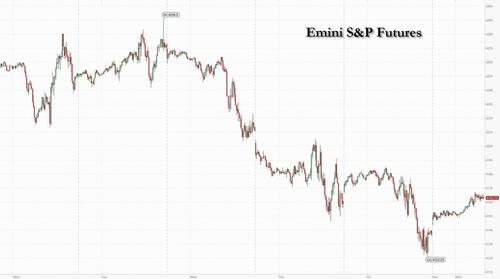

Ending a week that saw the S&P be the most overshorted in history, with Goldman PB reporting that its HF clients had shorted stocks for a record 12 consecutive weeks, it was inevitable that we would get an oversold bounce at some point and this morning we are seeing just that, with stocks in Europe broadly higher, and US equity futures also rising and reversing all of Friday's loss. As of 7:45am, S&P futures were higher by 0.7%, Nasdaq futures gained 0.8% and the Estoxx rose 0.8% in early London session with gains led by utilities and energy; WTI futures were lower by 1.1% on the day because the complacent market downplayed the Israeli ground offensive into Gaza as "less aggressive than feared." Ahead of a very busy week, JPM summarizes sentiment as follows: "are futures potentially setting up a relief rally into month-end or does the selling pressure continue with SPX under its 200dma." Gold slipped below $2,000 an ounce, the dollar dropped as bitcoin gained and ten-year Treasury yields resumed their grind higher to 4.86% ahead of today's Treasury issuance projections statement.

In premarket trading, HSBC was steady after the bank’s further share buyback of as much as $3 billion offset news of a pretax profit of $7.71 billion that fell short of analyst estimates. Cisco shares are little changed after the digital communications technology company was downgraded to market perform from outperform at Raymond James. Here are some other notable premarket movers:

- Coherus Biosciences shares surge 29% in premarket trading after the biotech company announced on Friday the US Food and Drug Administration had approved its cancer drug, Loqtorzi.

- ReAlpha Tech shares jump 23% as the property technology startup began its second week of trading following a direct listing on the Nasdaq last week.

As usual we start with geopolitics, where instead of a massive ground invasion, newsflow over the weekend revealed that the Israeli military has started slowly and according to Bloomberg, "so far there are few signs that the conflict will spread across the wider Middle East region" (the shekel took a pause from recent selling, gaining 0.4% at 4.0566 but remains the world’s worst-performing currency this month, recently hitting 11-year lows). That’s being seen as enough good news for investors to wade back into markets after last week’s sharp selloff, which sent the S&P 500 into a correction on Friday after the index closing 10% below a recent peak.

"The relatively contained operations over the weekend were perhaps a relief to markets, who are worried about other players being dragged into the conflict,” said James Rossiter, global head of macro strategy at TD Securities. “That should bode well for some risk assets. That said, there are definitely a few risk events for markets to chew on this week.”

Still, stocks globally have lost $12 trillion in value since the end of July - aka since the Fed's last rate hike - as concern mounts that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession. The S&P 500 entered a technical correction and Morgan Stanley strategist Michael Wilson said investors hoping for a boost to stocks by the end of the year will be disappointed.

The week also includes a slew of potentially market-moving events for investors to track, including central bank meetings in Japan, the US and the UK, while the US Treasury Department announces its quarterly bond sales plan. Concern that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession.

Government bonds have also tumbled, with 10-year Treasury yields hitting a 16-year high last week, despite signals from policy makers they’re “at or near” the end of rate hikes. Bond yields remain high even after the outbreak of the Israel-Hamas war three weeks ago – the kind of geopolitical flashpoint that can spur haven demand for Treasuries. On Monday, the Treasury will set the stage for its issuance plans with an update of quarterly borrowing estimates, and for its cash balance.

European stocks also rose, with the Stoxx 600 gaining 0.7% as all 20 sectors rise after data showed German inflation eased further, while its economy shrank in the third quarter, as Europe slides into its next recession. Travel & leisure and retail sectors the biggest gainers, while automotive shares gained the least. Siemens Energy is among top performers, rebounding after its board chairman moved to reassure investors over state aid concerns. Here are the most notable European movers:

- Siemens Energy rise as much as 17% after its supervisory board chairman said the renewables firm doesn’t need state money, following last week’s selloff on worries over it might need state aid

- Dassault Systemes gains as much as 3.9% after JPMorgan upgrades to overweight, saying the software firm’s license sales growth has improved and large deals have returned

- Clariant gains 3.1% after it reported adjusted Ebitda for the third quarter that beat estimates. Analysts say the Swiss specialty chemicals company reported a surprisingly strong performance

- Ascential gains as much as 38% after the UK media company proposes a sale of its digital commerce business to Omnicom Group, and to sell its consumer trend-spotting WGSN unit

- Erste Bank advances as much as 2.6%, the second-best performer on the Stoxx 600 Banks Index, after the Austrian lender raised its net interest income guidance for 2023

- TomTom shares jump as much as 8.1% after the navigation firm announced a €50 million buyback. ING says the buyback follows a strong set of results in the third quarter

- Glencore climbs after the natural resources company reaffirms its guidance for adjusted marketing pre-tax profit. Liberum says current trading is giving it a “sound footing” into year-end

- Rightmove gains as much as 4.3% after Berenberg upgrades to buy from hold and says concerns over increased competition for the property listings portal are overdone

- ArcelorMittal shares fall as much as 5.5% after the Kazakh government announced plans to take over the company’s operations in the country following its worst mining accident in recent history

- Merck KGaA shares drop as much as 5.2% to the lowest since May 2021, as analysts cut their price targets on the German biotech company ahead of next week’s results

Earlier in the session, Asian stocks declined as weak corporate earnings took center stage amid continued concerns over high US interest rates, geopoliitcal tensions and China’s economy.The MSCI Asia Pacific Index slid as much as 0.6%, with Toyota and Alibaba among the biggest drags.

- China's Shanghai Comp and the Hang Seng were both initially lower with financials pressured after mixed earnings from some of the large banks including China’s biggest commercial lender ICBC which posted flat profit for Q3, while there was turbulence in Evergrande shares owing to a wind-up hearing which was adjourned to December 4th. Nonetheless, the declines were stemmed in the mainland amid hopes of improving US-China ties after US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November.

- Japan was among the hardest hit, amid disappointing earnings from the likes of machinery maker Komatsu, while yields edged higher as the BoJ kick-started its 'live' 2-day policy meeting.

- Australia's ASX 200 was led lower by underperformance in energy and the top-weighted financial sector although the index moved off intraday lows as participants also digested stronger-than-expected Australian Retail Sales data.

- Indian stocks began the week with gains as buying in market heavyweights Reliance Industries and HDFC Bank helped the key gauges rebound from early losses amid a mixed trend in global equities. The S&P BSE Sensex rose 0.5% to 64,112.65 at the close in Mumbai, after falling as much as 0.6% soon after trading began. The NSE Nifty 50 Index rose by a similar measure. Last week, the Sensex’s relative strength index fell to oversold zone, suggesting a likelihood of a pullback.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Aussie is the strongest of the G-10 currencies after retail-sales data beat estimates, an outcome that may boost the Reserve Bank of Australia’s confidence that the economy can withstand further interest-rate hikes. The Swiss franc was the weakest. The recent rebound in the Aussie “is spurred by higher iron ore prices, rising expectations for the RBA to deliver one more rate hike,” strategists at Malayan Banking Bhd. led by Saktiandi Supaat wrote in a research note. “We see more room for upside than down” for AUD/USD, they said. The Swedish krona underperformed G10 counterparts after a flash estimate showed the economy was stagnant last quarter

In rates, treasuries were cheaper across the curve, with losses led by front and belly, unwinding a portion of Friday’s sharp 5s30s steepening move. US yields cheaper by up to 5.5bp across belly of the curve, with 5s30s spread flatter by 3bp on the day; 10-year yields around 4.88%, cheaper by 4bp vs. Friday close with bunds and gilts outperforming by 5.5bp and 2bp in the sector. Safe-haven demand eased for Treasuries, pushing yields slightly higher after the market lulled itself into complacency again, and instead of believing in a ceasefire any moment, today the narrative was that "Israel’s military action in Gaza proceeded more cautiously than anticipated." At this rate anything else that mushroom clouds will be bullish. Meanwhile, bunds are higher, the curve bull steepening as S&P futures advance, boosted by German state inflation readings that point to a lower-than-expected national CPI print later today. Data also showed the German economy shrank in the third quarter.

In commodities, oil prices fell, along with gold and Treasuries. WTI falls 1.2% to trade near $84.50. Spot gold drops 0.5%. Iron-ore futures traded in Singapore rose after posting their first weekly gain in more than a month amid optimism that China’s authorities will step up their efforts to support growth

US economic data includes October Dallas Fed manufacturing activity at 10:30 a.m. New York time; employment cost index, consumer confidence, manufacturing PMI, ADP employment change, ISM manufacturing, factory orders and jobs report also due this week. Fed officials are in self-imposed quiet period ahead of Nov. 1 rate decision; Treasury quarterly debt refunding announcement also due Nov. 1

Market Snapshot

- S&P 500 futures up 0.5% to 4,159.00

- MXAP down 0.3% to 151.72

- MXAPJ up 0.1% to 475.96

- Nikkei down 1.0% to 30,696.96

- Topix down 1.0% to 2,231.24

- Hang Seng Index little changed at 17,406.36

- Shanghai Composite up 0.1% to 3,021.55

- Sensex up 0.3% to 64,000.81

- Australia S&P/ASX 200 down 0.8% to 6,772.93

- Kospi up 0.3% to 2,310.55

- STOXX Europe 600 up 0.7% to 432.56

- German 10Y yield little changed at 2.79%

- Euro down 0.1% to $1.0550

- Brent Futures down 1.0% to $89.57/bbl

- Gold spot down 0.6% to $1,993.85

- U.S. Dollar Index up 0.13% to 106.69

Top Overnight News

- Foreign direct investment into China is falling across multiple measures, adding to pressure on Beijing and local governments as they seek to counter an economic slowdown. Financial Times calculations based on Chinese commerce ministry data compiled by Wind show that FDI fell 34 per cent to Rmb72.8bn ($10bn) year on year in September, the biggest decline since monthly figures became available in 2014. FT

- More than 30 Chinese listed companies unveiled share buyback and purchase plans over the weekend while major mutual fund house E Fund Management Co said it would invest in its own product as Beijing steps up efforts to put a floor under a sliding stock market. RTRS

- Spain’s headline CPI for Oct comes in at +3.5% headline, 30bp below the Street’s +3.8% forecast, while core drops to +5.2% (down from +5.8% in Sept and below the Street’s +5.6% forecast); German regional CPIs tumble in Oct vs. Sept, including Baden Wuerttemberg +4.4% (down from +5.1% in Sept), Bavaria +3.7% (down from +4.1% in Sept), Hesse +3.6% (down from +4.7% in Sept), and North Rhine Westphalia +3.1% (down from +4.2% in Sept). BBG

- The United Auto Workers called a fresh strike at a General Motors factory in Tennessee, a surprise walkout after negotiators had been working nearly around the clock to finalize a new contract this weekend. WSJ

- Daniel Hagari, Israel Defense Forces spokesman, said on Sunday that Israel had sent more troops into Gaza overnight and combat operations were continuing in the north of the strip. “We are advancing in the stages of the war, according to our plan,” he said. “We are gradually expanding our ground operations.” FT

- Iran appears committed to offering full diplomatic support to Hamas. But militarily, its strategy is more nuanced. American officials said that Iran was trying to carefully calibrate attacks by its proxy forces, so they did not start a wider war but still diverted resources away from Israel’s effort in Gaza. NYT

- Oleg Tsaryov, the person Russia planned to install as leader of Ukraine if its war proved successful, was shot and wounded in an assassination attempt. NYT

- Heavy-hitting investors are snapping up US government bonds with longer maturities, betting the pain in the Treasury market is nearly over and an elusive slowdown in the US economy may be on the horizon. Money managers including Pimco, Janus Henderson, Vanguard and BlackRock are taking the plunge — a bold bet after a multi-month rout in bond prices that has repeatedly wrongfooted asset managers and sent the 10-year Treasury yield above 5 per cent this week for the first time since 2007. FT

- OpenAI seals deal for San Francisco office space (the city’s largest office lease since 2018) after CEO Sam Altman calls remote work ‘experiment’ one of tech industry’s worst mistakes. Fortune

- Goldman's PB data from last week highlights that mega cap tech stocks (the “Mag 7”) collectively saw the largest notional net selling since early September, driven by short sales and to a lesser extent long sales (2.5 to 1). The Mag 7 stocks collectively now make up 18.5% of total US single stock net exposure on the Prime book, down modestly from the record high level of ~20% seen in Jul ’23 but still elevated vs. history in the 96th percentile on a 5-year lookback.

A more detailed look at global markets

APAC stocks ultimately traded mixed but with the major indices mostly in the red as geopolitics continued to dominate headlines ahead of month-end and this week’s slew of upcoming risk events. ASX 200 was led lower by underperformance in energy and the top-weighted financial sector although the index moved off intraday lows as participants also digested stronger-than-expected Australian Retail Sales data. Nikkei 225 suffered as yields edged higher and the BoJ kick-started its 'live' 2-day policy meeting. Hang Seng and Shanghai Comp were both initially lower with financials pressured after mixed earnings from some of the large banks including China’s biggest commercial lender ICBC which posted flat profit for Q3, while there was turbulence in Evergrande shares owing to a wind-up hearing which was adjourned to December 4th. Nonetheless, the declines were stemmed in the mainland amid hopes of improving US-China ties after US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November.

Top Asian News

- US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November in San Francisco. Furthermore, Wang Yi said both sides hope Sino-US relations will stabilise as soon as possible, while he added that the road to San Francisco will not be smooth and is not on autopilot.

- Japanese Trade Minister Nishimura said G7 agreed to build reliable supply chains for critical minerals and chips to reduce dependency on a particular country.

- China's Embassy in Japan said G7 members undermine the level playing field and disrupt the security and stability of global production and supply chain, which followed calls by the G7 for a repeal of Japanese food bans.

- Japan keeps overall view on economy for October, saying it is recovering moderately; Japan warns middle east situation could affect economy via energy cost.

European bourses, Euro Stoxx 50 +0.7%, began the week on the front foot after a mixed APAC handover. Focus since has been on the geopolitical front and data, with reports of tanks around Gaza City briefly halting sentiment for the region. Sectors are all in the green with no overarching bias, Energy and Banks lagged initially given benchmarks and an update from JPM on the European sector respectively. Stateside, futures are in the green ES +0.6% ahead of the latest Treasury Estimates before Wednesday's refunding announcement. As it stands, the NQ is experiencing some modest outperformance and perhaps aided by the modest EGB bid on data.

Top European News

- ECB’s Vujcic said the ECB is finished with rate hikes for now and that a bigger part of hikes have already been transmitted to households and businesses, while he added that 2% inflation is attainable by 2025 and that they held rates as they have hiked adequately, according to an interview with Croatian state broadcaster HRT1.

- ECB's Kazimir says it is too soon to declare victory and say the job is done; additional tightening could arise if data forces the ECB; bets on rate cuts happening already in H1-2024 are entirely misplaced. December forecasts are one of the milestones, March is the next - only then will the ECB be able to say the tightening cycle is completed and move on to the monitoring phase.

- ECB's Simkus, when asked about December, reiterates that unless especially surprising data comes up, current levels of restriction is sufficient.

- SNB: As of 1 December 2023, will lower the threshold factor for the remuneration of sight deposits of account holders subject to minimum reserve requirements from 28 to 25. The changes have no impact on the current monetary policy stance. Thus, the entire minimum reserve requirement will now no longer be remunerated, irrespective of whether it is met using cash or sight deposits.

- Fitch affirmed France at AA; Outlook Stable and affirmed Sweden at AAA; Outlook Stable, while it affirmed Bulgaria at BBB; Outlook Stable.

FX

- Dollar drifts ahead of busy agenda into month end and early November as DXY straddles 106.50 within a 106.71-42 range.

- Aussie outperforms after much stronger than expected final retail sales add to rationale for RBA rate hike.

- AUD/USD solid around 0.6350 and AUD/NZD elevated mostly above 1.0900.

- Yen and Euro conscious of decent option expiries nearby as USD/JPY pivots 149.50 on the eve of BoJ and EUR/USD grinds higher between 1.0548-86 parameters.

- PBoC set USD/CNY mid-point at 7.1781 vs exp. 7.3165 (prev. 7.1782)

- Eskom's CEO Cassim said they must delay plans to wind down its ageing coal power plants in order to reduce the number of blackouts, according to the FT.

Fixed Income

- Debt futures fade to varying degrees after extending recovery rally in early EU trade.

- Bunds and EGB peers still firm as latter holds within 128.68-129.43 range.

- Gilts retreat below par between 93.30-92.75 parameters and T-note closer to 106-05+ bottom than 106-14+ top.

Commodities

- WTI and Brent futures are softer intraday amid an unwinding of the geopolitical risk premium that baked in on Friday, as the weekend lacked any major regional escalation.

- Crude markets remain heavy with WTI Dec around USD 84/bbl (in a USD 83.71-85.30/bbl range), while Brent Jan trades under USD 88/bbl (in a USD 87.51-88.94/bbl parameter).

- Spot gold has, in a similar way to crude, been unwinding some geopolitical risk premium with prices back under the USD 2,000/oz mark from a USD 2,006/oz intraday high, and still within Friday’s USD 2,009.56-1,976.92/oz range; base metals are higher across the board following a pick-up in sentiment after the European cash open.

- Saudi Arabia may refrain from raising its flagship oil price for Asian customers for the first time in six months as refinery margins weaken across the region which undercuts demand for physical cargoes, according to Bloomberg.

- The EU and UK are seeking a ban on subsidies for fossil fuel projects, according to FT.

- Russia’s Medvedev said Europe’s energy cooperation with Russia has been ruined or frozen for a very long time and that hard times have come for the EU, while he added that the EU can no longer act on its own and that energy cooperation with the EU is pointless, according to Reuters.

- Chevron (CVX) Australia spokesperson said proposed enterprise agreements for frontline field operations employees at Gorgon and Wheatstone gas facilities were backed by a majority of employees in a vote.

Geopolitics

Israel-Gaza

- Israeli tanks on the outskirts of Gaza City block the road between the north and south of the Strip, according to Sky News Arabia citing AFP; Israeli tanks are now stationed in the central Gaza Strip, according to Al Arabiya.

- "Israeli artillery shelling on the western sector of southern Lebanon and throwing phosphorous shells", according to Sky News Arabia citing its correspondent; Israeli artillery shells Wadi Shebaa with phosphorus shells, according Ashaq News.

- Israel's Military spokesperson says we are gradually moving ahead according to plan, forces deployed across the northern border and prepared for any scenario.

- Israeli PM Netanyahu said the ongoing ground operation in Gaza is the second stage of the war and said the war inside the Gaza Strip will be difficult and long, while he added that contacts to secure the hostage release are continuing even during the ground operation.

- Israeli Defence Minister Gallant said the army is inflicting heavy blows on Hamas and they have no interest in expanding the war but are prepared on all fronts.

- Israel conducted a strike on a military base in the western Daraa countryside in Syria where Iranian militias are stationed Furthermore, IDF carried out airstrikes against Hezbollah positions in southern Lebanon in response to the rocket and missile fire on northern Israel.

- US Marine rapid response force is moving towards the eastern Mediterranean, according to officials cited by CNN amid concerns the war in Gaza is broadening into a regional conflict.

- US President Biden spoke with Egyptian President El-Sisi and briefed him on US efforts to ensure that regional actors do not expand the conflict in Gaza, while the leaders committed to the significant acceleration and increase of assistance flowing into Gaza. It was separately reported that President Biden said the US is ready to take further action following attacks by Iran-linked groups against US forces in Iraq and Syria, according to Reuters.

- White House’s National Security Adviser Sullivan said it is unacceptable to have extremist settler violence against innocent people in the West Bank and that the US believes Israeli PM Netanyahu has the responsibility to rein in extremist settlers in the West Bank.

- UK PM Sunak and French President Macron discussed in a call the importance of getting urgent humanitarian support into Gaza and expressed their shared concern at the risk of escalation in the wider region, in particular in the West Bank.

- French Foreign Ministry said France strongly condemns attacks by settlers that have led to the deaths of several Palestinian civilians over the past few days in the West Bank, while it called on Israeli authorities to take immediate measures to protect the Palestinian population.

- UAE asked the UN Security Council to meet as soon as possible following Israel’s expanded ground operation in Gaza and condemned the ground operation, according to Reuters.

- Jordan's army said the kingdom asked the US to deploy Patriot air defence systems to help bolster border defences, according to Reuters.

- Turkish President Erdogan told a pro-Palestinian rally in Istanbul that Hamas is not a terrorist organisation and that Israel is the occupier, while he added that they will tell the whole world that Israel is a war criminal and are making preparations for this.

- Russia's aviation authority said Dagestan’s main airport will be closed until November 6th after it was stormed by a mob in protest against a plane carrying Israelis.

Other

- Russian Defence Minister Shoigu called the Russia-China relations model exemplary and said the West has openly set a course to inflict strategic defeat on Russia in a hybrid war unleashed against Moscow. Furthermore, Shoigu said the West, having provoked the crisis in Europe, is seeking to potentially expand the conflict to the Asia-Pacific region, while he added Moscow revoking the nuclear test ban treaty does not mean the destruction of military strategic balance, according to Reuters.

US Event Calendar

- 10:30: Oct. Dallas Fed Manf. Activity, est. -16.0, prior -18.1

DB's Jim Reid concludes the overnight wrap

We start a busy week for markets after a few major landmarks were reached on Friday that are worth highlighting. The S&P 500 moved into "correction" territory, now down -10.27% from the July highs. Meanwhile the benchmark small-cap Russell 2000 index went through its June 2022 lows and back to levels last seen in November 2020, around the time that Pfizer announced the first successful Covid-19 vaccine trials. In fact, it's now back to levels it first breached in November 2018. When you factor in the huge inflation over this period, that's some serious real adjusted declines. So for all the optimism surrounding US equities this year it really is only a handful of huge companies that's skewing the positivity.

The move into correction territory comes as we hit a very busy week of important central bank meetings, data, earnings and a fresh Treasury refunding announcement. The BoJ could be the stand-out (tomorrow) as our economist believes (close call) they will revise YCC. That could overshadow the FOMC (Wednesday) and the BoE (Thursday) meeting. In terms of data all roads point towards Payolls on Friday, with ADP and JOLTs (Wednesday) providing the warm-up act. Elsewhere US ISM Manufacturing (Wednesday) and Services (Friday) will be a focal point as will the various global PMI numbers, especially China's.

Over in Europe, the highlights will include the preliminary October CPIs and Q3 GDP reports for Germany today, followed by France, Italy and the Eurozone on Tuesday. Earnings will be in full flow but with Apple on Thursday the highlight. The full day-by-day calendar is at the end as usual but we'll preview the highlights in more detail now below.

Starting with the BoJ tomorrow, our Chief Japanese economist (see full preview here) expects the central bank to revise its monetary policy framework but acknowledges it is a close call. They are likely to revise up their inflation forecast for the second successive Outlook Report which makes it hard for them to do nothing. Our economist would favour the abandonment of YCC but acknowledges that local media have suggested a bias towards tweaks. In his view, even if the BoJ maintains the status quo, the YCC is likely to come under further pressure as expectations of policy normalisation build up .

For the Fed on Wednesday, our US economists expect the central bank to stay on hold and see future hikes as a function of financial conditions and the path of the economy. While their baseline is for rates to stay at 5.3% through year end, they see an increasing risk of a hike in December or Q1. They also recently published a note on what the recent tightening in financial conditions mean for the Fed here. Linked into financial conditions, the latest US financing estimates (today) and refunding announcement (Wednesday) will be important given how much the early August equivalent spooked the market given the extra supply that it heralded. There is some hope that the Treasury may pause its coupon increases it flagged back in August. However our strategists think this is unlikely. See their report here. Remember the August refunding announcement has arguably proved to be the most important macro event of the last 3 months .

The BoE will round out the busy week for central banks on Thursday and our UK economist expects no change in the Bank Rate (5.25%) or the Bank's forward guidance. The full preview of the meeting here also touches on central bank's forecasts as well as QT. Elsewhere in Europe, Norges Bank will also decide on its monetary policy that day as well.

In terms of payrolls, our US economists expect the headline to come in at 140k (consensus 190k), down from +336k in September with the UAW strike causing around a 35k drag. They also see the unemployment rate remaining at 3.8% (same as consensus). There will be plenty of labour market data before hand with the ECI (tomorrow), JOLTS and ADP (Wednesday), claims (Thursday), and all the employment subcomponents within the PMI surveys.

German GDP today will likely see a -0.3% contraction (consensus -0.2%) with a mild contraction of -0.1% (consensus 0.0%) in the wider Euro area (tomorrow ). Our economists also expect the headline inflation measure for the Euro area to further decline to 3.1% from 4.3% in September, and see the core gauge slowing to 4.1% (4.5%).

Elsewhere, reports indicate Chinese officials may gather as early as today for the National Financial Work Conference that takes place once every five years behind closed doors. The real estate turmoil as well as other financial risks will be key discussion points.

Equity markets in Asia are mixed this morning as continued concerns over the direction of the Israel-Hamas war are being tempered by the fact that major escalations have been avoided so far. As I check my screens, the Nikkei (-1.20%) is the biggest underperformer as the Bank of Japan (BOJ) starts its two-day monetary policy meeting. Elsewhere, the Hang Seng (-0.28%) is also trading in negative territory while the CSI (+0.67%), the Shanghai Composite (+0.17%) and the KOSPI (+0.46%) are higher. S&P 500 (+0.33%) and NASDAQ 100 (+0.51%) futures are seeing a decent bid for the time of day. US Treasury yields are 2-4bps higher across the curve as we go to print.

Early morning data showed that retail sales in Australia advanced at the fastest pace in eight months, rising +0.9% m/m in September (v/s +0.3% expected) accelerating from August’s upwardly revised +0.3% increase thus encouraging some expectation of a hike at the RBA meeting next week. The Australian dollar (+0.28%) is trading at 0.635 versus the dollar while 3yr yields are up around 5bps. Oil prices have dipped in Asia with Brent futures (-1.36%) slipping back below $90/bbl.

Now, reflecting on last week, on Friday we had the PCE data for September. Headline PCE inflation came in at a four-month high of +0.4% month-on-month (+0.3% expected), while core PCE was in line with expectations at 0.3%. In year-on-year terms, headline was at 3.4%, while core PCE inflation was 3.7% (both as expected). This slight upside came as the strength of consumer spending showed no sign of abating, after nominal personal spending jumped from 0.4% in August to 0.7% month-on-month (vs 0.5% expected). In other data, the University of Michigan survey saw 1-year inflation expectations unexpectedly rise to a five-month high (from 3.8% to 4.2%), though longer-term expectations were flat at 3.0% .

The data did little to budge near-term Fed expectations, with markets pricing a 16% chance of another hike by year-end (from 19% Thursday and 20% a week earlier). Our economists noted that while the core PCE print was the strongest since April, its pace would need to pick up marginally further in Q4 to meet the September SEP projections for end-23. Bonds saw a decent rally last week, with 10yr Treasury yields down -7.9bps to 4.84% (-0.9bps Friday). Renewed curve steepening was a key theme on Friday, with the 2yr yield down -3.8bps to 5.00% but the 30yr up +2.8bps to 5.01%. This marks the first time since August 2022 that the 2s30s slope has closed in positive territory .

After an ECB meeting on Thursday that delivered as expected, although with some dovish tilts, German 10yr bunds yields closed down -5.8bps last week (-3.0bps Friday). We heard from ECB’s Nagel on Friday, who stated that “tight monetary policy is showing effect”, with “future decisions to be made meeting by meeting”. So one of the hawks sticking to the tone of Thursday’s meeting.

In equities, the main story at the end of last week was the S&P 500 entering correction territory, down -10.27% from its end-July peak. The index was down -0.48% on Friday and -2.53% on the week. The -4.86% decline over the past two weeks is its sharpest in 10 months. Equities had started Friday on the front foot after strong earnings results from the likes of Amazon (+6.83% Friday) and Intel (+9.29%) the previous evening. This saw consumer discretionary (+1.70%) and information technology (+0.58%) sectors outperform on an otherwise negative day (with 82% of S&P constituents down on Friday). The NASDAQ benefitted from late week tech earnings, gaining +0.38% on Friday (but still down -2.62% week-on-week). Europe was similarly gripped by the risk-off mood, with the STOXX 600 down -0.84% on Friday (and -0.96% week-on-week) .

The largest underperformer in the S&P on Friday was the energy sector, falling -2.30%. This followed disappointing earnings reports from Exxon Mobil and Chevron, which slipped -4.98% (and -1.91% on Friday) and -13.47% (-6.72% on Friday) over the week respectively. Friday’s decline in energy stocks came despite Brent and WTI crude prices jumping +2.90% and +2.80% respectively on Friday after news that Israel forces undertook a second raid into Gaza, destroying Hamas naval infrastructure. However, oil prices still declined on the week, with Brent down -1.82% to $90.48/bbl and WTI down -3.62% to $85.54/bbl .

Gold secured a third consecutive week of gains, rising +1.26% (and +1.11% on Friday) to $2,006 per ounce, its first time above $2,000 since May.

Ending a week that saw the S&P be the most overshorted in history, with Goldman PB reporting that its HF clients had shorted stocks for a record 12 consecutive weeks, it was inevitable that we would get an oversold bounce at some point and this morning we are seeing just that, with stocks in Europe broadly higher, and US equity futures also rising and reversing all of Friday’s loss. As of 7:45am, S&P futures were higher by 0.7%, Nasdaq futures gained 0.8% and the Estoxx rose 0.8% in early London session with gains led by utilities and energy; WTI futures were lower by 1.1% on the day because the complacent market downplayed the Israeli ground offensive into Gaza as “less aggressive than feared.” Ahead of a very busy week, JPM summarizes sentiment as follows: “are futures potentially setting up a relief rally into month-end or does the selling pressure continue with SPX under its 200dma.” Gold slipped below $2,000 an ounce, the dollar dropped as bitcoin gained and ten-year Treasury yields resumed their grind higher to 4.86% ahead of today’s Treasury issuance projections statement.

In premarket trading, HSBC was steady after the bank’s further share buyback of as much as $3 billion offset news of a pretax profit of $7.71 billion that fell short of analyst estimates. Cisco shares are little changed after the digital communications technology company was downgraded to market perform from outperform at Raymond James. Here are some other notable premarket movers:

- AbbVie climbs 1% as it is raised to overweight from equal-weight at Barclays, with the broker calling Friday’s selloff in the drugmaker’s stock “an over-reaction.”

- Check Point Software shares are down 3.1% after the security software company reported third-quarter results that analysts see as mixed, with billings singled out as weaker than expected.

- Datadog shares are down 0.8%, after Baird downgraded the cloud software company to neutral from outperform.

- Deciphera Pharmaceuticals gains 18% after saying the company’s Phase 3 study of vimseltinib met the primary endpoint and all key secondary endpoints.

- Krispy Kreme shares drop 0.9% after the donut company is downgraded to hold from buy at Truist Securities, which said it has a difficult time recommending the stock until the impact of GLP-1 weight-loss drugs becomes more apparent.

- Meta rose as much as 1.9% on plans to offer people in the EU, EEA and Switzerland the option to pay a monthly subscription to use Facebook and Instagram without any ads, the company says in a statement.

- Miromatrix Medical shares soar 224% to $3.37 as United Therapeutics agreed to buy the firm for $3.25 per share in cash for an aggregate of about $91 million, according to a press release.

- Newell Brands shares decline 0.9% after the household-products maker was downgraded at JPMorgan and Truist Securities, with the former seeing demand taking longer to recover than anticipated.

- ON Semiconductor shares are down 4.1%, after the semiconductor device company gave a fourth-quarter forecast that was weaker than expected in terms of both adjusted earnings and revenue. It also reported its third-quarter results.

- ReAlpha Tech shares jump 34% as the property technology startup began its second week of trading following a direct listing on the Nasdaq last week. If the gains hold, it will snap a four-day losing streak.

- Sanofi to purchase $30 million of ordinary shares of MeiraGTx Holdings at a price of $7.50 per share.

- Spirit Realty Capital gains 13% as Realty Income agreed to buy the firm in an all-stock transaction at an enterprise value of about $9.3b.

- Western Digital shares surge 14% after the company forecast operating expenses for the second quarter; the guidance beat the average analyst estimate.

As usual we start with geopolitics, where instead of a massive ground invasion, newsflow over the weekend revealed that the Israeli military has started slowly and according to Bloomberg, “so far there are few signs that the conflict will spread across the wider Middle East region” (the shekel took a pause from recent selling, gaining 0.4% at 4.0566 but remains the world’s worst-performing currency this month, recently hitting 11-year lows). That’s being seen as enough good news for investors to wade back into markets after last week’s sharp selloff, which sent the S&P 500 into a correction on Friday after the index closing 10% below a recent peak.

“The relatively contained operations over the weekend were perhaps a relief to markets, who are worried about other players being dragged into the conflict,” said James Rossiter, global head of macro strategy at TD Securities. “That should bode well for some risk assets. That said, there are definitely a few risk events for markets to chew on this week.”

Still, stocks globally have lost $12 trillion in value since the end of July – aka since the Fed’s last rate hike – as concern mounts that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession. The S&P 500 entered a technical correction and Morgan Stanley strategist Michael Wilson said investors hoping for a boost to stocks by the end of the year will be disappointed.

The week also includes a slew of potentially market-moving events for investors to track, including central bank meetings in Japan, the US and the UK, while the US Treasury Department announces its quarterly bond sales plan. Concern that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession.

Government bonds have also tumbled, with 10-year Treasury yields hitting a 16-year high last week, despite signals from policy makers they’re “at or near” the end of rate hikes. Bond yields remain high even after the outbreak of the Israel-Hamas war three weeks ago – the kind of geopolitical flashpoint that can spur haven demand for Treasuries. On Monday, the Treasury will set the stage for its issuance plans with an update of quarterly borrowing estimates, and for its cash balance.

European stocks also rose, with the Stoxx 600 gaining 0.7% as all 20 sectors rise after data showed German inflation eased further, while its economy shrank in the third quarter, as Europe slides into its next recession. Travel & leisure and retail sectors the biggest gainers, while automotive shares gained the least. Siemens Energy is among top performers, rebounding after its board chairman moved to reassure investors over state aid concerns. Here are the most notable European movers:

- Siemens Energy rise as much as 17% after its supervisory board chairman said the renewables firm doesn’t need state money, following last week’s selloff on worries over it might need state aid

- Dassault Systemes gains as much as 3.9% after JPMorgan upgrades to overweight, saying the software firm’s license sales growth has improved and large deals have returned

- Clariant gains 3.1% after it reported adjusted Ebitda for the third quarter that beat estimates. Analysts say the Swiss specialty chemicals company reported a surprisingly strong performance

- Ascential gains as much as 38% after the UK media company proposes a sale of its digital commerce business to Omnicom Group, and to sell its consumer trend-spotting WGSN unit

- Erste Bank advances as much as 2.6%, the second-best performer on the Stoxx 600 Banks Index, after the Austrian lender raised its net interest income guidance for 2023

- TomTom shares jump as much as 8.1% after the navigation firm announced a €50 million buyback. ING says the buyback follows a strong set of results in the third quarter

- Glencore climbs after the natural resources company reaffirms its guidance for adjusted marketing pre-tax profit. Liberum says current trading is giving it a “sound footing” into year-end

- Rightmove gains as much as 4.3% after Berenberg upgrades to buy from hold and says concerns over increased competition for the property listings portal are overdone

- ArcelorMittal shares fall as much as 5.5% after the Kazakh government announced plans to take over the company’s operations in the country following its worst mining accident in recent history

- Merck KGaA shares drop as much as 5.2% to the lowest since May 2021, as analysts cut their price targets on the German biotech company ahead of next week’s results

Earlier in the session, Asian stocks declined as weak corporate earnings took center stage amid continued concerns over high US interest rates, geopoliitcal tensions and China’s economy.The MSCI Asia Pacific Index slid as much as 0.6%, with Toyota and Alibaba among the biggest drags.

- China’s Shanghai Comp and the Hang Seng were both initially lower with financials pressured after mixed earnings from some of the large banks including China’s biggest commercial lender ICBC which posted flat profit for Q3, while there was turbulence in Evergrande shares owing to a wind-up hearing which was adjourned to December 4th. Nonetheless, the declines were stemmed in the mainland amid hopes of improving US-China ties after US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November.

- Japan was among the hardest hit, amid disappointing earnings from the likes of machinery maker Komatsu, while yields edged higher as the BoJ kick-started its ‘live’ 2-day policy meeting.

- Australia’s ASX 200 was led lower by underperformance in energy and the top-weighted financial sector although the index moved off intraday lows as participants also digested stronger-than-expected Australian Retail Sales data.

- Indian stocks began the week with gains as buying in market heavyweights Reliance Industries and HDFC Bank helped the key gauges rebound from early losses amid a mixed trend in global equities. The S&P BSE Sensex rose 0.5% to 64,112.65 at the close in Mumbai, after falling as much as 0.6% soon after trading began. The NSE Nifty 50 Index rose by a similar measure. Last week, the Sensex’s relative strength index fell to oversold zone, suggesting a likelihood of a pullback.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Aussie is the strongest of the G-10 currencies after retail-sales data beat estimates, an outcome that may boost the Reserve Bank of Australia’s confidence that the economy can withstand further interest-rate hikes. The Swiss franc was the weakest. The recent rebound in the Aussie “is spurred by higher iron ore prices, rising expectations for the RBA to deliver one more rate hike,” strategists at Malayan Banking Bhd. led by Saktiandi Supaat wrote in a research note. “We see more room for upside than down” for AUD/USD, they said. The Swedish krona underperformed G10 counterparts after a flash estimate showed the economy was stagnant last quarter

In rates, treasuries were cheaper across the curve, with losses led by front and belly, unwinding a portion of Friday’s sharp 5s30s steepening move. US yields cheaper by up to 5.5bp across belly of the curve, with 5s30s spread flatter by 3bp on the day; 10-year yields around 4.88%, cheaper by 4bp vs. Friday close with bunds and gilts outperforming by 5.5bp and 2bp in the sector. Safe-haven demand eased for Treasuries, pushing yields slightly higher after the market lulled itself into complacency again, and instead of believing in a ceasefire any moment, today the narrative was that “Israel’s military action in Gaza proceeded more cautiously than anticipated.” At this rate anything else that mushroom clouds will be bullish. Meanwhile, bunds are higher, the curve bull steepening as S&P futures advance, boosted by German state inflation readings that point to a lower-than-expected national CPI print later today. Data also showed the German economy shrank in the third quarter.

In commodities, oil prices fell, along with gold and Treasuries. WTI falls 1.2% to trade near $84.50. Spot gold drops 0.5%. Iron-ore futures traded in Singapore rose after posting their first weekly gain in more than a month amid optimism that China’s authorities will step up their efforts to support growth

US economic data includes October Dallas Fed manufacturing activity at 10:30 a.m. New York time; employment cost index, consumer confidence, manufacturing PMI, ADP employment change, ISM manufacturing, factory orders and jobs report also due this week. Fed officials are in self-imposed quiet period ahead of Nov. 1 rate decision; Treasury quarterly debt refunding announcement also due Nov. 1

Market Snapshot

- S&P 500 futures up 0.5% to 4,159.00

- MXAP down 0.3% to 151.72

- MXAPJ up 0.1% to 475.96

- Nikkei down 1.0% to 30,696.96

- Topix down 1.0% to 2,231.24

- Hang Seng Index little changed at 17,406.36

- Shanghai Composite up 0.1% to 3,021.55

- Sensex up 0.3% to 64,000.81

- Australia S&P/ASX 200 down 0.8% to 6,772.93

- Kospi up 0.3% to 2,310.55

- STOXX Europe 600 up 0.7% to 432.56

- German 10Y yield little changed at 2.79%

- Euro down 0.1% to $1.0550

- Brent Futures down 1.0% to $89.57/bbl

- Gold spot down 0.6% to $1,993.85

- U.S. Dollar Index up 0.13% to 106.69

Top Overnight News

- Foreign direct investment into China is falling across multiple measures, adding to pressure on Beijing and local governments as they seek to counter an economic slowdown. Financial Times calculations based on Chinese commerce ministry data compiled by Wind show that FDI fell 34 per cent to Rmb72.8bn ($10bn) year on year in September, the biggest decline since monthly figures became available in 2014. FT

- More than 30 Chinese listed companies unveiled share buyback and purchase plans over the weekend while major mutual fund house E Fund Management Co said it would invest in its own product as Beijing steps up efforts to put a floor under a sliding stock market. RTRS

- Spain’s headline CPI for Oct comes in at +3.5% headline, 30bp below the Street’s +3.8% forecast, while core drops to +5.2% (down from +5.8% in Sept and below the Street’s +5.6% forecast); German regional CPIs tumble in Oct vs. Sept, including Baden Wuerttemberg +4.4% (down from +5.1% in Sept), Bavaria +3.7% (down from +4.1% in Sept), Hesse +3.6% (down from +4.7% in Sept), and North Rhine Westphalia +3.1% (down from +4.2% in Sept). BBG

- The United Auto Workers called a fresh strike at a General Motors factory in Tennessee, a surprise walkout after negotiators had been working nearly around the clock to finalize a new contract this weekend. WSJ

- Daniel Hagari, Israel Defense Forces spokesman, said on Sunday that Israel had sent more troops into Gaza overnight and combat operations were continuing in the north of the strip. “We are advancing in the stages of the war, according to our plan,” he said. “We are gradually expanding our ground operations.” FT

- Iran appears committed to offering full diplomatic support to Hamas. But militarily, its strategy is more nuanced. American officials said that Iran was trying to carefully calibrate attacks by its proxy forces, so they did not start a wider war but still diverted resources away from Israel’s effort in Gaza. NYT

- Oleg Tsaryov, the person Russia planned to install as leader of Ukraine if its war proved successful, was shot and wounded in an assassination attempt. NYT

- Heavy-hitting investors are snapping up US government bonds with longer maturities, betting the pain in the Treasury market is nearly over and an elusive slowdown in the US economy may be on the horizon. Money managers including Pimco, Janus Henderson, Vanguard and BlackRock are taking the plunge — a bold bet after a multi-month rout in bond prices that has repeatedly wrongfooted asset managers and sent the 10-year Treasury yield above 5 per cent this week for the first time since 2007. FT

- OpenAI seals deal for San Francisco office space (the city’s largest office lease since 2018) after CEO Sam Altman calls remote work ‘experiment’ one of tech industry’s worst mistakes. Fortune

- Goldman’s PB data from last week highlights that mega cap tech stocks (the “Mag 7”) collectively saw the largest notional net selling since early September, driven by short sales and to a lesser extent long sales (2.5 to 1). The Mag 7 stocks collectively now make up 18.5% of total US single stock net exposure on the Prime book, down modestly from the record high level of ~20% seen in Jul ’23 but still elevated vs. history in the 96th percentile on a 5-year lookback.

A more detailed look at global markets

APAC stocks ultimately traded mixed but with the major indices mostly in the red as geopolitics continued to dominate headlines ahead of month-end and this week’s slew of upcoming risk events. ASX 200 was led lower by underperformance in energy and the top-weighted financial sector although the index moved off intraday lows as participants also digested stronger-than-expected Australian Retail Sales data. Nikkei 225 suffered as yields edged higher and the BoJ kick-started its ‘live’ 2-day policy meeting. Hang Seng and Shanghai Comp were both initially lower with financials pressured after mixed earnings from some of the large banks including China’s biggest commercial lender ICBC which posted flat profit for Q3, while there was turbulence in Evergrande shares owing to a wind-up hearing which was adjourned to December 4th. Nonetheless, the declines were stemmed in the mainland amid hopes of improving US-China ties after US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November.

Top Asian News

- US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November in San Francisco. Furthermore, Wang Yi said both sides hope Sino-US relations will stabilise as soon as possible, while he added that the road to San Francisco will not be smooth and is not on autopilot.

- Japanese Trade Minister Nishimura said G7 agreed to build reliable supply chains for critical minerals and chips to reduce dependency on a particular country.

- China’s Embassy in Japan said G7 members undermine the level playing field and disrupt the security and stability of global production and supply chain, which followed calls by the G7 for a repeal of Japanese food bans.

- Japan keeps overall view on economy for October, saying it is recovering moderately; Japan warns middle east situation could affect economy via energy cost.

European bourses, Euro Stoxx 50 +0.7%, began the week on the front foot after a mixed APAC handover. Focus since has been on the geopolitical front and data, with reports of tanks around Gaza City briefly halting sentiment for the region. Sectors are all in the green with no overarching bias, Energy and Banks lagged initially given benchmarks and an update from JPM on the European sector respectively. Stateside, futures are in the green ES +0.6% ahead of the latest Treasury Estimates before Wednesday’s refunding announcement. As it stands, the NQ is experiencing some modest outperformance and perhaps aided by the modest EGB bid on data.

Top European News

- ECB’s Vujcic said the ECB is finished with rate hikes for now and that a bigger part of hikes have already been transmitted to households and businesses, while he added that 2% inflation is attainable by 2025 and that they held rates as they have hiked adequately, according to an interview with Croatian state broadcaster HRT1.

- ECB’s Kazimir says it is too soon to declare victory and say the job is done; additional tightening could arise if data forces the ECB; bets on rate cuts happening already in H1-2024 are entirely misplaced. December forecasts are one of the milestones, March is the next – only then will the ECB be able to say the tightening cycle is completed and move on to the monitoring phase.

- ECB’s Simkus, when asked about December, reiterates that unless especially surprising data comes up, current levels of restriction is sufficient.

- SNB: As of 1 December 2023, will lower the threshold factor for the remuneration of sight deposits of account holders subject to minimum reserve requirements from 28 to 25. The changes have no impact on the current monetary policy stance. Thus, the entire minimum reserve requirement will now no longer be remunerated, irrespective of whether it is met using cash or sight deposits.

- Fitch affirmed France at AA; Outlook Stable and affirmed Sweden at AAA; Outlook Stable, while it affirmed Bulgaria at BBB; Outlook Stable.

FX

- Dollar drifts ahead of busy agenda into month end and early November as DXY straddles 106.50 within a 106.71-42 range.

- Aussie outperforms after much stronger than expected final retail sales add to rationale for RBA rate hike.

- AUD/USD solid around 0.6350 and AUD/NZD elevated mostly above 1.0900.

- Yen and Euro conscious of decent option expiries nearby as USD/JPY pivots 149.50 on the eve of BoJ and EUR/USD grinds higher between 1.0548-86 parameters.

- PBoC set USD/CNY mid-point at 7.1781 vs exp. 7.3165 (prev. 7.1782)

- Eskom’s CEO Cassim said they must delay plans to wind down its ageing coal power plants in order to reduce the number of blackouts, according to the FT.

Fixed Income

- Debt futures fade to varying degrees after extending recovery rally in early EU trade.

- Bunds and EGB peers still firm as latter holds within 128.68-129.43 range.

- Gilts retreat below par between 93.30-92.75 parameters and T-note closer to 106-05+ bottom than 106-14+ top.

Commodities

- WTI and Brent futures are softer intraday amid an unwinding of the geopolitical risk premium that baked in on Friday, as the weekend lacked any major regional escalation.

- Crude markets remain heavy with WTI Dec around USD 84/bbl (in a USD 83.71-85.30/bbl range), while Brent Jan trades under USD 88/bbl (in a USD 87.51-88.94/bbl parameter).

- Spot gold has, in a similar way to crude, been unwinding some geopolitical risk premium with prices back under the USD 2,000/oz mark from a USD 2,006/oz intraday high, and still within Friday’s USD 2,009.56-1,976.92/oz range; base metals are higher across the board following a pick-up in sentiment after the European cash open.

- Saudi Arabia may refrain from raising its flagship oil price for Asian customers for the first time in six months as refinery margins weaken across the region which undercuts demand for physical cargoes, according to Bloomberg.

- The EU and UK are seeking a ban on subsidies for fossil fuel projects, according to FT.

- Russia’s Medvedev said Europe’s energy cooperation with Russia has been ruined or frozen for a very long time and that hard times have come for the EU, while he added that the EU can no longer act on its own and that energy cooperation with the EU is pointless, according to Reuters.

- Chevron (CVX) Australia spokesperson said proposed enterprise agreements for frontline field operations employees at Gorgon and Wheatstone gas facilities were backed by a majority of employees in a vote.

Geopolitics

Israel-Gaza

- Israeli tanks on the outskirts of Gaza City block the road between the north and south of the Strip, according to Sky News Arabia citing AFP; Israeli tanks are now stationed in the central Gaza Strip, according to Al Arabiya.

- “Israeli artillery shelling on the western sector of southern Lebanon and throwing phosphorous shells”, according to Sky News Arabia citing its correspondent; Israeli artillery shells Wadi Shebaa with phosphorus shells, according Ashaq News.

- Israel’s Military spokesperson says we are gradually moving ahead according to plan, forces deployed across the northern border and prepared for any scenario.

- Israeli PM Netanyahu said the ongoing ground operation in Gaza is the second stage of the war and said the war inside the Gaza Strip will be difficult and long, while he added that contacts to secure the hostage release are continuing even during the ground operation.

- Israeli Defence Minister Gallant said the army is inflicting heavy blows on Hamas and they have no interest in expanding the war but are prepared on all fronts.

- Israel conducted a strike on a military base in the western Daraa countryside in Syria where Iranian militias are stationed Furthermore, IDF carried out airstrikes against Hezbollah positions in southern Lebanon in response to the rocket and missile fire on northern Israel.

- US Marine rapid response force is moving towards the eastern Mediterranean, according to officials cited by CNN amid concerns the war in Gaza is broadening into a regional conflict.

- US President Biden spoke with Egyptian President El-Sisi and briefed him on US efforts to ensure that regional actors do not expand the conflict in Gaza, while the leaders committed to the significant acceleration and increase of assistance flowing into Gaza. It was separately reported that President Biden said the US is ready to take further action following attacks by Iran-linked groups against US forces in Iraq and Syria, according to Reuters.

- White House’s National Security Adviser Sullivan said it is unacceptable to have extremist settler violence against innocent people in the West Bank and that the US believes Israeli PM Netanyahu has the responsibility to rein in extremist settlers in the West Bank.

- UK PM Sunak and French President Macron discussed in a call the importance of getting urgent humanitarian support into Gaza and expressed their shared concern at the risk of escalation in the wider region, in particular in the West Bank.

- French Foreign Ministry said France strongly condemns attacks by settlers that have led to the deaths of several Palestinian civilians over the past few days in the West Bank, while it called on Israeli authorities to take immediate measures to protect the Palestinian population.

- UAE asked the UN Security Council to meet as soon as possible following Israel’s expanded ground operation in Gaza and condemned the ground operation, according to Reuters.

- Jordan’s army said the kingdom asked the US to deploy Patriot air defence systems to help bolster border defences, according to Reuters.

- Turkish President Erdogan told a pro-Palestinian rally in Istanbul that Hamas is not a terrorist organisation and that Israel is the occupier, while he added that they will tell the whole world that Israel is a war criminal and are making preparations for this.

- Russia’s aviation authority said Dagestan’s main airport will be closed until November 6th after it was stormed by a mob in protest against a plane carrying Israelis.

Other

- Russian Defence Minister Shoigu called the Russia-China relations model exemplary and said the West has openly set a course to inflict strategic defeat on Russia in a hybrid war unleashed against Moscow. Furthermore, Shoigu said the West, having provoked the crisis in Europe, is seeking to potentially expand the conflict to the Asia-Pacific region, while he added Moscow revoking the nuclear test ban treaty does not mean the destruction of military strategic balance, according to Reuters.

US Event Calendar

- 10:30: Oct. Dallas Fed Manf. Activity, est. -16.0, prior -18.1

DB’s Jim Reid concludes the overnight wrap

We start a busy week for markets after a few major landmarks were reached on Friday that are worth highlighting. The S&P 500 moved into “correction” territory, now down -10.27% from the July highs. Meanwhile the benchmark small-cap Russell 2000 index went through its June 2022 lows and back to levels last seen in November 2020, around the time that Pfizer announced the first successful Covid-19 vaccine trials. In fact, it’s now back to levels it first breached in November 2018. When you factor in the huge inflation over this period, that’s some serious real adjusted declines. So for all the optimism surrounding US equities this year it really is only a handful of huge companies that’s skewing the positivity.

The move into correction territory comes as we hit a very busy week of important central bank meetings, data, earnings and a fresh Treasury refunding announcement. The BoJ could be the stand-out (tomorrow) as our economist believes (close call) they will revise YCC. That could overshadow the FOMC (Wednesday) and the BoE (Thursday) meeting. In terms of data all roads point towards Payolls on Friday, with ADP and JOLTs (Wednesday) providing the warm-up act. Elsewhere US ISM Manufacturing (Wednesday) and Services (Friday) will be a focal point as will the various global PMI numbers, especially China’s.

Over in Europe, the highlights will include the preliminary October CPIs and Q3 GDP reports for Germany today, followed by France, Italy and the Eurozone on Tuesday. Earnings will be in full flow but with Apple on Thursday the highlight. The full day-by-day calendar is at the end as usual but we’ll preview the highlights in more detail now below.

Starting with the BoJ tomorrow, our Chief Japanese economist (see full preview here) expects the central bank to revise its monetary policy framework but acknowledges it is a close call. They are likely to revise up their inflation forecast for the second successive Outlook Report which makes it hard for them to do nothing. Our economist would favour the abandonment of YCC but acknowledges that local media have suggested a bias towards tweaks. In his view, even if the BoJ maintains the status quo, the YCC is likely to come under further pressure as expectations of policy normalisation build up .

For the Fed on Wednesday, our US economists expect the central bank to stay on hold and see future hikes as a function of financial conditions and the path of the economy. While their baseline is for rates to stay at 5.3% through year end, they see an increasing risk of a hike in December or Q1. They also recently published a note on what the recent tightening in financial conditions mean for the Fed here. Linked into financial conditions, the latest US financing estimates (today) and refunding announcement (Wednesday) will be important given how much the early August equivalent spooked the market given the extra supply that it heralded. There is some hope that the Treasury may pause its coupon increases it flagged back in August. However our strategists think this is unlikely. See their report here. Remember the August refunding announcement has arguably proved to be the most important macro event of the last 3 months .

The BoE will round out the busy week for central banks on Thursday and our UK economist expects no change in the Bank Rate (5.25%) or the Bank’s forward guidance. The full preview of the meeting here also touches on central bank’s forecasts as well as QT. Elsewhere in Europe, Norges Bank will also decide on its monetary policy that day as well.

In terms of payrolls, our US economists expect the headline to come in at 140k (consensus 190k), down from +336k in September with the UAW strike causing around a 35k drag. They also see the unemployment rate remaining at 3.8% (same as consensus). There will be plenty of labour market data before hand with the ECI (tomorrow), JOLTS and ADP (Wednesday), claims (Thursday), and all the employment subcomponents within the PMI surveys.

German GDP today will likely see a -0.3% contraction (consensus -0.2%) with a mild contraction of -0.1% (consensus 0.0%) in the wider Euro area (tomorrow ). Our economists also expect the headline inflation measure for the Euro area to further decline to 3.1% from 4.3% in September, and see the core gauge slowing to 4.1% (4.5%).

Elsewhere, reports indicate Chinese officials may gather as early as today for the National Financial Work Conference that takes place once every five years behind closed doors. The real estate turmoil as well as other financial risks will be key discussion points.

Equity markets in Asia are mixed this morning as continued concerns over the direction of the Israel-Hamas war are being tempered by the fact that major escalations have been avoided so far. As I check my screens, the Nikkei (-1.20%) is the biggest underperformer as the Bank of Japan (BOJ) starts its two-day monetary policy meeting. Elsewhere, the Hang Seng (-0.28%) is also trading in negative territory while the CSI (+0.67%), the Shanghai Composite (+0.17%) and the KOSPI (+0.46%) are higher. S&P 500 (+0.33%) and NASDAQ 100 (+0.51%) futures are seeing a decent bid for the time of day. US Treasury yields are 2-4bps higher across the curve as we go to print.

Early morning data showed that retail sales in Australia advanced at the fastest pace in eight months, rising +0.9% m/m in September (v/s +0.3% expected) accelerating from August’s upwardly revised +0.3% increase thus encouraging some expectation of a hike at the RBA meeting next week. The Australian dollar (+0.28%) is trading at 0.635 versus the dollar while 3yr yields are up around 5bps. Oil prices have dipped in Asia with Brent futures (-1.36%) slipping back below $90/bbl.

Now, reflecting on last week, on Friday we had the PCE data for September. Headline PCE inflation came in at a four-month high of +0.4% month-on-month (+0.3% expected), while core PCE was in line with expectations at 0.3%. In year-on-year terms, headline was at 3.4%, while core PCE inflation was 3.7% (both as expected). This slight upside came as the strength of consumer spending showed no sign of abating, after nominal personal spending jumped from 0.4% in August to 0.7% month-on-month (vs 0.5% expected). In other data, the University of Michigan survey saw 1-year inflation expectations unexpectedly rise to a five-month high (from 3.8% to 4.2%), though longer-term expectations were flat at 3.0% .

The data did little to budge near-term Fed expectations, with markets pricing a 16% chance of another hike by year-end (from 19% Thursday and 20% a week earlier). Our economists noted that while the core PCE print was the strongest since April, its pace would need to pick up marginally further in Q4 to meet the September SEP projections for end-23. Bonds saw a decent rally last week, with 10yr Treasury yields down -7.9bps to 4.84% (-0.9bps Friday). Renewed curve steepening was a key theme on Friday, with the 2yr yield down -3.8bps to 5.00% but the 30yr up +2.8bps to 5.01%. This marks the first time since August 2022 that the 2s30s slope has closed in positive territory .

After an ECB meeting on Thursday that delivered as expected, although with some dovish tilts, German 10yr bunds yields closed down -5.8bps last week (-3.0bps Friday). We heard from ECB’s Nagel on Friday, who stated that “tight monetary policy is showing effect”, with “future decisions to be made meeting by meeting”. So one of the hawks sticking to the tone of Thursday’s meeting.

In equities, the main story at the end of last week was the S&P 500 entering correction territory, down -10.27% from its end-July peak. The index was down -0.48% on Friday and -2.53% on the week. The -4.86% decline over the past two weeks is its sharpest in 10 months. Equities had started Friday on the front foot after strong earnings results from the likes of Amazon (+6.83% Friday) and Intel (+9.29%) the previous evening. This saw consumer discretionary (+1.70%) and information technology (+0.58%) sectors outperform on an otherwise negative day (with 82% of S&P constituents down on Friday). The NASDAQ benefitted from late week tech earnings, gaining +0.38% on Friday (but still down -2.62% week-on-week). Europe was similarly gripped by the risk-off mood, with the STOXX 600 down -0.84% on Friday (and -0.96% week-on-week) .

The largest underperformer in the S&P on Friday was the energy sector, falling -2.30%. This followed disappointing earnings reports from Exxon Mobil and Chevron, which slipped -4.98% (and -1.91% on Friday) and -13.47% (-6.72% on Friday) over the week respectively. Friday’s decline in energy stocks came despite Brent and WTI crude prices jumping +2.90% and +2.80% respectively on Friday after news that Israel forces undertook a second raid into Gaza, destroying Hamas naval infrastructure. However, oil prices still declined on the week, with Brent down -1.82% to $90.48/bbl and WTI down -3.62% to $85.54/bbl .

Gold secured a third consecutive week of gains, rising +1.26% (and +1.11% on Friday) to $2,006 per ounce, its first time above $2,000 since May.

Loading…