Following weakness in the Manufacturing survey data, Services surveys were expected rebound in November, despite the plunge in 'hard' data seen in November.

S&P Global's Services PMI ticked up in November to 50.8 from 50.6 in October (flat from the flash print)

ISM's Services PMI beat expectations, rising from 51.8 to 52.7 (vs 52.3 exp) in November.

Source: Bloomberg

Under the hood, Employment rose less than expected; New Orders were flat ; and Prices Paid declined...

Source: Bloomberg

“Fifteen industries reported growth in November," noted Anthony Nieves, Chair of the ISM Services Survey Committee.

"The Services PMI, by being above 50 percent for the 11th month after a single month of contraction and a prior 30-month period of expansion, continues to indicate sustained growth for the sector, and at a slightly faster rate in November.”

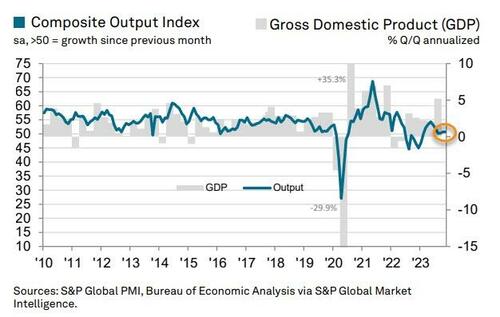

Manufacturing continues to contract according to both surveys while Services expand...

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"The latest PMI data point to a further cooling of inflation pressures, but the surveys also signal only modest economic growth and near-stagnant employment, with the risk of the expansion losing further momentum as we head towards 2024.

"While service sector businesses continued to report further output gains in November, growth remains considerably weaker than seen earlier in the year, and forward-looking indicators point to growth slowing in the months ahead.

"Firms providing both goods and services have become increasingly concerned about excessive staffing levels in the face of weakened demand, resulting in the smallest overall jobs gain recorded by the survey since the early pandemic lockdowns of 2020.

But there is some good news:

"The cooling jobs market has been accompanied by lower wage growth which, combined with recent oil price falls, helped pull business cost growth down to its lowest for three years, dropping in November to a level indicative of inflation approaching The Fed's 2% target in the coming months."

Is that good enough to keep the dream alive for 125bps of rate-cuts next year?

Following weakness in the Manufacturing survey data, Services surveys were expected rebound in November, despite the plunge in ‘hard’ data seen in November.

S&P Global’s Services PMI ticked up in November to 50.8 from 50.6 in October (flat from the flash print)

ISM’s Services PMI beat expectations, rising from 51.8 to 52.7 (vs 52.3 exp) in November.

Source: Bloomberg

Under the hood, Employment rose less than expected; New Orders were flat ; and Prices Paid declined…

Source: Bloomberg

“Fifteen industries reported growth in November,” noted Anthony Nieves, Chair of the ISM Services Survey Committee.

“The Services PMI, by being above 50 percent for the 11th month after a single month of contraction and a prior 30-month period of expansion, continues to indicate sustained growth for the sector, and at a slightly faster rate in November.”

Manufacturing continues to contract according to both surveys while Services expand…

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The latest PMI data point to a further cooling of inflation pressures, but the surveys also signal only modest economic growth and near-stagnant employment, with the risk of the expansion losing further momentum as we head towards 2024.

“While service sector businesses continued to report further output gains in November, growth remains considerably weaker than seen earlier in the year, and forward-looking indicators point to growth slowing in the months ahead.

“Firms providing both goods and services have become increasingly concerned about excessive staffing levels in the face of weakened demand, resulting in the smallest overall jobs gain recorded by the survey since the early pandemic lockdowns of 2020.

But there is some good news:

“The cooling jobs market has been accompanied by lower wage growth which, combined with recent oil price falls, helped pull business cost growth down to its lowest for three years, dropping in November to a level indicative of inflation approaching The Fed’s 2% target in the coming months.”

Is that good enough to keep the dream alive for 125bps of rate-cuts next year?

Loading…