China's yuan has overtaken the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

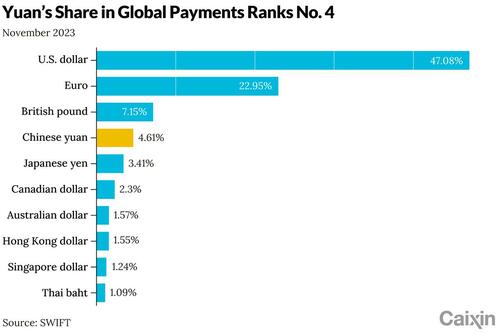

The share of the yuan as a global payment currency climbed to 4.61% in November from 3.6% the previous month, according to data compiled by SWIFT and released on Thursday. According to Caixin, the redback surpassed the Japanese yen, whose share came in at 3.41% in November, down from 3.91% the month before.

Thanks to its sharp devaluation throughout 2023, the yuan has been on a steady march upward throughout 2023, having started the year with just a 1.91% share in January. The November reading for the yuan was the highest since SWIFT began compiling the data series in 2010.

Meanwhile, the U.S. dollar maintained its dominance in global payments with a share of 47.08% in November. It was trailed by the euro, which was used in 22.95% of global payments, and the British pound, which had a share of 7.15%.

While China has been ramping up efforts to expand use of the yuan in cross-border transactions as an alternative to the US dollar, it has so far achieved very limited success due to the country's impenetrable capital account firewall which means the yuan can never truly float (and if it does, watch as tens of trillions in domestic savings promptly flood the rest of the world, after a massive devaluation of course). To overcome the yuan's natural limitations, China has been encouraging other countries to settle trade and investment in the Chinese currency (something Russia has been pursuing in recent months), and setting up yuan clearing banks in offshore markets to cater to cross-border yuan settlements.

The yuan’s ranking in global payment currencies by value has been hovering around fifth for years, SWIFT data show. It temporarily captured the fourth spot for a two-month spell in December 2021 and January 2022, but dropped back to fifth the following month, where it had remained until last month.

In November, the yuan also unexpectedly surpassed the euro as the second-most used currency in the global trade finance market, SWIFT data show. It edged out the euro to occupy the No. 2 position in global trade finance for the first time in September — according to available data going back to 2017 — and then dipped to third place in October.

SWIFT’s tracker for the yuan counts data computed from certain message types and exchanged between financial institutions through its system, so it’s not a reflection of the entire financial market, the association noted in its report.

China’s yuan has overtaken the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The share of the yuan as a global payment currency climbed to 4.61% in November from 3.6% the previous month, according to data compiled by SWIFT and released on Thursday. According to Caixin, the redback surpassed the Japanese yen, whose share came in at 3.41% in November, down from 3.91% the month before.

Thanks to its sharp devaluation throughout 2023, the yuan has been on a steady march upward throughout 2023, having started the year with just a 1.91% share in January. The November reading for the yuan was the highest since SWIFT began compiling the data series in 2010.

Meanwhile, the U.S. dollar maintained its dominance in global payments with a share of 47.08% in November. It was trailed by the euro, which was used in 22.95% of global payments, and the British pound, which had a share of 7.15%.

While China has been ramping up efforts to expand use of the yuan in cross-border transactions as an alternative to the US dollar, it has so far achieved very limited success due to the country’s impenetrable capital account firewall which means the yuan can never truly float (and if it does, watch as tens of trillions in domestic savings promptly flood the rest of the world, after a massive devaluation of course). To overcome the yuan’s natural limitations, China has been encouraging other countries to settle trade and investment in the Chinese currency (something Russia has been pursuing in recent months), and setting up yuan clearing banks in offshore markets to cater to cross-border yuan settlements.

The yuan’s ranking in global payment currencies by value has been hovering around fifth for years, SWIFT data show. It temporarily captured the fourth spot for a two-month spell in December 2021 and January 2022, but dropped back to fifth the following month, where it had remained until last month.

In November, the yuan also unexpectedly surpassed the euro as the second-most used currency in the global trade finance market, SWIFT data show. It edged out the euro to occupy the No. 2 position in global trade finance for the first time in September — according to available data going back to 2017 — and then dipped to third place in October.

SWIFT’s tracker for the yuan counts data computed from certain message types and exchanged between financial institutions through its system, so it’s not a reflection of the entire financial market, the association noted in its report.

Loading…