By Greg Miller of FreightWaves,

Shipping already faces fallout from two wars: trade shifts due to Russia’s invasion of Ukraine and vessel attacks off Yemen in the wake of the Israel-Hamas conflict.

Could there be a third simultaneous war — and even more trade complications for shipping?

Venezuela is threatening to invade Guyana and annex Guyana’s oil-rich Essequibo region, claiming the jungle territory and its offshore areas were stolen from Venezuela in 1899. Essequibo comprises around two-thirds of Guyana.

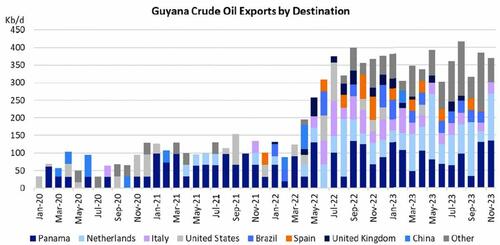

Guyana has been a bright spot for crude tankers. Since offshore production began in 2019, crude exports have risen to 400,000 barrels per day (b/d), with projections for volumes to double by the end of 2025 and top 1 million b/d by 2027.

“In the unlikely event that Venezuela decides to go further than rhetoric and actually moves into Guyana, the oil production and exports from both countries will likely suffer,” said Erik Broekhuizen, manager of marine research and consulting at Poten & Partners, in a report on Saturday.

“Sanctions [on Venezuela] will be reimposed — and probably tightened — and international oil companies will move their assets out of Guyana, crippling the country’s production.”

Invasion would reduce Atlantic Basin exports

The positive spin for tankers on production cuts by OPEC is that these cuts reduce Middle East-to-Asia volume, which is replaced by Atlantic Basin-to-Asia volume. This increases tanker demand measured in ton-miles (volume multiplied by distance).

“I’m tempted to say it’s flat out positive,” said Lars Barstad, CEO of tanker owner Frontline (NYSE: FRO), on his company’s Nov. 30 conference call, referring to the latest round of OPEC cuts and the positive ton-mile effect.

“We’re seeing refinery capacity built up and continuing to be built up east of Suez. New oil production is coming from west of Suez. We’ve seen Brazil increasing production and new production coming out of Guyana. We’ve seen Venezuelan exports increasing,” he said, adding that OPEC cuts are also “great news for U.S. fracking and great news for U.S. production.”

In the Americas region, U.S. exports are averaging 4 million b/d this year, according to Kpler. The International Energy Agency put Brazilian exports at 1.8 million b/d. Colombia is at 400,000 b/d, according to Colombian oil company Ecopetrol. Venezuela is exporting 300,000-400,000 b/d, according to Frontline.

To the extent Atlantic Basin exports are being touted as a tanker-demand positive in light of OPEC cuts, a Venezuela-Guyana conflict would be a negative, potentially impacting around 11% of regional exports.

As Venezuela flounders, Guyana rises

“The oil industries of Venezuela and Guyana are a study in contrasts,” said Broekhuizen. “Venezuela boasts one of the largest oil reserves in the world, but its industry … is in bad shape after decades of mismanagement and corruption and — in recent years — ever-tightening sanctions.” Current Venezuelan production is less than a third of 2009 levels.

“In contrast to developments in Venezuela, Guyana’s oil industry has been a success story,” said Broekhuizen, adding that “the future for Guyana appears bright.”

Current output is via two floating production, storage and offloading (FPSO) vessels, the Liza Destiny and Liza Unity, with a third FPSO, the Prosperity, now ramping up.

Production is being handled by a consortium led by Exxon Mobil (NYSE: XOM), with a 45% stake, together with partners Hess (NYSE: HES), with 30%, and China’s CNOOC, with 25%. Hess is in the process of being acquired by Chevron (NYSE: CVX). Guyana awarded exploration rights to eight additional offshore blocs in October.

Data from Vortexa cited by Poten & Partners shows that almost all of Guyana’s current exports are staying within the Atlantic Basin, with very little headed long-haul to Asia, at least so far.

Top buyers are Panama, the Netherlands and the U.S.

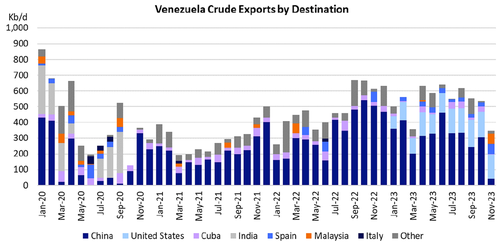

The destination of Venezuelan exports has changed significantly as a result of the temporary relaxation of U.S. sanctions.

Previously, most Venezuelan crude was shipped to China using tankers in the so-called “shadow fleet” — vessels outside the Western financial and insurance systems.

In more recent months, with U.S. sanctions temporarily suspended, the U.S. has replaced China as the largest buyer of Venezuelan crude.

Double negative for tanker demand

Frontline’s Barstad predicted that Venezuelan exports would increase to 600,000-700,000 b/d if sanctions are not reinstated. “One would assume that most of this Venezuelan oil will move short-haul on Aframaxes and potentially Suezmaxes to the U.S.” (Aframaxes carry 750,000 barrels, Aframaxes 1 million barrels).

But there is also an effect on demand for very large crude carriers (VLCCs, tankers with capacity of 2 million barrels).

“What we’ve seen recently is VLCC cargoes being built up, and some of them are pointing toward India,” said Barstad. He reported four to six VLCC loadings scheduled in Venezuela in late November through December.

“These are vessels that are then not available for U.S. exports, so we believe this will actually tighten up the Atlantic market.”

An invasion of Guyana by Venezuela would be a double negative for mainstream tanker demand. It would derail burgeoning exports from Guyana and inevitably lead to renewed U.S. sanctions, pushing Venezuelan cargoes back to the shadow fleet.

The caveat is that Venezuelan and Guyanese exports are much less important to crude tanker demand than U.S. and Brazilian exports, so downside would be limited. The potential shipping impact of a third simultaneous war would be much less significant than the consequences of the first two.

By Greg Miller of FreightWaves,

Shipping already faces fallout from two wars: trade shifts due to Russia’s invasion of Ukraine and vessel attacks off Yemen in the wake of the Israel-Hamas conflict.

Could there be a third simultaneous war — and even more trade complications for shipping?

Venezuela is threatening to invade Guyana and annex Guyana’s oil-rich Essequibo region, claiming the jungle territory and its offshore areas were stolen from Venezuela in 1899. Essequibo comprises around two-thirds of Guyana.

Guyana has been a bright spot for crude tankers. Since offshore production began in 2019, crude exports have risen to 400,000 barrels per day (b/d), with projections for volumes to double by the end of 2025 and top 1 million b/d by 2027.

“In the unlikely event that Venezuela decides to go further than rhetoric and actually moves into Guyana, the oil production and exports from both countries will likely suffer,” said Erik Broekhuizen, manager of marine research and consulting at Poten & Partners, in a report on Saturday.

“Sanctions [on Venezuela] will be reimposed — and probably tightened — and international oil companies will move their assets out of Guyana, crippling the country’s production.”

Invasion would reduce Atlantic Basin exports

The positive spin for tankers on production cuts by OPEC is that these cuts reduce Middle East-to-Asia volume, which is replaced by Atlantic Basin-to-Asia volume. This increases tanker demand measured in ton-miles (volume multiplied by distance).

“I’m tempted to say it’s flat out positive,” said Lars Barstad, CEO of tanker owner Frontline (NYSE: FRO), on his company’s Nov. 30 conference call, referring to the latest round of OPEC cuts and the positive ton-mile effect.

“We’re seeing refinery capacity built up and continuing to be built up east of Suez. New oil production is coming from west of Suez. We’ve seen Brazil increasing production and new production coming out of Guyana. We’ve seen Venezuelan exports increasing,” he said, adding that OPEC cuts are also “great news for U.S. fracking and great news for U.S. production.”

In the Americas region, U.S. exports are averaging 4 million b/d this year, according to Kpler. The International Energy Agency put Brazilian exports at 1.8 million b/d. Colombia is at 400,000 b/d, according to Colombian oil company Ecopetrol. Venezuela is exporting 300,000-400,000 b/d, according to Frontline.

To the extent Atlantic Basin exports are being touted as a tanker-demand positive in light of OPEC cuts, a Venezuela-Guyana conflict would be a negative, potentially impacting around 11% of regional exports.

As Venezuela flounders, Guyana rises

“The oil industries of Venezuela and Guyana are a study in contrasts,” said Broekhuizen. “Venezuela boasts one of the largest oil reserves in the world, but its industry … is in bad shape after decades of mismanagement and corruption and — in recent years — ever-tightening sanctions.” Current Venezuelan production is less than a third of 2009 levels.

“In contrast to developments in Venezuela, Guyana’s oil industry has been a success story,” said Broekhuizen, adding that “the future for Guyana appears bright.”

Current output is via two floating production, storage and offloading (FPSO) vessels, the Liza Destiny and Liza Unity, with a third FPSO, the Prosperity, now ramping up.

Production is being handled by a consortium led by Exxon Mobil (NYSE: XOM), with a 45% stake, together with partners Hess (NYSE: HES), with 30%, and China’s CNOOC, with 25%. Hess is in the process of being acquired by Chevron (NYSE: CVX). Guyana awarded exploration rights to eight additional offshore blocs in October.

Data from Vortexa cited by Poten & Partners shows that almost all of Guyana’s current exports are staying within the Atlantic Basin, with very little headed long-haul to Asia, at least so far.

Top buyers are Panama, the Netherlands and the U.S.

The destination of Venezuelan exports has changed significantly as a result of the temporary relaxation of U.S. sanctions.

Previously, most Venezuelan crude was shipped to China using tankers in the so-called “shadow fleet” — vessels outside the Western financial and insurance systems.

In more recent months, with U.S. sanctions temporarily suspended, the U.S. has replaced China as the largest buyer of Venezuelan crude.

Double negative for tanker demand

Frontline’s Barstad predicted that Venezuelan exports would increase to 600,000-700,000 b/d if sanctions are not reinstated. “One would assume that most of this Venezuelan oil will move short-haul on Aframaxes and potentially Suezmaxes to the U.S.” (Aframaxes carry 750,000 barrels, Aframaxes 1 million barrels).

But there is also an effect on demand for very large crude carriers (VLCCs, tankers with capacity of 2 million barrels).

“What we’ve seen recently is VLCC cargoes being built up, and some of them are pointing toward India,” said Barstad. He reported four to six VLCC loadings scheduled in Venezuela in late November through December.

“These are vessels that are then not available for U.S. exports, so we believe this will actually tighten up the Atlantic market.”

An invasion of Guyana by Venezuela would be a double negative for mainstream tanker demand. It would derail burgeoning exports from Guyana and inevitably lead to renewed U.S. sanctions, pushing Venezuelan cargoes back to the shadow fleet.

The caveat is that Venezuelan and Guyanese exports are much less important to crude tanker demand than U.S. and Brazilian exports, so downside would be limited. The potential shipping impact of a third simultaneous war would be much less significant than the consequences of the first two.

Loading…