Philip Marey, Senior US Strategist at Rabobank

Inflation data from the Eurozone and the US were encouraging with declines in headline and core inflation. While inflation is falling, OPEC+ is said to have decided to cut oil production by 1 million barrels a day. This will not be announced by a communique, but individually by each country. This news was not enough to boost oil prices yesterday.

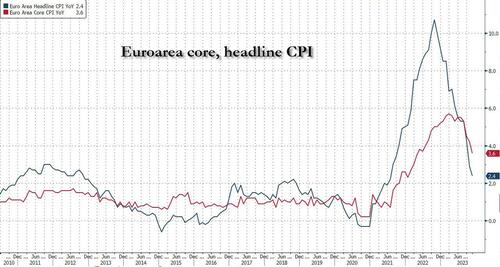

As our Elwin de Groot put it yesterday, Eurozone inflation data confirm the favorable trend seen in recent data in several member states, such as Germany, France and Spain. Headline inflation dropped more sharply than expected to 3.6 %y/y in November from 4.2% in October but it was a large negative surprise in core inflation that really drew attention. Core inflation fell to 3.6%, 0.3%-points more than the consensus estimate, which is a sizeable negative surprise.

The broad-based decline in inflation when looking at the key components suggests that the weakening economy is increasingly weighing on businesses' willingness or perhaps even ability to raise prices. Energy, food, industrial goods and services inflation all fell. The question is whether services sector firms can refrain from price hikes when their cost base continues to increase (wages growing at a clip of 4-5% a year), but at least these data suggest that some service sector providers may be taking a 'wait-and-see' approach. The big size of the services inflation drop (from 4.6% to 3.9% y/y) may also point at one-off (or transitory) effects, such as from the recreation and culture sector, but lack of details at this point does not allow a firm conclusion there.

US PCE inflation fell to 3.0% headline and 3.5% core in October in year-on-year terms, with headline prices flat between September and October and core prices climbing by 0.2%. This means that both headline and core PCE inflation are now ahead of the FOMC projections made in September, which anticipated 3.3% headline and 3.7% core inflation in the final quarter of this year. Goods inflation has fallen to 0.2% from 0.9% year-on-year and services inflation to 4.4% from 4.7%. Even the component watched most closely by the FOMC improved. Core services ex housing inflation, as calculated by Bloomberg, fell to 3.9% from 4.3% year-on year and to 0.1% from 0.4% month-on-month. This should give the FOMC some confidence that this component, closely related to labor market tightness and wage growth, is easing as well. The PCE inflation data support the FOMC remaining on hold in December. In the remainder of the year, headline PCE inflation is likely to move sideways, while we expect core PCE inflation to continue its gradual decline.

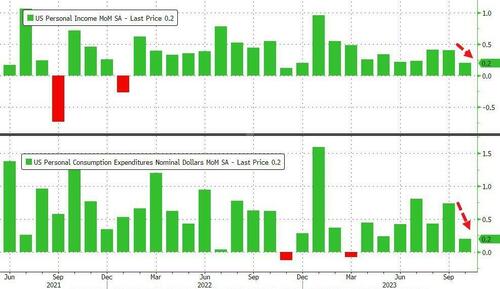

Meanwhile, US personal spending slowed down to 0.2% in October, both in nominal and real terms. This is in line with the Fed’s Beige Book, published on Wednesday, which concluded that sales of discretionary items and durable goods declined on average. Personal income also slowed down to 0.2%, from 0.4% (revised) in September.

Initial jobless claims rebounded modestly to 218K in the week ending on November 25, from 211K (revised) a week before. Continuing claims saw a bigger jump to 1927K in the week ending on November 18, from 1841K (revised) a week earlier. This is the highest level in almost two years, after 1964K in the week ending on November 26. 2021. Note that the unemployment rate has quietly risen to 3.9% from 3.4% this year. An increase of this size in the three month averages of the unemployment rate would signal the start of a recession according to the Sahm rule. We are not there yet, but we continue to expect a US recession in the coming months.

In an interview with a German financial newspaper earlier this month, but published yesterday, San Francisco Fed president Mary Daly, who will be voting in 2024, said it was too soon to say if hikes are finished, that interest rates are in a very good place to control inflation and she’s not thinking about rate cuts. However, she said “We don’t need an insurance mentality now, where we hedge against rising inflation. We should simply be patient and remain vigilant.” So Daly wants the FOMC to remain on hold, but is in no hurry to cut rates.

New York Fed president John Williams, speaking at a conference, said the Fed’s policy rate is at or near its peak level and that rates are “estimated to be the most restrictive in 25 years.” He said he expected it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance to our 2% longer-run goal on a sustainable basis. Williams is a permanent voter on the FOMC and also in no rush to pivot. Markets may be getting ahead of themselves by pricing in an almost 50% chance of a rate cut in March, but even the FOMC’s own projections made in September showed two rate cuts of 25 bps each before the end of 2024.

While we seem to be heading for a rematch between Biden and Trump in the 2024 US presidential election, Fox hosted a debate between Governor Gavin Newsom (Democrat, California) and Governor Ron DeSantis (Republican, Florida), which can either be seen as an early presidential debate for 2028 or a debate between two reserve-candidates for 2024. DeSantis probably hoped to boost his chances in the current Republican primaries, after Nikki Haley’s campaign to be the main challenger to Trump has gained momentum.

Philip Marey, Senior US Strategist at Rabobank

Inflation data from the Eurozone and the US were encouraging with declines in headline and core inflation. While inflation is falling, OPEC+ is said to have decided to cut oil production by 1 million barrels a day. This will not be announced by a communique, but individually by each country. This news was not enough to boost oil prices yesterday.

As our Elwin de Groot put it yesterday, Eurozone inflation data confirm the favorable trend seen in recent data in several member states, such as Germany, France and Spain. Headline inflation dropped more sharply than expected to 3.6 %y/y in November from 4.2% in October but it was a large negative surprise in core inflation that really drew attention. Core inflation fell to 3.6%, 0.3%-points more than the consensus estimate, which is a sizeable negative surprise.

The broad-based decline in inflation when looking at the key components suggests that the weakening economy is increasingly weighing on businesses’ willingness or perhaps even ability to raise prices. Energy, food, industrial goods and services inflation all fell. The question is whether services sector firms can refrain from price hikes when their cost base continues to increase (wages growing at a clip of 4-5% a year), but at least these data suggest that some service sector providers may be taking a ‘wait-and-see’ approach. The big size of the services inflation drop (from 4.6% to 3.9% y/y) may also point at one-off (or transitory) effects, such as from the recreation and culture sector, but lack of details at this point does not allow a firm conclusion there.

US PCE inflation fell to 3.0% headline and 3.5% core in October in year-on-year terms, with headline prices flat between September and October and core prices climbing by 0.2%. This means that both headline and core PCE inflation are now ahead of the FOMC projections made in September, which anticipated 3.3% headline and 3.7% core inflation in the final quarter of this year. Goods inflation has fallen to 0.2% from 0.9% year-on-year and services inflation to 4.4% from 4.7%. Even the component watched most closely by the FOMC improved. Core services ex housing inflation, as calculated by Bloomberg, fell to 3.9% from 4.3% year-on year and to 0.1% from 0.4% month-on-month. This should give the FOMC some confidence that this component, closely related to labor market tightness and wage growth, is easing as well. The PCE inflation data support the FOMC remaining on hold in December. In the remainder of the year, headline PCE inflation is likely to move sideways, while we expect core PCE inflation to continue its gradual decline.

Meanwhile, US personal spending slowed down to 0.2% in October, both in nominal and real terms. This is in line with the Fed’s Beige Book, published on Wednesday, which concluded that sales of discretionary items and durable goods declined on average. Personal income also slowed down to 0.2%, from 0.4% (revised) in September.

Initial jobless claims rebounded modestly to 218K in the week ending on November 25, from 211K (revised) a week before. Continuing claims saw a bigger jump to 1927K in the week ending on November 18, from 1841K (revised) a week earlier. This is the highest level in almost two years, after 1964K in the week ending on November 26. 2021. Note that the unemployment rate has quietly risen to 3.9% from 3.4% this year. An increase of this size in the three month averages of the unemployment rate would signal the start of a recession according to the Sahm rule. We are not there yet, but we continue to expect a US recession in the coming months.

In an interview with a German financial newspaper earlier this month, but published yesterday, San Francisco Fed president Mary Daly, who will be voting in 2024, said it was too soon to say if hikes are finished, that interest rates are in a very good place to control inflation and she’s not thinking about rate cuts. However, she said “We don’t need an insurance mentality now, where we hedge against rising inflation. We should simply be patient and remain vigilant.” So Daly wants the FOMC to remain on hold, but is in no hurry to cut rates.

New York Fed president John Williams, speaking at a conference, said the Fed’s policy rate is at or near its peak level and that rates are “estimated to be the most restrictive in 25 years.” He said he expected it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance to our 2% longer-run goal on a sustainable basis. Williams is a permanent voter on the FOMC and also in no rush to pivot. Markets may be getting ahead of themselves by pricing in an almost 50% chance of a rate cut in March, but even the FOMC’s own projections made in September showed two rate cuts of 25 bps each before the end of 2024.

While we seem to be heading for a rematch between Biden and Trump in the 2024 US presidential election, Fox hosted a debate between Governor Gavin Newsom (Democrat, California) and Governor Ron DeSantis (Republican, Florida), which can either be seen as an early presidential debate for 2028 or a debate between two reserve-candidates for 2024. DeSantis probably hoped to boost his chances in the current Republican primaries, after Nikki Haley’s campaign to be the main challenger to Trump has gained momentum.

Loading…