Remember when we mocked the BEA's recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably "growth" factors as surging inventories and government consumption...

... and said prepare for Bidenomics to collapse in Q4?

Well it just did, and not once but twice.

First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis." Translation: the economy is already in contraction, which would hardly be a shock since Europe is also in contraction, China's economy is imploding and the US will never decouple from the rest of the world.

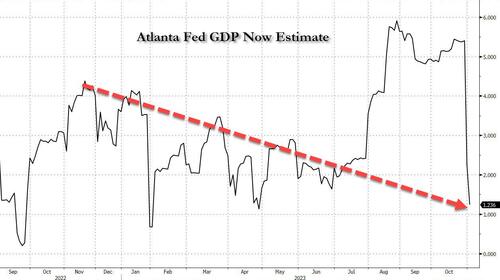

And now, it's the same Atlanta Fed which last quarter stunned Wall Street with its 5%+ Q3 GDP estimates, and which just came out with its second Q4 GDP forecast which was a doozy: at 1.2% it was almost 50% below the Atlanta Fed's first Q4 GDP estimate of 2.3%.

Here are the details:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on November 1, down from 2.3 percent on October 27.

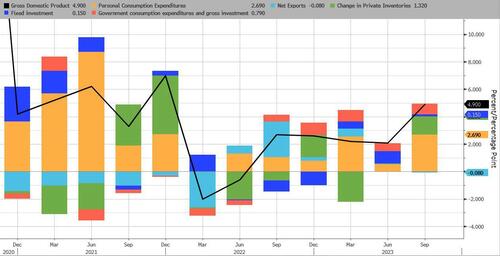

After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 3.0 percent and -2.2 percent, respectively, to 1.5 percent and -2.8 percent, while the nowcast of the contribution of the change in real net exports to fourth-quarter real GDP growth increased from 0.11 percentage points to 0.22 percentage points.

Bottom line: the Bidenomics trendline that was so laughably interrupted by the one-time, artificial, and debt-driven burst in Q3 GDP is back to normal...

... and the ridiculous economic "boost" that Biden tried to represent as being the normal, is now gone. Next step: recession, rate cuts, more stimmies, and so on.

Remember when we mocked the BEA’s recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably “growth” factors as surging inventories and government consumption…

… and said prepare for Bidenomics to collapse in Q4?

Well it just did, and not once but twice.

First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis.” Translation: the economy is already in contraction, which would hardly be a shock since Europe is also in contraction, China’s economy is imploding and the US will never decouple from the rest of the world.

And now, it’s the same Atlanta Fed which last quarter stunned Wall Street with its 5%+ Q3 GDP estimates, and which just came out with its second Q4 GDP forecast which was a doozy: at 1.2% it was almost 50% below the Atlanta Fed’s first Q4 GDP estimate of 2.3%.

Here are the details:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on November 1, down from 2.3 percent on October 27.

After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 3.0 percent and -2.2 percent, respectively, to 1.5 percent and -2.8 percent, while the nowcast of the contribution of the change in real net exports to fourth-quarter real GDP growth increased from 0.11 percentage points to 0.22 percentage points.

Bottom line: the Bidenomics trendline that was so laughably interrupted by the one-time, artificial, and debt-driven burst in Q3 GDP is back to normal…

… and the ridiculous economic “boost” that Biden tried to represent as being the normal, is now gone. Next step: recession, rate cuts, more stimmies, and so on.

Loading…