By Sagarika Jaisanghani, Bloomberg markets live reporter and analyst

A deteriorating outlook for corporate earnings offers little support for the S&P 500 reeling from its worst October since 2018.

While data from Bloomberg Intelligence show US firms are on pace to report a surprise increase in third-quarter earnings, forecasts for future quarters have been marked down as companies warned of tepid demand and an uncertain macroeconomic outlook. Deutsche Bank Group AG said analysts’ estimates for the fourth quarter have been cut by a “more than typical” 1.9% since the start of the reporting season.

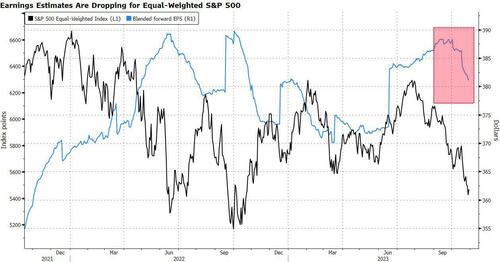

Profit estimates for the next 12 months for the S&P 500 Equal Weight Index — which weights companies equally rather than by market value, a move that pares the influence of the technology behemoths — have come down 1.8% since the start of October, data compiled by Bloomberg show.

“The pessimistic tone” on post-earnings conference calls “is striking,” said Lori Calvasina, head of US equity strategy at RBC Capital Markets LLC. The magnitude of downward revisions in 2023 and 2024 forecasts means the season so far hasn’t been “enough to get the US equity market out of its recent malaise,” she wrote in a note.

US stocks have slumped this month in their worst October performance in six years, hurt by a surge in bond yields and renewed geopolitical concerns. A disappointing showing from technology giants including Google parent Alphabet Inc. and Facebook owner Meta Platforms Inc. has also weighed on sentiment. The S&P 500 confirmed a technical correction on Friday after slumping 10% from its July peak.

Morgan Stanley strategist Michael Wilson — among the most bearish voices on Wall Street — said profit expectations are still “too high for the fourth quarter and 2024, even in an economy that’s performing well.” The strategist said the odds of a rally in the fourth quarter were much lower given “narrowing breadth, cautious factor leadership, falling earnings revisions and fading consumer and business confidence.”

By Sagarika Jaisanghani, Bloomberg markets live reporter and analyst

A deteriorating outlook for corporate earnings offers little support for the S&P 500 reeling from its worst October since 2018.

While data from Bloomberg Intelligence show US firms are on pace to report a surprise increase in third-quarter earnings, forecasts for future quarters have been marked down as companies warned of tepid demand and an uncertain macroeconomic outlook. Deutsche Bank Group AG said analysts’ estimates for the fourth quarter have been cut by a “more than typical” 1.9% since the start of the reporting season.

Profit estimates for the next 12 months for the S&P 500 Equal Weight Index — which weights companies equally rather than by market value, a move that pares the influence of the technology behemoths — have come down 1.8% since the start of October, data compiled by Bloomberg show.

“The pessimistic tone” on post-earnings conference calls “is striking,” said Lori Calvasina, head of US equity strategy at RBC Capital Markets LLC. The magnitude of downward revisions in 2023 and 2024 forecasts means the season so far hasn’t been “enough to get the US equity market out of its recent malaise,” she wrote in a note.

US stocks have slumped this month in their worst October performance in six years, hurt by a surge in bond yields and renewed geopolitical concerns. A disappointing showing from technology giants including Google parent Alphabet Inc. and Facebook owner Meta Platforms Inc. has also weighed on sentiment. The S&P 500 confirmed a technical correction on Friday after slumping 10% from its July peak.

Morgan Stanley strategist Michael Wilson — among the most bearish voices on Wall Street — said profit expectations are still “too high for the fourth quarter and 2024, even in an economy that’s performing well.” The strategist said the odds of a rally in the fourth quarter were much lower given “narrowing breadth, cautious factor leadership, falling earnings revisions and fading consumer and business confidence.”

Loading…