By Ye Xie Bloomberg markets live reporter and analyst

Washington isn’t the only capital that is flooding the market with government bonds. Beijing is doing it too. A more-proactive fiscal expansion signals that Beijing isn’t entirely complacent about its current economic stability.

Inevitably, bond sales will suck up liquidity from the banking system. That may required the PBOC to offset the liquidity drain by lowering the reserve requirement ratio. If so, it would put a ceiling on the recent rise in bond yields.

US bond yields resumed their surge Wednesday after a five-year note auction met with poor demand. It underscored investors’ anxiety toward the anticipated increase of bond sales by the Treasury next week.

China’s bond market has also been pressured by supply lately, with 10-year yields rising to a five-month high. In a rare move, Beijing announced on Tuesday plans to issue additional sovereign debt worth 1 trillion yuan ($137 billion) to support disaster relief and construction.

The signaling effect of the move — which will send China’s budget deficit to a three-decade high — is more significant than the actual impact. Bloomberg Economics estimated the fiscal spending will only add 0.5 percentage point to GDP growth in 2024. Still, it shows that Beijing is concerned about the economic outlook amid the property crisis that’s claimed Country Garden as its latest victim.

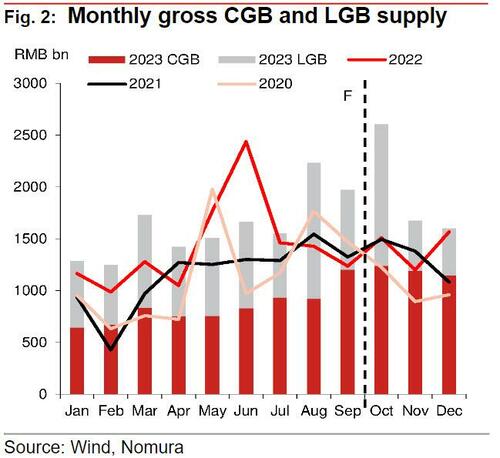

For the central bank, the immediate concern is to offer more funding to accommodate bond issuance. According to Nomura’s estimate, government issuance will amount to 5.9 trillion yuan in the fourth quarter, well above the 4.3 trillion in 2022 and an average of 2.8 trillion in three years through 2021.

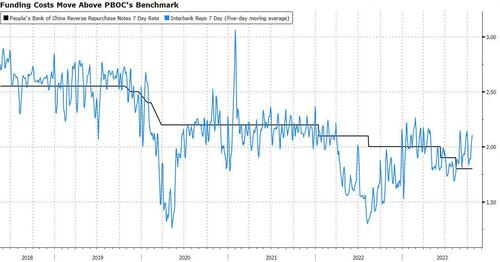

Liquidity conditions have already been tight. In recent weeks, the seven-day repo rate has been persistently trading well above the PBOC’s benchmark of 1.8%. Bloomberg also reported that one-year bank funding costs shot up above the PBOC’s MLF lending rate, an unusual occurrence since 2019.

So the consensus is looking for the PBOC to lower the RRR, unleashing more cash into the banking system, and potentially lower interest rates. Standard Chartered’s economists now call for 50bp cut in RRR by year-end, versus no reduction seen previously. Economists at Goldman Sachs expect a 25bp cut in RRR and a 10bp reduction in the policy rate in the fourth quarter.

Yields on 10-year bonds have increased 16 basis points since the PBOC’s last rate cut in August. If the PBOC pumps more liquidity into the market, it may put a lid on rising yields.

So the consensus is looking for the PBOC to lower the RRR, unleashing more cash into the banking system, and potentially lower interest rates. Standard Chartered’s economists now call for 50bp cut in RRR by year-end, versus no reduction seen previously. Economists at Goldman Sachs expect a 25bp cut in RRR and a 10bp reduction in the policy rate in the fourth quarter.

Yields on 10-year bonds have increased 16 basis points since the PBOC’s last rate cut in August. If the PBOC pumps more liquidity into the market, it may put a lid on rising yields.

By Ye Xie Bloomberg markets live reporter and analyst

Washington isn’t the only capital that is flooding the market with government bonds. Beijing is doing it too. A more-proactive fiscal expansion signals that Beijing isn’t entirely complacent about its current economic stability.

Inevitably, bond sales will suck up liquidity from the banking system. That may required the PBOC to offset the liquidity drain by lowering the reserve requirement ratio. If so, it would put a ceiling on the recent rise in bond yields.

US bond yields resumed their surge Wednesday after a five-year note auction met with poor demand. It underscored investors’ anxiety toward the anticipated increase of bond sales by the Treasury next week.

China’s bond market has also been pressured by supply lately, with 10-year yields rising to a five-month high. In a rare move, Beijing announced on Tuesday plans to issue additional sovereign debt worth 1 trillion yuan ($137 billion) to support disaster relief and construction.

The signaling effect of the move — which will send China’s budget deficit to a three-decade high — is more significant than the actual impact. Bloomberg Economics estimated the fiscal spending will only add 0.5 percentage point to GDP growth in 2024. Still, it shows that Beijing is concerned about the economic outlook amid the property crisis that’s claimed Country Garden as its latest victim.

For the central bank, the immediate concern is to offer more funding to accommodate bond issuance. According to Nomura’s estimate, government issuance will amount to 5.9 trillion yuan in the fourth quarter, well above the 4.3 trillion in 2022 and an average of 2.8 trillion in three years through 2021.

Liquidity conditions have already been tight. In recent weeks, the seven-day repo rate has been persistently trading well above the PBOC’s benchmark of 1.8%. Bloomberg also reported that one-year bank funding costs shot up above the PBOC’s MLF lending rate, an unusual occurrence since 2019.

So the consensus is looking for the PBOC to lower the RRR, unleashing more cash into the banking system, and potentially lower interest rates. Standard Chartered’s economists now call for 50bp cut in RRR by year-end, versus no reduction seen previously. Economists at Goldman Sachs expect a 25bp cut in RRR and a 10bp reduction in the policy rate in the fourth quarter.

Yields on 10-year bonds have increased 16 basis points since the PBOC’s last rate cut in August. If the PBOC pumps more liquidity into the market, it may put a lid on rising yields.

So the consensus is looking for the PBOC to lower the RRR, unleashing more cash into the banking system, and potentially lower interest rates. Standard Chartered’s economists now call for 50bp cut in RRR by year-end, versus no reduction seen previously. Economists at Goldman Sachs expect a 25bp cut in RRR and a 10bp reduction in the policy rate in the fourth quarter.

Yields on 10-year bonds have increased 16 basis points since the PBOC’s last rate cut in August. If the PBOC pumps more liquidity into the market, it may put a lid on rising yields.

Loading…