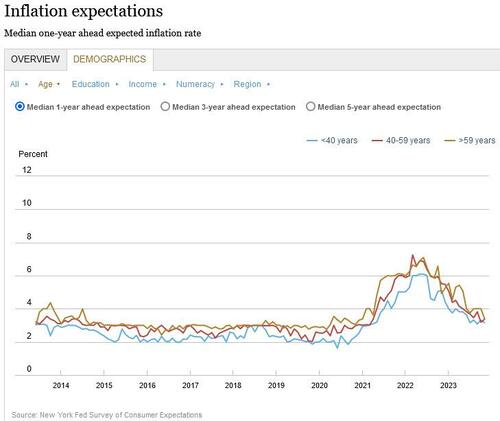

After two months of late summer increases in the 1-Year inflation expectation as tracked by the NY Fed's monthly consumer survey, November saw the second consecutive decline in this series which traditionally is also a proxy for the price of oil, and which last month dropped to the lowest since April 2021. The drop in 1 year inflation expectations was not, however, matched by moves in the other series, as both the 3 and 5 year inflation expectations were unchanged.

Here are the details: as shown in the chart below, inflation expectations at the one-year horizon decreased to 3.36% from 3.57% in October, while median inflation expectations at the three- and five-year ahead horizon remained unchanged at 3.0% and 2.7%, respectively.

Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—fell at the one-year ahead horizon, increased slightly at the three-year ahead horizon, and remained unchanged at the five-year ahead horizon.

Amusingly, inflation views among those over age 60 retreated to a nearly three-year low, but virtually every age group was at or near a multi-year low. One almost wonders just who are these people the NY fed "randomly" calls up to "survey."

The latest survey comes just one day before the release of November consumer price index, which also coincides with the start of the Federal Reserve’s two-day policy meeting. Economists forecast consumer prices will be unchanged in November from the prior month, helped by retreating gasoline costs.

The pullback in consumers’ near-term inflation views reflected a number of factors, but most notably the price of gas: as shown in the next chart, the expected price changes for gasoline slipped, and those for both rent and a college education fell to the lowest since January 2021. Good luck with that.

Median year-ahead expected price changes decreased by 0.5 percentage point for gas to 4.5%, 0.2 percentage point for the cost of a college education to 5.8% (the lowest reading since January 2021), 1.1 percentage points for rent to 8.0% (the lowest reading since January 2021), and 0.3 percentage point for food to 5.3%, while it remained flat for medical care at 9.1%.

Elsewhere, median home price growth expectations were unchanged for the second consecutive month at 3.0%. The series has remained within a narrow range of 2.8% to 3.1% since June 2023.

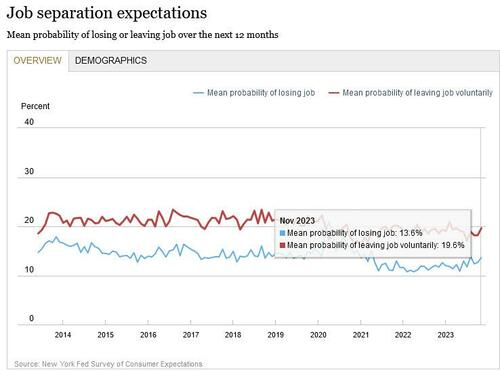

At the same time, consumers’ views about the labor market worsened somewhat. The mean perceived probability of losing one’s job in the next 12 months increased by nearly a percentage point to 13.6%....

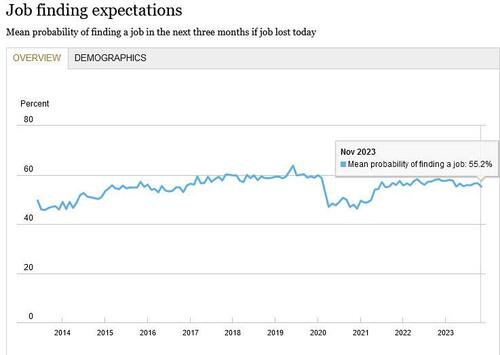

... while the probability of finding a job after becoming unemployed decreased to a seven-month low of 55.2%. Those in the Midwest expressed the least confidence about their chances of finding new employment.

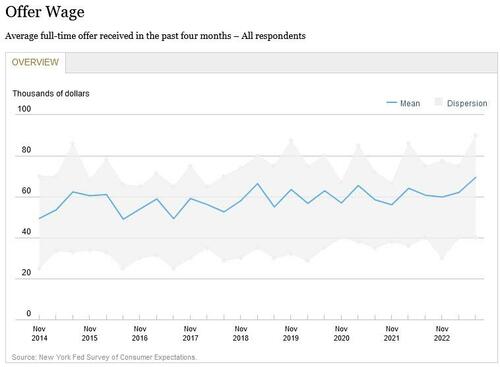

Still what we found especially interesting is that at a time when wages are supposedly dropping, the NY Fed survey found that the average full-time job offer received in the past 4 months just hit a record high $69,475, up more than $7K in the past quarter.

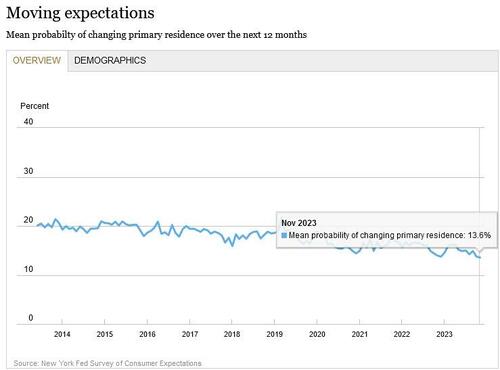

Americans are also increasingly reluctant to move. The odds of changing one’s primary residence over the next 12 months dropped in November to the lowest in data back to mid-2013, which is understandable with mortgage rates still just shy of a 40 year high.

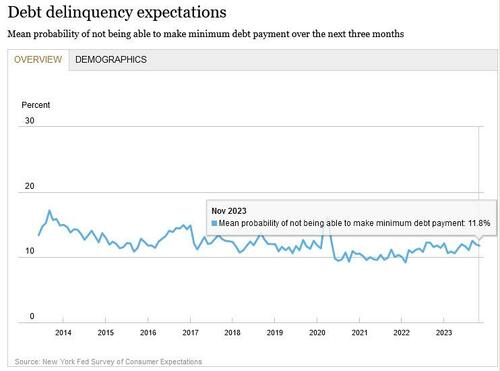

That said, several measures of household finances did improve in the month. Consumers said they were less likely to miss a minimum debt payment over the next three months...

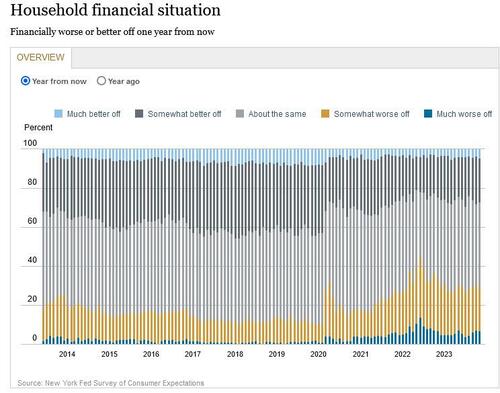

... and respondents were more optimistic about their year-ahead financial situation.

Some more detailed from the latest report:

Labor Market

- Median one-year ahead expected earnings growth decreased by 0.1 percentage point to 2.7%. In November, the series finally moved out of the 2.8% to 3.0% narrow range in which it had been confined since September 2021. The decline was driven by respondents above the age of 60.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 0.2 percentage point to 38.4%, slightly below the series 12-month trailing average of 39.8%.

- The mean perceived probability of losing one’s job in the next 12 months increased by 0.9 percentage point to 13.6%. The mean probability of leaving one’s job voluntarily in the next 12 months increased by 1.4 percentage points to 19.6%. Both figures are above their series 12-month trailing average of 12.2% and 18.9%, respectively.

- The mean perceived probability of finding a job (if one’s current job was lost) decreased to 55.2% in November from 56.6%.

Household Finance

- Median expected growth in household income was unchanged at 3.1% in November, remaining above the series’ pre-pandemic level of 2.7% in February 2020.

- Median household spending growth expectations declined by 0.1 percentage point to 5.2% in November. The series has remained stable between 5.2% and 5.4% since June 2023, but it remains well above its February 2020 pre-pandemic level of 3.1%.

- Perceptions of credit access compared to a year ago improved for the second consecutive month with a smaller (larger) share of respondents reporting that it is harder (easier) to obtain credit today compared to a year ago. Similarly, consumers were more optimistic about future credit access with a decreased share of respondents expecting tighter credit conditions a year from now.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 0.2 percentage point to 11.8% in November, a level comparable to those prevailing just before the pandemic.

- After reaching its lowest reading in three years last month, the median expected year-ahead change in taxes (at current income level) bounced back by 0.3 percentage point to 4.1% in November.

- Median year-ahead expected growth in government debt increased to 10% in November from 9.8% in October.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.8 percentage point to 29.5%.

- Perceptions about households’ current financial situation were mostly unchanged compared to last month. In contrast, consumers were more optimistic about their year-ahead financial situation with a smaller share expecting to be worse off.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now rose by 2.3 percentage points to 36.5%.

After two months of late summer increases in the 1-Year inflation expectation as tracked by the NY Fed’s monthly consumer survey, November saw the second consecutive decline in this series which traditionally is also a proxy for the price of oil, and which last month dropped to the lowest since April 2021. The drop in 1 year inflation expectations was not, however, matched by moves in the other series, as both the 3 and 5 year inflation expectations were unchanged.

Here are the details: as shown in the chart below, inflation expectations at the one-year horizon decreased to 3.36% from 3.57% in October, while median inflation expectations at the three- and five-year ahead horizon remained unchanged at 3.0% and 2.7%, respectively.

Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—fell at the one-year ahead horizon, increased slightly at the three-year ahead horizon, and remained unchanged at the five-year ahead horizon.

Amusingly, inflation views among those over age 60 retreated to a nearly three-year low, but virtually every age group was at or near a multi-year low. One almost wonders just who are these people the NY fed “randomly” calls up to “survey.”

The latest survey comes just one day before the release of November consumer price index, which also coincides with the start of the Federal Reserve’s two-day policy meeting. Economists forecast consumer prices will be unchanged in November from the prior month, helped by retreating gasoline costs.

The pullback in consumers’ near-term inflation views reflected a number of factors, but most notably the price of gas: as shown in the next chart, the expected price changes for gasoline slipped, and those for both rent and a college education fell to the lowest since January 2021. Good luck with that.

Median year-ahead expected price changes decreased by 0.5 percentage point for gas to 4.5%, 0.2 percentage point for the cost of a college education to 5.8% (the lowest reading since January 2021), 1.1 percentage points for rent to 8.0% (the lowest reading since January 2021), and 0.3 percentage point for food to 5.3%, while it remained flat for medical care at 9.1%.

Elsewhere, median home price growth expectations were unchanged for the second consecutive month at 3.0%. The series has remained within a narrow range of 2.8% to 3.1% since June 2023.

At the same time, consumers’ views about the labor market worsened somewhat. The mean perceived probability of losing one’s job in the next 12 months increased by nearly a percentage point to 13.6%….

… while the probability of finding a job after becoming unemployed decreased to a seven-month low of 55.2%. Those in the Midwest expressed the least confidence about their chances of finding new employment.

Still what we found especially interesting is that at a time when wages are supposedly dropping, the NY Fed survey found that the average full-time job offer received in the past 4 months just hit a record high $69,475, up more than $7K in the past quarter.

Americans are also increasingly reluctant to move. The odds of changing one’s primary residence over the next 12 months dropped in November to the lowest in data back to mid-2013, which is understandable with mortgage rates still just shy of a 40 year high.

That said, several measures of household finances did improve in the month. Consumers said they were less likely to miss a minimum debt payment over the next three months…

… and respondents were more optimistic about their year-ahead financial situation.

Some more detailed from the latest report:

Labor Market

- Median one-year ahead expected earnings growth decreased by 0.1 percentage point to 2.7%. In November, the series finally moved out of the 2.8% to 3.0% narrow range in which it had been confined since September 2021. The decline was driven by respondents above the age of 60.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 0.2 percentage point to 38.4%, slightly below the series 12-month trailing average of 39.8%.

- The mean perceived probability of losing one’s job in the next 12 months increased by 0.9 percentage point to 13.6%. The mean probability of leaving one’s job voluntarily in the next 12 months increased by 1.4 percentage points to 19.6%. Both figures are above their series 12-month trailing average of 12.2% and 18.9%, respectively.

- The mean perceived probability of finding a job (if one’s current job was lost) decreased to 55.2% in November from 56.6%.

Household Finance

- Median expected growth in household income was unchanged at 3.1% in November, remaining above the series’ pre-pandemic level of 2.7% in February 2020.

- Median household spending growth expectations declined by 0.1 percentage point to 5.2% in November. The series has remained stable between 5.2% and 5.4% since June 2023, but it remains well above its February 2020 pre-pandemic level of 3.1%.

- Perceptions of credit access compared to a year ago improved for the second consecutive month with a smaller (larger) share of respondents reporting that it is harder (easier) to obtain credit today compared to a year ago. Similarly, consumers were more optimistic about future credit access with a decreased share of respondents expecting tighter credit conditions a year from now.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 0.2 percentage point to 11.8% in November, a level comparable to those prevailing just before the pandemic.

- After reaching its lowest reading in three years last month, the median expected year-ahead change in taxes (at current income level) bounced back by 0.3 percentage point to 4.1% in November.

- Median year-ahead expected growth in government debt increased to 10% in November from 9.8% in October.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.8 percentage point to 29.5%.

- Perceptions about households’ current financial situation were mostly unchanged compared to last month. In contrast, consumers were more optimistic about their year-ahead financial situation with a smaller share expecting to be worse off.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now rose by 2.3 percentage points to 36.5%.

Loading…