Authored by Simon White, Bloomberg macro strategist,

The bonds of European countries are among the most overbought following the global rally in fixed income, and are therefore most susceptible to a correction.

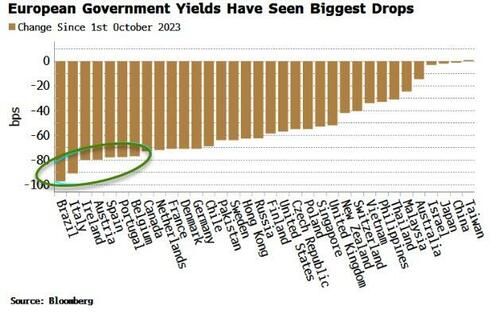

Yields have fallen almost everywhere since October. Oversold conditions led to a reversal in the bond selloff, further galvanized by central bankers from the Federal Reserve to the ECB tempering their hawkishness based on their view that inflation is probably back under control.

The biggest drops in yields, after Brazil, have been in Italy, Ireland and Austria. Germany and France have also seen large declines, greater than in the US or the UK.

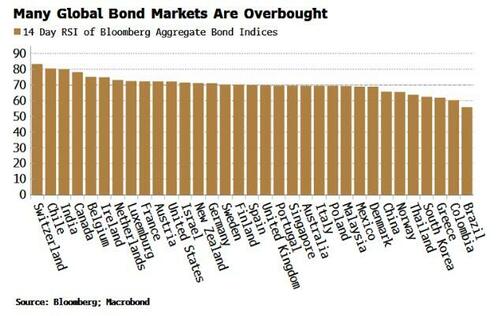

How overbought does that leave individual bond markets? To answer that we can take the Bloomberg aggregate indices for countries around the world. The aggregate indices are made up of corporate and government debt.

Using the RSI as a gauge of overboughtness (it is imperfect as a trading signal, but is a good first filter for markets that may be cheap or expensive), we can see that many European countries have potentially extended bond markets. For example, the bond markets of Switzerland, Belgium, Netherlands and France are all overbought on this measure (14-day RSI > 70), and are more so than the US.

As with the US, the drop in yields in Europe has been driven by rising expectations of fairly deep rate cuts next year, with over 140 bps worth currently discounted.

The ECB is increasingly comfortable with the inflation outlook, with noted hawk Isabel Schnabel recently softening her stance.

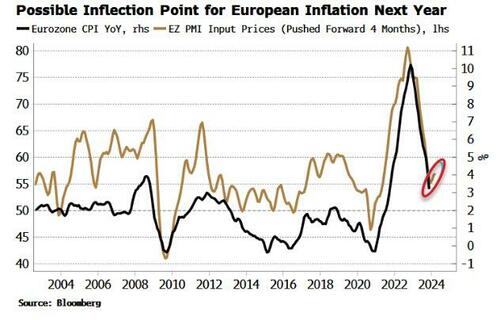

However, the growth outlook for Europe may not be so bleak next year (GDP for the last quarter was confirmed today as falling 0.1%), as real M1 growth, which leads economic growth by about six months, looks like it has stabilized and started to turn up. Further, leading indicators of inflation, such as PMI input prices, are also hinting that inflation may not be done and dusted as several in the ECB appear to believe.

Again, as with the US, far fewer -- if any -- cuts may actually be delivered, leaving overbought European bond markets subject to another reversal.

Authored by Simon White, Bloomberg macro strategist,

The bonds of European countries are among the most overbought following the global rally in fixed income, and are therefore most susceptible to a correction.

Yields have fallen almost everywhere since October. Oversold conditions led to a reversal in the bond selloff, further galvanized by central bankers from the Federal Reserve to the ECB tempering their hawkishness based on their view that inflation is probably back under control.

The biggest drops in yields, after Brazil, have been in Italy, Ireland and Austria. Germany and France have also seen large declines, greater than in the US or the UK.

How overbought does that leave individual bond markets? To answer that we can take the Bloomberg aggregate indices for countries around the world. The aggregate indices are made up of corporate and government debt.

Using the RSI as a gauge of overboughtness (it is imperfect as a trading signal, but is a good first filter for markets that may be cheap or expensive), we can see that many European countries have potentially extended bond markets. For example, the bond markets of Switzerland, Belgium, Netherlands and France are all overbought on this measure (14-day RSI > 70), and are more so than the US.

As with the US, the drop in yields in Europe has been driven by rising expectations of fairly deep rate cuts next year, with over 140 bps worth currently discounted.

The ECB is increasingly comfortable with the inflation outlook, with noted hawk Isabel Schnabel recently softening her stance.

However, the growth outlook for Europe may not be so bleak next year (GDP for the last quarter was confirmed today as falling 0.1%), as real M1 growth, which leads economic growth by about six months, looks like it has stabilized and started to turn up. Further, leading indicators of inflation, such as PMI input prices, are also hinting that inflation may not be done and dusted as several in the ECB appear to believe.

Again, as with the US, far fewer — if any — cuts may actually be delivered, leaving overbought European bond markets subject to another reversal.

Loading…