Authored by Lance Roberts via realinvestmentadvice.com,

Are you an “investor” or a “speculator?”

Over the last month, we have discussed the “false market narratives” that push investors to make portfolio mistakes. Such is why we previously discussed the “Investing Rules” needed to navigate volatile markets.

This past week, on the #RealInvestmentShow, we discussed the difference between being an investor, like Warren Buffett, and a speculator, which is both you and I.

In today’s market, the majority of investors are simply chasing performance. However, why would you NOT expect this to happen when financial advisers, the mainstream media, and Wall Street continually press the idea that investors “must beat” some random benchmark index from one year to the next?

But this defines the difference between being a “speculator” or an “investor?”

Graham And Carret

If you were playing a hand of poker and were dealt a “pair of deuces,” would you push all your chips to the center of the table?

Of course not.

The reason is you intuitively understand the other factors “at play.” Even a cursory understanding of the game of poker suggests other players at the table are probably holding better hands, which will rapidly reduce your wealth.

More importantly, just like a game of poker, as individuals buying a few company shares, we have ZERO control over how that company manages its finances, makes decisions, or conducts its business. As such, we are “betting” on an unknowable future outcome with only a basic understanding of the risks involved.

Therefore, as individuals, we are “speculators” in the financial markets, and as such, we must focus on the management of the risks to allow us to “stay in the game long enough” to “win.”

“Philip Carret, who wrote The Art of Speculation (1930), believed “motive” was the test for determining the difference between investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. ‘Speculation,’ wrote Carret, ‘may be defined as the purchase or sale of securities or commodities in expectation of profiting by fluctuations in their prices.’” – Robert Hagstrom, CFA

Chasing markets is the purest form of speculation. It is simply a bet on prices going higher rather than determining if the price being paid for those assets is selling at a discount to fair value.

Benjamin Graham and David Dodd attempted a precise definition of investing and speculation in their seminal work Security Analysis (1934).

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

There is also an essential passage in Graham’s The Intelligent Investor:

“The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a cause for concern. We have often said that Wall Street as an institution would be well advised to reinstate this distinction and to emphasize it in all its dealings with the public. Otherwise the stock exchanges may some day be blamed for heavy speculative losses, which those who suffered them had not been properly warned against.”

Indeed, in today’s world of chasing markets from one year to the next, the meaning of being an investor has been lost. However, the following ten guidelines from legends of our time will hopefully get you back on track and turn you from being a speculator to a successful investor.

10-Investing Guidelines From Legendary Investors

1) Jeffrey Gundlach, DoubleLine

“The trick is to take risks and be paid for taking those risks, but to take a diversified basket of risks in a portfolio.”

This is a common theme that you will see throughout this post. Great investors focus on “risk management” because “risk” is not a function of how much money you will make but how much you will lose when you are wrong. As a speculator, you can only play if you have capital.

Be greedy when others are fearful and fearful when others are greedy. One of the best times to invest is when uncertainty and fear are the highest.

2) Ray Dalio, Bridgewater Associates

“The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.”

Nothing good or bad goes on forever. The mistake that investors repeatedly make is thinking, “This time is different.” The reality is that it will change despite whatever mainstream narrative is permeating headlines. The rule that never changes is that “what goes up must and will come down, and vice versa.”

Wall Street wants you to be fully invested “all the time” because that is how they generate fees. However, as an investor, it is crucially important to remember that “price is what you pay, and value is what you get.”

Speculators don’t care about value. Investors do.

3) Seth Klarman, Baupost

“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”

The most significant risk in investing is investor behavior driven by cognitive biases. “Greed and fear” dominate the investment cycle of investors, ultimately leading to “buying high and selling low.”

4) Jeremy Grantham, GMO

“You don’t get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it.”

Successful investors avoid “risk” at all costs, even if it means underperforming in the short term. The reason is that while the media and Wall Street have you focused on chasing market returns in the short term, ultimately, the excess “risk” built into your portfolio will lead to abysmal long-term returns. Like Wyle E. Coyote, chasing financial markets will eventually lead you over the cliff’s edge.

5) Jesse Livermore, Speculator

“The speculator’s deadly enemies are: ignorance, greed, fear and hope. All the statute books in the world and all the rule books on all the Exchanges of the earth cannot eliminate these from the human animal….”

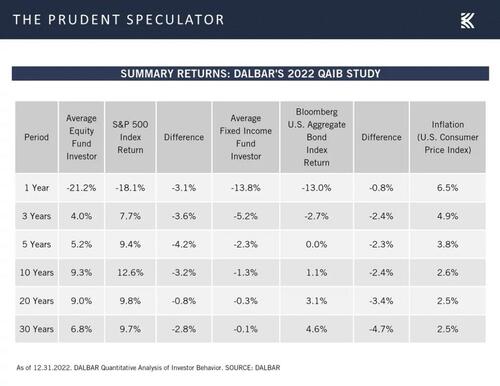

Allowing emotions to rule your investment strategy is, and always has been, a recipe for disaster. All great investors follow a strict discipline, process, and risk management diet. The emotional mistakes show up in the returns of individual portfolios over time. (Source: Dalbar)

6) Howard Marks, Oaktree Capital Management

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.”

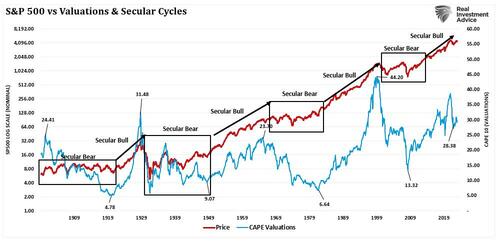

As with Ray Dalio, realizing nothing lasts forever is critical to long-term investing. To “buy low,” one must first “sell high.” Understanding that all things are cyclical suggests that investments become more prone to declines after long price increases.

7) James Montier, GMO

“There is a simple, although not easy alternative [to forecasting]… Buy when an asset is cheap, and sell when an asset gets expensive…. Valuation is the primary determinant of long-term returns, and the closest thing we have to a law of gravity in finance.”

“Cheap” is when an asset sells for less than its intrinsic value. “Cheap” is not a low price per share. When a stock has a very low price, it is usually priced there for a reason. However, a very high-priced stock CAN be cheap. Price per share is only part of the valuation determination, not the measure of value itself.

8) George Soros, Soros Capital Management

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Regarding risk management, being right and making money is great when markets are rising. However, rising markets tend to mask investment risk that is quickly revealed during market declines. If you fail to manage the risk in your portfolio and give up all of your previous gains and then some, you lose the investment game.

9) Jason Zweig, Wall Street Journal

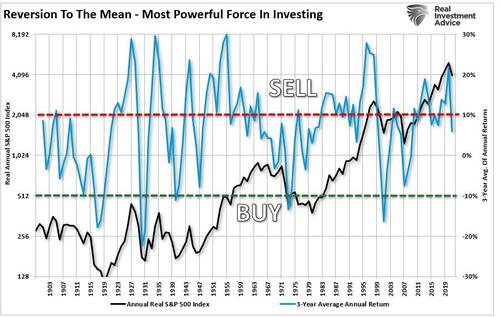

“Regression to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.”

The chart below shows the 3-year average of annual inflation-adjusted returns of the S&P 500 to 1900. The power of regression is seen. Historically, when returns exceeded 10%, it was not long before they fell to 10% below the long-term mean. Those reversions were devastating to investor’s capital.

10) Howard Marks, Oaktree Capital Management

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.”

The biggest driver of long-term investment returns is the minimization of psychological investment mistakes.

Baron Rothschild once said, “Buy when there is blood in the streets.” This means that when investors are “panic selling,” you want to be the one they sell to at deeply discounted prices. Howard Marks expressed the same sentiment: “The absolute best buying opportunities come when asset holders are forced to sell.”

Conclusion

As an investor, it is simply your job to step away from your “emotions” and look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend significantly on how you answer that question and manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

As I stated at the beginning of this message, “Market Timing” is ineffective in managing your money. However, as you will note, every great investor throughout history has had one core philosophy in common: the management of the inherent risk of investing to conserve and preserve investment capital.

“If you run out of chips, you are out of the game.”

Authored by Lance Roberts via realinvestmentadvice.com,

Are you an “investor” or a “speculator?”

Over the last month, we have discussed the “false market narratives” that push investors to make portfolio mistakes. Such is why we previously discussed the “Investing Rules” needed to navigate volatile markets.

This past week, on the #RealInvestmentShow, we discussed the difference between being an investor, like Warren Buffett, and a speculator, which is both you and I.

In today’s market, the majority of investors are simply chasing performance. However, why would you NOT expect this to happen when financial advisers, the mainstream media, and Wall Street continually press the idea that investors “must beat” some random benchmark index from one year to the next?

But this defines the difference between being a “speculator” or an “investor?”

Graham And Carret

If you were playing a hand of poker and were dealt a “pair of deuces,” would you push all your chips to the center of the table?

Of course not.

The reason is you intuitively understand the other factors “at play.” Even a cursory understanding of the game of poker suggests other players at the table are probably holding better hands, which will rapidly reduce your wealth.

More importantly, just like a game of poker, as individuals buying a few company shares, we have ZERO control over how that company manages its finances, makes decisions, or conducts its business. As such, we are “betting” on an unknowable future outcome with only a basic understanding of the risks involved.

Therefore, as individuals, we are “speculators” in the financial markets, and as such, we must focus on the management of the risks to allow us to “stay in the game long enough” to “win.”

“Philip Carret, who wrote The Art of Speculation (1930), believed “motive” was the test for determining the difference between investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. ‘Speculation,’ wrote Carret, ‘may be defined as the purchase or sale of securities or commodities in expectation of profiting by fluctuations in their prices.’” – Robert Hagstrom, CFA

Chasing markets is the purest form of speculation. It is simply a bet on prices going higher rather than determining if the price being paid for those assets is selling at a discount to fair value.

Benjamin Graham and David Dodd attempted a precise definition of investing and speculation in their seminal work Security Analysis (1934).

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

There is also an essential passage in Graham’s The Intelligent Investor:

“The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a cause for concern. We have often said that Wall Street as an institution would be well advised to reinstate this distinction and to emphasize it in all its dealings with the public. Otherwise the stock exchanges may some day be blamed for heavy speculative losses, which those who suffered them had not been properly warned against.”

Indeed, in today’s world of chasing markets from one year to the next, the meaning of being an investor has been lost. However, the following ten guidelines from legends of our time will hopefully get you back on track and turn you from being a speculator to a successful investor.

10-Investing Guidelines From Legendary Investors

1) Jeffrey Gundlach, DoubleLine

“The trick is to take risks and be paid for taking those risks, but to take a diversified basket of risks in a portfolio.”

This is a common theme that you will see throughout this post. Great investors focus on “risk management” because “risk” is not a function of how much money you will make but how much you will lose when you are wrong. As a speculator, you can only play if you have capital.

Be greedy when others are fearful and fearful when others are greedy. One of the best times to invest is when uncertainty and fear are the highest.

2) Ray Dalio, Bridgewater Associates

“The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.”

Nothing good or bad goes on forever. The mistake that investors repeatedly make is thinking, “This time is different.” The reality is that it will change despite whatever mainstream narrative is permeating headlines. The rule that never changes is that “what goes up must and will come down, and vice versa.”

Wall Street wants you to be fully invested “all the time” because that is how they generate fees. However, as an investor, it is crucially important to remember that “price is what you pay, and value is what you get.”

Speculators don’t care about value. Investors do.

3) Seth Klarman, Baupost

“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”

The most significant risk in investing is investor behavior driven by cognitive biases. “Greed and fear” dominate the investment cycle of investors, ultimately leading to “buying high and selling low.”

4) Jeremy Grantham, GMO

“You don’t get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it.”

Successful investors avoid “risk” at all costs, even if it means underperforming in the short term. The reason is that while the media and Wall Street have you focused on chasing market returns in the short term, ultimately, the excess “risk” built into your portfolio will lead to abysmal long-term returns. Like Wyle E. Coyote, chasing financial markets will eventually lead you over the cliff’s edge.

5) Jesse Livermore, Speculator

“The speculator’s deadly enemies are: ignorance, greed, fear and hope. All the statute books in the world and all the rule books on all the Exchanges of the earth cannot eliminate these from the human animal….”

Allowing emotions to rule your investment strategy is, and always has been, a recipe for disaster. All great investors follow a strict discipline, process, and risk management diet. The emotional mistakes show up in the returns of individual portfolios over time. (Source: Dalbar)

6) Howard Marks, Oaktree Capital Management

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.”

As with Ray Dalio, realizing nothing lasts forever is critical to long-term investing. To “buy low,” one must first “sell high.” Understanding that all things are cyclical suggests that investments become more prone to declines after long price increases.

7) James Montier, GMO

“There is a simple, although not easy alternative [to forecasting]… Buy when an asset is cheap, and sell when an asset gets expensive…. Valuation is the primary determinant of long-term returns, and the closest thing we have to a law of gravity in finance.”

“Cheap” is when an asset sells for less than its intrinsic value. “Cheap” is not a low price per share. When a stock has a very low price, it is usually priced there for a reason. However, a very high-priced stock CAN be cheap. Price per share is only part of the valuation determination, not the measure of value itself.

8) George Soros, Soros Capital Management

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Regarding risk management, being right and making money is great when markets are rising. However, rising markets tend to mask investment risk that is quickly revealed during market declines. If you fail to manage the risk in your portfolio and give up all of your previous gains and then some, you lose the investment game.

9) Jason Zweig, Wall Street Journal

“Regression to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.”

The chart below shows the 3-year average of annual inflation-adjusted returns of the S&P 500 to 1900. The power of regression is seen. Historically, when returns exceeded 10%, it was not long before they fell to 10% below the long-term mean. Those reversions were devastating to investor’s capital.

10) Howard Marks, Oaktree Capital Management

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.”

The biggest driver of long-term investment returns is the minimization of psychological investment mistakes.

Baron Rothschild once said, “Buy when there is blood in the streets.” This means that when investors are “panic selling,” you want to be the one they sell to at deeply discounted prices. Howard Marks expressed the same sentiment: “The absolute best buying opportunities come when asset holders are forced to sell.”

Conclusion

As an investor, it is simply your job to step away from your “emotions” and look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend significantly on how you answer that question and manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

As I stated at the beginning of this message, “Market Timing” is ineffective in managing your money. However, as you will note, every great investor throughout history has had one core philosophy in common: the management of the inherent risk of investing to conserve and preserve investment capital.

“If you run out of chips, you are out of the game.”

Loading…