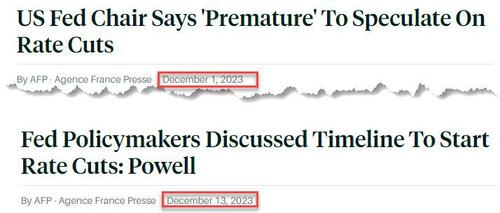

One day after the Fed's bizarre, unexpected pivot, many are struggling to wrap their heads around what happened: what exactly changed in less than two weeks for Powell to go from telling the market it was "premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease" to suddenly warning that rate cuts are something “that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today."

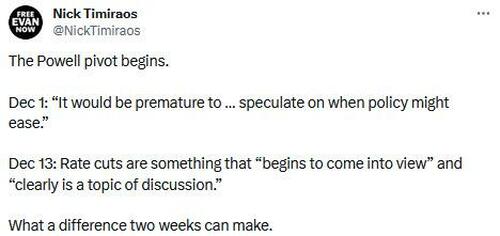

Even Powell's own mouthpiece, WSJ reporter Nick "Nikileaks" Timiraos, was confused remarking sarcastically after the FOMC "what a difference two weeks can make."

Ok, so let's take a closer look at the two weeks between Dec 1 and Dec 13 when supposedly everything changed.

What we find is that the main economic events that took place were the ISM Services on Dec 5, the November Payrolls report on Dec 8, the University of Michigan Consumer Sentiment report, the CPI report on Dec 12 (and let's add today's retail sales data just for additional context).

Turning to each of these in order, we start with the ISM Services report which was a clear beat and rebound from the previous month...

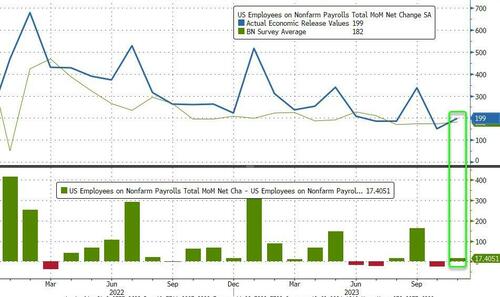

... the jobs report was an impressive beat and also a significant improvement from the previous report...

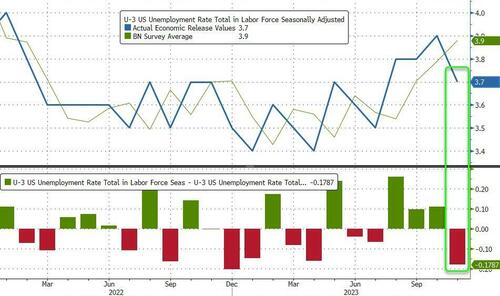

... not to mention the unemployment rate which came in far below expected and was a big drop from the previous one (the Sahm's Rule watchers, who were worried it would telegraph an imminent recession, could relax)...

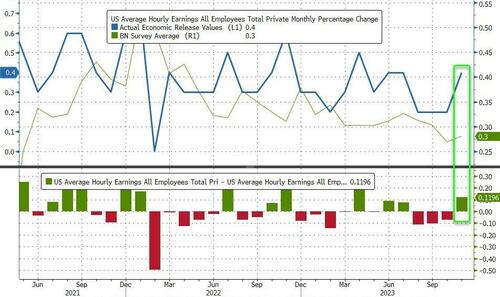

... average hourly earnings also came in hotter than expected (i.e., inflationary)...

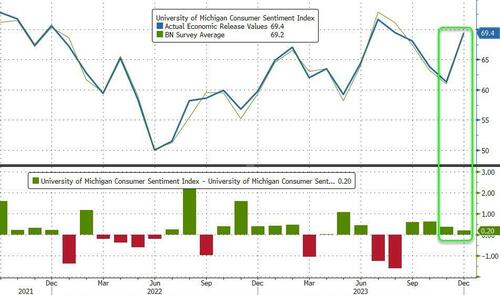

... which in turn helped the UMichigan Consumer Sentiment report, which exploded higher from 61.3 to 69.4 (smashing estimates of 62.0)...

... as for the inflation print, well November CPI came in hotter than expected (so contrary to whatever disinflationary trend the Fed may be falling back on to justify its dovishness).

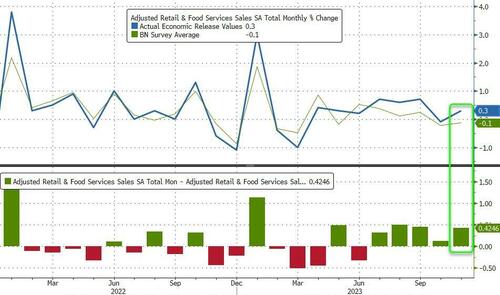

Last but not least was today's retail sales which came in scorching hot - the 5th consecutive beat in a row - and confirmed that contrary to what the Fed is telegraphing, the US consumer is not only not slowing but supposedly spending much more than Wall Street expected. Maybe Powell did not have that data, but he certainly had access to the same real-time card spending data that Bank of America has, and which allowed to correctly predict just how big of a beat today's retail sales data would be.

Yet, after all this stronger than expected and/or improving data, or hotter inflation, Powell made an unexpected 180 pivot on what he said two weeks earlier when the data was generally worse - and less inflationary - than it is today. And as the FOMC ‘pivoted’ in a dovish direction, its impact on markets was profound. Looking at the market this morning, the US 10y yield has plunged nearly 20bps since the decision, the 2y yield a little over 30bps. Markets are now pricing for six cuts of 25bp in 2024, with the first one fully priced in for March.

Yet, clearly, the key driver of the sharp reaction by markets was the fact that Powell decided not to push back against market expectations of early (and significant) cuts for 2024.

And the punchline: although the FOMC hasn’t taken the possibility of further hikes off the table, Powell admitted that the FOMC has started to talk about when to dial back rates, a huge reversal from what he said less than two weeks prior when he claimed that it was "premature" to speculate on rate cuts. He said that the Committee had not worked out the cutting cycle yet, but he did say they would not wait with cutting until inflation was at 2%, because they don’t want to overshoot.

Of course, as we have shown above, none of this overshooting danger was in the recent data; if anything, the data has come in stronger since the start of the month as did inflation, so assuming the same Powell from his Dec 1 appearance at the Spelman College fireside chat was still around, what he should have said is doubling down on that very same message.... instead he did just the opposite.

This, according to Rabobank, basically erodes the importance of any near-term inflation data that would still point to inflation above its target, whilst it elevates those data that support the view that inflation is on its way down. The Wall Street Journal’s Nick Timiraos tweeted that Powell said that some members even changed their minds halfway through the meeting, when (lower-than-expected) PPI numbers came out.

Powell: Some Fed officials changed their forecasts after the PPI numbers were released on Wednesday

— Nick Timiraos (@NickTimiraos) December 13, 2023

But as even first-year financial analysts know, what PPI measures more than anything, is commodity input costs, i.e., oil, gasoline, food, and so on... all items the Fed religiously avoids in its preferred inflation measure, the core PCE.

So the picture that emerges is a puzzling one: on one hand with weaker data in hand, the Fed Chair said it was "premature" to talk about rate cuts, yet less than two weeks later, with stronger data in place and with hotter than expected inflation, Powell suddenly flip-flopped 180 degrees, shocking even veteran traders, when supposedly the Fed now was looking at precisely those things (PPI) which it went to great lengths to avoid when inflation was soaring.

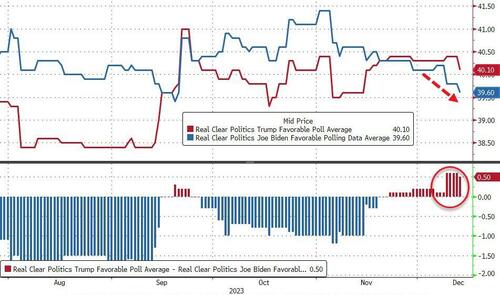

Or maybe there is no puzzle at all: maybe what that happened in the past two weeks had nothing to do with economic data, the state of the US consumer, or how hot inflation is running and everything to do with... phone calls from the increasingly angry White House, the same White House which after seeing the latest polling data putting Biden at the biggest disadvantage behind Trump despite the miracle of "Bidenomics"...

... decided to pull its last political level, and had a back room conversation with the Fed Chair, making it very clear that it is in everyone's best interest if the Fed ends its tightening campaign and informs the market that rate cuts are coming. It certainly would explain why despite keeping the 2026 projected fed funds rate unchanged at 2.875%, the Fed just as unexpectedly decided to pull one full rate cut out of the non-election year 2025 and push it into the pre-election 2024.

Nonsense, the Fed is apolitical, it would never yield to political pressure, you say!?

Well, that dear reader, is bullshit, as even the NYT reminds us in this particular vivid anecdote from 1965 recounting the dramatic interaction between former US president Lyndon B Johnson and then-Fed president William McChesney Martin, when the head of the US central bank - much to LBJ's displeasure - hiked rates by half a percentage point, infuriating the Democratic president, to wit:

At the Board of Governors meeting that afternoon, he called for a vote to raise the discount rate a half-percentage point, to 4.5 percent. But before the vote, he conceded that raising the rate would essentially wave a red flag before the critics of an independent Federal Reserve, in Congress and in the White House. “We should be under no illusions,” he told his colleagues. “A decision to move now can lead to an important revamping of the Federal Reserve System, including its structure and operating methods. This is a real possibility and I have been turning it over in my mind for months.”

The vote was 4 to 3. Martin cast the deciding ballot.

In Texas, Johnson was enraged. Joseph Califano, an aide (later a cabinet secretary under President Jimmy Carter), recalled Johnson’s “burning up the wires to Washington, asking one member of Congress after another, ‘How can I run the country and the government if I have to read on a news-service ticker that Bill Martin is going to run his own economy?’”

Martin was summoned to explain why he had defied the president.

Martin flew down to the Johnson Ranch on Monday, Dec. 6, along with Fowler and other advisers. The president met them at an airstrip behind the wheel of his Lincoln convertible. They piled in and he drove them to the house.

There, Johnson got Martin alone and did not mince words. According to different accounts, the 6-foot-4 Johnson pushed the shorter Martin up against a wall.

“You went ahead and did something that you knew I disapproved of, that can affect my entire term here,” Johnson said, as Martin recalled later in an oral history. “You took advantage of me and I’m not going to forget it, because here I am, a sick man. You’ve got me into a position where you can run a rapier into me and you’ve run it.”

“Martin, my boys are dying in Vietnam, and you won’t print the money I need,” he said.

Martin stood his ground. He pointed out that he had given the president fair warning that a raise was coming. More broadly, he insisted that he and the president had different jobs to do, that the Federal Reserve Act gave the Fed responsibility over interest rates.

“I knew you disapproved of it, but I had to call the shot as I saw it,” he said.

The two eventually stepped outside and tried to assure reporters that any differences had been patched up. Their sour expressions, captured in newspapers the next day, suggested otherwise.

Ironically, in the end LBJ got what he wanted as the next episode from the NYT reveals:

... in 1965, President Lyndon B. Johnson, who wanted cheap credit to finance the Vietnam War and his Great Society, summoned Fed chairman William McChesney Martin to his Texas ranch. There, after asking other officials to leave the room, Johnson reportedly shoved Martin against the wall as he demanding that the Fed once again hold down interest rates. Martin caved, the Fed printed money, and inflation kept climbing until the early 1980s.

Almost 60 years later, Powell decided not to "call the shot as he saw it" just two weeks ago, and instead of being shoved against the wall by Biden's thugs, to instead capitulate what little credibility the Fed had just so Biden's odds of getting reelected in 2024 were ever so fractionally higher...

One day after the Fed’s bizarre, unexpected pivot, many are struggling to wrap their heads around what happened: what exactly changed in less than two weeks for Powell to go from telling the market it was “premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease” to suddenly warning that rate cuts are something “that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.”

Even Powell’s own mouthpiece, WSJ reporter Nick “Nikileaks” Timiraos, was confused remarking sarcastically after the FOMC “what a difference two weeks can make.“

Ok, so let’s take a closer look at the two weeks between Dec 1 and Dec 13 when supposedly everything changed.

What we find is that the main economic events that took place were the ISM Services on Dec 5, the November Payrolls report on Dec 8, the University of Michigan Consumer Sentiment report, the CPI report on Dec 12 (and let’s add today’s retail sales data just for additional context).

Turning to each of these in order, we start with the ISM Services report which was a clear beat and rebound from the previous month…

… the jobs report was an impressive beat and also a significant improvement from the previous report…

… not to mention the unemployment rate which came in far below expected and was a big drop from the previous one (the Sahm’s Rule watchers, who were worried it would telegraph an imminent recession, could relax)…

… average hourly earnings also came in hotter than expected (i.e., inflationary)…

… which in turn helped the UMichigan Consumer Sentiment report, which exploded higher from 61.3 to 69.4 (smashing estimates of 62.0)…

… as for the inflation print, well November CPI came in hotter than expected (so contrary to whatever disinflationary trend the Fed may be falling back on to justify its dovishness).

Last but not least was today’s retail sales which came in scorching hot – the 5th consecutive beat in a row – and confirmed that contrary to what the Fed is telegraphing, the US consumer is not only not slowing but supposedly spending much more than Wall Street expected. Maybe Powell did not have that data, but he certainly had access to the same real-time card spending data that Bank of America has, and which allowed to correctly predict just how big of a beat today’s retail sales data would be.

Yet, after all this stronger than expected and/or improving data, or hotter inflation, Powell made an unexpected 180 pivot on what he said two weeks earlier when the data was generally worse – and less inflationary – than it is today. And as the FOMC ‘pivoted’ in a dovish direction, its impact on markets was profound. Looking at the market this morning, the US 10y yield has plunged nearly 20bps since the decision, the 2y yield a little over 30bps. Markets are now pricing for six cuts of 25bp in 2024, with the first one fully priced in for March.

Yet, clearly, the key driver of the sharp reaction by markets was the fact that Powell decided not to push back against market expectations of early (and significant) cuts for 2024.

And the punchline: although the FOMC hasn’t taken the possibility of further hikes off the table, Powell admitted that the FOMC has started to talk about when to dial back rates, a huge reversal from what he said less than two weeks prior when he claimed that it was “premature” to speculate on rate cuts. He said that the Committee had not worked out the cutting cycle yet, but he did say they would not wait with cutting until inflation was at 2%, because they don’t want to overshoot.

Of course, as we have shown above, none of this overshooting danger was in the recent data; if anything, the data has come in stronger since the start of the month as did inflation, so assuming the same Powell from his Dec 1 appearance at the Spelman College fireside chat was still around, what he should have said is doubling down on that very same message…. instead he did just the opposite.

This, according to Rabobank, basically erodes the importance of any near-term inflation data that would still point to inflation above its target, whilst it elevates those data that support the view that inflation is on its way down. The Wall Street Journal’s Nick Timiraos tweeted that Powell said that some members even changed their minds halfway through the meeting, when (lower-than-expected) PPI numbers came out.

Powell: Some Fed officials changed their forecasts after the PPI numbers were released on Wednesday

— Nick Timiraos (@NickTimiraos) December 13, 2023

But as even first-year financial analysts know, what PPI measures more than anything, is commodity input costs, i.e., oil, gasoline, food, and so on… all items the Fed religiously avoids in its preferred inflation measure, the core PCE.

So the picture that emerges is a puzzling one: on one hand with weaker data in hand, the Fed Chair said it was “premature” to talk about rate cuts, yet less than two weeks later, with stronger data in place and with hotter than expected inflation, Powell suddenly flip-flopped 180 degrees, shocking even veteran traders, when supposedly the Fed now was looking at precisely those things (PPI) which it went to great lengths to avoid when inflation was soaring.

Or maybe there is no puzzle at all: maybe what that happened in the past two weeks had nothing to do with economic data, the state of the US consumer, or how hot inflation is running and everything to do with… phone calls from the increasingly angry White House, the same White House which after seeing the latest polling data putting Biden at the biggest disadvantage behind Trump despite the miracle of “Bidenomics”…

… decided to pull its last political level, and had a back room conversation with the Fed Chair, making it very clear that it is in everyone’s best interest if the Fed ends its tightening campaign and informs the market that rate cuts are coming. It certainly would explain why despite keeping the 2026 projected fed funds rate unchanged at 2.875%, the Fed just as unexpectedly decided to pull one full rate cut out of the non-election year 2025 and push it into the pre-election 2024.

Nonsense, the Fed is apolitical, it would never yield to political pressure, you say!?

Well, that dear reader, is bullshit, as even the NYT reminds us in this particular vivid anecdote from 1965 recounting the dramatic interaction between former US president Lyndon B Johnson and then-Fed president William McChesney Martin, when the head of the US central bank – much to LBJ’s displeasure – hiked rates by half a percentage point, infuriating the Democratic president, to wit:

At the Board of Governors meeting that afternoon, he called for a vote to raise the discount rate a half-percentage point, to 4.5 percent. But before the vote, he conceded that raising the rate would essentially wave a red flag before the critics of an independent Federal Reserve, in Congress and in the White House. “We should be under no illusions,” he told his colleagues. “A decision to move now can lead to an important revamping of the Federal Reserve System, including its structure and operating methods. This is a real possibility and I have been turning it over in my mind for months.”

The vote was 4 to 3. Martin cast the deciding ballot.

In Texas, Johnson was enraged. Joseph Califano, an aide (later a cabinet secretary under President Jimmy Carter), recalled Johnson’s “burning up the wires to Washington, asking one member of Congress after another, ‘How can I run the country and the government if I have to read on a news-service ticker that Bill Martin is going to run his own economy?’”

Martin was summoned to explain why he had defied the president.

Martin flew down to the Johnson Ranch on Monday, Dec. 6, along with Fowler and other advisers. The president met them at an airstrip behind the wheel of his Lincoln convertible. They piled in and he drove them to the house.

There, Johnson got Martin alone and did not mince words. According to different accounts, the 6-foot-4 Johnson pushed the shorter Martin up against a wall.

“You went ahead and did something that you knew I disapproved of, that can affect my entire term here,” Johnson said, as Martin recalled later in an oral history. “You took advantage of me and I’m not going to forget it, because here I am, a sick man. You’ve got me into a position where you can run a rapier into me and you’ve run it.”

“Martin, my boys are dying in Vietnam, and you won’t print the money I need,” he said.

Martin stood his ground. He pointed out that he had given the president fair warning that a raise was coming. More broadly, he insisted that he and the president had different jobs to do, that the Federal Reserve Act gave the Fed responsibility over interest rates.

“I knew you disapproved of it, but I had to call the shot as I saw it,” he said.

The two eventually stepped outside and tried to assure reporters that any differences had been patched up. Their sour expressions, captured in newspapers the next day, suggested otherwise.

Ironically, in the end LBJ got what he wanted as the next episode from the NYT reveals:

… in 1965, President Lyndon B. Johnson, who wanted cheap credit to finance the Vietnam War and his Great Society, summoned Fed chairman William McChesney Martin to his Texas ranch. There, after asking other officials to leave the room, Johnson reportedly shoved Martin against the wall as he demanding that the Fed once again hold down interest rates. Martin caved, the Fed printed money, and inflation kept climbing until the early 1980s.

Almost 60 years later, Powell decided not to “call the shot as he saw it” just two weeks ago, and instead of being shoved against the wall by Biden’s thugs, to instead capitulate what little credibility the Fed had just so Biden’s odds of getting reelected in 2024 were ever so fractionally higher…

Loading…