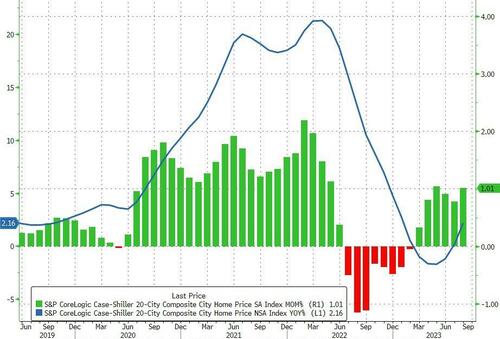

Home prices rose for the 5th straight month in August (the latest data released by S&P Global Case-Shiller today), up 1.01% MoM (better than the 0.8% rise expected).

Source: Bloomberg

The ongoing MoM rises pushed the YoY gain in home prices at America's 20 largest cities up 2.16%, the most since January 2023. The National Home Price index rose even faster at 2.57% YoY.

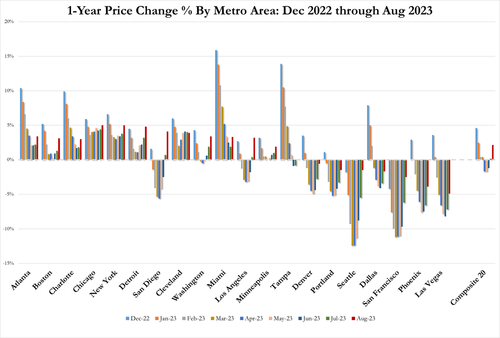

Chicago, New York, and Detroit all saw major home price rises (+5.0%, +4.9%, and +4.8% YoY respectively). Las Vegas, Phoenix, and San Francisco remain lower YoY (-4.9%, -3.9%, -2.5% respectively).

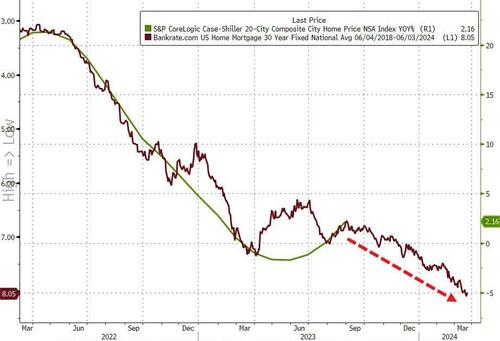

But, judging by the resumption of the rise of mortgage rates since the Case-Shiller data was created, we would expect prices to also resume their decline...

Source: Bloomberg

Inventory is going nowhere, buyers and sellers are stuck (affordability for the former and the mortgage cost gap for the latter), and The Fed isn't cutting rates any time soon. Not pretty...

Home prices rose for the 5th straight month in August (the latest data released by S&P Global Case-Shiller today), up 1.01% MoM (better than the 0.8% rise expected).

Source: Bloomberg

The ongoing MoM rises pushed the YoY gain in home prices at America’s 20 largest cities up 2.16%, the most since January 2023. The National Home Price index rose even faster at 2.57% YoY.

Chicago, New York, and Detroit all saw major home price rises (+5.0%, +4.9%, and +4.8% YoY respectively). Las Vegas, Phoenix, and San Francisco remain lower YoY (-4.9%, -3.9%, -2.5% respectively).

But, judging by the resumption of the rise of mortgage rates since the Case-Shiller data was created, we would expect prices to also resume their decline…

Source: Bloomberg

Inventory is going nowhere, buyers and sellers are stuck (affordability for the former and the mortgage cost gap for the latter), and The Fed isn’t cutting rates any time soon. Not pretty…

Loading…