By Benjamin Picton, senior markets strategist at Rabobank

The University of Michigan’s gauge of 5-10 year inflation expectations rose to 3.2% last week. The last time it was that high was in June of 2011, and you have to go all the way back to June of 2008 to find a higher reading (3.4%). 1-year inflation expectations also surprised by lifting to 4.4% versus a prior reading of 4.2% and an expected print of just 4%. This sets an interesting scene for the week ahead, because the US CPI report for October will be released tomorrow, and Keynesian types will tell you that inflation expectations ultimately become inflation.

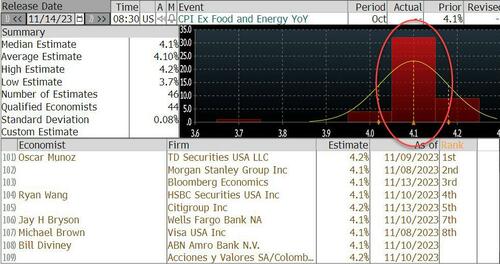

Headline CPI is expected to print at 3.3% y-o-y (down from 3.7% in September), but the consensus estimate of economists surveyed by Bloomberg is for the core reading to remain unchanged at 4.1%. Stubborn inflation pressures, and the risk of ‘un-anchored’ expectations may have been on Fed Chair Powell’s mind last week when he told an IMF conference in Washington that “we’re trying to make a judgement at this point about whether we need to do more.”

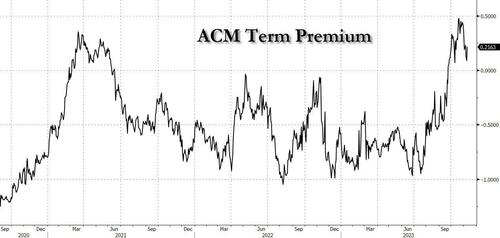

This recalls Powell’s words from August, where he said that (with respect to monetary policy) “we are navigating by the stars under cloudy skies”. In short, the Fed doesn’t know whether it has done enough or not, and if the world’s most powerful central banker is uncertain on the outlook for rates and inflation, perhaps it comes as no surprise that compensation for uncertainty (the term premium) has been rising since July.

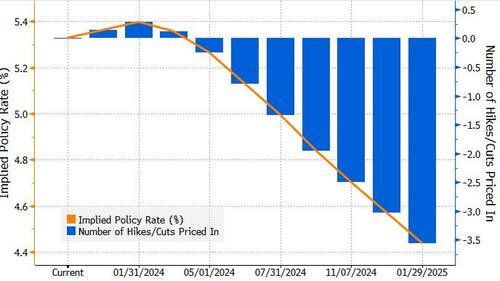

Financial markets seem to think the tightening cycle is over. Fed funds futures put the probability of another rate hike at only ~30%, and also imply close to three 25bp cuts before Christmas next year. With expectations of a cutting cycle that steep, it makes you wonder why any further hikes would be priced in at all? There seems to be a disconnect between what the central bank is saying (higher for longer, honest!), and what traders are hearing. We are firmly in the camp of Fed sceptics ourselves, maintaining as we do our call for a US recession beginning in Q4 and no more rate hikes.

The last few days have thrown up some new complications for policy makers in the USA. Moody’s announced on Friday that it has cut its outlook for the US credit rating from stable to negative. The rationale behind the shift is rising risks from large fiscal deficits and seemingly intractable political polarization, but you have to wonder if last week’s dreadful 30-year treasury auction that saw the longest tail on record and primary dealers left holding the baby to the tune of 24.7% of total issuance (more than double the average for the past year) was also a factor. Moody’s affirmation of the USA’s AAA long-term issuer and senior unsecured ratings seems to suggest that it was not, but maybe we have to read between the lines here.

Moody’s has been the lone holdout on rating the USA’s credit as AAA after Fitch cut their rating to AA+ in August and S&P did the same all the way back in 2011. The timing of the Moody’s change presents a source of embarrassment for the White House as Joe Biden is due to host Xi Xinping in San Francisco this week for the APEC conference. The two leaders will meet on Wednesday in what is sure to be an important event for both geopolitics and trade relations.

China has struck a more conciliatory tone recently as trade restrictions and a drought of foreign direct investment have added to economic woes from high debt loads and a teetering real estate sector. Just this morning Bloomberg reported that Xi may seek to offer Biden an olive branch on Wednesday by agreeing to smooth the path for Boeing to sell its 737 Max aircraft in China. This follows similar softening of China’s trade stance against US ally Australia, who had been put in the naughty corner after signing up to buy US nuclear submarines.

For Biden’s part, it might be a case of seeing is believing when it comes to market access in China. Long-time China watchers may be getting the feeling that they have seen this film before. Securing a deal to sell Boeing jets into China would be a win for Biden though, and with the loss of the final AAA rating looming, he could definitely use a win.

Trade considerations aside, White House National Security Advisor Jake Sullivan has indicated that restoring bilateral communication links between the American and Chinese militaries will be a priority for the conference. Those links were severed last year when former Speaker Nancy Pelosi visited Taiwan, and are seen as critical for minimising risks of ‘miscalculation’. The subject of Iran’s nuclear program is also likely to be discussed, though it’s hard to see China agreeing to use its influence to reign in Iranian ambitions while Iran remains a major energy supplier for China and a fellow traveller in seeking to dismantle American hegemony.

So, it’s another big week ahead for financial markets and geopolitics. We will be watching the US CPI print and the Biden-Xi meeting with interest, but not with any sense of great expectation.

By Benjamin Picton, senior markets strategist at Rabobank

The University of Michigan’s gauge of 5-10 year inflation expectations rose to 3.2% last week. The last time it was that high was in June of 2011, and you have to go all the way back to June of 2008 to find a higher reading (3.4%). 1-year inflation expectations also surprised by lifting to 4.4% versus a prior reading of 4.2% and an expected print of just 4%. This sets an interesting scene for the week ahead, because the US CPI report for October will be released tomorrow, and Keynesian types will tell you that inflation expectations ultimately become inflation.

Headline CPI is expected to print at 3.3% y-o-y (down from 3.7% in September), but the consensus estimate of economists surveyed by Bloomberg is for the core reading to remain unchanged at 4.1%. Stubborn inflation pressures, and the risk of ‘un-anchored’ expectations may have been on Fed Chair Powell’s mind last week when he told an IMF conference in Washington that “we’re trying to make a judgement at this point about whether we need to do more.”

This recalls Powell’s words from August, where he said that (with respect to monetary policy) “we are navigating by the stars under cloudy skies”. In short, the Fed doesn’t know whether it has done enough or not, and if the world’s most powerful central banker is uncertain on the outlook for rates and inflation, perhaps it comes as no surprise that compensation for uncertainty (the term premium) has been rising since July.

Financial markets seem to think the tightening cycle is over. Fed funds futures put the probability of another rate hike at only ~30%, and also imply close to three 25bp cuts before Christmas next year. With expectations of a cutting cycle that steep, it makes you wonder why any further hikes would be priced in at all? There seems to be a disconnect between what the central bank is saying (higher for longer, honest!), and what traders are hearing. We are firmly in the camp of Fed sceptics ourselves, maintaining as we do our call for a US recession beginning in Q4 and no more rate hikes.

The last few days have thrown up some new complications for policy makers in the USA. Moody’s announced on Friday that it has cut its outlook for the US credit rating from stable to negative. The rationale behind the shift is rising risks from large fiscal deficits and seemingly intractable political polarization, but you have to wonder if last week’s dreadful 30-year treasury auction that saw the longest tail on record and primary dealers left holding the baby to the tune of 24.7% of total issuance (more than double the average for the past year) was also a factor. Moody’s affirmation of the USA’s AAA long-term issuer and senior unsecured ratings seems to suggest that it was not, but maybe we have to read between the lines here.

Moody’s has been the lone holdout on rating the USA’s credit as AAA after Fitch cut their rating to AA+ in August and S&P did the same all the way back in 2011. The timing of the Moody’s change presents a source of embarrassment for the White House as Joe Biden is due to host Xi Xinping in San Francisco this week for the APEC conference. The two leaders will meet on Wednesday in what is sure to be an important event for both geopolitics and trade relations.

China has struck a more conciliatory tone recently as trade restrictions and a drought of foreign direct investment have added to economic woes from high debt loads and a teetering real estate sector. Just this morning Bloomberg reported that Xi may seek to offer Biden an olive branch on Wednesday by agreeing to smooth the path for Boeing to sell its 737 Max aircraft in China. This follows similar softening of China’s trade stance against US ally Australia, who had been put in the naughty corner after signing up to buy US nuclear submarines.

For Biden’s part, it might be a case of seeing is believing when it comes to market access in China. Long-time China watchers may be getting the feeling that they have seen this film before. Securing a deal to sell Boeing jets into China would be a win for Biden though, and with the loss of the final AAA rating looming, he could definitely use a win.

Trade considerations aside, White House National Security Advisor Jake Sullivan has indicated that restoring bilateral communication links between the American and Chinese militaries will be a priority for the conference. Those links were severed last year when former Speaker Nancy Pelosi visited Taiwan, and are seen as critical for minimising risks of ‘miscalculation’. The subject of Iran’s nuclear program is also likely to be discussed, though it’s hard to see China agreeing to use its influence to reign in Iranian ambitions while Iran remains a major energy supplier for China and a fellow traveller in seeking to dismantle American hegemony.

So, it’s another big week ahead for financial markets and geopolitics. We will be watching the US CPI print and the Biden-Xi meeting with interest, but not with any sense of great expectation.

Loading…