By Irina Slav of OilPrice.com

The United States has slapped sanctions on two tanker owners for carrying Russian oil sold for over $60 per barrel.

This is the first time the U.S. is imposing sanctions for a breach of the price cap that the G7 and the European Union agreed to impose on Russia last year.

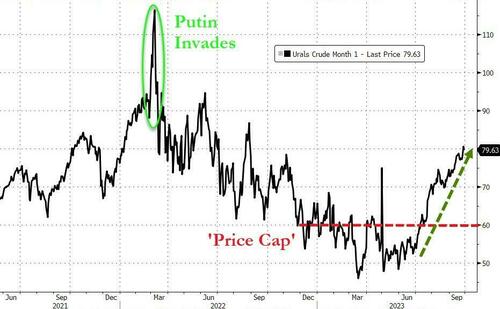

For several months, Russian crude traded lower than the price cap anyway, which made the cap easily enforceable. This year, however, as benchmark prices began to climb so did the prices for Russian crude, and by September the gap between the G7 price cap and the actual price at which Russian crude sold was over $20 per barrel.

Earlier this week, Treasury Secretary Janet Yellen said that the price cap on Russian oil has “significantly reduced Russian revenue over the last 10 months while promoting stable energy markets.” Yet it appears the cap has not reduced Russian revenue enough if further enforcement action was necessary.

One of the sanctioned companies is Turkish Ice Pearl Navigation, which, according to the Treasury, owns a vessel that carried Russian ESPO crude sold for over $80 per barrel.

The other company is based in the United Arab Emirates, called Lumber Marine SA, which owns a tanker that carried a cargo of Russian Novy Port crude that sold for over $75 per barrel, Reuters reported.

"Because of the actions we're announcing today, and the further actions we will take in the coming weeks and months, these costs will continue to rise and Russia's ability to sustain its barbaric war will continue to weaken," a Treasury official told media.

The International Monetary Fund has forecast Russia’s economy would grow by 2.2% this year—an upward revision from an earlier forecast for 1.5% growth. For the United States, the IMF has forecast growth of 2.1% for 2023.

By Irina Slav of OilPrice.com

The United States has slapped sanctions on two tanker owners for carrying Russian oil sold for over $60 per barrel.

This is the first time the U.S. is imposing sanctions for a breach of the price cap that the G7 and the European Union agreed to impose on Russia last year.

For several months, Russian crude traded lower than the price cap anyway, which made the cap easily enforceable. This year, however, as benchmark prices began to climb so did the prices for Russian crude, and by September the gap between the G7 price cap and the actual price at which Russian crude sold was over $20 per barrel.

Earlier this week, Treasury Secretary Janet Yellen said that the price cap on Russian oil has “significantly reduced Russian revenue over the last 10 months while promoting stable energy markets.” Yet it appears the cap has not reduced Russian revenue enough if further enforcement action was necessary.

One of the sanctioned companies is Turkish Ice Pearl Navigation, which, according to the Treasury, owns a vessel that carried Russian ESPO crude sold for over $80 per barrel.

The other company is based in the United Arab Emirates, called Lumber Marine SA, which owns a tanker that carried a cargo of Russian Novy Port crude that sold for over $75 per barrel, Reuters reported.

“Because of the actions we’re announcing today, and the further actions we will take in the coming weeks and months, these costs will continue to rise and Russia’s ability to sustain its barbaric war will continue to weaken,” a Treasury official told media.

The International Monetary Fund has forecast Russia’s economy would grow by 2.2% this year—an upward revision from an earlier forecast for 1.5% growth. For the United States, the IMF has forecast growth of 2.1% for 2023.

Loading…