the benefit of the recent taxpayer-funded fortressization in the form of acquiring all First Republic good assets.

First, here is a summary of what the bank just reported, courtesy of Bloomberg:

- JPMorgan lifted its full-year NII outlook to $89 billion from $87 billion (excluding markets).

- Full-year expenses will be down slightly from an earlier estimate ($84 billion vs $84.5 billion).

- Investment banking revenue topped analyst estimates, driven by Fixed Income trading and advisory revenue beats.

- Jamie Dimon & Co. are not done with their campaign to water down new capital rules. They say they will be hit harder than what regulators are advertising.

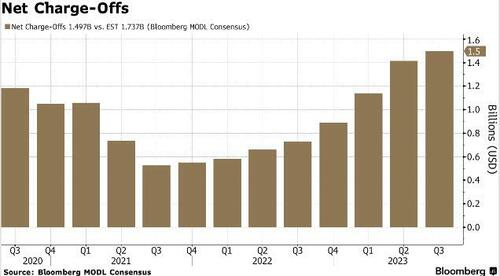

- There were $1.5 billion of net charge-offs, and a surprise net reserve release of $113 million.

- The bank is still sanguine about the US consumer but increasingly concerned about the impact from the situation unfolding in the Middle East as well as the continuing war in Ukraine.

- The purchase of First Republic added another $1.1 billion to JPMorgan’s net income.

Now, let's turn to the details, by taking a closer look at what the bank just reported for the just concluded third quarter, where the bank beat expectations across the board:

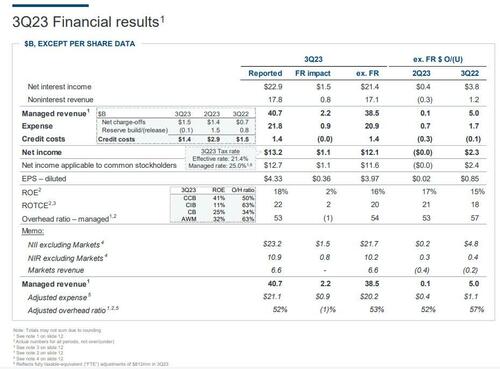

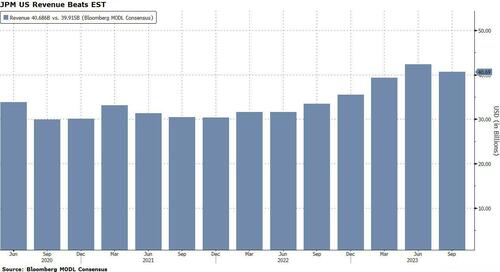

- Q3 Adjusted Revenue $40.686 billion, beating exp. $39.92 billion, and vs $33.491 billion a year ago

- Q3 Unadjusted revenue $39.874 billion, Exp. $39.645 billion, and vs $32.716 billion a year ago

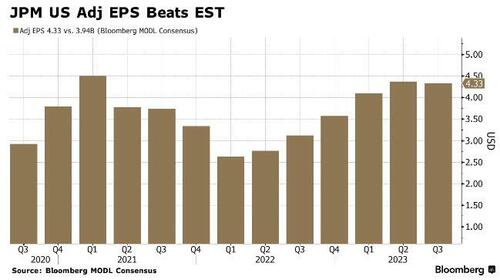

- Q3 Net Income $13.2 billion and EPS $4.33, beating exp. $3.94, and vs $3.12 Y/Y (the bank's effective rate was 21.4%, much lower than a “managed rate” of 25%)

- Significant items included $669 million in pretax securities losses in Corporate ($0.17 in EPS terms) and $665 million in pretax legal expenses ($0.22 in EPS terms).

- Provision for credit losses $1.38 billion, below the estimate $2.49 billion

- Net Charge offs more than doubled to $1.497 billion from $727 million YoY, which however was below the expected $1.74 billion

- The big surprise here is that offsetting the spike in charge offs was a release in loan loss Reserves of $113 million; virtually everyone was expecting a reserve build!

- Return on equity 18%, beating the estimate 16%

- Return on tangible common equity 22%, beating the estimate 19.7%

- Tangible book value per share $82.04

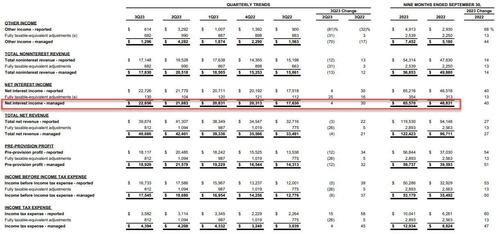

Courtesy of the First Republic handout and other beneficial factor, JPM reported another record Net Interest Income quarter, which rose to $22.9 billion, beating estimates and far above the $17.6 billion one year ago.

Looking at the balance sheet, JPM reported:

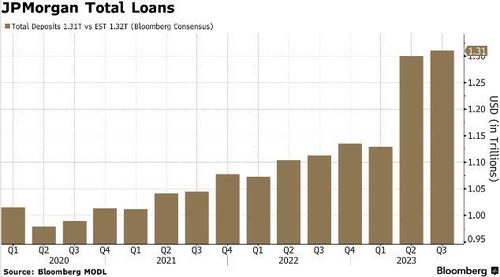

- Loans: Average loans of $1.31T, below exp. $1.32 trillion, up 17% YoY and 5% QoQ

- Deposits: average deposits of $2.38T, below exp. $2.37 trillion, down 4% YoY and 1% QoQ, as QT continues as shrinks bank balance sheets

- CET1 capital of $242BN

- Standardized CET1 capital ratio of 14.3%; Advanced CET1 capital ratio of 14.5%

As usual, the bank was quite generous in distributing shareholder capital in the form of:

- Common dividend of $3.1B or $1.05 per share

- $2.0B of common stock net repurchases

- An LTM net payout of 35%

We already mentioned it above, but let’s look a little closer into the $1.4 billion provision for credit losses, which as shown above, reflects $1.5 billion of net charge-offs and a net reserve release of $113 million. As the bank notes, “the net reserve release in Wholesale of $184 million was predominantly driven by the impact of net lending activity in CIB,” while “the net reserve build in Consumer of $58 million included a net build of $301 million in Card Services, predominantly offset by a net release of $250 million in Home Lending.” In other words, as Bloomberg notes, cards is going to be a big deal this morning: “Net charge-offs of $1.5 billion were up $770 million, predominantly driven by Card Services.”

Some more observations on the bank's loan losses from BBG's Max Abelson:

We have to start, of course, inside CCB, where there was “a net reserve build of $47 million, including a net build of $301 million in Card Services and a net release of $250 million in Home Lending.”

Why? “The net reserve build in Card Services was driven by loan growth, including increases in revolving balances, largely offset by changes in the macroeconomic outlook and reduced borrower uncertainty. The net reserve release in Home Lending was driven by improvements in the outlook for home prices. Net charge-offs of $1.4 billion were up $720 million, predominantly driven by continued normalization in Card Services.”

Inside the CIB, the net benefit of $185 million reflected “a net reserve release of $230 million, driven by the impact of net lending activity and changes in the central scenario.” What does that central scenario entail? I’m curious.

One more: “The net reserve build of $37 million” inside CB “was driven by updates to certain commercial real estate pricing variables, largely offset by other changes in the central scenario and the impact of net lending activity.”

Commenting on the results, CEO Jamie Dimon said US consumers and businesses generally remain healthy, but consumers are beginning to spend down their excess cash buffers.

He also said "persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here".

Dimon said: "The war in Ukraine compounded by last week’s attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades."

Dimon also warned that "the war in Ukraine compounded by last week's attacks on Israel may have far- reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades."

The CEO cited the bank’s “total loss-absorbing capacity (equity plus long-term debt)” of $496 billion as “formidable,” in the same sentence that he cites $1.3 trillion of loans, “which are our riskiest assets.” As for Liquidity, it is “Extraordinarily high,” he writes, citing $1.4 trillion of cash and marketable securities.

Finally, Dimon cautioned that the good times may not last for ever: “we acknowledge that these results benefit from our over-earning on both net interest income and below normal credit costs, both of which will normalize over time.”

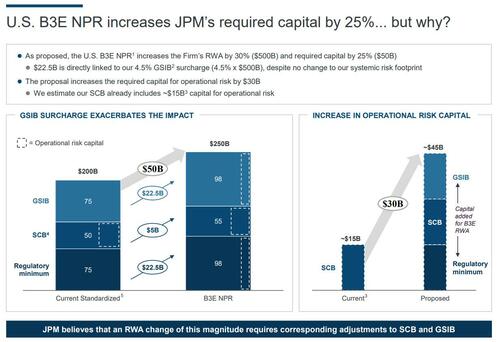

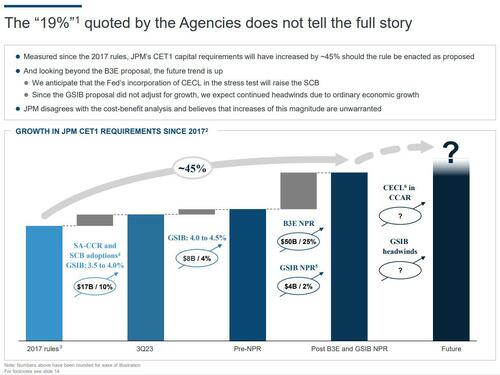

As has been often the case in recent months, JPM - which again is the largest US bank and perhaps the most systemically important bank int he world and benefits unduly from any and every small bank failure - once again lamented the impact of the proposed Basel 3 capital rules which according to JPM, will increase the bank's required capital by 25%, something the bank is clearly not happy with and dedicated not one but two slides in its presentation to address the coming changes.

Never once to mince his words, Dimon addressed this in his remarks saying that "looking ahead to Basel III finalization, we intend to adapt and manage to the new rules very quickly as we have shown in the past. However, we caution that such material regulatory changes would likely have real world consequences for markets and end users."

There was more: "additionally, we still do not know the longer-term consequences of quantitative tightening, which reduces liquidity in the system at a time when market-making capabilities are increasingly limited by regulations" Dimon said.

Bottom line, the bank said that "JPM disagrees with the cost-benefit analysis and believes that increases of this magnitude are unwarranted."

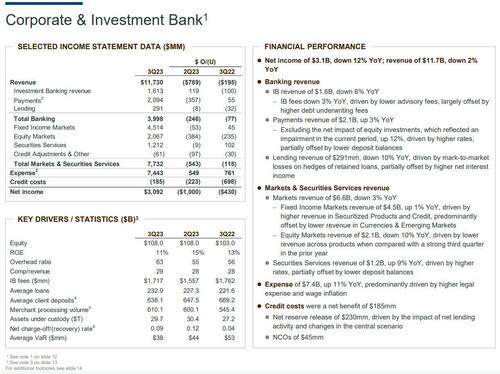

Turning now to the income statement, we first look at the bank's high margin investment banking business where the bank reported somewhat mixed results, beating on the top line thanks to strong fixed-income results which however were offset by a bigger-than-expected drop-off in equities results. At just $2.1 billion, the equities numbers are down 10% from a year ago. The expectation was just for a 2% drop. As for Investment Banking revenue, there was a modest positive surprise here because despite dropping by $100mm YoY to $1.613 billion, the number was above the exp. $1.48BN.

Here are some more details:

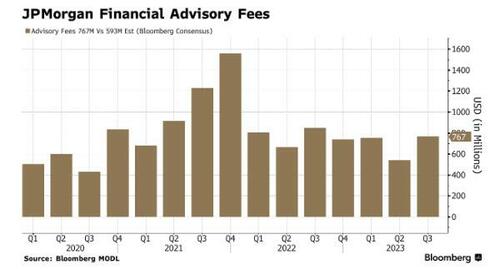

- IB revenue of $1.6B, down 6% YoY; IB fees down 3% YoY, "driven by lower advisory fees, largely offset by higher debt underwriting fees"

- JPM pulled in $767 million in advisory fees, perhaps underscoring some of the expectation that Q2 2023 might have been the trough of this investment banking cycle.

Jamie Dimon talked how the bank has gained market share this year in investment banking. That was a trend that was apparent through the first half on M&A Advisory but not so much when you take a live look at the league table. Per Bloomberg’s numbers, after missing out on a couple of recent biggies, JPM has now fallen to third place behind Goldman Sachs and Morgan Stanley on the M&A LEAG table.

In any case, turning to the all important markets section we read:

- Markets revenue of $6.58B, down 3% YoY and missing estimates of $6.63BN.

- Fixed Income Markets revenue of $4.5B, up 1% YoY, driven by higher revenue in Securitized Products and Credit, predominantly offset by lower revenue in Currencies & Emerging Markets

- Equity Markets revenue of $2.1B, down 10% YoY, driven by lower revenue across products when compared with a strong third quarter in the prior year

Meanwhile, expenses in the group rose 11% to $7.4B, " predominantly driven by higher legal expense and wage inflation."

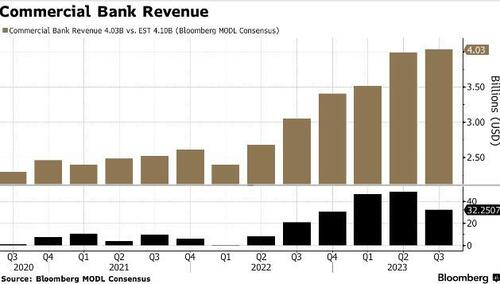

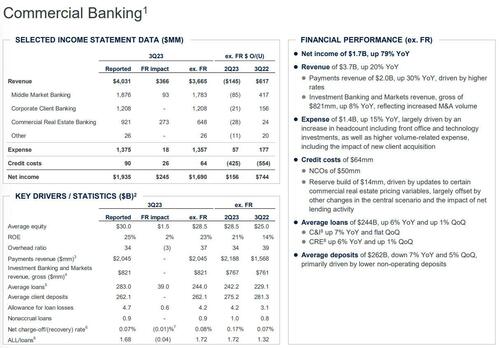

Turning to the commercial bank division, here revenue shot up 32%, and would still be up 20% excluding the First Republic numbers. Also, while at a firmwide level, JPM announced some reserve release, it did have some build in this segment, mainly tied to what it calls “certain commercial real estate pricing variables.” That amounts to about $37 million.

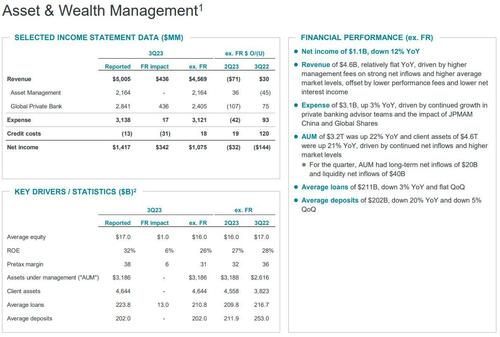

Finally, AUM in JPM’s Asset & Wealth Management division rose by a whopping 22%, to $3.2 trillion. This is a unit that contributed $5 billion in revenue, which at first glance is up 10%, but it is flat if one excludes the First Republic taxpayer gift "purchase" from earlier this year.

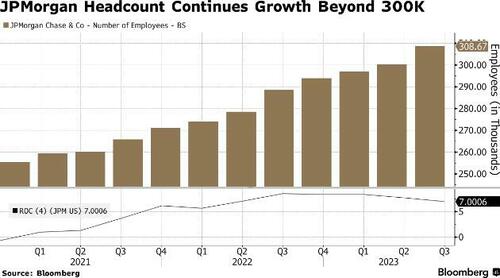

Taking a quick look at expenses, we of course have to note headcount which is always a big story, but will be bigger than normal, because JPMorgan’s $8.5 billion of expenses inside CCB (ex-First Republic) were up 7% year over year, partially “driven by higher compensation, including an increase in headcount,” just as the $1.4 billion of expenses inside CB were up 15%, “largely driven by an increase in headcount.”

So what’s the final headcount: JPMorgan’s roster stands at 308,669, up 3% from last quarter’s 300,066 and up 7% from last year’s 288,474. First Republic explains part, but not all, of that jump. This quarter’s number includes 4,774 people there who became employees in July.

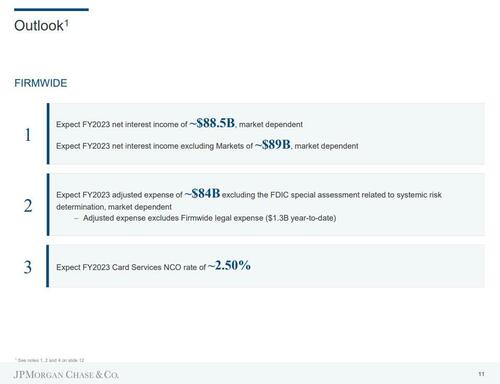

Finally, looking ahead, the biggest US bank said it now expects to generate $89 billion in net interest income this year; up from $87 billion last quarter. Some more details:

- Sees FY Adj. Expense About $84B, Saw About $84.5B

- Sees 2023 Card Services NCO Rate of About 2.50%

- Est SCB Includes ~$15B Capital for Operational Risk

- Had $2.0B of Common Stock Net Repurchases in 3Q

After initially dipping in premarket trading, JPM stock has since pushed to session higher, about 1.5% higher.

Commenting on JPM's and other banks results, Vital Knowledge's Adam Criasfuli writes:

“What bulls will say about bank earnings: The industry outperformed expectations thanks to ongoing NII tailwinds (especially for the large money centers, which have the most deposit pricing power), healthy credit quality and expense controls. Given how low the bar is for the industry, these results should be received very well.”

“What bears will say about bank earnings: No one expected Q3 numbers to be horrible (so the upside EPS results are nothing to celebrate), and all the big worries are still outstanding: NII benefits are peaking (or have already peaked) while credit deterioration will continue and the regulatory burden intensifies.”

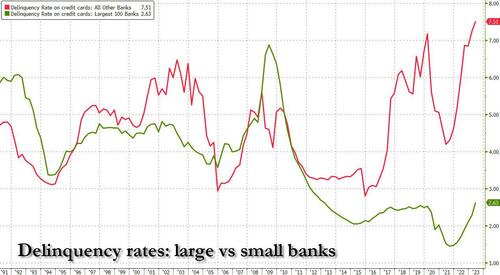

And while that may all be true about the big banks, just wait until the small banks start reporting - and then collapsing - once again which they will courtesy of record delinquency rate which is only going higher.

Here is the full JPM investor presentation (pdf link).

As happens every quarter, moments ago JPM – the largest US bank – officially fired the starting gun on Q3 earnings season when it reported earnings which – courtesy of the bank’s taxpayer-funded g(r)ift of First Republic earlier this year – were stellar, beating on the top and bottom line, and despite some weakness (in equity sales and trading) and some gloomy comments from CEO Jamie Dimon, were well received by the market: it is the other US banks, and especially the smaller ones, that are a far more concerning prospect, while JPM once again validates its “fortress balance sheet” especially with the benefit of the recent taxpayer-funded fortressization in the form of acquiring all First Republic good assets.

First, here is a summary of what the bank just reported, courtesy of Bloomberg:

- JPMorgan lifted its full-year NII outlook to $89 billion from $87 billion (excluding markets).

- Full-year expenses will be down slightly from an earlier estimate ($84 billion vs $84.5 billion).

- Investment banking revenue topped analyst estimates, driven by Fixed Income trading and advisory revenue beats.

- Jamie Dimon & Co. are not done with their campaign to water down new capital rules. They say they will be hit harder than what regulators are advertising.

- There were $1.5 billion of net charge-offs, and a surprise net reserve release of $113 million.

- The bank is still sanguine about the US consumer but increasingly concerned about the impact from the situation unfolding in the Middle East as well as the continuing war in Ukraine.

- The purchase of First Republic added another $1.1 billion to JPMorgan’s net income.

Now, let’s turn to the details, by taking a closer look at what the bank just reported for the just concluded third quarter, where the bank beat expectations across the board:

- Q3 Adjusted Revenue $40.686 billion, beating exp. $39.92 billion, and vs $33.491 billion a year ago

- Q3 Unadjusted revenue $39.874 billion, Exp. $39.645 billion, and vs $32.716 billion a year ago

- Q3 Net Income $13.2 billion and EPS $4.33, beating exp. $3.94, and vs $3.12 Y/Y (the bank’s effective rate was 21.4%, much lower than a “managed rate” of 25%)

- Significant items included $669 million in pretax securities losses in Corporate ($0.17 in EPS terms) and $665 million in pretax legal expenses ($0.22 in EPS terms).

- Provision for credit losses $1.38 billion, below the estimate $2.49 billion

- Net Charge offs more than doubled to $1.497 billion from $727 million YoY, which however was below the expected $1.74 billion

- The big surprise here is that offsetting the spike in charge offs was a release in loan loss Reserves of $113 million; virtually everyone was expecting a reserve build!

- Return on equity 18%, beating the estimate 16%

- Return on tangible common equity 22%, beating the estimate 19.7%

- Tangible book value per share $82.04

Courtesy of the First Republic handout and other beneficial factor, JPM reported another record Net Interest Income quarter, which rose to $22.9 billion, beating estimates and far above the $17.6 billion one year ago.

Looking at the balance sheet, JPM reported:

- Loans: Average loans of $1.31T, below exp. $1.32 trillion, up 17% YoY and 5% QoQ

- Deposits: average deposits of $2.38T, below exp. $2.37 trillion, down 4% YoY and 1% QoQ, as QT continues as shrinks bank balance sheets

- CET1 capital of $242BN

- Standardized CET1 capital ratio of 14.3%; Advanced CET1 capital ratio of 14.5%

As usual, the bank was quite generous in distributing shareholder capital in the form of:

- Common dividend of $3.1B or $1.05 per share

- $2.0B of common stock net repurchases

- An LTM net payout of 35%

We already mentioned it above, but let’s look a little closer into the $1.4 billion provision for credit losses, which as shown above, reflects $1.5 billion of net charge-offs and a net reserve release of $113 million. As the bank notes, “the net reserve release in Wholesale of $184 million was predominantly driven by the impact of net lending activity in CIB,” while “the net reserve build in Consumer of $58 million included a net build of $301 million in Card Services, predominantly offset by a net release of $250 million in Home Lending.” In other words, as Bloomberg notes, cards is going to be a big deal this morning: “Net charge-offs of $1.5 billion were up $770 million, predominantly driven by Card Services.”

Some more observations on the bank’s loan losses from BBG’s Max Abelson:

We have to start, of course, inside CCB, where there was “a net reserve build of $47 million, including a net build of $301 million in Card Services and a net release of $250 million in Home Lending.”

Why? “The net reserve build in Card Services was driven by loan growth, including increases in revolving balances, largely offset by changes in the macroeconomic outlook and reduced borrower uncertainty. The net reserve release in Home Lending was driven by improvements in the outlook for home prices. Net charge-offs of $1.4 billion were up $720 million, predominantly driven by continued normalization in Card Services.”

Inside the CIB, the net benefit of $185 million reflected “a net reserve release of $230 million, driven by the impact of net lending activity and changes in the central scenario.” What does that central scenario entail? I’m curious.

One more: “The net reserve build of $37 million” inside CB “was driven by updates to certain commercial real estate pricing variables, largely offset by other changes in the central scenario and the impact of net lending activity.”

Commenting on the results, CEO Jamie Dimon said US consumers and businesses generally remain healthy, but consumers are beginning to spend down their excess cash buffers.

He also said “persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here”.

Dimon said: “The war in Ukraine compounded by last week’s attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades.”

Dimon also warned that “the war in Ukraine compounded by last week’s attacks on Israel may have far- reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades.”

The CEO cited the bank’s “total loss-absorbing capacity (equity plus long-term debt)” of $496 billion as “formidable,” in the same sentence that he cites $1.3 trillion of loans, “which are our riskiest assets.” As for Liquidity, it is “Extraordinarily high,” he writes, citing $1.4 trillion of cash and marketable securities.

Finally, Dimon cautioned that the good times may not last for ever: “we acknowledge that these results benefit from our over-earning on both net interest income and below normal credit costs, both of which will normalize over time.”

As has been often the case in recent months, JPM – which again is the largest US bank and perhaps the most systemically important bank int he world and benefits unduly from any and every small bank failure – once again lamented the impact of the proposed Basel 3 capital rules which according to JPM, will increase the bank’s required capital by 25%, something the bank is clearly not happy with and dedicated not one but two slides in its presentation to address the coming changes.

Never once to mince his words, Dimon addressed this in his remarks saying that “looking ahead to Basel III finalization, we intend to adapt and manage to the new rules very quickly as we have shown in the past. However, we caution that such material regulatory changes would likely have real world consequences for markets and end users.”

There was more: “additionally, we still do not know the longer-term consequences of quantitative tightening, which reduces liquidity in the system at a time when market-making capabilities are increasingly limited by regulations” Dimon said.

Bottom line, the bank said that “JPM disagrees with the cost-benefit analysis and believes that increases of this magnitude are unwarranted.”

Turning now to the income statement, we first look at the bank’s high margin investment banking business where the bank reported somewhat mixed results, beating on the top line thanks to strong fixed-income results which however were offset by a bigger-than-expected drop-off in equities results. At just $2.1 billion, the equities numbers are down 10% from a year ago. The expectation was just for a 2% drop. As for Investment Banking revenue, there was a modest positive surprise here because despite dropping by $100mm YoY to $1.613 billion, the number was above the exp. $1.48BN.

Here are some more details:

- IB revenue of $1.6B, down 6% YoY; IB fees down 3% YoY, “driven by lower advisory fees, largely offset by higher debt underwriting fees”

- JPM pulled in $767 million in advisory fees, perhaps underscoring some of the expectation that Q2 2023 might have been the trough of this investment banking cycle.

Jamie Dimon talked how the bank has gained market share this year in investment banking. That was a trend that was apparent through the first half on M&A Advisory but not so much when you take a live look at the league table. Per Bloomberg’s numbers, after missing out on a couple of recent biggies, JPM has now fallen to third place behind Goldman Sachs and Morgan Stanley on the M&A LEAG table.

In any case, turning to the all important markets section we read:

- Markets revenue of $6.58B, down 3% YoY and missing estimates of $6.63BN.

- Fixed Income Markets revenue of $4.5B, up 1% YoY, driven by higher revenue in Securitized Products and Credit, predominantly offset by lower revenue in Currencies & Emerging Markets

- Equity Markets revenue of $2.1B, down 10% YoY, driven by lower revenue across products when compared with a strong third quarter in the prior year

Meanwhile, expenses in the group rose 11% to $7.4B, ” predominantly driven by higher legal expense and wage inflation.”

Turning to the commercial bank division, here revenue shot up 32%, and would still be up 20% excluding the First Republic numbers. Also, while at a firmwide level, JPM announced some reserve release, it did have some build in this segment, mainly tied to what it calls “certain commercial real estate pricing variables.” That amounts to about $37 million.

Finally, AUM in JPM’s Asset & Wealth Management division rose by a whopping 22%, to $3.2 trillion. This is a unit that contributed $5 billion in revenue, which at first glance is up 10%, but it is flat if one excludes the First Republic taxpayer gift “purchase” from earlier this year.

Taking a quick look at expenses, we of course have to note headcount which is always a big story, but will be bigger than normal, because JPMorgan’s $8.5 billion of expenses inside CCB (ex-First Republic) were up 7% year over year, partially “driven by higher compensation, including an increase in headcount,” just as the $1.4 billion of expenses inside CB were up 15%, “largely driven by an increase in headcount.”

So what’s the final headcount: JPMorgan’s roster stands at 308,669, up 3% from last quarter’s 300,066 and up 7% from last year’s 288,474. First Republic explains part, but not all, of that jump. This quarter’s number includes 4,774 people there who became employees in July.

Finally, looking ahead, the biggest US bank said it now expects to generate $89 billion in net interest income this year; up from $87 billion last quarter. Some more details:

- Sees FY Adj. Expense About $84B, Saw About $84.5B

- Sees 2023 Card Services NCO Rate of About 2.50%

- Est SCB Includes ~$15B Capital for Operational Risk

- Had $2.0B of Common Stock Net Repurchases in 3Q

After initially dipping in premarket trading, JPM stock has since pushed to session higher, about 1.5% higher.

Commenting on JPM’s and other banks results, Vital Knowledge’s Adam Criasfuli writes:

“What bulls will say about bank earnings: The industry outperformed expectations thanks to ongoing NII tailwinds (especially for the large money centers, which have the most deposit pricing power), healthy credit quality and expense controls. Given how low the bar is for the industry, these results should be received very well.”

“What bears will say about bank earnings: No one expected Q3 numbers to be horrible (so the upside EPS results are nothing to celebrate), and all the big worries are still outstanding: NII benefits are peaking (or have already peaked) while credit deterioration will continue and the regulatory burden intensifies.”

And while that may all be true about the big banks, just wait until the small banks start reporting – and then collapsing – once again which they will courtesy of record delinquency rate which is only going higher.

Here is the full JPM investor presentation (pdf link).

Loading…