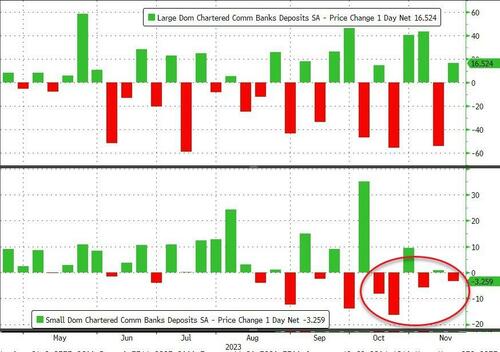

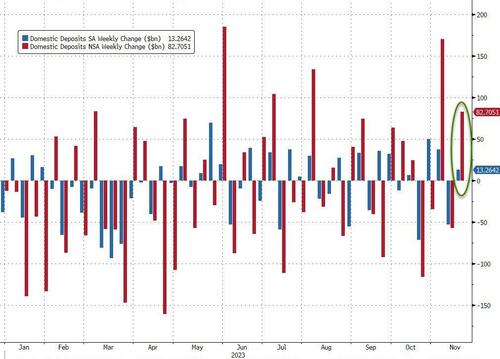

Total domestic US banks saw inflows last week on a SA and NSA basis...

Source: Bloomberg

But, while large banks saw $16.5BN (SA) in deposit inflow, small banks suffered another weekly deposit outflow (of $3.3BN SA) last week...

Source: Bloomberg

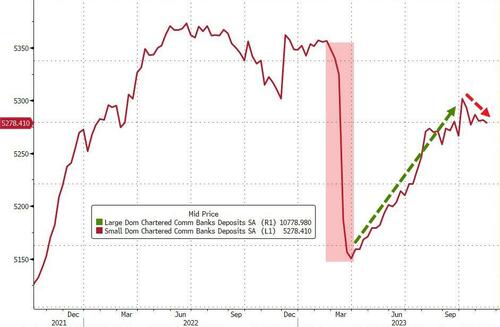

This pulled total deposits down to their lowest since September after rising (on a Fed magically-adjusted basis) for six months...

Source: Bloomberg

And as deposits flow out of small banks, usage of The Fed's emergency funding facility for the banks increased to a new record high again, above $114BN...

Source: Bloomberg

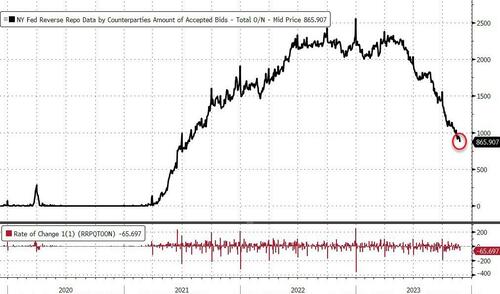

Meanwhile, the amount of money that investors are parking at The Fed's reverse repo facility has accelerated since breaking below $1 trillion to its lowest since July 2021. Some 94 counterparties parked $865.9 billion at the Fed’s overnight reverse repo facility, the lowest since July 2021, from $931.6 billion the prior session. The roughly $66 billion decrease is the largest drop since Oct 12.

Source: Bloomberg

As we previously noted, this marks a steep decline from a record $2.554 trillion stashed on Dec. 30, and some are starting to worry about the consequences.

Wrightson ICAP economist Lou Crandall said in a note Monday that the Fed should stop paring its bond holdings before the facility is completely emptied to make sure that banks’ cash buffers don’t get too lean and increase pressure on short-term funding markets.

“We think banks should be encouraged to hold deep liquidity buffers, so our preference would be to adopt a generous definition of ‘ample,’” Crandall wrote.

“Surplus cash sitting in the RRP facility can be redeployed by money funds into the repo market in the event of a spike in financing needs.”

Reserve scarcity has caused overnight lending rates to jump in the past, notably in 2019, when the Treasury increased its borrowing and the Fed stopped buying as many Treasuries for its balance sheet.

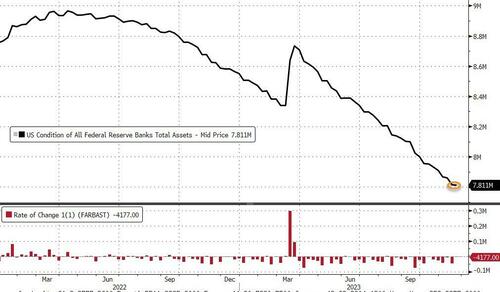

The Fed's balance sheet shrank very modestly last week, down by just $4.2BN

Source: Bloomberg

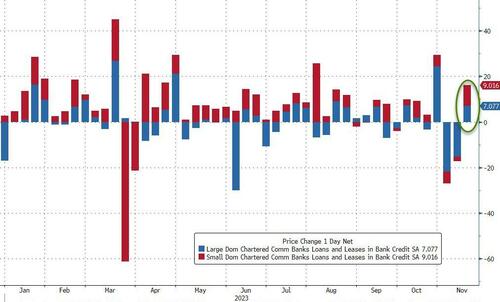

Loan volumes increased last week (after two weeks of declines) with large bank loans up $7.1BN and small bank loans up $9BN (odd given the deposit outflows)...

Source: Bloomberg

Equity market cap continued to bounce back along with an increase in bank reserves at The Fed...

Source: Bloomberg

All of which is a problem, as the key warning sign continues to trend ominously lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now)...

Source: Bloomberg

As the green line shows, without The Fed's help, the crisis is back (and large bank cash needs a home - blue line - like picking up a small bank from the FDIC?).

Total domestic US banks saw inflows last week on a SA and NSA basis…

Source: Bloomberg

But, while large banks saw $16.5BN (SA) in deposit inflow, small banks suffered another weekly deposit outflow (of $3.3BN SA) last week…

Source: Bloomberg

This pulled total deposits down to their lowest since September after rising (on a Fed magically-adjusted basis) for six months…

Source: Bloomberg

And as deposits flow out of small banks, usage of The Fed’s emergency funding facility for the banks increased to a new record high again, above $114BN…

Source: Bloomberg

Meanwhile, the amount of money that investors are parking at The Fed’s reverse repo facility has accelerated since breaking below $1 trillion to its lowest since July 2021. Some 94 counterparties parked $865.9 billion at the Fed’s overnight reverse repo facility, the lowest since July 2021, from $931.6 billion the prior session. The roughly $66 billion decrease is the largest drop since Oct 12.

Source: Bloomberg

As we previously noted, this marks a steep decline from a record $2.554 trillion stashed on Dec. 30, and some are starting to worry about the consequences.

Wrightson ICAP economist Lou Crandall said in a note Monday that the Fed should stop paring its bond holdings before the facility is completely emptied to make sure that banks’ cash buffers don’t get too lean and increase pressure on short-term funding markets.

“We think banks should be encouraged to hold deep liquidity buffers, so our preference would be to adopt a generous definition of ‘ample,’” Crandall wrote.

“Surplus cash sitting in the RRP facility can be redeployed by money funds into the repo market in the event of a spike in financing needs.”

Reserve scarcity has caused overnight lending rates to jump in the past, notably in 2019, when the Treasury increased its borrowing and the Fed stopped buying as many Treasuries for its balance sheet.

The Fed’s balance sheet shrank very modestly last week, down by just $4.2BN

Source: Bloomberg

Loan volumes increased last week (after two weeks of declines) with large bank loans up $7.1BN and small bank loans up $9BN (odd given the deposit outflows)…

Source: Bloomberg

Equity market cap continued to bounce back along with an increase in bank reserves at The Fed…

Source: Bloomberg

All of which is a problem, as the key warning sign continues to trend ominously lower (Small Banks’ reserve constraint), supported above the critical level by The Fed’s emergency funds (for now)…

Source: Bloomberg

As the green line shows, without The Fed’s help, the crisis is back (and large bank cash needs a home – blue line – like picking up a small bank from the FDIC?).

Loading…