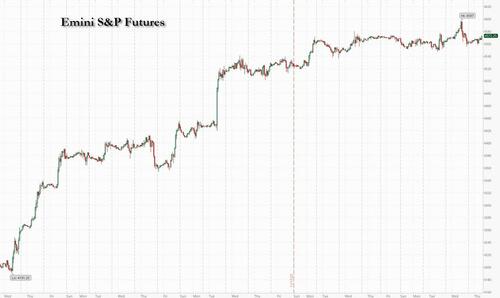

US equity futures, European bourses and Asian markets all advanced, and Treasuries steadied at the end of a blistering November run after more dovish comments from hawkish Fed officials this week, and as investors waited for a key US inflation metric for further evidence that price pressure are cooling. As of 7:55am ET, S&P futures rose 0.3% while US 10-year yields climb 3bp to 4.29%. Treasuries paused their strongest monthly gain since 2008, with yields on 10-year paper up four basis points at 4.30%. The dollar bounced 0.4% at the end of its worst month in a year, sending all major developed- and emerging-market currencies lower. The euro traded down 0.5% versus the greenback as the pace of price growth in the region cooled. Today’s macro focus will be the PCE, Personal Income/Spending and Initial Jobless Claims. The PCE release today will provide us with more details on the disinflation trend in Q4: Consensus sees core PCE printing 3.5% YoY vs. 3.68% prior. Eyes will also be on OPEC+ today as the group may consider a production cut at today’s meeting: RTRS sources said OPEC+ ministers agreed for a preliminary cut for over 1mn bpd.

In premarket trading, megacap tech are leading gains morning, with TSLA +65bp and GOOGL + 29bp. Salesforce jumped about 9% after the application software company’s third-quarter results and profit forecasts beat estimates. Here are some other notable premarket movers:

- HP Enterprise shares are up about 3% and are set to extend gains for a second session as Morgan Stanley raised its recommendation following results.

- ImmunoGen shares are halted after AbbVie (ABBV) agreed to buy the company. Stock is set to resume trading at 8 a.m.

- Nutanix gains about 9% as strong demand fueled a quarterly sales beat.

- Okta Inc. is down about 2% after a pair of analysts issued downgrades following the company’s breach disclosures.

- Pure Storage slumps 17% after the technology company’s outlook disappointed.

- Snowflake climbs about 7% after the US cloud-software company posted 3Q results that beat expectations and the firm gave an outlook that is seen as strong.

- Synopsys shares are up 2% after the maker of electronic design automation software reported fourth-quarter results that beat expectations.

Easing inflation and signs of a milder-than-expected slowdown in the US economy have sent Treasuries, agency and mortgage debt to their best month since the 1980s, triggering a November surge that pulled along assets from stocks to credit to emerging markets.

Oil gained following a Reuters reports that OPEC+ has reached a preliminary agreement on an additional output cut of more than 1mb/d. Details of how the cut will be distributed are yet to be finalised, but it is important that Saudi Arabia appears to have been able to maintain the unified stance from OPEC+ -- at least long enough to move through the seasonally low demand period of 1Q24. Front-month Brent crude is up is up 2% at $84.69 a barrel.

Data due Thursday is forecast to show the Fed’s preferred inflation metric — the personal consumption expenditures price index — decelerated in October to the slowest annual rate since early 2021.

“Momentum on the other side of the pond is likely to remain bullish rates,” wrote Evelyne Gomez-Liechti, a multi-asset strategist at Mizuho International Plc in London. “The PCE inflation data for October is most likely going to echo what we already saw in the October CPI and PPI reports and add to the soft-landing narrative.”

Now, traders are looking to a speech by Fed Chair Jerome Powell on Friday.

“Upcoming Fed communication could continue to stress the need hold rates steady for some time,” said Hauke Siemssen, rates strategist at Commerzbank AG. “We expect the air to be getting thinner for further bond market performance ahead of the usual supply wave early next year.”

European stocks are in the green with the Stoxx 600 rising 0.4%, set for their best month since January. Energy, financial and insurance shares are leading gains; oil stocks are the top performers on Europe’s Stoxx 600 index, as OPEC+ producers prepare to discuss additional output cuts of about one million barrels a day. The euro sank after weak French economic data and a Euro-zone inflation print that came in lower than the estimates of all economists in a Bloomberg poll. Traders are now fully pricing in a rate cut from the ECB by April after data showed euro-area inflation slowed more than expected in November. Here are some of the biggest movers on Thursday:

- VAT Group shares climb as much as 5.6%, to the highest level since January 2022 after the Swiss chipmaker announced it will end its short-time work scheme in the country’s production sites.

- Leonardo shares rise as much as 4.8%, the most intraday since Oct. 9, as JPMorgan reinstates full coverage of the aerospace and defense company with an overweight rating. A recovery in end markets and “self-help” can drive the shares higher in coming years, according to the analysts.

- ABB shares climb as much as 1.9%, touching the highest level since August, as the Swiss industrial conglomerate’s new revenue and margin targets came in ahead of estimates. The update will trigger low to mid-single digit percentage upgrades to 2025 consensus expectations, according to Citigroup.

- ASR Nederland and NN Group both soar by as much as 15% as ASR’s settlement of a long-standing miss-selling case removes a major overhang for the company and provides optimism of a resolution for its Dutch peer NN.

- Outokumpu shares surge as much as 14%, the most in almost 13 months, after the Finnish steelmaker announces an extension to its partnership with AM/NS within the Americas region, which Morgan Stanley says removes a key overhang.

- ASML shares drop as much as 1.8% after the Dutch chip-equipment maker said Christophe Fouquet will become CEO when Peter Wennink retires next year. Chief Technology Officer Martin van den Brink, who worked at the firm since its foundation in 1984, will also retire.

- Dr Martens shares plummet as much as 27%, dropping to the lowest intraday level on record, after the bootmaker’s first-half revenue missed estimates. The company also said that improvement in the US business will probably take longer than expected. Analysts viewed the results as weak overall, with Morgan Stanley attributing the miss mainly to industry-wide destocking across the Americas wholesale channel.

- OCI falls as much as 9.3% after being downgraded to hold from buy at Jefferies, which said that natural gas supply is becoming ample, potentially hurting profits from company’s planned investments.

- Future plc drops as much as 8.5% after Canaccord Genuity downgrades the media company to sell from hold, saying there is material risk of downgrades to consensus. It is the stock’s only negative analyst rating.

- Elekta shares fall as much as 7.1%, the most intraday in six months, after the Swedish medical equipment firm reported second-quarter results, with analysts noting some weakness in the company’s outlook comments and a strong share-price performance ahead of the release.

- Siltronic shares fall as much as 5.7% after the German silicon wafer manufacturer says chip inventories will remain high for at least the first half of 2024. The company also set mid-term sales growth targets that Jefferies said were slightly below consensus expectations.

Earlier in the session, Asian stocks gained, with investors in Chinese shares shrugging off a weak set of economic data on expectations that Beijing will ramp up support for the flagging economy. The MSCI Asia Pacific Index rose as much as 0.2%, buoyed by Chinese tech giants such as Tencent, with the gauge headed toward its best month since January. Japanese shares fell for a fourth day as the yen strengthened, while Korean stocks advanced after the Bank of Korea held its key interest rate. Hong Kong’s Hang Seng Index rebounded from the lowest level in a year after activity in China’s manufacturing and services sectors shrank in November, adding to expectations of further government support for the economy. Chinese President Xi Jinping’s first visit to Shanghai in three years was also seen as a positive for the tech sector. The relief rally in Chinese stocks could extend into early 2024 on “easing US-China tensions, China’s easing deflation, revenue growth pickup and further cost and interest expense cuts by enterprises lending support to non-financial margins,” JPMorgan & Chase Co. strategists including Wendy Liu wrote in a note.

- Hang Seng and Shanghai Comp were indecisive with only brief pressure seen after the PMI data showed a steeper contraction in China’s factory activity which raises the prospects for further supportive measures.

- Japan's Nikkei 225 swung between gains and losses amid recent currency strength and with better-than-expected Industrial Production offset by softer Retail Sales.

- Korea's Kospi was just about kept afloat following the unsurprising decision by the BoK to keep rates unchanged and noted that it will maintain a restrictive policy stance for a sufficiently long period of time.

- Australia's ASX 200 was choppy after mixed data in which Building Approvals topped forecast and Private Capital Expenditure missed estimates.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4%; but for the month it is poised to fall around 3%, its worst month in a year. The euro fell 0.5% as German yields slid as markets pulled forward expectations for ECB rate cuts, now fully pricing in the first rate cut by April 2024. Investors have become confident that the Fed has ended its monetary tightening campaign, and have turned their focus on rate cuts for next year, which has weighed on the dollar and boosted Treasuries. “A medium-term US dollar weakening trend is already underway,” Wells Fargo strategists including Aroop Chatterjee wrote in a research note. “The US dollar owes its recent strength to the high levels of US real rates — above 2% across much of the curve. We expect these to head toward more normal levels as the economy slows and disinflation continues”

In rates, treasuries were slightly cheaper across the curve with losses led by long-end, extending Wednesday’s steepening move. US 10-year yields around 4.295%, cheaper by 4bp on the day with bunds outperforming by 3bp in the sector; continued long-end underperformance steepens 2s10s spread by 2.5bp while 5s30s is only slightly wider vs Wednesday close. 10-year touched 4.246% during Asia session, lowest level since September, extending retreat from October’s multiyear high near 5.02% that has fueled the market’s biggest monthly advance since 2008 (3.9% through Nov. 29). Core European rates outperform after French November inflation slowed more than expected.

In commodities, crude futures advance as the OPEC meeting gets underway, with WTI rising 1% to trade near $78.70. Spot gold falls 0.3%.

To the day ahead now, and the main data highlight will be the flash CPI release for the Euro Area in November, which printed below the lowest estimate as European inflation slides, along with the unemployment rate for October. In the US, we’ll get the weekly initial jobless claims, PCE inflation, and personal income and spending for October. Central bank speakers include ECB President Lagarde, the ECB’s Panetta and Nagel, the Fed’s Williams, and the BoE’s Greene. Otherwise, the COP28 summit begins today, and there’s also the OPEC+ meeting taking place.

Market Snapshot

- S&P 500 futures up 0.1% to 4,565.75

- STOXX Europe 600 up 0.2% to 459.86

- MXAP up 0.4% to 162.25

- MXAPJ up 0.3% to 505.27

- Nikkei up 0.5% to 33,486.89

- Topix up 0.4% to 2,374.93

- Hang Seng Index up 0.3% to 17,042.88

- Shanghai Composite up 0.3% to 3,029.67

- Sensex little changed at 66,932.47

- Australia S&P/ASX 200 up 0.7% to 7,087.33

- Kospi up 0.6% to 2,535.29

- German 10Y yield little changed at 2.41%

- Euro down 0.3% to $1.0936

- Brent Futures up 0.8% to $83.80/bbl

- Gold spot down 0.1% to $2,041.77

- U.S. Dollar Index up 0.34% to 103.11

Top Overnight News

- Occidental Petroleum is in talks to buy CrownRock, a major energy producer in the west Texas area of the Permian basin, continuing a frenzy of deal making in the oil patch. A deal for the closely held company, which could be valued well above $10 billion including debt, could come together soon assuming the talks don’t fall apart or another suitor doesn’t prevail, according to people familiar with the matter. WSJ

- Elon Musk told advertisers who have halted spending on X due to his endorsement of an antisemitic post to “go F” themselves, deepening a rift between the billionaire and the companies that generate most of the social media platform’s revenue. FT

- China’s NBS PMIs for Nov fall short of expectations, with manufacturing coming in at 49.4 (down from 49.5 in Oct and below the Street’s 49.8 forecast) and services sliding to 50.2 (down from 50.6 in Oct and below the Street’s 50.9 forecast). FT

- WMT shipped 25% of all its US imports from India between Jan and Aug of '23 vs. just 2% in '18 as the firm moves its supply chain away from China (imports from China went from 80% to 60% of the total). RTRS

- China Evergrande seeks to avoid liquidation with a last-minute debt restructuring plan, but creditors are unlikely to accept the new proposal. RTRS

- France’s CPI falls by more than expected in Nov, coming in at +3.8% (down from +4.5% in Oct and below the Street’s +4.1% forecast). RTRS

- Eurozone CPI sinks by more than anticipated in Nov, with headline coming in at +2.4% (down from +2.9% in Oct and below the Street’s +2.7% forecast) and core +3.6% (down from +4.2% in Oct and below the Street’s +3.9% forecast). BBG

- Israel and Hamas agreed to extend their truce for at least another day in an announcement just minutes before it was set to expire. Antony Blinken will discuss the path forward with the Israeli government today. BBG

- Henry Kissinger, the former US secretary of state, died at the age of 100. He defined American foreign policy in the 1970s with his strategies to end the Vietnam War, and remained China’s preferred go-between with Washington until his death. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed and indecisively capped off this month’s notable gains as the Israel-Hamas truce hung in the balance before the announcement of a last-minute one-day extension, while participants also digested a slew of key data releases including disappointing Chinese official PMI figures. ASX 200 was choppy after mixed data in which Building Approvals topped forecast and Private Capital Expenditure missed estimates. Nikkei 225 swung between gains and losses amid recent currency strength and with better-than-expected Industrial Production offset by softer Retail Sales. KOSPI was just about kept afloat following the unsurprising decision by the BoK to keep rates unchanged and noted that it will maintain a restrictive policy stance for a sufficiently long period of time. Hang Seng and Shanghai Comp were indecisive with only brief pressure seen after the PMI data showed a steeper contraction in China’s factory activity which raises the prospects for further supportive measures.

Top Asian News

- Taiwan is closely monitoring China's respiratory illnesses outbreak and will adjust epidemic prevention measures when needed.

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision unanimous and four out of the seven board members said the door to a rate hike should remain open. BoK said uncertainties to the growth path are high with the economy facing heightened geopolitical risks and restrictive monetary policies abroad, while it will maintain a restrictive policy stance for a "sufficiently long period" of time (prev. "considerable time") until the board is confident inflation will converge to the target level. Furthermore. Governor Rhee said the current policy rate is sufficiently restrictive and that restrictive monetary policy could stay for longer than six months.

- Hong Kong Exchange consultation paper on severe weather: severe conditions will no longer have automatic consequential impact on the continuity of trading

European bourses currently post modest gains, Euro Stoxx 50 +0.2%, despite spending the majority of the morning in the red; with the FTSE 100 outperforming, +0.6%, boosted by broader Crude price action pre-OPEC+; DAX 40 is lifted by SAP, +1.1%, as a read-over from Salesforce earnings. European sectors are mixed, though with a positive tilt; Energy significantly outperforms whilst Autos lag. Stateside futures, NQ & ES +0.2%, tilt higher in-fitting with the European bias as markets await US PCE data.

Top European News

- German Finance Minister Lindner said Germany faces a EUR 17bln gap in the 2024 budget.

- Dutch NSC party said it is not ready to negotiate on joining the Cabinet with far-right leader Wilders, according to ANP.

- ECB to, as usual, temporarily pause PEPP purchases (reinvestments) in anticipation of significantly lower market liquidity towards the end of this year. The last trading day before 19th December 2023, and purchases will resume on 2nd January 2024.

- BoE Monthly Decision Maker Panel (3rd-17th Nov): One-year ahead CPI inflation expectations decreased to 4.4% in November, down from 4.6% in October, expected year-ahead wage growth remained unchanged at 5.1%. The three-month moving average fell by 0.2 percentage points to 4.6% in the three months to November. Three-year ahead CPI inflation expectations increased 0.1 percentage point to 3.2% in November.

- ECB will discuss QT in December, via Econostream citing an ECB insider; some preference for coming to a QT decision next year as it means less once in 2024. Lagarde will not try to delay the discussion indefinitely. Will not take many meetings to come to a decision on PEPP, given broad agreement currently. PEPP change is expected, liquidity is high; unworried by how markets will take the change.

- ECB’s Panetta says ECB needs to avoid "useless damage" to the economy and financial stability that would end up also putting price stability at risk; ECB may be able to ease monetary conditions if persistently weak output accelerates decline in inflation; Monetary tightening has not yet had full impact, it will continue to dampen demand in the future

FX

- Dollar resumes recovery rally with a firm fillip from the Euro post-EZ inflation data and pre-US PCE/IJC.

- DXY towards top of 103.35-102.71 range and EUR/USD hovering near bottom of 1.0910-84 band.

- Pound and Yen suffer contagion, with Cable sub-1.2650 and USD/JPY above 147.50 compared to 1.2700+ and 146.85 at one stage.

- Loonie underpinned between 1.3568-1.3616 parameters as oil rebounds in advance of Canadian GDP metrics.

- PBoC set USD/CNY mid-point at 7.1018 vs exp. 7.1273 (prev. 7.1031).

- Banxico Governor Rodriguez said they do not see a rate cut in the December decision but it is possible they could begin a discussion of rate cuts in meetings early next year.

Fixed Income

- Debt futures wane after short squeeze fizzles out.

- Bunds hit brakes just ahead of 133.00 as cool EZ inflation data pre-empted.

- Gilts undermined by extra DMO issuance and probing 97.00 to downside.

- T-note near base of 110-05+/14 range awaiting US PCE and IJC.

- UK DMO Gilt Auction Calendar: December 2023-March 2024. Two Gilts (2053 & 2034) to be sold at the additional auctions on 13th & 19th December; The gilts to be issued at auctions on 5, 6 and 12 December 2023 were previously announced on 31 August 2023. The auctions on 13 and 19 December 2023 were added to the calendar at the remit revision published on 22 November 2023

Commodities

- WTI and Brent, +1.9%, extend gains following reports that OPEC+ has a preliminary agreement for additional oil output cuts in excess of 1mln BPD, according to Reuters; reminder the JMMC commences at 08:30EST and the OPEC+ gathering at 09:30EST.

- Spot Gold is marginally lower, owing to the firmer Dollar, though with overall trade rangebound ahead of US PCE, base metals are mixed/flat following on from weaker Chinese PMI data and the FX influence.

- OPEC "proposal is around Saudi Arabia extending the voluntary cuts of 1 million bpd and then on top of that other states may add additional cuts", via Energy Intel's Bakr

- OPEC+ has a preliminary agreement for additional oil output cuts in excess of 1mln BPD, via Reuters citing a delegate; Talks around an OPEC cut of more than 1mln BPD will depend on how much could be contributed by members states, Energy Intel reports; adds almost all member states appear to be aligned that a deeper cut is needed

- Updated OPEC Timings for today: OPEC meeting at 10:00GMT/05:00EST, JMMC meeting at 13:30GMT/08:30EST, OPEC+ meeting at 14:30GMT/09:30EST, according to EnergyIntel's Bakr

- OPEC/OPEC+ meetings expected to occur as scheduled on Thursday, via Reuters citing sources; OPEC+ continues to discuss additional oil output cut for early-2024

- OPEC+ additional output cut discussions range from 1-2mln BPD, according to Reuters sources

- OPEC+ reportedly mulls new oil production cuts amid the Middle East conflict with Saudi Arabia favouring a curb of up to 1mln BPD, while other members oppose downgrading quotas with Nigeria and Angola resisting a downgrade of their individual quotas and the UAE is also reluctant to cut output. Furthermore, it was stated that a rollover of most existing output curbs is the most likely scenario but talks are continuing, according to WSJ citing delegates.

- Kazakhstan Energy Ministry said oil output was down 34% at Karachaganak oilfield on November 29th due to the Black Sea storm.

- Oil loadings from Novorossiysk and CPC terminals remained shut on Wednesday amid a storm with the November plan for Novorossiysk delayed by over 1mln tons, according to Reuters sources.

- First Quantum (FM CA) announced the suspension of 7,000 contract employees due to force majeure at its Panama mine.

Geopolitics: Israel-Hamas

- Israeli military said the truce will continue in light of mediators' efforts to release more hostages and Hamas also confirmed that it agreed to extend the truce for a seventh day, according to Reuters.

- Sources in Israel's war council earlier noted that Hamas's list of the new batch of hostages to be released did not meet the agreed criteria and Israel officials warned fighting will resume if Hamas does not present a new list by 07:00 local time (05:00GMT/00:00EST), while Hamas confirmed Israel rejected its proposed hostage release and it told its fighters to be ready for renewed battles if the truce with Israel was not extended, according to Al Jazeera, Al Arabiya and Reuters.

- Israeli prison service announced it released 30 Palestinians in the sixth round of Gaza truce swaps on Wednesday.

- UK Defence Minister Shapps is sending a warship to the Gulf region amid fears of a ramp up in Iranian missile attacks. The warship will protect against drone threats and ensure safe flow of trade, according to the Telegraph.

- China issued a position paper on the Israeli-Palestinian conflict which stated that the UN Security Council should respond to the general call of the international community for a comprehensive ceasefire to be put in place to stop the fighting. Furthermore, China's Foreign Minister Wang Yi said a spillover of the Israeli-Palestinian conflict to the entire Middle East region should be avoided by urging countries that have an impact on the parties to play an active role, while he added that China is to send another batch of emergency humanitarian supplies to Gaza to alleviate the humanitarian situation.

- "Sirens in the Upper Galilee in northern Israel after a march crept in from southern Lebanon", according to Al Arabiya

- United Nations Interim Force In Lebanon says Israel retaliated to cross-border fire from Lebanon

- "Estimates in Israel indicate that tomorrow is the last day of the truce in Gaza", according to Al Arabiya citing Israeli Press Yedioth Ahronoth

Geopolitics: North Korea

- North Korean leader Kim inspected satellite photos of a US naval base in San Diego and Kadena air base in Japan, while North Korea said it will never sit face-to-face with the US for negotiations, according to KCNA.

US Event Calendar

- 08:30: Nov. Initial Jobless Claims, est. 218,000, prior 209,000

- Nov. Continuing Claims, est. 1.87m, prior 1.84m

- 08:30: Oct. Personal Income, est. 0.2%, prior 0.3%

- Oct. Personal Spending, est. 0.2%, prior 0.7%

- Oct. Real Personal Spending, est. 0.1%, prior 0.4%

- 08:30: Oct. PCE Deflator MoM, est. 0.1%, prior 0.4%

- Oct. PCE Core Deflator YoY, est. 3.5%, prior 3.7%

- Oct. PCE Core Deflator MoM, est. 0.2%, prior 0.3%

- Oct. PCE Deflator YoY, est. 3.0%, prior 3.4%

- 09:45: Nov. MNI Chicago PMI, est. 46.0, prior 44.0

- 10:00: Oct. Pending Home Sales YoY, est. -8.8%, prior -13.1%

- Oct. Pending Home Sales (MoM), est. -2.0%, prior 1.1%

Central Bank speakers

- 09:15: Fed’s Williams Speaks on Innovations in Central Banking

DB's Jim Reid concludes the overnight wrap

Morning from Zurich where it is currently snowing. I know that as the hotel gym is 200 meters away from the hotel and I've finished this off on an exercise bike here this morning. That was a long 200 meters dressed in just gym kits!

For markets the sun has shined almost every day this month and as we arrive at the last day, bonds have continued their extraordinary performance over November, driven by growing hopes for a soft landing and a dovish central bank pivot. That excitement meant that we saw another strong rally yesterday, with the 2yr Treasury yield (-8.8bps) falling to its lowest level since July, at 4.65%, whilst other records were being set across the board. For instance, Bloomberg’s global bond aggregate is currently on course for its best month since December 2008, and the US bond aggregate is on course for its best month since May 1985. That said, equities struggled to gain much traction yesterday after an equally dizzying run, with the S&P 500 paring back its initial gains to close down -0.09%.

The main catalyst for this rally was another round of downside surprises on inflation. In particular, the preliminary German CPI reading for November fell to just +2.3% on the EU-harmonised measure (vs. +2.5% expected), which is the lowest it’s been since June 2021. Earlier in the day, we also had a downside surprise from Spain, where CPI fell to +3.2% (vs. +3.7% expected). So all that has set us up nicely for the Euro Area-wide release this morning.

That good news narrative was then supported by some robust data from the US, which saw the strong Q3 GDP performance revised up even higher. The latest estimate showed annualised growth at a +5.2% rate (vs. +4.9% before), and it also included downward revisions to PCE and core PCE inflation, which is the measure the Fed officially targets. Specifically, the Q3 PCE number was revised down a tenth to +2.8%, and core PCE was also revised down a tenth to +2.3%. So all other things being equal the revisions were in a soft landing direction. Today’s PCE and personal spending data for October will give us more colour on where in Q3 these revisions came and the read through for Q4.

This data meant that investors grew even more excited about near-term rate cuts, with futures pricing in the most dovish path in months. For instance, a March rate cut by the Fed was seen as a 50% chance at the close, and a cut is now fully priced in by the May meeting. It’s a similar story at the ECB as well, with a cut now fully priced by April. So when it comes to market pricing, a Q1 rate cut has gone from being a complete out-of-consensus view only a month ago, to a serious proposition now. It will be fascinating to see what Mr Powell makes of all this tomorrow. This rally all started at the last FOMC meeting on 1 November with him repeatedly noting that financial conditions had tightened "significantly". This shifted the market’s attention from a slight chance of hikes to cuts. Since then this trade has taken a life of its own. With bonds and equities performing so strongly over the past month, it will be very interesting if Powell endorses or pushes back on it.

With rate cuts seemingly coming closer, sovereign bonds rallied very strongly on both sides of the Atlantic, particularly at the front end. For instance, yields on 2yr Treasuries (-8.8bps) fell to their lowest level since July, at 4.65%, and those on 10yr Treasuries (-6.6bps) were at their lowest since September, at 4.26%. In Europe, there was a similar rally, with yields on 10yr bunds (-6.4bps), OATs (-6.4bps) and BTPs (-8.2bps) all seeing a considerable decline. In fact for 10yr bunds, that left them at 2.43%, which is the lowest they’ve been since July .

Whilst hopes were growing about a soft landing, risk assets struggled to gain much traction despite a strong performance at the open. Some of that weakness followed comments from Richmond Fed President Barkin, who struck a more hawkish tone than recent Fed speakers. He pointed out that “if inflation is going to flare back up, I think you want to have the option of doing more on rates. That said, other Fed speakers avoided such hawkish signals. Atlanta Fed President Bostic expressed confidence that the “the downward trajectory of inflation will likely continue”, while Cleveland Fed President Mester said that “monetary policy is in a good place”. Back in Europe, we heard from Greek central bank Governor Stournaras that the first rate cut could come in mid-2024 but that pricing of an April ECB cut seemed a bit optimistic. So some pushback against increased market pricing of cuts coming from one of the more dovish ECB voices.

Equities started the day on the front foot but then lost ground, with the S&P 500 falling back from a gain of +0.72% to close -0.09% lower. The Dow Jones (+0.04%) and the NASDAQ (-0.16%) were also near-flat on the day, with one outperformer being the small-cap Russell 2000, which rose +0.61%. Bank stocks were also a notable outperformer, with the S&P 500 banks index (+1.46%) rising to its highest level since mid-August .

European risk assets outperformed their US counterparts yesterday, with the STOXX 600 advancing +0.45%, whilst the DAX was up +1.09% to its highest level since early August. That was echoed in the credit space too, where the iTraxx Crossover (-10.2bps) moved to its tightest since April 2022, at 367bps. The moves came as we also got some better-than-expected sentiment data, with the European Commission’s economic sentiment indicator ticking up for a second month running to 93.8 (vs. 93.6 expected), having previously been on a run of five consecutive declines.

In the commodities space, oil prices gained ahead of today’s OPEC+ meeting, with Brent crude up +1.74% to $83.10/bbl and WTI up +1.90% to $77.86/bbl. Today’s OPEC+ meeting had previously been scheduled for last weekend but was delayed amid negotiation difficulties over potential new output cuts. The WSJ reported yesterday that the alliance was considering new production cuts of as much as 1mmb/day. In our 2024 World Outlook mentioned at the start, our oil analyst noted that, with subdued oil demand growth and rising non-OPEC production, the global oil market would move into an oversupplied position in early 2024 if there were no further OPEC+ output cuts .

Moving on to Asia, equity markets are trading in a tight range this morning even with the downbeat China PMIs highlighting the sustained softness in the world’s second biggest economy. In terms of specific moves, the Hang Seng (+0.18%), the CSI (+0.24%) and the Shanghai Composite (+0.16%) are trading slightly higher on the hopes for more policy support. Elsewhere, the Nikkei (+0.03%) is reversing its opening losses while the KOSPI (+0.04%) is also fairly flat following the Bank of Korea’s decision to keep its interest rate unchanged at 3.5%. S&P 500 (+0.13%) and NASDAQ 100 (+0.20%) futures are looking to wrap up a stella month in style .

Coming back to China, the official factory activity measure shrank for the second consecutive month in November, slipping to 49.4 (v/s 49.8 expected) from 49.5 in October, dragged down by insufficient demand. Additionally, the official non-manufacturing PMI dropped to 50.2 in November (v/s 50.9 expected) from 50.6 in October, recording its weakest level since December 2022. Elsewhere, retail sales in Japan rose at its slowest pace so far this year, increasing +4.2% y/y in October (v/s +6.0% expected) compared to a revised +6.2% gain in September. Meanwhile, industrial output rebounded +0.9% y/y in October, exceeding market forecasts for a +0.4% increase and after a -4.4% drop in the previous month.

Staying with data, there was some more positive data from the UK yesterday, where mortgage approvals rose to 47.4k in October (vs. 45.3k expected), ending a run of three consecutive declines. That was above every economist’s estimate in Bloomberg’s survey, and it adds to the theme of better-than-expected UK data over the last week, including the flash PMIs and the GfK’s consumer confidence reading.

To the day ahead now, and the main data highlight will be the flash CPI release for the Euro Area in November, along with the unemployment rate for October. In the US, we’ll get the weekly initial jobless claims, PCE inflation, and personal income and spending for October. Central bank speakers include ECB President Lagarde, the ECB’s Panetta and Nagel, the Fed’s Williams, and the BoE’s Greene. Otherwise, the COP28 summit begins today, and there’s also the OPEC+ meeting taking place.

US equity futures, European bourses and Asian markets all advanced, and Treasuries steadied at the end of a blistering November run after more dovish comments from hawkish Fed officials this week, and as investors waited for a key US inflation metric for further evidence that price pressure are cooling. As of 7:55am ET, S&P futures rose 0.3% while US 10-year yields climb 3bp to 4.29%. Treasuries paused their strongest monthly gain since 2008, with yields on 10-year paper up four basis points at 4.30%. The dollar bounced 0.4% at the end of its worst month in a year, sending all major developed- and emerging-market currencies lower. The euro traded down 0.5% versus the greenback as the pace of price growth in the region cooled. Today’s macro focus will be the PCE, Personal Income/Spending and Initial Jobless Claims. The PCE release today will provide us with more details on the disinflation trend in Q4: Consensus sees core PCE printing 3.5% YoY vs. 3.68% prior. Eyes will also be on OPEC+ today as the group may consider a production cut at today’s meeting: RTRS sources said OPEC+ ministers agreed for a preliminary cut for over 1mn bpd.

In premarket trading, megacap tech are leading gains morning, with TSLA +65bp and GOOGL + 29bp. Salesforce jumped about 9% after the application software company’s third-quarter results and profit forecasts beat estimates. Here are some other notable premarket movers:

- HP Enterprise shares are up about 3% and are set to extend gains for a second session as Morgan Stanley raised its recommendation following results.

- ImmunoGen shares are halted after AbbVie (ABBV) agreed to buy the company. Stock is set to resume trading at 8 a.m.

- Nutanix gains about 9% as strong demand fueled a quarterly sales beat.

- Okta Inc. is down about 2% after a pair of analysts issued downgrades following the company’s breach disclosures.

- Pure Storage slumps 17% after the technology company’s outlook disappointed.

- Snowflake climbs about 7% after the US cloud-software company posted 3Q results that beat expectations and the firm gave an outlook that is seen as strong.

- Synopsys shares are up 2% after the maker of electronic design automation software reported fourth-quarter results that beat expectations.

Easing inflation and signs of a milder-than-expected slowdown in the US economy have sent Treasuries, agency and mortgage debt to their best month since the 1980s, triggering a November surge that pulled along assets from stocks to credit to emerging markets.

Oil gained following a Reuters reports that OPEC+ has reached a preliminary agreement on an additional output cut of more than 1mb/d. Details of how the cut will be distributed are yet to be finalised, but it is important that Saudi Arabia appears to have been able to maintain the unified stance from OPEC+ — at least long enough to move through the seasonally low demand period of 1Q24. Front-month Brent crude is up is up 2% at $84.69 a barrel.

Data due Thursday is forecast to show the Fed’s preferred inflation metric — the personal consumption expenditures price index — decelerated in October to the slowest annual rate since early 2021.

“Momentum on the other side of the pond is likely to remain bullish rates,” wrote Evelyne Gomez-Liechti, a multi-asset strategist at Mizuho International Plc in London. “The PCE inflation data for October is most likely going to echo what we already saw in the October CPI and PPI reports and add to the soft-landing narrative.”

Now, traders are looking to a speech by Fed Chair Jerome Powell on Friday.

“Upcoming Fed communication could continue to stress the need hold rates steady for some time,” said Hauke Siemssen, rates strategist at Commerzbank AG. “We expect the air to be getting thinner for further bond market performance ahead of the usual supply wave early next year.”

European stocks are in the green with the Stoxx 600 rising 0.4%, set for their best month since January. Energy, financial and insurance shares are leading gains; oil stocks are the top performers on Europe’s Stoxx 600 index, as OPEC+ producers prepare to discuss additional output cuts of about one million barrels a day. The euro sank after weak French economic data and a Euro-zone inflation print that came in lower than the estimates of all economists in a Bloomberg poll. Traders are now fully pricing in a rate cut from the ECB by April after data showed euro-area inflation slowed more than expected in November. Here are some of the biggest movers on Thursday:

- VAT Group shares climb as much as 5.6%, to the highest level since January 2022 after the Swiss chipmaker announced it will end its short-time work scheme in the country’s production sites.

- Leonardo shares rise as much as 4.8%, the most intraday since Oct. 9, as JPMorgan reinstates full coverage of the aerospace and defense company with an overweight rating. A recovery in end markets and “self-help” can drive the shares higher in coming years, according to the analysts.

- ABB shares climb as much as 1.9%, touching the highest level since August, as the Swiss industrial conglomerate’s new revenue and margin targets came in ahead of estimates. The update will trigger low to mid-single digit percentage upgrades to 2025 consensus expectations, according to Citigroup.

- ASR Nederland and NN Group both soar by as much as 15% as ASR’s settlement of a long-standing miss-selling case removes a major overhang for the company and provides optimism of a resolution for its Dutch peer NN.

- Outokumpu shares surge as much as 14%, the most in almost 13 months, after the Finnish steelmaker announces an extension to its partnership with AM/NS within the Americas region, which Morgan Stanley says removes a key overhang.

- ASML shares drop as much as 1.8% after the Dutch chip-equipment maker said Christophe Fouquet will become CEO when Peter Wennink retires next year. Chief Technology Officer Martin van den Brink, who worked at the firm since its foundation in 1984, will also retire.

- Dr Martens shares plummet as much as 27%, dropping to the lowest intraday level on record, after the bootmaker’s first-half revenue missed estimates. The company also said that improvement in the US business will probably take longer than expected. Analysts viewed the results as weak overall, with Morgan Stanley attributing the miss mainly to industry-wide destocking across the Americas wholesale channel.

- OCI falls as much as 9.3% after being downgraded to hold from buy at Jefferies, which said that natural gas supply is becoming ample, potentially hurting profits from company’s planned investments.

- Future plc drops as much as 8.5% after Canaccord Genuity downgrades the media company to sell from hold, saying there is material risk of downgrades to consensus. It is the stock’s only negative analyst rating.

- Elekta shares fall as much as 7.1%, the most intraday in six months, after the Swedish medical equipment firm reported second-quarter results, with analysts noting some weakness in the company’s outlook comments and a strong share-price performance ahead of the release.

- Siltronic shares fall as much as 5.7% after the German silicon wafer manufacturer says chip inventories will remain high for at least the first half of 2024. The company also set mid-term sales growth targets that Jefferies said were slightly below consensus expectations.

Earlier in the session, Asian stocks gained, with investors in Chinese shares shrugging off a weak set of economic data on expectations that Beijing will ramp up support for the flagging economy. The MSCI Asia Pacific Index rose as much as 0.2%, buoyed by Chinese tech giants such as Tencent, with the gauge headed toward its best month since January. Japanese shares fell for a fourth day as the yen strengthened, while Korean stocks advanced after the Bank of Korea held its key interest rate. Hong Kong’s Hang Seng Index rebounded from the lowest level in a year after activity in China’s manufacturing and services sectors shrank in November, adding to expectations of further government support for the economy. Chinese President Xi Jinping’s first visit to Shanghai in three years was also seen as a positive for the tech sector. The relief rally in Chinese stocks could extend into early 2024 on “easing US-China tensions, China’s easing deflation, revenue growth pickup and further cost and interest expense cuts by enterprises lending support to non-financial margins,” JPMorgan & Chase Co. strategists including Wendy Liu wrote in a note.

- Hang Seng and Shanghai Comp were indecisive with only brief pressure seen after the PMI data showed a steeper contraction in China’s factory activity which raises the prospects for further supportive measures.

- Japan’s Nikkei 225 swung between gains and losses amid recent currency strength and with better-than-expected Industrial Production offset by softer Retail Sales.

- Korea’s Kospi was just about kept afloat following the unsurprising decision by the BoK to keep rates unchanged and noted that it will maintain a restrictive policy stance for a sufficiently long period of time.

- Australia’s ASX 200 was choppy after mixed data in which Building Approvals topped forecast and Private Capital Expenditure missed estimates.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4%; but for the month it is poised to fall around 3%, its worst month in a year. The euro fell 0.5% as German yields slid as markets pulled forward expectations for ECB rate cuts, now fully pricing in the first rate cut by April 2024. Investors have become confident that the Fed has ended its monetary tightening campaign, and have turned their focus on rate cuts for next year, which has weighed on the dollar and boosted Treasuries. “A medium-term US dollar weakening trend is already underway,” Wells Fargo strategists including Aroop Chatterjee wrote in a research note. “The US dollar owes its recent strength to the high levels of US real rates — above 2% across much of the curve. We expect these to head toward more normal levels as the economy slows and disinflation continues”

In rates, treasuries were slightly cheaper across the curve with losses led by long-end, extending Wednesday’s steepening move. US 10-year yields around 4.295%, cheaper by 4bp on the day with bunds outperforming by 3bp in the sector; continued long-end underperformance steepens 2s10s spread by 2.5bp while 5s30s is only slightly wider vs Wednesday close. 10-year touched 4.246% during Asia session, lowest level since September, extending retreat from October’s multiyear high near 5.02% that has fueled the market’s biggest monthly advance since 2008 (3.9% through Nov. 29). Core European rates outperform after French November inflation slowed more than expected.

In commodities, crude futures advance as the OPEC meeting gets underway, with WTI rising 1% to trade near $78.70. Spot gold falls 0.3%.

To the day ahead now, and the main data highlight will be the flash CPI release for the Euro Area in November, which printed below the lowest estimate as European inflation slides, along with the unemployment rate for October. In the US, we’ll get the weekly initial jobless claims, PCE inflation, and personal income and spending for October. Central bank speakers include ECB President Lagarde, the ECB’s Panetta and Nagel, the Fed’s Williams, and the BoE’s Greene. Otherwise, the COP28 summit begins today, and there’s also the OPEC+ meeting taking place.

Market Snapshot

- S&P 500 futures up 0.1% to 4,565.75

- STOXX Europe 600 up 0.2% to 459.86

- MXAP up 0.4% to 162.25

- MXAPJ up 0.3% to 505.27

- Nikkei up 0.5% to 33,486.89

- Topix up 0.4% to 2,374.93

- Hang Seng Index up 0.3% to 17,042.88

- Shanghai Composite up 0.3% to 3,029.67

- Sensex little changed at 66,932.47

- Australia S&P/ASX 200 up 0.7% to 7,087.33

- Kospi up 0.6% to 2,535.29

- German 10Y yield little changed at 2.41%

- Euro down 0.3% to $1.0936

- Brent Futures up 0.8% to $83.80/bbl

- Gold spot down 0.1% to $2,041.77

- U.S. Dollar Index up 0.34% to 103.11

Top Overnight News

- Occidental Petroleum is in talks to buy CrownRock, a major energy producer in the west Texas area of the Permian basin, continuing a frenzy of deal making in the oil patch. A deal for the closely held company, which could be valued well above $10 billion including debt, could come together soon assuming the talks don’t fall apart or another suitor doesn’t prevail, according to people familiar with the matter. WSJ

- Elon Musk told advertisers who have halted spending on X due to his endorsement of an antisemitic post to “go F” themselves, deepening a rift between the billionaire and the companies that generate most of the social media platform’s revenue. FT

- China’s NBS PMIs for Nov fall short of expectations, with manufacturing coming in at 49.4 (down from 49.5 in Oct and below the Street’s 49.8 forecast) and services sliding to 50.2 (down from 50.6 in Oct and below the Street’s 50.9 forecast). FT

- WMT shipped 25% of all its US imports from India between Jan and Aug of ’23 vs. just 2% in ’18 as the firm moves its supply chain away from China (imports from China went from 80% to 60% of the total). RTRS

- China Evergrande seeks to avoid liquidation with a last-minute debt restructuring plan, but creditors are unlikely to accept the new proposal. RTRS

- France’s CPI falls by more than expected in Nov, coming in at +3.8% (down from +4.5% in Oct and below the Street’s +4.1% forecast). RTRS

- Eurozone CPI sinks by more than anticipated in Nov, with headline coming in at +2.4% (down from +2.9% in Oct and below the Street’s +2.7% forecast) and core +3.6% (down from +4.2% in Oct and below the Street’s +3.9% forecast). BBG

- Israel and Hamas agreed to extend their truce for at least another day in an announcement just minutes before it was set to expire. Antony Blinken will discuss the path forward with the Israeli government today. BBG

- Henry Kissinger, the former US secretary of state, died at the age of 100. He defined American foreign policy in the 1970s with his strategies to end the Vietnam War, and remained China’s preferred go-between with Washington until his death. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed and indecisively capped off this month’s notable gains as the Israel-Hamas truce hung in the balance before the announcement of a last-minute one-day extension, while participants also digested a slew of key data releases including disappointing Chinese official PMI figures. ASX 200 was choppy after mixed data in which Building Approvals topped forecast and Private Capital Expenditure missed estimates. Nikkei 225 swung between gains and losses amid recent currency strength and with better-than-expected Industrial Production offset by softer Retail Sales. KOSPI was just about kept afloat following the unsurprising decision by the BoK to keep rates unchanged and noted that it will maintain a restrictive policy stance for a sufficiently long period of time. Hang Seng and Shanghai Comp were indecisive with only brief pressure seen after the PMI data showed a steeper contraction in China’s factory activity which raises the prospects for further supportive measures.

Top Asian News

- Taiwan is closely monitoring China’s respiratory illnesses outbreak and will adjust epidemic prevention measures when needed.

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision unanimous and four out of the seven board members said the door to a rate hike should remain open. BoK said uncertainties to the growth path are high with the economy facing heightened geopolitical risks and restrictive monetary policies abroad, while it will maintain a restrictive policy stance for a “sufficiently long period” of time (prev. “considerable time”) until the board is confident inflation will converge to the target level. Furthermore. Governor Rhee said the current policy rate is sufficiently restrictive and that restrictive monetary policy could stay for longer than six months.

- Hong Kong Exchange consultation paper on severe weather: severe conditions will no longer have automatic consequential impact on the continuity of trading

European bourses currently post modest gains, Euro Stoxx 50 +0.2%, despite spending the majority of the morning in the red; with the FTSE 100 outperforming, +0.6%, boosted by broader Crude price action pre-OPEC+; DAX 40 is lifted by SAP, +1.1%, as a read-over from Salesforce earnings. European sectors are mixed, though with a positive tilt; Energy significantly outperforms whilst Autos lag. Stateside futures, NQ & ES +0.2%, tilt higher in-fitting with the European bias as markets await US PCE data.

Top European News

- German Finance Minister Lindner said Germany faces a EUR 17bln gap in the 2024 budget.

- Dutch NSC party said it is not ready to negotiate on joining the Cabinet with far-right leader Wilders, according to ANP.

- ECB to, as usual, temporarily pause PEPP purchases (reinvestments) in anticipation of significantly lower market liquidity towards the end of this year. The last trading day before 19th December 2023, and purchases will resume on 2nd January 2024.

- BoE Monthly Decision Maker Panel (3rd-17th Nov): One-year ahead CPI inflation expectations decreased to 4.4% in November, down from 4.6% in October, expected year-ahead wage growth remained unchanged at 5.1%. The three-month moving average fell by 0.2 percentage points to 4.6% in the three months to November. Three-year ahead CPI inflation expectations increased 0.1 percentage point to 3.2% in November.

- ECB will discuss QT in December, via Econostream citing an ECB insider; some preference for coming to a QT decision next year as it means less once in 2024. Lagarde will not try to delay the discussion indefinitely. Will not take many meetings to come to a decision on PEPP, given broad agreement currently. PEPP change is expected, liquidity is high; unworried by how markets will take the change.

- ECB’s Panetta says ECB needs to avoid “useless damage” to the economy and financial stability that would end up also putting price stability at risk; ECB may be able to ease monetary conditions if persistently weak output accelerates decline in inflation; Monetary tightening has not yet had full impact, it will continue to dampen demand in the future

FX

- Dollar resumes recovery rally with a firm fillip from the Euro post-EZ inflation data and pre-US PCE/IJC.

- DXY towards top of 103.35-102.71 range and EUR/USD hovering near bottom of 1.0910-84 band.

- Pound and Yen suffer contagion, with Cable sub-1.2650 and USD/JPY above 147.50 compared to 1.2700+ and 146.85 at one stage.

- Loonie underpinned between 1.3568-1.3616 parameters as oil rebounds in advance of Canadian GDP metrics.

- PBoC set USD/CNY mid-point at 7.1018 vs exp. 7.1273 (prev. 7.1031).

- Banxico Governor Rodriguez said they do not see a rate cut in the December decision but it is possible they could begin a discussion of rate cuts in meetings early next year.

Fixed Income

- Debt futures wane after short squeeze fizzles out.

- Bunds hit brakes just ahead of 133.00 as cool EZ inflation data pre-empted.

- Gilts undermined by extra DMO issuance and probing 97.00 to downside.

- T-note near base of 110-05+/14 range awaiting US PCE and IJC.

- UK DMO Gilt Auction Calendar: December 2023-March 2024. Two Gilts (2053 & 2034) to be sold at the additional auctions on 13th & 19th December; The gilts to be issued at auctions on 5, 6 and 12 December 2023 were previously announced on 31 August 2023. The auctions on 13 and 19 December 2023 were added to the calendar at the remit revision published on 22 November 2023

Commodities

- WTI and Brent, +1.9%, extend gains following reports that OPEC+ has a preliminary agreement for additional oil output cuts in excess of 1mln BPD, according to Reuters; reminder the JMMC commences at 08:30EST and the OPEC+ gathering at 09:30EST.

- Spot Gold is marginally lower, owing to the firmer Dollar, though with overall trade rangebound ahead of US PCE, base metals are mixed/flat following on from weaker Chinese PMI data and the FX influence.

- OPEC “proposal is around Saudi Arabia extending the voluntary cuts of 1 million bpd and then on top of that other states may add additional cuts”, via Energy Intel’s Bakr

- OPEC+ has a preliminary agreement for additional oil output cuts in excess of 1mln BPD, via Reuters citing a delegate; Talks around an OPEC cut of more than 1mln BPD will depend on how much could be contributed by members states, Energy Intel reports; adds almost all member states appear to be aligned that a deeper cut is needed

- Updated OPEC Timings for today: OPEC meeting at 10:00GMT/05:00EST, JMMC meeting at 13:30GMT/08:30EST, OPEC+ meeting at 14:30GMT/09:30EST, according to EnergyIntel’s Bakr

- OPEC/OPEC+ meetings expected to occur as scheduled on Thursday, via Reuters citing sources; OPEC+ continues to discuss additional oil output cut for early-2024

- OPEC+ additional output cut discussions range from 1-2mln BPD, according to Reuters sources

- OPEC+ reportedly mulls new oil production cuts amid the Middle East conflict with Saudi Arabia favouring a curb of up to 1mln BPD, while other members oppose downgrading quotas with Nigeria and Angola resisting a downgrade of their individual quotas and the UAE is also reluctant to cut output. Furthermore, it was stated that a rollover of most existing output curbs is the most likely scenario but talks are continuing, according to WSJ citing delegates.

- Kazakhstan Energy Ministry said oil output was down 34% at Karachaganak oilfield on November 29th due to the Black Sea storm.

- Oil loadings from Novorossiysk and CPC terminals remained shut on Wednesday amid a storm with the November plan for Novorossiysk delayed by over 1mln tons, according to Reuters sources.

- First Quantum (FM CA) announced the suspension of 7,000 contract employees due to force majeure at its Panama mine.

Geopolitics: Israel-Hamas

- Israeli military said the truce will continue in light of mediators’ efforts to release more hostages and Hamas also confirmed that it agreed to extend the truce for a seventh day, according to Reuters.

- Sources in Israel’s war council earlier noted that Hamas’s list of the new batch of hostages to be released did not meet the agreed criteria and Israel officials warned fighting will resume if Hamas does not present a new list by 07:00 local time (05:00GMT/00:00EST), while Hamas confirmed Israel rejected its proposed hostage release and it told its fighters to be ready for renewed battles if the truce with Israel was not extended, according to Al Jazeera, Al Arabiya and Reuters.

- Israeli prison service announced it released 30 Palestinians in the sixth round of Gaza truce swaps on Wednesday.

- UK Defence Minister Shapps is sending a warship to the Gulf region amid fears of a ramp up in Iranian missile attacks. The warship will protect against drone threats and ensure safe flow of trade, according to the Telegraph.

- China issued a position paper on the Israeli-Palestinian conflict which stated that the UN Security Council should respond to the general call of the international community for a comprehensive ceasefire to be put in place to stop the fighting. Furthermore, China’s Foreign Minister Wang Yi said a spillover of the Israeli-Palestinian conflict to the entire Middle East region should be avoided by urging countries that have an impact on the parties to play an active role, while he added that China is to send another batch of emergency humanitarian supplies to Gaza to alleviate the humanitarian situation.

- “Sirens in the Upper Galilee in northern Israel after a march crept in from southern Lebanon”, according to Al Arabiya

- United Nations Interim Force In Lebanon says Israel retaliated to cross-border fire from Lebanon

- “Estimates in Israel indicate that tomorrow is the last day of the truce in Gaza”, according to Al Arabiya citing Israeli Press Yedioth Ahronoth

Geopolitics: North Korea

- North Korean leader Kim inspected satellite photos of a US naval base in San Diego and Kadena air base in Japan, while North Korea said it will never sit face-to-face with the US for negotiations, according to KCNA.

US Event Calendar

- 08:30: Nov. Initial Jobless Claims, est. 218,000, prior 209,000

- Nov. Continuing Claims, est. 1.87m, prior 1.84m

- 08:30: Oct. Personal Income, est. 0.2%, prior 0.3%

- Oct. Personal Spending, est. 0.2%, prior 0.7%

- Oct. Real Personal Spending, est. 0.1%, prior 0.4%

- 08:30: Oct. PCE Deflator MoM, est. 0.1%, prior 0.4%

- Oct. PCE Core Deflator YoY, est. 3.5%, prior 3.7%

- Oct. PCE Core Deflator MoM, est. 0.2%, prior 0.3%

- Oct. PCE Deflator YoY, est. 3.0%, prior 3.4%

- 09:45: Nov. MNI Chicago PMI, est. 46.0, prior 44.0

- 10:00: Oct. Pending Home Sales YoY, est. -8.8%, prior -13.1%

- Oct. Pending Home Sales (MoM), est. -2.0%, prior 1.1%

Central Bank speakers

- 09:15: Fed’s Williams Speaks on Innovations in Central Banking

DB’s Jim Reid concludes the overnight wrap

Morning from Zurich where it is currently snowing. I know that as the hotel gym is 200 meters away from the hotel and I’ve finished this off on an exercise bike here this morning. That was a long 200 meters dressed in just gym kits!

For markets the sun has shined almost every day this month and as we arrive at the last day, bonds have continued their extraordinary performance over November, driven by growing hopes for a soft landing and a dovish central bank pivot. That excitement meant that we saw another strong rally yesterday, with the 2yr Treasury yield (-8.8bps) falling to its lowest level since July, at 4.65%, whilst other records were being set across the board. For instance, Bloomberg’s global bond aggregate is currently on course for its best month since December 2008, and the US bond aggregate is on course for its best month since May 1985. That said, equities struggled to gain much traction yesterday after an equally dizzying run, with the S&P 500 paring back its initial gains to close down -0.09%.

The main catalyst for this rally was another round of downside surprises on inflation. In particular, the preliminary German CPI reading for November fell to just +2.3% on the EU-harmonised measure (vs. +2.5% expected), which is the lowest it’s been since June 2021. Earlier in the day, we also had a downside surprise from Spain, where CPI fell to +3.2% (vs. +3.7% expected). So all that has set us up nicely for the Euro Area-wide release this morning.

That good news narrative was then supported by some robust data from the US, which saw the strong Q3 GDP performance revised up even higher. The latest estimate showed annualised growth at a +5.2% rate (vs. +4.9% before), and it also included downward revisions to PCE and core PCE inflation, which is the measure the Fed officially targets. Specifically, the Q3 PCE number was revised down a tenth to +2.8%, and core PCE was also revised down a tenth to +2.3%. So all other things being equal the revisions were in a soft landing direction. Today’s PCE and personal spending data for October will give us more colour on where in Q3 these revisions came and the read through for Q4.

This data meant that investors grew even more excited about near-term rate cuts, with futures pricing in the most dovish path in months. For instance, a March rate cut by the Fed was seen as a 50% chance at the close, and a cut is now fully priced in by the May meeting. It’s a similar story at the ECB as well, with a cut now fully priced by April. So when it comes to market pricing, a Q1 rate cut has gone from being a complete out-of-consensus view only a month ago, to a serious proposition now. It will be fascinating to see what Mr Powell makes of all this tomorrow. This rally all started at the last FOMC meeting on 1 November with him repeatedly noting that financial conditions had tightened “significantly”. This shifted the market’s attention from a slight chance of hikes to cuts. Since then this trade has taken a life of its own. With bonds and equities performing so strongly over the past month, it will be very interesting if Powell endorses or pushes back on it.

With rate cuts seemingly coming closer, sovereign bonds rallied very strongly on both sides of the Atlantic, particularly at the front end. For instance, yields on 2yr Treasuries (-8.8bps) fell to their lowest level since July, at 4.65%, and those on 10yr Treasuries (-6.6bps) were at their lowest since September, at 4.26%. In Europe, there was a similar rally, with yields on 10yr bunds (-6.4bps), OATs (-6.4bps) and BTPs (-8.2bps) all seeing a considerable decline. In fact for 10yr bunds, that left them at 2.43%, which is the lowest they’ve been since July .

Whilst hopes were growing about a soft landing, risk assets struggled to gain much traction despite a strong performance at the open. Some of that weakness followed comments from Richmond Fed President Barkin, who struck a more hawkish tone than recent Fed speakers. He pointed out that “if inflation is going to flare back up, I think you want to have the option of doing more on rates. That said, other Fed speakers avoided such hawkish signals. Atlanta Fed President Bostic expressed confidence that the “the downward trajectory of inflation will likely continue”, while Cleveland Fed President Mester said that “monetary policy is in a good place”. Back in Europe, we heard from Greek central bank Governor Stournaras that the first rate cut could come in mid-2024 but that pricing of an April ECB cut seemed a bit optimistic. So some pushback against increased market pricing of cuts coming from one of the more dovish ECB voices.

Equities started the day on the front foot but then lost ground, with the S&P 500 falling back from a gain of +0.72% to close -0.09% lower. The Dow Jones (+0.04%) and the NASDAQ (-0.16%) were also near-flat on the day, with one outperformer being the small-cap Russell 2000, which rose +0.61%. Bank stocks were also a notable outperformer, with the S&P 500 banks index (+1.46%) rising to its highest level since mid-August .

European risk assets outperformed their US counterparts yesterday, with the STOXX 600 advancing +0.45%, whilst the DAX was up +1.09% to its highest level since early August. That was echoed in the credit space too, where the iTraxx Crossover (-10.2bps) moved to its tightest since April 2022, at 367bps. The moves came as we also got some better-than-expected sentiment data, with the European Commission’s economic sentiment indicator ticking up for a second month running to 93.8 (vs. 93.6 expected), having previously been on a run of five consecutive declines.

In the commodities space, oil prices gained ahead of today’s OPEC+ meeting, with Brent crude up +1.74% to $83.10/bbl and WTI up +1.90% to $77.86/bbl. Today’s OPEC+ meeting had previously been scheduled for last weekend but was delayed amid negotiation difficulties over potential new output cuts. The WSJ reported yesterday that the alliance was considering new production cuts of as much as 1mmb/day. In our 2024 World Outlook mentioned at the start, our oil analyst noted that, with subdued oil demand growth and rising non-OPEC production, the global oil market would move into an oversupplied position in early 2024 if there were no further OPEC+ output cuts .

Moving on to Asia, equity markets are trading in a tight range this morning even with the downbeat China PMIs highlighting the sustained softness in the world’s second biggest economy. In terms of specific moves, the Hang Seng (+0.18%), the CSI (+0.24%) and the Shanghai Composite (+0.16%) are trading slightly higher on the hopes for more policy support. Elsewhere, the Nikkei (+0.03%) is reversing its opening losses while the KOSPI (+0.04%) is also fairly flat following the Bank of Korea’s decision to keep its interest rate unchanged at 3.5%. S&P 500 (+0.13%) and NASDAQ 100 (+0.20%) futures are looking to wrap up a stella month in style .

Coming back to China, the official factory activity measure shrank for the second consecutive month in November, slipping to 49.4 (v/s 49.8 expected) from 49.5 in October, dragged down by insufficient demand. Additionally, the official non-manufacturing PMI dropped to 50.2 in November (v/s 50.9 expected) from 50.6 in October, recording its weakest level since December 2022. Elsewhere, retail sales in Japan rose at its slowest pace so far this year, increasing +4.2% y/y in October (v/s +6.0% expected) compared to a revised +6.2% gain in September. Meanwhile, industrial output rebounded +0.9% y/y in October, exceeding market forecasts for a +0.4% increase and after a -4.4% drop in the previous month.

Staying with data, there was some more positive data from the UK yesterday, where mortgage approvals rose to 47.4k in October (vs. 45.3k expected), ending a run of three consecutive declines. That was above every economist’s estimate in Bloomberg’s survey, and it adds to the theme of better-than-expected UK data over the last week, including the flash PMIs and the GfK’s consumer confidence reading.

To the day ahead now, and the main data highlight will be the flash CPI release for the Euro Area in November, along with the unemployment rate for October. In the US, we’ll get the weekly initial jobless claims, PCE inflation, and personal income and spending for October. Central bank speakers include ECB President Lagarde, the ECB’s Panetta and Nagel, the Fed’s Williams, and the BoE’s Greene. Otherwise, the COP28 summit begins today, and there’s also the OPEC+ meeting taking place.

Loading…